The nationwide median monthly rent in 2019 was $934 for a studio apartment and $953 for a one-bedroom, according to Census Bureau data. This can add up to anywhere between about $11,200 and $11,400 per year for solo renters. Living with a roommate is a common alternative to save money, but some residents may prefer to live alone. The good news is that depending on the city, living alone won’t break your budget. With this in mind, SmartAsset identified and ranked the top cities where renters can afford to live alone in 2021.

In this study, we compared the 100 largest U.S. cities across five metrics: average rent for a unit with fewer than two bedrooms, percentage of housing units with fewer than two bedrooms, median earnings for full-time workers, cost of living and unemployment rate. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s fourth annual study on the cities where renters can afford to live alone. Check out the 2020 version here.

Key Findings

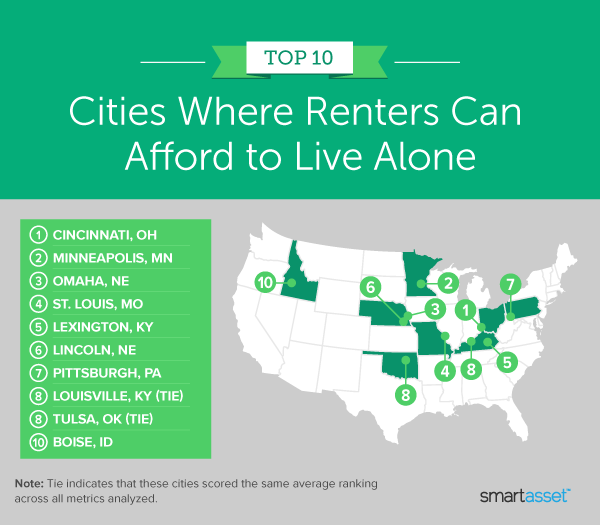

- Cincinnati, Ohio claims the top spot for a fourth consecutive year. In fact, eight cities from 2020 rank in the top 10 again this year. The two exceptions are Louisville, Kentucky and Tulsa, Oklahoma, which are tied for eighth place in our study.

- Nebraska and Kentucky are the top states for solo renters. Two Nebraska cities – Omaha and Lincoln – and two Kentucky cities – Lexington and Louisville – make it into the top 10. The average estimated annual cost of living across all four cities is less than $24,000 per year. The average rent across them for a unit with fewer than two bedrooms is $724 per month, or $8,688 per year.

1. Cincinnati, OH

Taking the No. 1 spot in this study yet again, Cincinnati, Ohio has many options for renters who wish to live alone. Average rent for a unit with fewer than two bedrooms is $612, the fifth-lowest figure for this metric across all of the 100 largest U.S. cities. The city also ranks within the top 10 of the study for its relatively low cost of living, $22,721 per year. Its April 2021 unemployment rate was 4.6% and more than 28% of its occupied housing units have fewer than two bedrooms, placing in the top-20 for both rates.

2. Minneapolis, MN

Though Minneapolis, Minnesota ranks towards the middle of study for average rent costs, these still total less than $1,000 per month – $893, to be exact. The city ranks similarly for cost of living, which is about $25,700 per year. However, it ranks in the top 20 cities for the other three metrics. About 32% of occupied housing units in the city have fewer than two bedrooms, and its April 2021 unemployment rate was only 4.2%. Additionally, in 2019, the average earnings for full-time workers was almost $56,500.

3. Omaha, NE

Omaha, Nebraska ties with Boise, Idaho and Arlington, Virginia for the second-lowest April 2021 unemployment rate in the study, at 3.0%. The city also ranks within the top quartile of study for its relatively low annual cost of living ($23,767) and average monthly rent for a unit with fewer than two bedrooms ($781).

4. St. Louis, MO

St. Louis, Missouri ranks within the top fifth of cities for three of the five metrics that we considered: average rent for a unit with fewer than two bedrooms ($727 per month), percentage of occupied housing units with fewer than two bedrooms (30.97%) and estimated cost of living ($23,462 per year).

5. Lexington, KY

The April 2021 unemployment rate in Lexington, Kentucky was low, at 3.2% – a top 10 rate. The average earnings for full-time workers is about $46,400, ranking in the middle of the study. But its cost of living is 12th-lowest ($23,163) and average monthly rent for units with fewer than two bedrooms is 16th-lowest ($680).

6. Lincoln, NE

In Lincoln, Nebraska, the average rent for a unit with fewer than two bedrooms will run residents $759 a month, the 21st-lowest figure for this metric overall. The estimated annual cost of living in the city is $23,419, 14th-lowest in the study. Lincoln also has the lowest April 2021 unemployment rate, 2.2%.

7. Pittsburgh, PA

Pittsburgh, Pennsylvania ranks within the top 25 for its relatively high percentage of occupied housing units with less than two bedrooms (26.32%). The city also has the 17th-lowest estimated annual cost of living, at $23,463 per year. And it ranks within the top 30 for its average earnings for full-time workers, at $51,328 per year.

8. Louisville, KY (tie)

Louisville, Kentucky ties with Tulsa, Oklahoma for the No. 8 spot in the study. It ranks in the top 15 of the study for three metrics: average rent for units with fewer than two bedrooms ($676 per month), cost of living ($23,367 per year) and April 2021 unemployment rate (4.1%).

8. Tulsa, OK (tie)

Tulsa, Oklahoma ranks within the top 10 for two metrics: average rent for units with fewer than two bedrooms ($658 per month) and annual cost of living ($22,786), for which it ranks second-lowest. Additionally, Tulsa ties for the 16th-lowest April 2021 unemployment rate (4.5%) across all 100 largest cities in the country.

10. Boise, ID

Rounding out our top 10 cities where renters can afford to live alone is Boise, Idaho. It ties for the second-lowest April 2021 unemployment rate in the study (3.0%) and has the 10th-lowest cost of living overall ($23,123 per year). It also ranks 20th-best for its relatively low average rent for a unit with fewer than two bedrooms, at $755 per month.

Data and Methodology

To find the cities where renters can afford to live alone, SmartAsset looked at data on the 100 largest U.S. cities. We compared them across five metrics:

- Average rent for a unit with fewer than two bedrooms. This is the average of median gross monthly rent for a studio and median gross monthly rent for a one-bedroom unit. Data comes from the Census Bureau’s 2019 1-year American Community Survey.

- Percentage of housing units with fewer than two bedrooms. This is the percentage of occupied housing units that are either studio or one-bedroom apartments or homes. Data comes from the Census Bureau’s 2019 1-year American Community Survey.

- Median earnings for full-time workers. Data comes from the Census Bureau’s 2019 1-year American Community Survey.

- Cost of living. Data comes from the MIT Cost of Living Calculator MIT Living Wage Calculator and is from June 2021. This metric is measured at the county level.

- April 2021 unemployment rate. Data comes from the Bureau of Labor Statistics and is measured at the county level.

We ranked each city in every metric and found each city’s average ranking, with each metric receiving an equal weight. Using this average ranking, we created our final score. The city with the best average ranking received a score of 100 while the city with the worst average ranking received a score of 0.

Savings Tips for Solo Renters

- Befriend your budget. Making regular purchases like groceries and other essentials for one person can often be tricky and lead to overspending. Knowing the ins and outs of your budget can help you keep track of your money more efficiently. Check out our free budget calculator to get started.

- Consider a professional partner for your finances. You may be living solo, but you don’t need to handle everything alone. Need some support with planning and executing your long-term financial goals? Even if it’s sometimes easier to just do things yourself, finding a financial advisor doesn’t have to be hard. SmartAsset’s free matching tool can connect you to financial advisors in just five minutes. If you’re ready to speak to a professional about your next money moves, get started now.

Questions about our study? Contact press@smartasset.com.

Photo credit: ©iStock.com/South_agency