How easily veterans adjust to their lives after service depends on many factors, not the least of which is their ability to maintain adequate finances to cover their home payments and daily needs. There’s good news for vets on that front, though: While about 37,000 veterans still experienced homelessness in January 2019, the homelessness rate among veterans declined more than 2% in 2019 and had decreased 50% since 2010, according to a 2019 report from the Department of Housing and Urban Development (HUD). Despite that marked improvement, not all places are equally suited to help veterans thrive. That’s why SmartAsset crunched the numbers in all 50 states and the District of Columbia to find the best places for veterans.

To do so, we looked at data across nine metrics: veterans as a percentage of population, veteran unemployment rate, overall unemployment rate, percentage of veterans living below the poverty line, housing costs as a percentage of median income for veterans, percentage of a state’s businesses owned by veterans, number of VA health centers per 100,000 veterans, number of VA benefits administration facilities per 100,000 residents and taxes on military pensions. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

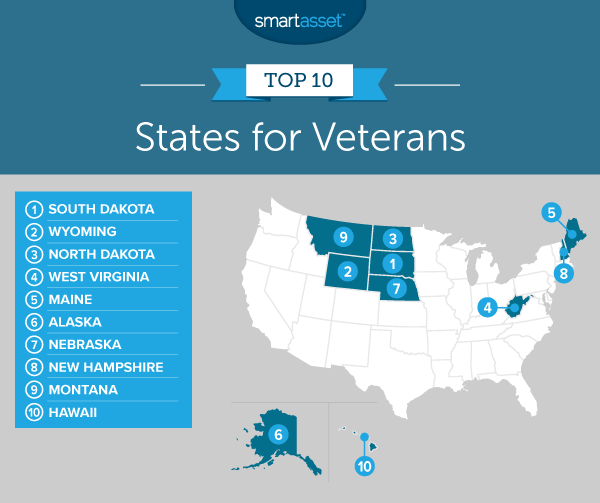

Key Findings

- Veterans are less likely than the general population to live below the poverty line. Nationally, 11.1% of the U.S. population is living in poverty, according to 2019 figures from the Census Bureau. The average for this metric across this study is 6.7%, possibly because military benefits help keep some veterans afloat when they might otherwise face financial challenges.

- More populous states may not be as suitable to veterans. The bottom three states in the study are California, New York and Illinois, which have the largest, fourth-largest and sixth-largest state populations, respectively. These states struggle in two metrics: the unemployment rate for veterans and housing costs as a percentage of median income for veterans. This may be due, in part, to their high populations, which increase both competition for available jobs and demand for housing.

- Pension taxes vary. Each state chooses how to tax military pensions. All in all, 30 states don’t tax military pensions at all, including eight out of the top 10 states (Nebraska and Montana are the exceptions). Military pensions are partially taxed in 13 states, along with the District of Columbia, and they are fully taxed in seven states.

1. South Dakota

South Dakota, home of the Black Hills and Mount Rushmore, is the best state in the U.S. for veterans. South Dakota has 21.04 Veterans Administration health facilities per 100,000 veterans, which is the second-highest rate for this metric overall, meaning veterans in South Dakota should have relatively good access to health services. There are also 3.51 VA benefits administration facilities per 100,000 residents, ranking 10th. In addition, South Dakota does not tax military pensions.

2. Wyoming

Wyoming takes the runner-up spot. Wyoming has the highest number of VA health facilities in the country, at 28.99 per 100,000 veterans. It also does not tax military pensions. Wyoming finishes in the bottom half of the study in terms of the percentage of veterans who are living below the poverty line (coming in at 38th, with a percentage of 7.1%). However, the veteran unemployment rate in the state is 1.0% – second-lowest in the study – so veterans looking for work could do worse than thinking about the Cowboy State.

3. North Dakota

North Dakota is one of the least populous states in the nation, but it does well by its veterans. The Rough Rider State has the lowest unemployment rate for veterans in the nation, at 0.9%. Its overall September 2020 unemployment rate is also low, coming in at 4.4% – fourth-lowest in the nation. Housing costs make up 19.90% of the median income for a veteran, the second-best rate for this metric in the study.

4. West Virginia

West Virginia has housing costs that make up just 18.95% of the median veteran income, the best rate for this metric in the study. The Mountain State has the sixth-highest concentration of VA health facilities in the study, at 12.39 per 100,000 veterans, and the third-highest number of VA benefits administration facilities, at 5.78 per 100,000 residents. Military pensions are not taxed in this state. See more about retirement tax friendliness in West Virginia here.

5. Maine

Maine is one of two Northeastern states to be ranked in the top 10, and it gets there partially on the strength of its 1.3% veteran unemployment rate, ranking fourth-lowest in the country. Maine’s population is made up of 8.89% veterans, the eighth-highest percentage for this metric. Maine also has 5.13 VA benefits administration centers per 100,000 residents, ranking sixth-best. There are no taxes on military pensions in the Pine Tree State.

6. Alaska

Also known as The Last Frontier State, Alaska has a relatively small population, but one that is 10.74% veterans, the highest percentage for this metric across all 50 states and the District of Columbia. Alaska also comes in first for the metric measuring the percentage of businesses owned by veterans, at 11.60%. The state doesn’t do nearly as well, though, when it comes to employing veterans, as the unemployment rate among veterans is 6.3%, near the very bottom of the study. On the plus side, the state does not tax military retirement pay.

7. Nebraska

Nebraska had an overall unemployment rate of just 3.5% in September 2020, the lowest in the country, and that rate is particularly impressive amid the COVID-19 pandemic. Nebraska also has the fifth-best unemployment rate for veterans, at just 1.4%. Nebraska taxes some portion of military pensions, making it one of two states in the top 10 of the study where military pensions are not completely tax-free.

8. New Hampshire

Veterans in New Hampshire own 9.42% of the state’s businesses, placing the Granite State at 12th overall for this metric. The entire population of the state is 8.52% veterans, the 14th-highest rate for this metric across all 50 states and the District of Columbia. New Hampshire performs relatively poorly in terms of housing affordability: The average housing cost represents 36.25% of the median veteran income, sixth-highest in the study. However, Military pensions are tax-free in the state. Those who are seeking assistance with balancing all of these financial factors may wish to consult our roundup of the top 10 financial advisors in New Hampshire.

9. Montana

Veterans will find a built-in community in Big Sky Country, where the population is 10.28% veterans, second-highest in the study. That said, Montana taxes military pensions fully – the only state in our top 10 to do so and one of just seven to do so nationwide. Still, Montana ranks ninth for both of the unemployment metrics we measured, with a veteran unemployment rate of 2.3% and an overall September 2020 unemployment rate of 5.3%.

10. Hawaii

Hawaii places first in this study in terms of number of VA benefits administration facilities, at 6.64 per 100,000 veterans. It is important to note, though, that the Aloha State had an unemployment rate of 15.1% in September 2020, ranking last for this metric in the study. Furthermore, housing costs make up 39.41% of median veteran income, second-worst overall. However, only 5.8% of veterans are living below the poverty line, good for 12th overall. The state also has top-20 rankings for veterans as a percentage of the population, veteran-owned businesses as a percentage of all businesses and VA health facilities per 100,000 veterans.

Data and Methodology

To conduct the 2020 version of our study on the best states for veterans, we compared all 50 states and the District of Columbia across the following metrics:

- Veterans as a percentage of the population. Data comes from the Census Bureau’s 2019 1-Year American Community Survey.

- Veteran unemployment rate. Data comes from the Census Bureau’s 2019 1-Year American Community Survey.

- Unemployment rate. Data comes from the Bureau of Labor Statistics and is for September 2020.

- Percentage of veterans living below the poverty line. Data comes from the Census Bureau’s 2019 1-Year American Community Survey.

- Housing costs as a percentage of median income for veterans. This is annual median housing costs divided by median income for veterans. Data comes from the Census Bureau’s 2019 1-Year American Community Survey.

- Share of veteran-owned businesses. This is the percentage of all businesses in a state that are owned by veterans. Data comes from the Census Bureau’s 2018 Annual Business Survey.

- VA health facilities per 100,000 veterans. Data come from the U.S. Department of Veterans Affairs and the Census Bureau’s 2019 1-year American Community Survey.

- VA benefits administration facilities per 100,000 veterans. Data come from the U.S. Department of Veterans Affairs and the Census Bureau’s 2019 1-year American Community Survey.

- Taxes on military pension. States were assigned a 1 if the state does not tax military retirement pay, a 2 if there are special provisions or other considerations for military pension taxes and a 3 if the state fully taxes military retirement pay. Data comes from militarybenefits.info.

First we ranked each state in each metric. From there, we found the average ranking for each state, giving all metrics a full weight except for the two metrics measuring unemployment, which each received a half weight. We used this average ranking to create our final score. The state with the best average ranking received a score of 100, and the state with the worst average ranking received score of 0.

Money Tips for Veterans

- Financial help from someone who’s always got your six. Veterans, like everybody else, sometimes need help with financial matters. A financial advisor can provide that help and bring in reinforcements to set you on the right path. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool connects you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors, get started now.

- Don’t sacrifice continuing education because of costs. If you want to go to college after you serve, the GI Bill will help — but you may still end up with student loans. To discover how much you’ll need to pay, use SmartAsset’s student loan calculator.

- Create a strong strategy for your budget. Use SmartAsset’s budget calculator to figure out how much you should be spending on different areas and you’ll make sure you have enough money for everything.

Questions about our study? Contact press@smartasset.com.

Photo credit: ©iStock.com/SDI Productions