Amazon (AMZN) is not only one of the most successful online retailers, but it’s also one of the few trillion-dollar U.S. companies that offers stocks. Founded in 1994 by Jeff Bezos, the company offers an array of products and services to customers on a global scale. Bezos stepped down as CEO in July 2021, with Andy Jassy taking his position. With its revenue and share price skyrocketing over the last few years, the company’s growth rate has attracted both rookie and experienced investors.

If you have specific questions about investing, try speaking with a financial advisor.

How to Buy Amazon Stock With a Brokerage Account

Amazon’s stock is technically available to any investor. Many companies offer direct investment options, but those interested in purchasing Amazon shares must utilize a brokerage account. To buy Amazon stock, you’ll need to use the Amazon ticker on the Nasdaq, which is AMZN.

Your Amazon stock trade will fall into one of two categories: market order or limit order. A market order allows you to purchase the stock at its current cost. A limit order, on the other hand, allows you to set the maximum price you’re willing to pay for a share. Then, if a stock exceeds that specified amount, the order won’t proceed.

If you can’t afford to purchase a full share of AMZN, you can also invest in fractional shares through an online brokerage. These services allow investors to purchase a partial share of equity.

Brokerage firms typically provide a wide range of investment options, including stocks, bonds, mutual funds, exchange-traded funds (ETFs) and more. Fees and investment selections also differ within each brokerage, though many firms now offer commission-free trades on stocks. You’ll need to carefully select which firm fits best with your financial goals and needs.

Comparison of Brokerage Accounts

| Brokerage Firm | Commissions | Minimum | Best For |

| Robinhood Read Review | None | None | – Mobile/online traders – Self-sufficient investors |

| Merrill Edge Read Review | Free online stock, ETF and options trades | None | – Bank of America account holders – Customer support users |

| Charles Schwab Read Review | Free online stock, ETF and options trades | None | – Sophisticated online traders – New investors who can afford to pay for assistance |

How to Buy Amazon Stock With a Financial Advisor

Buying Amazon shares on your own is not your only option. If you’re looking for expert support with your investments, hiring a financial advisor could be right for you. Simply tell your advisor that you want to invest in Amazon, and he or she can help you do it. Your financial advisor can also help figure out when it’s time to sell your shares, which can be a tricky decision.

Markets can be volatile, meaning your investment strategy can change course amid highs and lows. Whether you’re new to the stock market or an experienced investor, the help of a financial advisor can set you on a course for better investment decisions. Advisors can also help you align your investment portfolio with your overall financial plan.

Company Overview of Amazon

Headquartered in Seattle, Amazon is a global leader in the online retail and e-commerce market that provides both national and international services to its customers. Though the company initially began as a digital bookstore, it has grown to offer cloud services and other retail products through its massive network of sellers. In addition, the company has acquired other businesses, such as Whole Foods Market and One Medical.

Amazon is divided into five separate business segments: North America, International, Grocery, Subscription/Streaming and Amazon Web Services (AWS). Here’s a breakdown:

| Amazon North America and International | – Retail products – Clothing, shoes, jewelry – Electronics – Food and groceries, pet supplies – Beauty and health – Automotive |

| Grocery | – Whole Foods Market |

| Subscription and Streaming | – Amazon Prime – Amazon Music |

| Amazon Web Services (AWS) | – Echo and Alexa – Kindle E-readers & Books – Advertising and publishing – AWS Marketplace – Storage and database services |

| Healthcare | – One Medical – Amazon Pharmacy |

Amazon’s Stock Price and Quality

Amazon is one of the many stocks that’s received a blue-chip status. In other words, this categorization means that the company’s stock is highly reliable. Typically, businesses that perform the strongest in the market earn that title.

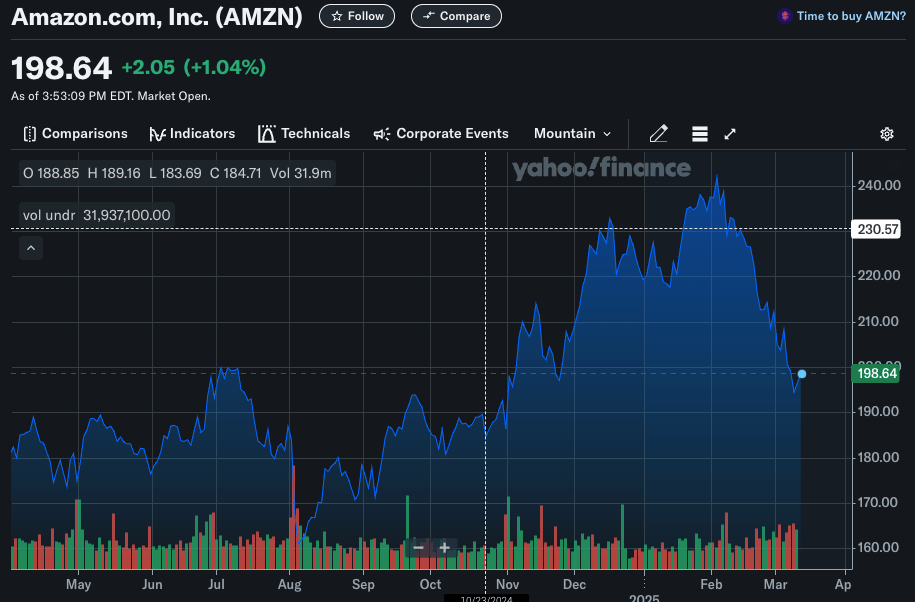

However, you should also take note of the company’s share price before making an investment. In April 2022, Amazon’s stock price was roughly $2,892 per share.

It’s important to consider your long-term investment goals before purchasing Amazon shares, especially since the stock price and how it is valued could change. You should keep in mind, for instance, that in May 2022, Amazon shareholders approved a 20-for-1 stock split. This approval means that if you owned stock before the split, you would have seen 19 additional shares for each stock that you owned.

For reference, Amazon’s stock price is valued roughly at $198 per share as of March 2025, which adds up to be more than the value it was at the time of the split.

Note that past performance does not guarantee future results.

You should always research a stock before investing. Important factors to consider include the company’s net income and earnings, which can be found on Amazon’s Form 10K. This is an annual report that all public companies must file with the SEC. In addition, it outlines everything from a company’s total revenue and assets to its risk factors and liabilities.

Is Amazon Stock Right for You?

Amazon’s share price runs considerably high, so you’ll want to consider your long-term investment goals before becoming a shareholder. While the company retains blue-chip status, with a history of significant growth, it’s also important to be mindful of some of its competitors. Companies like Microsoft and Walmart also offer competitively successful stocks. And, similar to Amazon, both companies specialize in either e-commerce, retail or cloud computing.

Though Amazon has recently experienced significant growth in shares, no company is insusceptible to risk. Many factors, such as competition, climate and economy, ultimately affect the performance of a stock. Therefore, potential investors should carefully analyze a company from a holistic standpoint when considering buying.

However, Amazon could be a great option for those looking for long-term financial gain. The company’s global customer base and diversified product have ultimately brought it much success. If you’re interested in stable and potentially promising investments, Amazon could be right for you.

Keep in mind that just because a stock is highly-solicited, it does not mean that it is the best investment for your portfolio. Make sure to consider your financial needs and investment goals, as well as the needs of your portfolio and the level of risk that you are willing to take on.

Bottom Line

Investing in Amazon stock can be a strategic move for those looking to diversify their portfolio with a well-established tech giant. To begin, it’s essential to understand the process of purchasing Amazon shares. First, you’ll need to set up a brokerage account if you don’t already have one. This account will serve as your platform for buying and selling stocks. Once your account is active, you can search for Amazon’s ticker symbol, AMZN, and decide how many shares you wish to purchase based on your investment strategy and budget.

Tips to Become a Better Investor

- A financial advisor can help you determine which stocks should fit into your portfolio to help you reach your unique long-term goals. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- If you’d like to invest, but aren’t exactly sure how much to spend, SmartAsset’s investment calculator can help you assess the potential long-term effects of your investment based on your financial goals.

Photo credit: ©iStock.com/AdrianHancu, Yahoo Finance, ©iStock.com/Jirapong Manustrong