Medical science has made enormous strides over the past century. Antibiotics, vaccinations and other treatments have all but eliminated many illnesses that once claimed thousands of lives each year. Likewise, advancements in surgical techniques and technologies have pushed the survival rates on many difficult procedures, including open-heart surgery, to over 95%.

Find out now: How much life insurance do I need?

Yet as a whole, the healthcare system in the United States remains far from perfect. For example, in all but two states, more than 10% of low-income people do not have health insurance (as of 2014).

Data & Methodology

To find the best states for healthcare access, SmartAsset collected and analyzed data on healthcare access, affordability and quality across all 50 states. In particular, we looked at the following six metrics:

- Total insurance rate. This is the percentage of total population with health insurance.

- Children’s insurance rate. The percentage of children (under the age of 18) with health insurance.

- Low-income insurance rate. The percentage of people whose income is less than 139% of the federal poverty line with health insurance.

- Average monthly insurance premium. Includes individual market policies only.

- Average annual insurance costs as a percentage of median individual income.

- Physician access index. A measure developed by Merritt Hawkins based on 33 different metrics of physician access, such as the number of physicians per capita and the number of retail clinics per capita.

- Prevention and treatment rank. A measure of healthcare quality developed by the Commonwealth Fund, based on metrics such as the 30-day mortality at hospitals and the percentage of children who have received all recommended vaccines.

We ranked all 50 states on those six metrics. We then averaged those rankings, giving double weight to the physician access index and the prevention and treatment rank, and single weight to all other metrics.

Lastly, we calculated a score on a 100-point scale according to those average rankings. States with better average rankings received higher scores. The top overall state scored a 100.

Data on insurance rates comes from the U.S. Census Bureau’s 2014 American Communities Survey. Data on the average monthly insurance premium comes from the Kaiser Family Foundation. Data on the median annual income comes from the Bureau of Labor Statistics.

In the market for life insurance? Compare policies here.

Key Findings

- Medicaid expansion looms large. Nineteen states have yet to adopt the Medicaid expansion provision that was part of the Affordable Care Act. Just one of those states (Wisconsin) ranks in the top ten for healthcare access, while six rank in the bottom ten. These states tend to have lower insurance rates for children and people in low-income households.

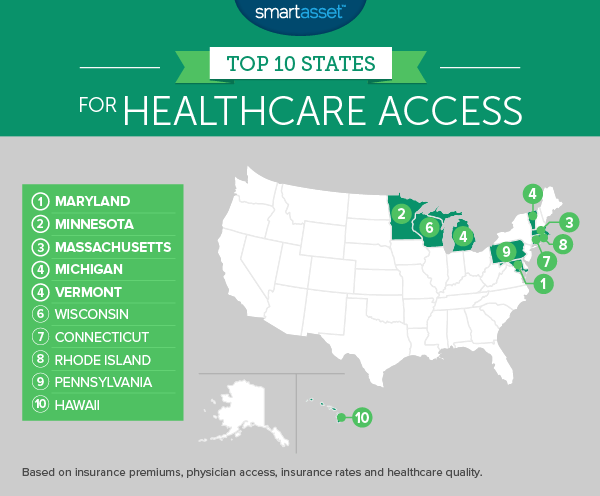

- Midwest, New England states have best healthcare access. Three Midwestern states (Minnesota, Michigan and Wisconsin) and three states in New England (Massachusetts, Vermont and Rhode Island) rank in the 10.

- Texas comes in last. There’s only one state in which more than 30% of people in low-income households are uninsured, and that’s Texas. The state also ranks in the bottom five for physician access and the quality of treatment.

1. Maryland

The top state for healthcare access, Maryland rated well on every single one of the metrics we considered. Its overall insurance rate and children’s insurance rate both rank among the top ten states, at 92.1% and 96.8% respectively. It also ranks in the top five for physician access.

What truly separates Maryland from other states when it come to overall healthcare access, however, is cost. While Maryland in general is fairly expensive, the state has managed to keep the cost of healthcare and the price of insurance premiums relatively low. According to the Kaiser Family Foundation, the average monthly cost of premiums is $180.40. On an annual basis, that’s equal to just 5.3% of median individual income, the lowest percentage of any state.

One reason for these low costs may be Maryland’s “all-payer” system. In such a system, all insurers (government and private) pay the same rates for services at a given hospital. It is the only state with such a system, though several European countries use similar systems.

Related Article: 529 Plans in Maryland

Find out now: What is credit life insurance?

2. Minnesota

Minnesota is home to some of the best health care facilities in the world, most notably the Mayo Clinic. According to the Commonwealth Fund, the state ranks as the eighth best state for prevention and treatment. It has the lowest number of premature deaths caused by potentially treatable conditions or complications, with just 56 per 100,000 residents.

It isn’t just the quality of care that makes Minnesota a great place for healthcare access. It also has some of the highest insurance rates in the country. As of 2014, 94.1% of Minnesotans had health insurance, fourth-highest of any state.

3. Massachusetts

In 2006, Massachusetts passed a first-of-its-kind healthcare law that aimed to provide health insurance to every man, woman and child in the state. That plan, which eventually became a model for the Affordable Care Act, hasn’t yet achieved its lofty goal but it has come close. Massachusetts ranks first in the country for the overall insurance rate, at 96.7%, as well as the children’s insurance rate (98.5%) and the insurance rate for people living in low-income households (94.4%).

The one area in which Massachusetts does not rate well is the cost of insurance. According to the Kaiser Family Foundation, the average price of an individual policy in the Bay State is $456.39. Even after controlling for the state’s relatively high level of income, that ranks among the highest four states in the U.S., adding to the high cost of living in cities like Boston.

4. Michigan

Michigan ranks no lower than 16th in the U.S. on any of the seven metrics SmartAsset analyzed. It rates especially well for the price of insurance premiums. The average cost of monthly individual insurance premiums in the Great Lakes State is $203.84, ninth lowest in the U.S. On an annual basis, that’s equal to 7% of the median income in Michigan. That makes it the sixth-most affordable state for health insurance when controlling for income.

5. Vermont

Though Vermont recently abandoned efforts to establish a first-in-the-nation single-payer healthcare system, it still ranks among the top states when it comes to access. It has particularly high rates of insurance coverage. 95% of the total population of Vermont is insured and 97.8% of children in Vermont are insured. Both of those rank second behind Massachusetts.

6. Wisconsin

While Wisconsin did not adopt the Medicaid expansion provision of the Affordable Care Act, it has enacted several policies of its own to increase Medicaid coverage. So, while states that opted out of the Medicaid expansion tend to have lower rates of coverage, Wisconsin bucks this trend. Nearly 93% of Wisconsinites have health insurance, the seventh-highest percentage of any state.

7. Connecticut

The Nutmeg State ranks in the top ten for all three measures of insurance coverage that SmartAsset considered. Its overall insurance rate of 93.1% ranks sixth in the U.S., as does the 88.3% coverage rate for people in low-income households.

While the average individual premium price of $291.35 is higher than the national average, it falls when controlling for income. Someone earning the median individual income in Connecticut would spend 8.1% of her income on health insurance at that rate, 21st-lowest in the U.S.

8. Rhode Island

Like several other New England states, Rhode Island rates very well for overall insurance coverage, but poorly for the cost of buying insurance on the individual market. It has the eighth-highest coverage rate for the general population, at 92.6%, and the fourth-highest coverage rate for people in low-income households, at 88.5%.

However, even after controlling for the state’s median income, policies purchased on the individual market are still fairly expensive. The average monthly price of health insurance in New Hampshire is $328.09. That’s equal to 10% of median income, seventh-highest in the U.S.

9. Pennsylvania

According to the Commonwealth Fund, Pennsylvania ranks as the seventh-best U.S. state for prevention and treatment in its healthcare system. Among children ages 18-35 months in Pennsylvania, nearly 80% have received all of their recommended vaccinations, the fifth-highest rate in the U.S.

Likewise, Merritt Hawkins ranked Pennsylvania as the seventh-best U.S. state when it comes to physician access. Healthcare purchased on the private market in Pennsylvania is also fairly affordable, one reason it’s a top state for early retirement.

Related Article: 529 Plans in Pennsylvania

10. Hawaii

Long before the Affordable Care Act made universal healthcare coverage a goal on the mainland, Hawaii was the first state in the U.S. that required employers to provide health insurance to their workers. The 1974 passage of the Hawaii Prepaid Healthcare Act led to higher rates of insurance coverage and better health outcomes for the entire state. Today, the rest of the country is beginning to catch up, but Hawaii still rates among the best. Its overall rate of insurance coverage is 94.7%, third-highest in the U.S.

Questions about our study? Contact us at blog@smartasset.com.

Photo credit: ©iStock.com/gpointstudio