Tax season can be a celebratory time for Americans who are owed a refund. But while the focus is often on those who have overpaid, it’s important to note that a significant number of people don’t pay enough. Americans who owe taxes are especially vulnerable if they cannot cover their tax bill with what’s in their savings account. Below, we analyze IRS data to find the states with the largest tax bills.

To create these rankings, we look at two factors: the number of tax returns resulting in underpayments and the total amount of underpaid taxes. The Data and Methodology section below shows our sources and how we put our data together to create our final rankings.

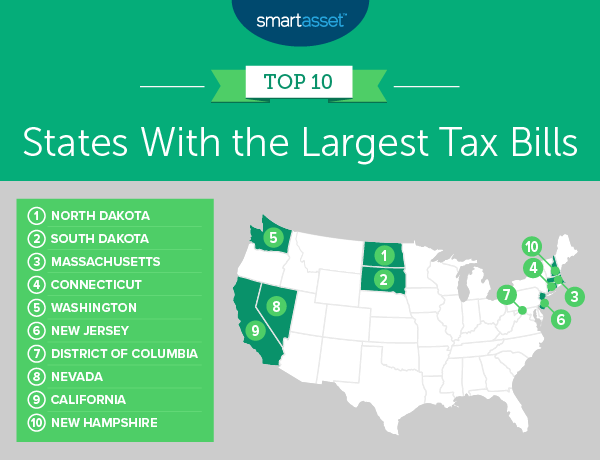

Key Findings

- The Dakotas owe the most – Taxpayers in the two Dakotas – North and South – owe the most in taxes by April 15. North Dakota tops the list with the average tax payment equaling $6,806. South Dakota takes second, averaging about $100 less at $6,697. This puts the two states about $200 and $100 above third-placed Massachusetts.

- Higher-income states tend to owe more taxes – Seven of the top 10 states owing the most in taxes come tax season are also some of the highest-earning states in the country. Massachusetts, Connecticut, Washington, New Jersey, Washington D.C., California and New Hampshire all rank in the top 15 for median household income.

- States with high rates of self-employed workers leave more taxes for tax season – One of the pitfalls of being self-employed is having to pay your own taxes without automatic withholdings from your paycheck. Data from the Census Bureau shows there is a small, positive relationship between the percentage of workers who are self-employed and the size of the average tax underpayment. The top 25 states with the highest average tax underpayment have an average self-employment rate of 10%. In the bottom 25 states, that figure is 9.5%.

1. North Dakota

Number of Underpayments: 78,180

Amount Underpaid: $532,093,000

Average Taxes Owed: $6,806

2. South Dakota

Number of Underpayments: 86,140

Amount Underpaid: $576,891,000

Average Taxes Owed: $6,697

3. Massachusetts

Number of Underpayments: 682,580

Amount Underpaid: $4,505,814,000

Average Taxes Owed: $6,601

4. Connecticut

Number of Underpayments: 342,610

Amount Underpaid: $2,221,436,000

Average Taxes Owed: $6,484

5. Washington

Number of Underpayments: 728,930

Amount Underpaid: $4,605,445,000

Average Taxes Owed: 6,318

6. New Jersey

Number of Underpayments: 841,370

Amount Underpaid: $5,298,496,000

Average Taxes Owed: $6,297

7. District Of Columbia

Number of Underpayments: 73,000

Amount Underpaid: $453,023,000

Average Taxes Owed: $6,206

8. Nevada

Number of Underpayments: 251,810

Amount Underpaid: 1,530,386,000

Average Taxes Owed: $6,078

9. California

Number of Underpayments: 4,099,160

Amount Underpaid: $24,790,639,000

Average Taxes Owed: $6,048

10. New Hampshire

Number of Underpayments: 131,310

Amount Underpaid: $786,572,000

Average Taxes Owed: $5,990

Data and Methodology

In order to rank the states in which taxpayers owe the most taxes, we looked at data for all 50 states and Washington, D.C. We focused on the following two factors:

- Number of tax underpayments.

- Amount of underpaid tax.

We then divided the amount of underpaid tax in each state by the number of tax underpayments in that state. The result represents the average underpayment amount for the average person who underpaid on their taxes and is the number we used to rank the entire list.

Tax-paying Tips

- Prepare an emergency fund – Many people receive a tax refund, but plenty of people also end up owing taxes. Even if you often receive a refund, it’s not a guarantee that your situation will stay the same. It’s important to be prepared, because the amount you may owe can be sizeable. If you don’t have an emergency fund handy and you owe the IRS taxes, you may find yourself taking out an expensive short-term loan or having to negotiate an installment plan with the IRS. But with an emergency fund, you can pay your back taxes without having to worry too much.

- Get an advisor – Contrary to popular belief, the ideal tax arrangement is neither to owe nor be owed. But it can be difficult to land in this situation. Instead of handling your taxes yourself, why not have an expert do it? A financial advisor can not only help you settle your tax arrangements but also make sure your finances are aligned with your long-term goals. If you are not sure where to find a financial advisor, check out SmartAsset’s financial advisor matching tool.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/Rawpixel, ©iStock.com/ChrisBoswell, ©iStock.com/Joecho-16, ©iStock.com/grantreig, ©iStock.com/Sean Pavone, ©iStock.com/saje, ©iStock.com/DenisTangneyJr, ©iStock.com/Sean Pavone, ©iStock.com/4kodiak, ©iStock.com/minddream, ©iStock.com/DenisTangneyJr