For those who don’t own a house, rent is one of the most important expenses to account for in a household budget. Keeping your rent-to-income ratio at a reasonable level allows you to use your money for other things, like saving for retirement and stockpiling enough cash to make a mortgage down payment. But because rent levels vary based on where in the country you live, the amount of income you need to afford rent varies as well.

The U.S. Department of Housing and Urban Development (HUD) uses a threshold of 30% to determine whether housing is affordable. In other words, housing is considered affordable if you spend less than 30% of household income on housing costs. If you spend more than 30% of your income on housing, you are considered housing cost-burdened. If you spend more than 50% of your income on housing, you are considered severely housing cost-burdened.

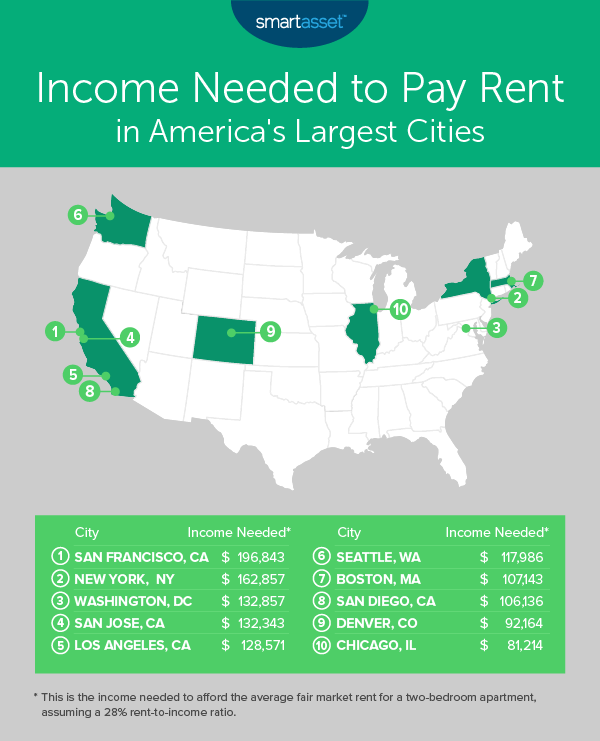

Taking HUD’s threshold into mind, SmartAsset set a 28% rent-to-income ratio to determine how much a person would need to make in order to be able to afford rent in the 25 largest cities across the country. For details on our data sources and how we analyzed the information to create our rankings, check out the Data and Methodology section below.

Key Findings

- Heavy burdens. In general, the median income in a city is not enough for the average person to avoid being housing cost-burdened. Each of the top 10 cities on our list has a median income that is less than the income needed to pay 28% or less of your income in rent.

- Cities with good value. The median household income exceeds the income needed to pay rent in only five of the cities in our study: Phoenix, Arizona; Indianapolis, Indiana; Columbus, Ohio; Memphis, Tennessee and El Paso, Texas. Of these, the difference is the highest in Indianapolis, where the yearly income to afford a two-bedroom apartment is $39,214 but the median household income is about $8,000 more than that, at $47,225.

1. San Francisco, CA

Unsurprisingly, San Francisco, California takes the top spot in this study. Our data shows that the average monthly rent for a two-bedroom apartment in the Bay Area city is $4,593, which comes to $55,116 per year on rent alone.

This means that a household in San Francisco would need to earn $196,843 to not be rent cost-burdened living there. Even with the highest median household income on this list at $110,816, many residents fall short of that.

2. New York, NY

New York, New York comes next with an average rent of $3,800 for a two-bedroom apartment. If you pay that monthly, your yearly rent comes to $45,600. To pay 28% or less of your income in rent, you’ll need a salary of at least $162,857. The median household income in Manhattan is about half that amount, at $85,071.

Note that these figures are only for the Borough of Manhattan. If you want to live in the Big Apple for a bit less than that, some areas in the outer boroughs are relatively more affordable and have relatively easy commutes into Manhattan.

3. Washington, D.C.

Washington, D.C ranks third on our list, with an average rent of $3,100 a month for a two-bedroom apartment. That comes to a yearly rent bill of $37,200 in the nation’s capital.

You’ll need to earn a household income $132,857 to not be rent cost-burdened at that average. The median household income in Washington, D.C. is about $50,000 less than that, at $82,372.

4. San Jose, CA

Another Bay Area city comes next in fourth place. The annual monthly rent for a two-bedroom apartment in San Jose, California is $3,088, which makes the average annual rent $37,056.

San Jose residents need to earn a household income of $132,343 to pay 28% or less of their salary in rent. The median household income in San Jose is $104,675 – the second-highest amount for this rate in the whole study, but still not enough to avoid being housing cost-burdened.

5. Los Angeles, CA

Los Angeles, California comes in fifth on this list with an average monthly rent of $3,000. That means the average annual rent is $36,000. The median household income in Los Angeles is $60,197, less than half of the $128,571 your household would need to not be rent cost-burdened.

6. Seattle, WA

Seattle, Washington follows for the No. 6 spot. The Emerald City has a monthly average rent of $2,753. That means the average yearly rent cost for a two-bedroom apartment is $33,036.

To pay that rent and not be rent cost-burdened, you’ll need to earn a household income of at least $117,986. The median household income is $86,822.

7. Boston, MA

Boston, Massachusetts ranks seventh in our study this year, with an average monthly rent of $2,500 for a two-bedroom apartment. The yearly rent bill, then, comes to $30,000. You’d need to have a household income of $107,143 to cover that rent without spending more than 28% of your income on rent. The median household income in Boston, though, is just $66,748.

8. San Diego, CA

The final California city on our list this year is San Diego, where a two-bedroom will run you $2,476.50 monthly, on average. That means the average yearly rent cost is $29,718.

To cover that and not spend more than 28% of your income on rent, you’ll need to earn an annual salary of $106,136. The median household income in San Diego, however, is approximately $30,000 less than that, $76,662.

9. Denver, CO

Denver, Colorado comes in at ninth. The average monthly rent cost for a two-bedroom apartment is $2,150.50. The average annual rent cost is $25,806.

A household in Denver would need to earn $92,164 to not be rent cost-burdened at the average cost. The median household income, though, is $65,224.

10. Chicago, IL

The final city on this list is Chicago, Illinois. Average rent for a Windy City two-bedroom is $1,895 per month. That comes to $22,740 per year.

To pay that rent and avoid being cost-burdened, you’ll need a household salary of $81,214. Median household income in Chicago is $55,295.

Data and Methodology

In order to find the income needed to pay rent in America’s largest cities, SmartAsset looked at data for the 25 largest cities in America. We estimated the household income renters would need to afford the average two-bedroom apartment while paying no more than 28% of their total income in rent. To find this number, we divided the average annual cost of a two-bedroom apartment by 0.28. The resulting number is the annual income needed for a rent costs to be equal to 28% of household income. Then we ranked the cities from highest to lowest based on this figure.

Data for average two-bedroom rent is from Zillow and is for April 2019.

Tips for Affordable Housing

- To buy or to rent? There are a lot of decisions you have to make, but whether or not to rent or buy is key. Use SmartAsset’s rent vs. buy tool to see which option makes more sense for you.

- Lessen the financial burden with expert advice. A financial advisor can help you with all things personal finance, including housing. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/skynesher