When a married couple files a joint tax return, both spouses typically share responsibility for any tax liabilities. However, if one spouse has past-due debts — such as unpaid federal taxes, state taxes, child support or student loans — the IRS may seize the entire tax refund to satisfy those obligations. Form 8379, also known as the Injured Spouse Allocation, allows the injured spouse to request their fair share of the refund so it is not used to cover the other spouse’s debts.

A financial advisor can help you determine eligibility for Form 8379 and guide the injured spouse in recovering their share of a joint tax refund.

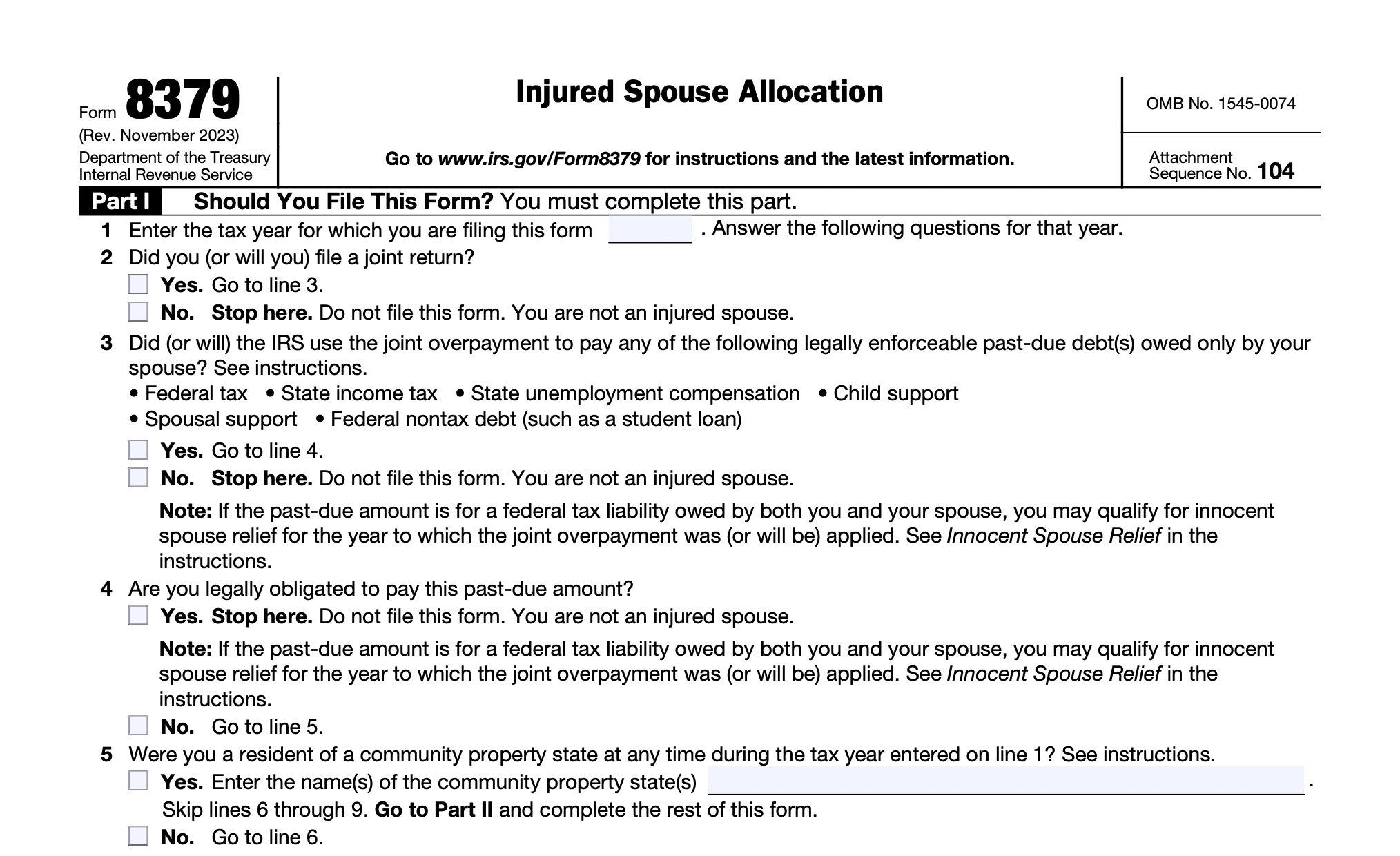

What Is Form 8379?

Form 8379, called the Injured Spouse Allocation tax form, allows an injured spouse to reclaim their portion of a joint tax refund that was offset due to the other spouse’s outstanding debts. These debts can include overdue federal or state taxes, child support, or student loans. This form is meant to protect a spouse who is not legally tied to the debt from losing their rightful share of the tax refund.

You should note that filing Form 8379 does not remove the debt or change tax responsibilities, but it stops one spouse’s refund from being used to cover the other’s obligations.

How to File Form 8379

If your share of a joint tax refund was applied to your spouse’s debts, here are six general steps to help you file Form 8379:

- Obtain Form 8379 from the IRS website or a tax professional.

- Complete with details from the joint tax return, including income, credits and deductions for both spouses.

- Indicate whether you are filing with a tax return or separately.

- Provide details about the offset, including the amount taken and the agency responsible for the debt.

- Sign and date the form to confirm its accuracy.

- Submit Form 8379 to the IRS along with the tax return (if applicable) or as a standalone document. If it is being filed separately after an offset has occurred, a paper version must be mailed to the IRS.

Who Can File an Injured Spouse Allocation

Not all spouses qualify to file Form 8379. The IRS has specific rules for who can apply. First, you may file if you earned income, paid taxes, or claimed credits on a joint return, and your portion of the tax refund was used to cover your spouse’s debts.

Second, you can qualify if you are not legally responsible for the debt. However, if both spouses share responsibility for the debt, Form 8379 cannot be used.

For example, if you and your spouse owe joint taxes or co-signed a loan, the IRS considers both of you responsible. In that case, you would not be eligible to file an injured spouse allocation.

Frequently Asked Questions

What Is the Difference Between an Injured Spouse and an Innocent Spouse?

An injured spouse is someone whose portion of a tax refund was used to cover their spouse’s outstanding debts. An innocent spouse, on the other hand, seeks relief from responsibility for tax liabilities that arose due to their spouse’s misreporting or fraud. Form 8857, also known as the Request for Innocent Spouse Relief, is used to request relief from joint tax liabilities when a spouse can prove they were unaware of tax understatements caused by their partner.

How Long Does It Take to Process Form 8379?

Processing times for Form 8379 vary. If filed electronically with a joint return, it typically takes around 11 weeks to process. If filed separately after an offset, it may take up to 14 weeks to receive the refund allocation.

Can Form 8379 Be Filed After an Offset Has Occurred?

Yes, Form 8379 can be filed after the IRS has already offset a refund. In such cases, the injured spouse must submit the form separately, providing details about the offset and their income, deductions, and credits to determine their portion of the refund.

Bottom Line

Filing Form 8379 allows an injured spouse to reclaim their share of a joint tax refund when it is seized due to their partner’s past-due debts. You must meet the eligibility requirements and complete the form correctly to ensure that the rightful portion of the refund is protected. For those dealing with ongoing refund offsets, consulting a financial advisor or tax consultant can provide strategic tax planning insights and help navigate financial challenges effectively.

Tips for Tax Planning

- A financial advisor with tax expertise can help optimize your portfolio to lower your liability. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- SmartAsset’s updated tax return calculator can help you get an estimate for how much your next tax refund or balance could be.

Photo credit: ©Department of the Treasury Internal Revenue Service, ©iStock.com/Pekic