Saving for retirement is tough. Between paying rent or a mortgage, combined with credit card debt, or maybe student loans, finding a few spare dollars to contribute to a retirement fund is difficult. In fact, almost one in 10 seniors have an income which puts them below the poverty line, according to Census Bureau data. But there are some places where seniors are set up for a financially secure retirement thanks to diligent financial planning. Below we look at the top 10 places where seniors are best positioned for retirement.

We looked at data on six metrics to find the cities where seniors are set up for retirement. Specifically, we looked at total retirement income, percent of seniors on food stamps, percent of seniors below the poverty level, percent of seniors who own their home, the percent of seniors with private retirement income and the percent of seniors who are housing cost-burdened. Check out our data and methodology to see where we got our data and how we put it together.

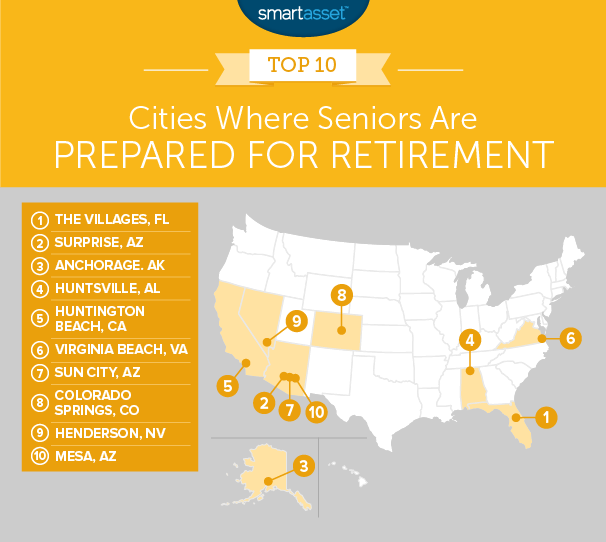

Key Findings

- Retirement communities – Two communities in our top 10 were built with retirees in mind. The Villages, Florida, ranked first, and Sun City, Arizona, ranked seventh, have both done a good job attracting financially secure retirees ready to enjoy their golden years.

- Warm cities – Warm climates, like beaches or deserts, are attractive places to end up for retirees. Eight of our top 10 cities are in warm climates.

- Struggling in the big city – Seniors in the biggest cities tend to be the least prepared for a secure retirement. Seniors in cities like New York, Boston and Miami (which all rank in the bottom five) are often housing cost-burdened and do not own their homes.

1. The Villages, Florida

The Villages is a popular retirement community. According to our data, seniors who live here have done a good job planning their retirement. Over 96% of seniors own their home and 64.5% of seniors have income saved for retirement. For both of those metrics, The Villages ranks first.

In fact The Villages ranks first in four out of six metrics and in the top 3 in every metric. The Villages’ “worst” score was in combined Social Security and retirement income. The average senior household in The Villages has a combined $58,300 in retirement income, or the third-most in the study.

2. Surprise, Arizona

Surprise is the second-fasting growing municipality in the Phoenix metro area. Over 88% of seniors in Surprise own their home. That home acts as a back-up plan if the retirees ever find themselves in a financial pinch. Retirees who own their home can choose to sell or refinance if need be.

Only 5.6% of seniors here are below the poverty line, that’s a top 5 rate.

3. Anchorage, Alaska

From two sunny retirement destinations, we head up to a slightly cooler destination, third-placed Anchorage, Alaska. Only 4.1% of seniors here have an income which puts them beneath the poverty level, the best score in the study.

However cost of living in Anchorage is fairly high and 6.1% of seniors use food stamps while 28% of seniors are housing cost-burdened. In those two metrics Anchorage ranks 23rd and 10th, respectively. While neither of those scores are bad, they’ll need to improve if Anchorage wants to jump up to second or first.

4. Huntsville, Alabama

Alabama’s tech hub takes fourth. The average senior household has a combined retirement income of $55,037 per year, fifth-most in our study. A high income often means a lower chance of being housing cost-burdened. That seems to be true in Huntsville, where only 23% of senior households are housing cost-burdened.

Over 79% of seniors here also have some retirement income, the fourth-highest rate in our study. For those who could use a hand with retirement planning , these are the top Huntsville financial advisor firms.

5. Huntington Beach, California

Who wouldn’t want to retire by the beach? Seniors who have targeted Huntington Beach as a place to spend their golden years seem to be prepared for retirement. The average senior household here has a total retirement income (including Social Security) of $59,800 per year. That’s the second-most in our study.

Of course, if you want to spend your retirement in Surf City it will cost you. Despite that high income, 37% of seniors here find themselves spending over 30% of their income on housing (the threshold for being considered housing cost-burdened by HUD).

6. Virginia Beach, Virginia

Another beach city takes sixth. Virginia Beach is home to the longest pleasure beach in the world, according to the Guinness Book of World Records, making it an attractive retiree destination.

Less than 6% of seniors in Virginia Beach have an income which puts them below the poverty line and over 81% own their homes. Both of those metrics are top 10 scores. Unfortunately for those seniors, living near the beach is in high demand, driving up the cost of living in the city. Over 36% of seniors in Virginia Beach are housing cost-burdened.

7. Sun City, Arizona

Sun City, like The Villages, is a community specifically catered to the needs of retirees. Seniors who live here are certainly prepared for a long, relaxing retirement. Over 84% of seniors here own their home and only 27% of seniors are housing cost-burdened. That means residents here should have some financial flexibility, since they are not putting the majority of their income toward housing.

However the average retirement income for seniors in this city is under $42,000, a below average rate.

8. Colorado Springs, Colorado

Seniors in Colorado Springs score well in most metrics. Only around 7.4% of seniors here are below the poverty line and 54.6% of seniors have private retirement income. For both of those metrics Colorado Springs’ seniors rank in the top 15.

If Colorado Springs wants to climb the ranks, it will need to improve two related scores: percent of seniors who own their home and percent of seniors who are housing cost-burdened. In both of those metrics, Colorado Springs has above-average scores but rank outside the top 20 in each.

9. Henderson, Nevada

The second-largest city in Nevada takes second. Hanging out in the Las Vegas metro area is a fun activity but you certainly need to have a secure retirement if you plan on doing any gambling. Seniors here, for the most part, are on firm financial footing and can probably afford throw a few dollars at the slot machines.

The average senior household, when taking Social Security into account, has $52,500 in retirement income. That is the ninth-most in our study. Plus, only 6.4% of seniors are below the poverty line.

10. Mesa, Arizona

Our list ends in the third Arizona city to crack our top 10, Mesa. Seniors here do not tend to have the highest incomes, but they should live a comfortable retirement. The average senior household has an income of $44,700, around average for this study, and 83% of seniors own their homes. Another boost to retirement prospects in Mesa: Over 52% of senior households have retirement income. Additionally only 5% of senior households here use food stamps a top-20 rate.

Live here and need some help saving for retirement? Check out our top financial advisor firms in Mesa.

Data and Methodology

In order to rank the places where seniors are prepared for retirement, we looked at data for the 100 cities with the largest 65-or-over population. We then ranked them using the following six metrics:

- Average senior retirement income. This is private retirement income, from savings, IRA, 401(k) or pensions, combined with Social Security income for households where the head of household is 65 or older.

- Percent of seniors under the poverty line. This is the percent of seniors who fall under the poverty line.

- Percent of seniors who use food stamps/SNAP benefits. This is the percent of households who use food stamps where the head of household is 65 or over.

- Percent of seniors who own their homes. This is the percent of households where the where the head of household is 65 or over and they own their home.

- Percent of seniors with retirement income. This is the percent of households where the head of household is 65 or over who have retirement income from private means. It includes money from income streams like annuities, insurance, IRAs and retirement pensions.

- Percent of seniors who are housing cost-burdened. This is the percent of households where the head of household is 65 or over and spends 30% or more of income on housing.

Data for all metrics comes from the U.S. Census Bureau’s 2016 5-Year American Community Survey.

Tips for Maximizing Your Retirement Savings

- It may make sense to get professional help from a financial advisor when it comes to saving for retirement. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- If you want to maximize your Social Security income it could be best to delay the age you take Social Security benefits. If you wait until you are 70 you can maximize your benefits. Of course, that means not taking any Social Security payments for eight years. If you don’t have the finances to go without Social Security for eight years, you’ll probably need to take it earlier. Another thing to consider is your long-term health. In order for waiting to take Social Security payments at 70 to be worth more than taking it at 62 you need to live until age 80. So if you are in poor health taking it earlier is probably a good idea.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/Johnny Greig