IRS Form 8962 is used to reconcile the tax credit you are entitled to with any advance credit payments (or subsidies) for the tax year. The size of your tax credit depends on the cost of available health insurance, the size of your family and where you live. A financial advisor with tax expertise can help you optimize a tax strategy for your financial needs and goals. Read on for more essential information about Form 8962.

What Is Form 8962?

Form 8962 helps taxpayers figure out their Premium Tax Credit (PTC) for the year when filing a federal income tax return. It also provides a way to compare that credit with any advance payments of the Advance Premium Tax Credit (APTC) they received during the year, allowing them to determine whether they owe additional tax or qualify for a refund.

Not everyone can file Form 8962 and claim the PTC. Only those who have health insurance through the Affordable Care Act Health Insurance Marketplace (also known as the exchange) are eligible to use Form 8962, and not everyone who has marketplace coverage can qualify. If you used healthcare.gov or your state’s health insurance exchange to get coverage, you may qualify.

You can’t use Form 8962 if you get health insurance through another insurer and receive a 1095-B form documenting your health insurance coverage. You also can’t use Form 8962 if you get coverage through your employer and receive a 1095-C form. If you have marketplace coverage and received a 1095-A form documenting that coverage, you may be a candidate for the PTC.

What Is APTC?

When you signed onto the Health Insurance Marketplace to enroll in a qualified health plan, the system told you whether you qualified for a subsidy. The marketplace determined your eligibility for a subsidy, which is also your advance payment or APTC, based on what you entered as your income and personal exemptions.

If either your income or personal exemptions changed during the year, you should have reported those changes to the marketplace. If you didn’t, you might have been receiving too much or too little in APTC.

On the other hand, if, say, your income rose and you didn’t report it, the government might have been overpaying APTC to you or your insurer. In that case, when you use Form 8962 to reconcile your PTC eligibility with the APTC already paid, you may have to repay the difference.

However, if you’re eligible for more money in PTC than was paid in APTC, you could get the difference back in your tax refund.

Who Must File Form 8962?

You must file Form 8962 with your 1040 or 1040NR if any of the following apply:

- You want to take the PTC

- APTC was paid during the year for you or someone in your tax household

- APTC was paid for someone (including you) for whom you told the marketplace you would claim a personal exemption and neither you nor anyone else claims a personal exemption for that person

If any of these conditions apply to you, you must file Form 8962 with your income tax return. This is the case even if you otherwise wouldn’t need to file taxes. And if you’re required to file Form 8962 you can’t use Form 1040-PR or Form 1040-SS. (If you’re filing an amended return for a previous year, note that prior to 2018, you could not file Form 8962 with Form 1040EZ.)

How to Fill Out Form 8962

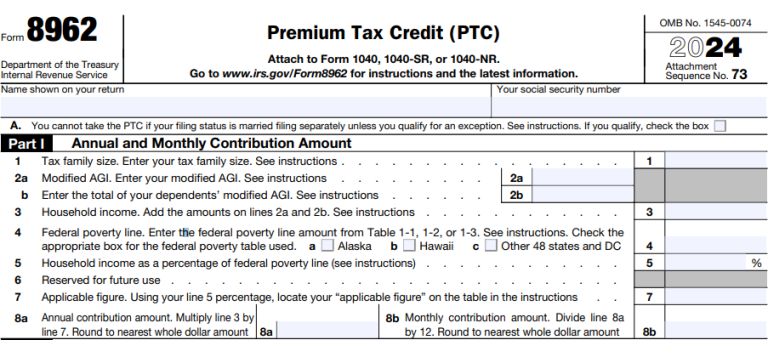

Form 8962 is divided into five parts. Before you dive into Part I, write your name and Social Security number at the top of the form. Part I is where you enter your annual and monthly contribution amounts. You’ll enter the number of exemptions and the modified adjusted gross income (MAGI) from your 1040 or 1040NR.

You’ll also enter your household income as a percentage of the federal poverty line. Consult the table in the IRS Instructions for Form 8962 to fill out the form. By the end of Part I, you’ll have your annual and monthly contribution amounts (lines 8a and 8b).

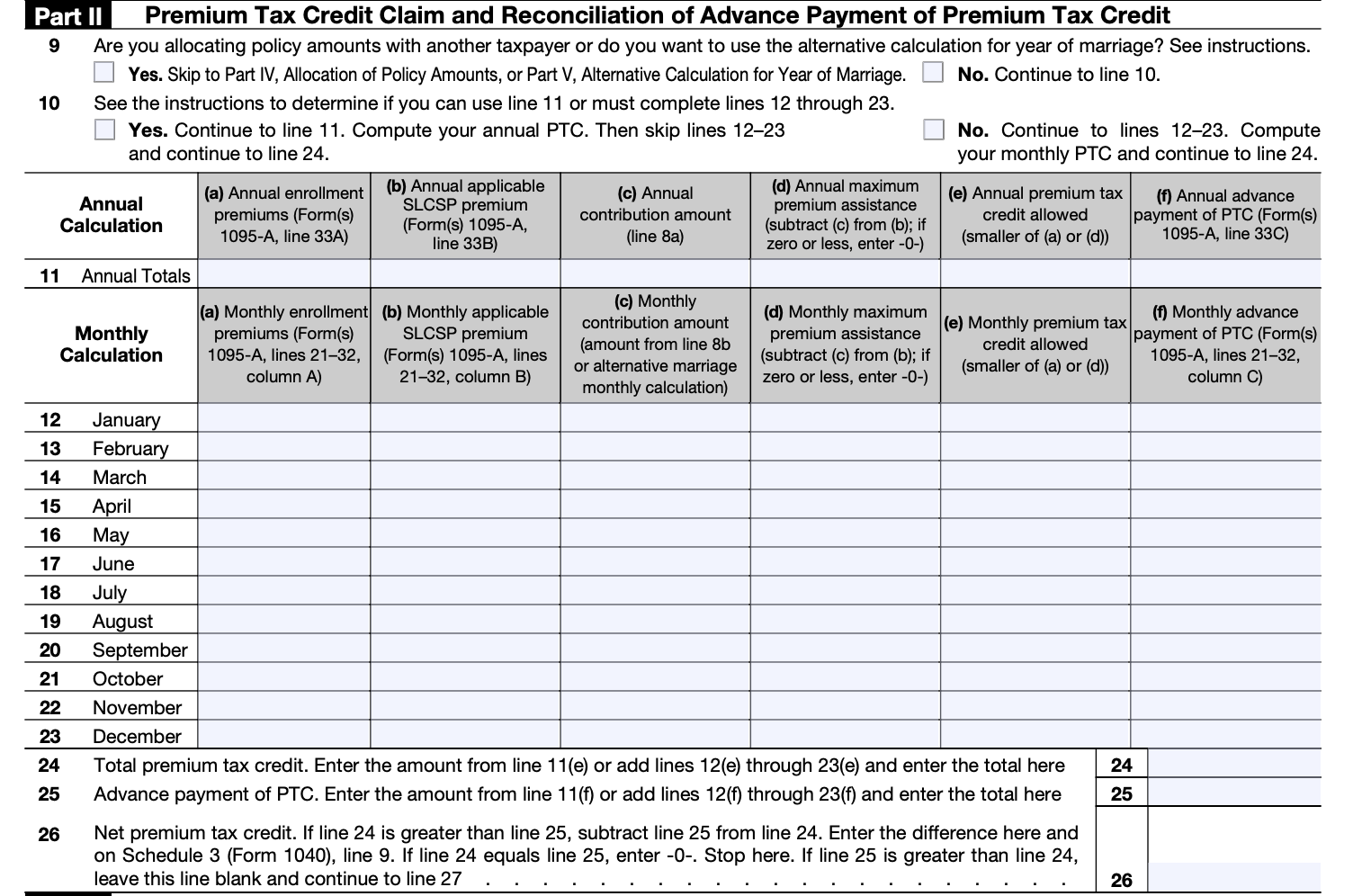

Now on to Part II, Premium Tax Credit Claim and Reconciliation of Advance Payment of Premium Tax Credit. This is where you’ll figure out your PTC and compare it against any advance payments (APTC). If you had marketplace coverage for the whole year you’ll use Line 11 to enter your annual totals. Otherwise, use one or more of the lines for the 12 months of the year to enter your monthly contributions.

At the end of Part II, you’ll have three very important numbers to enter. On line 24 you’ll write the total PTC. On line 25 you’ll write the advance payment of the PTC amount. And on line 26 you’ll write the net PTC.

If the amount on line 24 is greater than that on line 25, subtract line 25’s amount from line 24. Enter the difference on line 26 and on your 1040 or 1040NR form. That’s your net PTC. You’re getting a tax credit! If you elected the alternative calculation for marriage, enter zero. If line 24 equals line 25, enter zero. Stop here.

But if line 25 (your APTC) is greater than line 24 (your PTC), leave line 26 blank and continue to line 27.

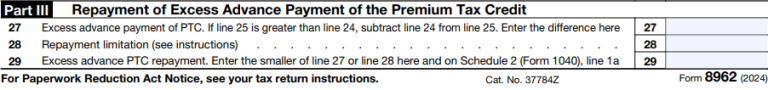

If your APTC is greater than your PTC, you’ll need to enter this information in Part III. On line 27, subtract line 24 from line 25 if line 25 is greater. Follow the form instructions to enter the repayment limitation on line 28. Enter your excess advance premium tax credit repayment on line 29. Write the smaller of either line 27 or line 28 on line 29, and on your Form 1040 or 1040NR. That’s the amount you owe in repayment for getting more than your fair share in advance payment of the PTC.

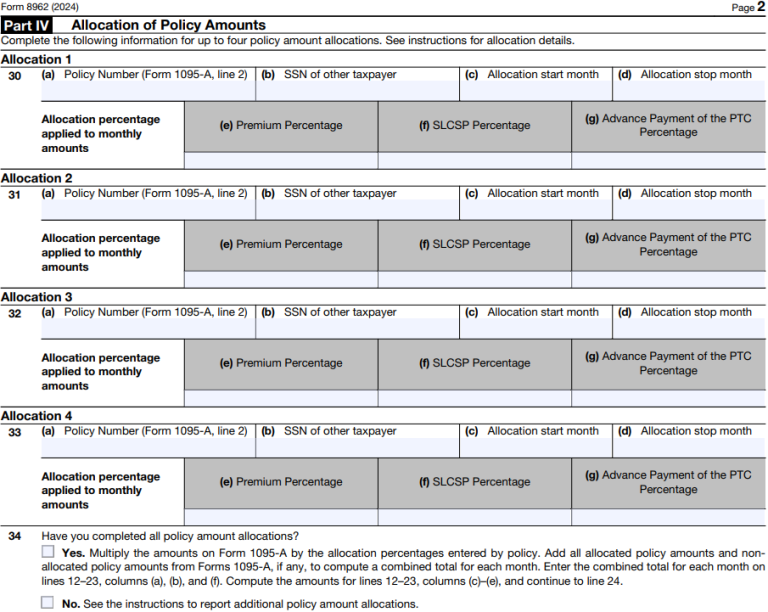

You might not need to use Part IV at all, depending on your situation. Lines 1 and 9 include notes that help you determine whether Part IV is necessary for you. Part IV is for Shared Policy Allocations. You can enter information for up to four of them. This is relevant in cases where a health care policy was shared between two “tax families.” So, if you and your spouse are filing separately but were covered by the same policy, follow the instructions for this section.

Or, if you got divorced in the tax year and are now filing separately but at one point during the year you both were covered by the same health care policy, this section is also for you. If no APTC was paid for a policy shared between two tax families, consult the Form 8962 instructions. You and the other tax family will have to decide how you will split the burden of reconciling any APTC repayments if applicable.

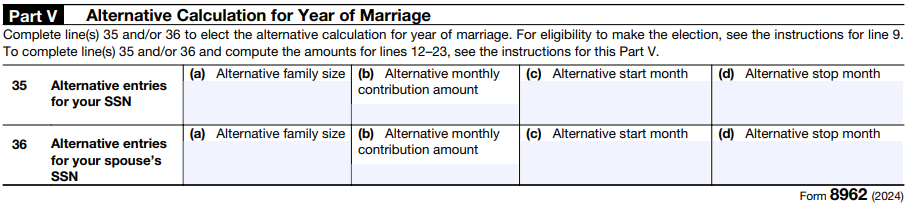

Part V is only for couples who got married in the tax year for which they’re filling out Form 8962. If this isn’t you, you can ignore this section. If this is you, consult the directions to figure out whether you need to fill out this section. The chart (Table 4) in the form instructions will help you determine whether you are eligible for the alternative calculation.

Bottom Line

Of course, using tax preparation software like TaxAct or H&R Block — or a tax accountant will simplify filling out Form 8962. But since the Premium Tax Credit is meant to help families afford health insurance, you may want to save the money and fill out the form yourself. While they seem complicated, IRS instructions are quite clear. And with any luck, you will get a refund.

Tips for Filing Your Taxes

- If you want professional help preparing your returns, consider hiring a financial advisor who also provides tax prep or who works with a tax accountant. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- If you need more time to do your taxes, you can file for an extension using Form 4868. That said, filing Form 4868 will only extend when your tax return is due. If you owe any taxes for 2024, they are still due April 15, 2025. So you should estimate how much you owe and pay it when you file Form 4868.

- If you don’t know whether you’re better off with the standard deduction versus itemizing your deductions, be sure to read up on the two options and do some math. You might find that you’d save a significant amount of money one way or another, so it’s best to educate yourself before the tax return deadline.

Photo credit: ©iStock.com/sturti, All images of Form 8962 come from IRS.gov, ©iStock.com/ayo888