Thinking about an early retirement? If so, you’ll need to plan carefully. There are a number of financial challenges for early retirees that those who wait until 65 or later don’t need to worry about.

For instance, while you can start claiming Social Security benefits as early as 62, doing so will cut into the benefit you receive throughout retirement. Furthermore, while retirees who are over the age of 65 receive numerous retirement tax benefits at both the state and federal level, younger retirees are often ineligible for these same advantages.

Plan for your early retirement with SmartAsset’s super-smart retirement calculator.

Another consideration when deciding to retire early is healthcare. While people who are at least 65 years old qualify for Medicare, younger retirees will have to buy their own insurance on the private market. This can cost thousands of dollars a year.

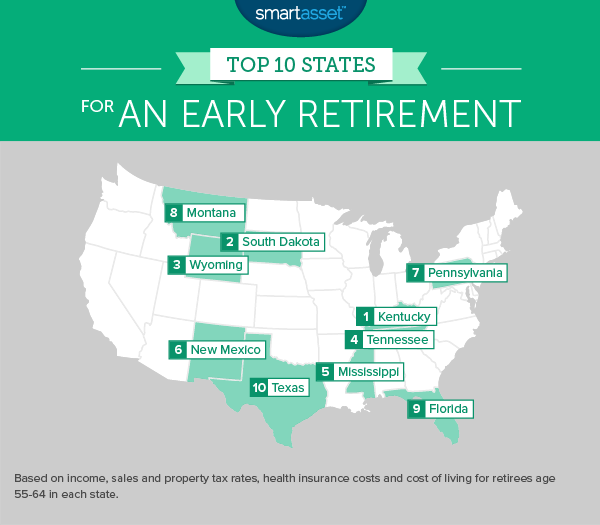

To find the best states for an early retirement, SmartAsset looked at six separate metrics for each state, emphasizing taxes and living costs in our analysis. We started by calculating effective state and local tax rates for retirees age 55-64, using our retirement income tax calculator to simulate over 600 different tax scenarios in each state.

We also considered sales tax rates, property tax rates and living costs such as health insurance and housing. (Read more about our methodology below.)

Key Findings

- Bluegrass State takes first. Thanks to low living costs and a large retirement income tax deduction, Kentucky rates as the best states for an early retirement.

- Retirement tax rules are key. Of the top ten best states for an early retirement, four have special rules for retirement income that reduce the tax burden on early retirees. Five other states have no income tax whatsoever.

- Not so good: California, New Jersey, Connecticut. Thanks to high tax rates and high living costs, these states rank at the bottom of SmartAsset’s list. They are relatively expensive choices not just for early retirees, but for all retirees.

Kentucky

From the rolling crests of the Cumberland Mountains to the lush fields of the Bluegrass Region, Kentucky can be a great place to spend an extended retirement. Though the state does collect its own income tax, few retirees pay the full tax and many pay nothing at all.

Why? The state allows taxpayers to claim a tax deduction of the first $41,110 in retirement income, from sources such as a 401(k) or IRA. And unlike similar rules in other states, there is no age restriction on who can claim the deduction.

In addition to that tax deduction, early retirees in Kentucky will appreciate a low cost of living. Average annual housing costs in Kentucky are just $8,544, fourth lowest in the U.S. Likewise, living expenses in Kentucky’s largest cities, including Louisville and Lexington, compare favorably to other major U.S. cities.

South Dakota

While some future retirees might take pause with South Dakota’s chilly winters, it may be worth it to give the Mount Rushmore State a close look when planning early retirement. Across the board, South Dakota’s taxes rank close to the lowest in the U.S.

That means every dollar you stash away will go that much further when you stop working – key for a successful early retirement. Likewise, housing costs in South Dakota (which has the sixth lowest population density of any state) rank as the fifth lowest in the U.S.

Wyoming

A Wyoming retirement is ideal for retirees who want to spend a good piece of their golden years in the outdoors. The state has some of the country’s most breathtaking scenery, from the wildlife of Yellowstone National Park to the peaks of the Grand Tetons and the slopes of Jackson Hole.

Retirees in Wyoming will also enjoy state and local taxes that are among the lowest in the U.S. Wyoming has no state income tax and its sales tax ranks as the eighth lowest in the U.S.

Early retirees should be aware that buying health insurance on the individual market in Wyoming can be pricey, however. We found that the average annual cost for a silver plan in Wyoming could be over $11,000 per year, second only to Alaska.

Tennessee

The Volunteer State offers early retirees a little bit of everything. Memphis and Nashville both have rich histories, great food and some of the country’s best live music. Those seeking natural wonders need look no further than Great Smoky Mountains National Park, 522,419 acres of mountains and forest. Sports fans can drop in for a game at one of the world’s largest stadiums, the University of Tennessee’s Neyland Stadium, which has an attendance record of 109,061.

All of that can be enjoyed without feeling the stress of a budget restricted by high taxes or living expenses. Tennessee has no income tax and its cost of living ranks among the lowest in the U.S. Retirees who love to shop should take note, however. Tennessee has the highest sales taxes in the U.S.

Mississippi

The early retirement math can be hard to work out. While other retirees can rely on Social Security for a source of income, early retirees need to rely entirely on savings for the first few years or retirement. Meanwhile, they have fewer years to build up their nest egg.

Retiring in Mississippi can make all that calculus a little easier. The state has the lowest cost of living of any U.S. state, with living expenses more than 15% below the national average. Furthermore, seniors living off of income from a 401(k), IRA or pension will benefit from an extremely retiree-friendly tax system. All retirement income is exempt from state and local taxes in Mississippi.

New Mexico

While retirees who are 65 or older are eligible for Medicare, early-retirees may need to buy their own health insurance on the individual market. Health insurance rates for seniors are limited to three times the rates for 20-year-olds, which means seniors will no longer face exorbitant premiums. Nonetheless, in some states, average annual premiums on seniors can be more than $10,000 per year.

Not so in New Mexico. We found that a 60-year-old buying a silver plan in New Mexico would pay $5,150 annually on average. That’s the third lowest rate in the U.S.

Pennsylvania

Unlike most of the other states in the northeast and mid-Atlantic, Pennsylvania rates quite well as a destination for those who want to get a jump-start on retirement. The state exempts all income from retirement accounts, like a 401(k), from taxation. For taxpayers over the age of 59.5, pension income is also exempt.

Related Article: 529 Plans in Pennsylvania

Calculate your retirement taxes in Tennessee.

Montana

If you want your retirement to feature a back-porch view of moose and snow-capped peaks, Montana might be a good – and affordable – choice. There is no sales tax in Montana and housing costs average just $8,928 per year, eighth lowest in the country.

While early retirees will have to pay state taxes on their retirement income, the rates are relatively low. For example, we found that a 60-year-old with $40,000 in income from retirement accounts would pay $1,483 in state taxes in Montana, which can also be deducted from federal taxes.

Florida

The Sunshine State is a favorite among retirees because of its warm weather, endless beaches and friendly income tax environment. There is no state income tax in Florida, saving retirees hundreds or thousands of dollars a year as compared with most other states on the east coast.

For early retirees, living expenses are especially important. In this regard, some parts of Florida rate well while others do not. For example, housing costs in the Miami area are quite high, while panhandle cities like Tallahassee are far more affordable. Early retirees will have to choose carefully when settling down to make sure their nest egg can meet their retirement expenses.

Texas

The largest of the lower 48 states, Texas offers a wide variety of geographical and cultural options when early retirees choose to settle down. There are major cities like Houston and Dallas. San Antonio and Austin have history, music and great food. There are beach towns along the gulf and mountain ranges like the Chisos and the Guadalupes in west Texas.

Early retirees in the Lone Star State will benefit from the state’s relatively low cost of living. Texas has no personal income tax, although property tax rates are among the highest in the U.S.

Related Article: 529 Plans in Texas

Data and Methodology

SmartAsset’s ranking of the best states for an early retirement focused on two financial considerations most important to early retirees: taxes and living expenses. We looked at six metrics overall, as listed below:

- Effective income tax rates on people age 55-64.

- State and local sales tax rates.

- Average effective property tax rates.

- Median annual housing costs.

- Non-housing cost of living.

- Average annual cost of a silver health insurance plan.

To calculate effective income tax rates, we ran over 30,000 simulations of our retirement income tax calculator. We simulated the state and local income taxes paid in every state for persons age 55, 60 and 64, with retirement income ranging from $20,000 annually to $80,000 annually.

Likewise, to calculate the average cost of health insurance plans in every state, we used the Kaiser Family Foundation’s health insurance calculator. We calculated the cost of a silver plan for a 60-year-old in the five largest counties in every state. We did not incorporate any potential subsidies, which vary depending on income.

Lastly, we ranked every state on these six metrics. We then averaged those rankings, giving double-weight to the effective income tax rates and equal weight to all other metrics. Scores from 0-100 were calculated based on that average ranking. A state that ranked first for every metric would have scored a perfect 100, while a state that ranked last would have scored a zero.

Data on property taxes and housing costs comes from the U.S. Census Bureau. Data on the cost of living comes from the Council for Community and Economic Research.

Questions about our study? Contact us at blog@smartasset.com.

Photo credit: ©iStock.com/alexeys