Between 2020 and 2021, the number of fraud reports filed with the Federal Trade Commission (FTC) increased by 27.3%, from 2.2 million to 2.8 million. Total reported monetary losses saw a bigger spike over the same time period (78%), jumping from $3.3 billion to $5.9 billion. Over the past 10 years, there was a 154.5% increase in monetary losses.

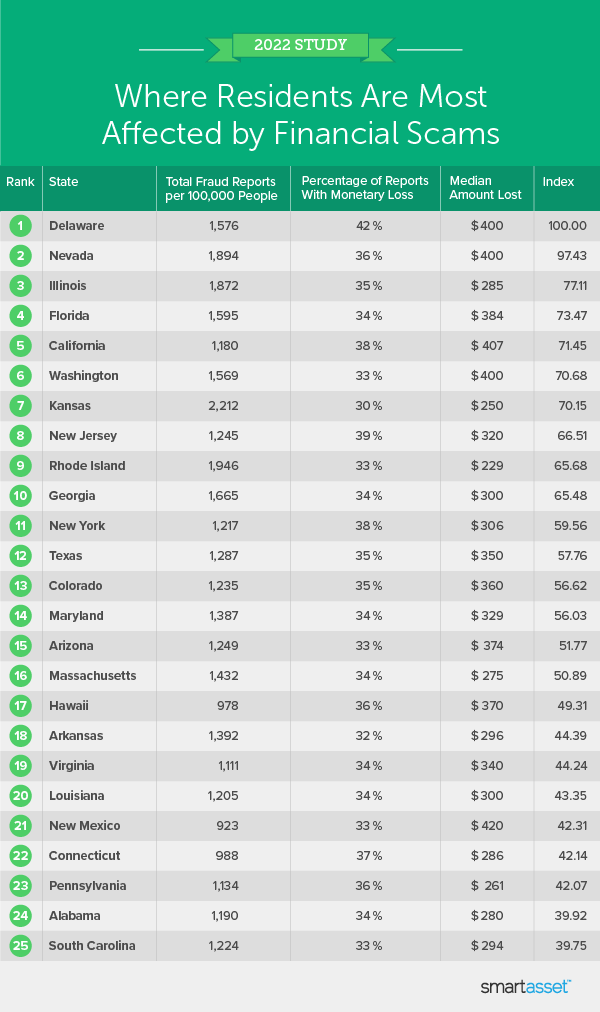

Keeping this upward trend in mind, SmartAsset analyzed the most common types of financial fraud and identified the states where residents face the most financial scams. To rank states, we considered three metrics: total fraud reports per 100,000 residents, percentage of fraud reports with monetary loss and median amount lost. For more information on our data sources and how we put all the information together to create the final rankings, read our Data and Methodology section below.

Key Findings

- Roughly half the states have more than 1,000 fraud reports for every 100,000 residents. The state with the highest per capita figure is Kansas (2,212) and the state with the lowest per capita figure is South Dakota (531).

- In 2020, one-third of fraud reports included a financial loss. The state with the highest percentage is Delaware with 42% of fraud reports including a monetary loss. Five states tie for the lowest percentage (30%): Kansas, Alaska, Montana, New Hampshire and Nebraska.

- The median amount lost ranges from $205 in West Virginia to $500 in Alaska. Just six states have a median amount loss of $400 or higher and four of them rank in the 10 states where residents face the most financial fraud.

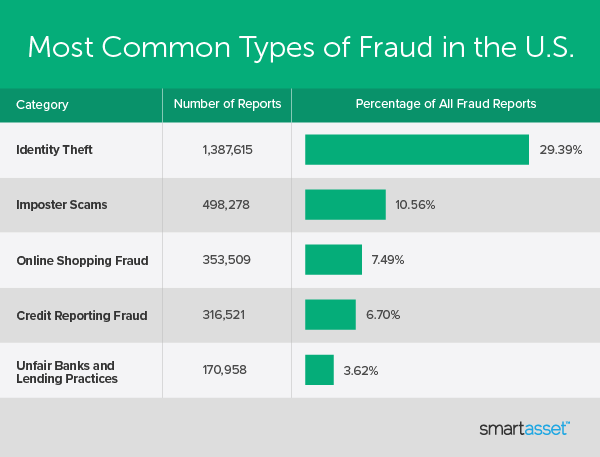

Most Common Types of Financial Fraud in the U.S.

The most common type of fraud in the U.S. is identity theft, which accounts for 29.39% of all reported fraud in 2020 and totals 1.3 million cases. In 2020, millions of people reached out to the government to deal with the financial fallout of the COVID-19 pandemic and over 400,000 reported identity theft that involved government documents or benefits fraud. That is a 2,920% increase in that type of identity theft when compared with 2019.

The second-most common type of fraud is imposter scams. There were nearly half a million reports for this type of fraud in 2020, accounting for about 11% of all fraud reports. Online shopping fraud (353,509 reports), credit reporting fraud (316,521 reports) and unfair bank and lending practices (170,958 reports) follow as the third-, fourth- and fifth-most common types of fraud.

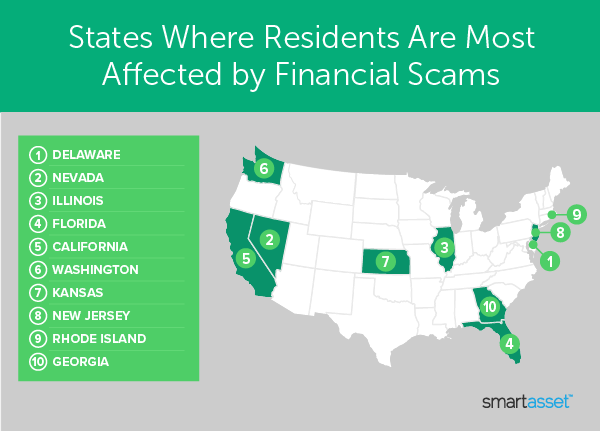

States Where Residents Are Most Affected by Financial Scams

1. Delaware

Of the three metrics we considered, Delaware ranks worst for the percentage of fraud reports that include a monetary loss (42%). The median amount lost in this state is $400, ranking fourth-worst (and tying with Nevada and Washington). Overall, there were 1,576 fraud reports for every 100,000 residents in 2020, the seventh-worst rate in our study.

2. Nevada

Nevada is the only other state besides Delaware to rank in the bottom 10 across all three metrics analyzed. It places third-worst for the number of fraud reports per 100,000 residents (1,894), fourth-worst for the median dollar amount lost ($400) and sixth-worst for the percentage of fraud reports that include a monetary loss (36%).

3. Illinois

This Midwestern state ranks fourth-worst for the number of fraud reports per 100,000 residents (1,872). Of total fraud reports, 35% of them include monetary losses (ranking 10th-worst). Despite this, the median amount lost is $285, which 32nd-lowest across all 50 states.

4. Florida

The Sunshine State may not be so sunny for those who’ve fallen victim to financial fraud. In 2020, there were 1,595 fraud reports for every 100,000 residents (ranking sixth-worst) and 34% of the total number of reports included monetary losses (ranking 16th-worst). The median amount lost in this state is $384, which ranks seventh-worst in our study.

5. California

California ranks third-worst for both the percentage of fraud reports including a monetary loss (38%) and the median amount lost ($407). However, California ranks better for its concentration of fraud reports. In 2020, there were less than 1,200 fraud reports per 100,000 residents.

6. Washington

Tied with Delaware and Nevada, Washington ranks fourth-worst for the median dollar amount lost to financial scams ($400). The state also ranks eighth-worst for the number of fraud reports per 100,000 residents (1,569). Of those reports, 33% include a monetary loss.

7. Kansas

The second Midwestern state in the bottom 10 is Kansas, which ranks worst overall for the number of fraud reports per 100,000 residents (2,212). Despite this, Kansas ranks better for the other two metrics. About 30% of fraud reports result in monetary losses and the median dollar loss amount is $250.

8. New Jersey

In New Jersey, there were 1,245 fraud reports per 100,000 residents in 2020, ranking 14th-worst in our study. Of the total number of fraud reports, 39% of them include a monetary loss (ranking second-worst). However, the median amount lost is $320, which ranks only 16th-worst.

9. Rhode Island

Rhode Island ranks second-worst for its number of fraud reports per 100,000 residents, at 1,946. However, the percentage of fraud reports with a monetary loss is 33% (ranking 26th-worst) and the median amount lost is $229 (ranking fifth-lowest).

10. Georgia

The last state to round out the 10 states where residents face the most financial fraud is Georgia. In 2020, there were 1,665 fraud reports per 100,000 residents, the fifth-worst rate in our study. Of the total number of fraud reports, 34% of them include a monetary loss (ranking 16th-worst) and the median amount lost is $300 (ranking 19th-worst).

Data and Methodology

To find the states where residents face the most financial scams, SmartAsset looked at data for all 50 states. We compared them across three metrics:

- Total fraud reports per 100,000 residents.

- Percentage of fraud reports with monetary loss.

- Median amount lost.

Data comes from Federal Trade Commission (FTC) Consumer Sentinel Network Data Book and is for 2020.

To create our final rankings, we gave each state a score in each of the metrics based on how far above or below the mean they were. We then used the sum of these numbers to create the final ranking. The state with the highest cumulative score received a score of 100, ranking as the state where residents face the most financial scams. The state with the lowest cumulative score received a score of 0, ranking as the state where residents face the fewest financial scams.

Tips for Preventing Financial Scams

- Be in the know. Fraudsters are constantly evolving and to outwit them, you should too. SmartAsset offers free resources to understand the current climate of fraud. Learn about the types of phishing scams, how to avoid jeopardizing your investments and how to keep yourself safe from the most common type of fraud: identity theft.

- Take the time to think through your options. According to Jeff Zhou, Chief Executive Officer of Fig Loans, “[Fraudsters are] so good at making you feel the urgency to act, sometimes without you realizing it, so you need to really pay attention. Avoid the urge to act swiftly. Big financial decisions require careful thinking and planning after all.”

- Work with a professional. A financial advisor can guide you through important financial decisions and be another line of defense against fraud. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Questions about our study? Contact press@smartasset.com.

Photo credit: ©iStock/Velishchuk