If you’re expecting a big refund, tax season can be a pleasant time of the year. There is always a chance, though, that you could end up actually owing the government money. Some taxpayers are able to cover those costs, while others have to turn to alternatives like payment via installment plan. With taxpayers meeting with their financial advisor or accountant to get prepared for tax season, SmartAsset decided to analyze the data and see which states have the biggest average tax debt among those taxpayers who do owe money to the government.

To find the states with the biggest tax bill in the U.S., we analyzed two metrics at the state level: the number of tax returns with underpayments and the total amount of underpaid taxes. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s second study on the states with the largest tax bills. Check out the 2019 version here.

Key Findings

- The average amount owed is $5,510. Across all 50 states and the District of Columbia, the average amount owed on tax returns with underpayments is $5,510.

- Tax bills tend to be higher in the Northeast and lower in the Midwest. Northeastern states have the highest average tax bill when we compare the data by region. Among all Northeastern returns with underpayments, the average amount owed is $5,962 versus an average of $5,196 among Midwestern returns.

- Some taxpayers will need twice as much on hand to pay Uncle Sam. In West Virginia, taxpayers owe $4,200 on average. That’s almost doubled in Wyoming, where taxpayers owe $8,000 on average.

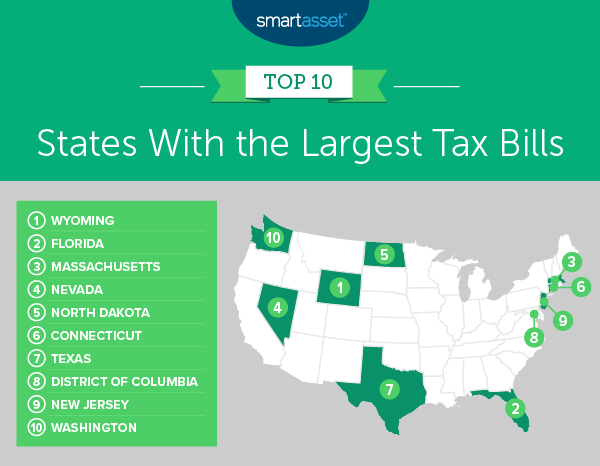

1. Wyoming

Wyoming has the highest average amount owed in taxes across all 50 states and the District of Columbia, at $8,077. The total amount underpaid in the state, according to 2017 data, was $442,198,000 spread out across 54,750 tax returns with underpayments.

2. Florida

The average amount owed at tax time in Florida is $7,197, almost $900 less than our highest-ranking state for this metric, Wyoming. This is the result of a total underpayment amount in the state of $14,797,608,000 – the third-largest amount for this metric in the study overall – spread out across 2,056,190 tax returns with underpayments.

3. Massachusetts

According to IRS data from 2017, there were 736,170 tax returns with underpayments in Massachusetts. The total amount underpaid was $5,192,037,000, and the average amount a Massachusetts taxpayer owed was $7,053. Those looking tackle their taxes in the Bay State should check out the top financial advisor firms in Massachusetts.

4. Nevada

Nevada had 273,960 tax returns with underpayments in 2017 and a total of $1,883,513,000 in the amount underpaid. That’s an average amount of $6,875 owed per return.

5. North Dakota

The total tax underpayment in the state of North Dakota was $567,112,000. There were 82,860 total tax returns with underpayments, making the average amount owed $6,844, which is the fifth-largest average amount owed in our study.

6. Connecticut

According to IRS data from 2017, the average amount owed by Connecticut taxpayers with underpayments was $6,802. The total underpayment amount in the state was $2,470,228,000, and the total number of returns with underpayments was 363,140.

7. Texas

In Texas, there were 2,324,300 tax returns with underpayments and a total underpayment of $15,788,868,000, according to IRS data from 2017. The average amount owed was $6,793, the seventh-largest amount for this metric across all 50 states and the District of Columbia.

8. District of Columbia

In the District of Columbia, taxpayers with underpayments owed $6,766 on average, according to IRS data from 2017. The total amount of underpaid taxes in the District of Columbia was $527,484,000, and there were 77,960 tax returns with underpayments.

9. New Jersey

The total amount of underpaid taxes in New Jersey was $6,019,362,000, according to IRS data from 2017. Furthermore, 894,740 tax returns had underpayments, resulting in an average amount owed of $6,727.

10. Washington

According to IRS data from 2017, the state of Washington had a total underpayment amount of $5,343,502,000 and 798,090 tax returns with underpayments, resulting in an average underpayment amount of $6,695.

Data and Methodology

To find the states with the largest tax bills, we looked at data for all 50 states and the District of Columbia. We focused on the following two metrics:

- Number of tax underpayments: This is the number of tax returns in which taxpayers have not paid sufficient taxes on income earned and thus owe money to the IRS.

- Amount of underpaid tax: This is the total amount owed to the IRS on returns as a result of income for which taxpayers failed to pay sufficient taxes.

We then divided the amount of total underpaid tax (the money taxpayers owed) in each state by the number of tax underpayments in that state. The result represents the average underpayment amount for taxpayers who underpaid on taxes throughout the year. We used this dollar figure of the average in taxes owed by state to rank the entire list from highest to lowest. All data comes from the IRS and is for 2017.

Tips for Dealing with Taxes

- Best to break even. If possible, it’s ideal not to owe the government or expect a refund. SmartAsset can help you prepare by showing you what your return might look like with our tax return calculator.

- Take caution with tax refunds. Though it can be a burden to owe money on your tax returns, refunds aren’t necessarily a positive. They essentially mean that you’ve loaned money to the government throughout the previous year. Uncover the hidden costs of tax refunds here.

- Be prepared for more than just taxes. Do you have questions about how long-term financial plans – like paying for college or planning your family’s estate – will affect your current and future tax situation. Consider seeking out professional advice. Finding the right financial advisor who fits your needs doesn’t have to be hard, though. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/AndreyPopov