Following mortgage debt, student loan debt is the second-largest form of U.S. consumer debt, growing substantially over recent years and negatively affecting Americans’ ability to save enough. According to data from Experian, student loan debt reached an all-time high of $1.4 trillion in the first quarter of 2019, an increase of 116% from 10 years prior. In fact, the average American with student loan debt had $35,359 in student loan debt.

Following mortgage debt, student loan debt is the second-largest form of U.S. consumer debt, growing substantially over recent years and negatively affecting Americans’ ability to save enough. According to data from Experian, student loan debt reached an all-time high of $1.4 trillion in the first quarter of 2019, an increase of 116% from 10 years prior. In fact, the average American with student loan debt had $35,359 in student loan debt.

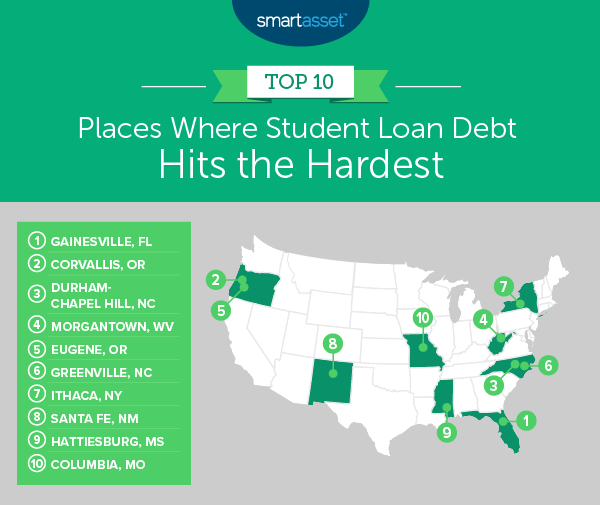

Though student loan debt is a national problem, some places have been more affected than others, with average amounts varying metro area. In this study, SmartAsset looked at some of the metro areas most impacted by student loan debt. We considered data from Experian, the Census and the IRS in order to form our rankings. For more information on our data sources and how put all the information together to create the final rankings, check out our Data and Methodology section below.

Key Findings

- Student loan debt outpaces yearly earnings in some places. In four of the top 10 metro areas in our study and six of the total 100 for which we considered data in our study, average student loan debt exceeds the median earnings for residents with a bachelor’s degree. The difference is the largest in Corvallis, Oregon, where average student debt is $6,325 more than the median earnings for individuals older than the age of 25 who have a bachelor’s degree.

- University towns are disproportionately affected. All of the top six metro areas hit hardest by student debt are college towns: Gainesville, Florida; Corvallis, Oregon; Durham-Chapel Hill, North Carolina; Morgantown, West Virginia; Eugene, Oregon and Greenville, North Carolina. The Durham-Chapel Hill metro area, home to both the University of North Carolina at Chapel Hill and Duke University, ranks third in the study and has the highest average student loan debt of any metro area, at $47,955, according to Experian findings.

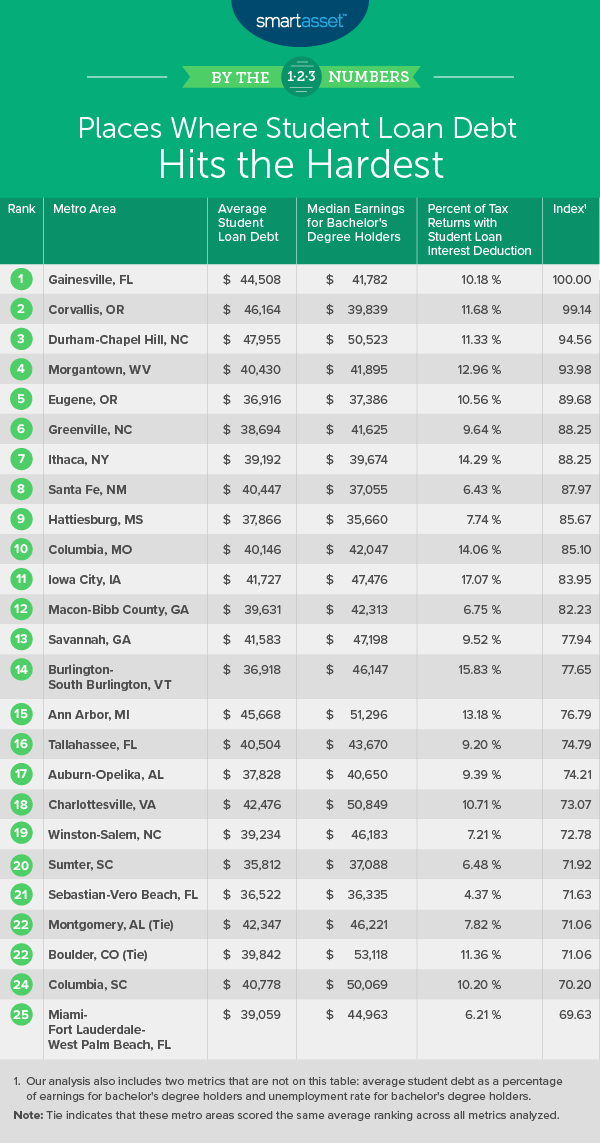

1. Gainesville, FL

Part of northern Florida and home to the University of Florida, Gainesville is the top place impacted by student loan debt, according to the five metrics we considered. Average student loan debt in Gainesville, at $44,508, is the fifth-highest across all 100 metro areas. The median annual earnings for residents with bachelor’s degrees was only $41,782 in 2017, the 16th-lowest.

2. Corvallis, OR

The average student loan debt in Corvallis, Oregon is $46,164, which is $6,325 more than the median earnings for individuals 25 and older who have a bachelor’s degree. In fact, average student debt as a percentage of earnings for residents with a bachelor’s degree here is 115.88%, the highest in our study. It is also important to note that student debt will be an even greater percentage of post-tax earnings. Take a look at our income tax calculator to see how state and local taxes will affect your take-home pay.

3. Durham-Chapel Hill, NC

According to Experian data, average student loan debt was the highest in Durham-Chapel Hill, North Carolina of any metro area in our study at the end of March 2019, reaching $47,955 on average. This is an increase of approximately 10.0% from March 2018, when average student loan debt in the Durham area was $43,614 on average.

Unfortunately, bachelor’s degree holders also seem to have a harder time finding jobs in Durham-Chapel Hill. According to Census estimates, the unemployment rate for residents with a bachelor’s was 3.2% in 2017, the 20th-highest rate across all 100 metro areas with the most student loan debt for which we considered data.

4. Morgantown, WV

Student loan interest is tax deductible, and the IRS reports the number of returns with a student loan interest deduction every year. Home to West Virginia University, Morgantown, West Virginia has the 10th-highest percentage of 2016 tax returns that took the deduction, with almost 13% of residents claiming it. For more information on the student loan interest deduction, take a look at our five tax rules to consider when paying off student loans.

5. Eugene, OR

In 2017, median earnings for bachelor’s degree holders in Eugene, Oregon were $37,386, the fifth-lowest amount for this metric of any metro area we considered. Though average student loan debt in Eugene does not exceed the median annual earnings for bachelor’s degree holders, it comes close. Specifically, Experian reports that as of the end of the first quarter in 2019, average student loan debt for residents in Eugene was $36,916, which is 98.74% of median earnings.

6. Greenville, NC

Greenville, North Carolina performs poorly in all five metrics we considered. Average student loan debt for residents was $38,694 in March 2019, the 38th-highest of the 100 areas we considered. Furthermore, median earnings for bachelor’s degree holders were only $41,625 in 2017, the 15th-lowest rate.

7. Ithaca, NY

About 14.29% of residents in Ithaca, New York claimed the student loan interest deduction in 2016. This is the highest percentage of any metro area in our top 10 and fifth-highest overall. Earnings for residents with bachelor’s degrees are also low in Ithaca, making student loans more difficult to pay off. According to 2017 Census estimates, the average annual earnings for bachelor’s degree holders 25 and older in Ithaca were less than $40,000.

8. Santa Fe, NM

Average earnings for residents with a bachelor’s degree are low in Santa Fe, New Mexico. In 2017, the Census reported that bachelor’s degree holders earned only $37,055 on average, the third-lowest amount across all 100 metro areas in our study. Additionally, average student loan debt in Santa Fe was $40,447, or $3,392 more than average earnings.

9. Hattiesburg, MS

Hattiesburg, Mississippi has the lowest average earnings for residents with a bachelor’s degree, at $35,660, of all 100 metro areas in our study. It is also the fourth metro area in our top 10 where average student loan debt exceeds the median earnings for residents with a bachelor’s degree. Experian reports that average student loan debt was $37,866 in March 2019, meaning that average student loan debt as a percentage of earnings with bachelor’s degree holders is 106.19%.

10. Columbia, MO

The unemployment rate for bachelor’s degree holders in Columbia, Missouri is relatively low compared to other metro areas. In 2017, only 1.7% of bachelor’s degree holders were unemployed, the 19th-lowest rate for this metric in the study. Despite this, student debt seems to be common in Columbia, as many residents claimed the student loan interest deduction in their tax returns. Specifically, 14.06% of 2016 returns reported the tax break, the seventh-highest percentage for this metric across all metro areas and third-highest in our top 10.

Data and Methodology

In this study we considered the 100 metro areas Experian identified as ranking the highest by student loan debt balance in its July 2019 report. In order to find places most impacted by student loan debt of those 100 areas, we looked at five metrics. They are:

- Average student loan debt. Data comes from Experian and is for March 2019.

- Median earnings for bachelor’s degree holders. This is for residents 25 years and older. Data comes from the U.S. Census Bureau’s 2017 1-year American Community Survey.

- Average student debt as a percentage of median earnings for bachelor’s degree holders. This is average student loan debt (per borrower with student loan debt) divided by median earnings for bachelor’s degree holders. Data for average student debt comes from Experian, and data for median earnings for bachelor’s degree holders comes from the U.S. Census Bureau’s 2017 1-year American Community Survey. Experian data is for March 2019.

- Percentage of tax returns with student loan interest deduction. Data comes from the IRS and is for 2016.

- Unemployment rate for bachelor’s degree holders. Data comes from the U.S. Census Bureau’s 2017 1-year American Community Survey.

First, we ranked each metro area in every metric, giving all metrics an equal weighting. We then found each area’s average ranking and used the average to determine a final score. The metro area with the best average ranking received a score of 100. The metro area with the lowest average ranking received a score of 0.

Tips for Managing Your Savings

- Invest early. An early retirement requires early planning. By planning and saving early, you can take advantage of compound interest. Take a look at our investment calculator to see how your investment can grow over time.

- Trusted personal finance advice. A financial advisor can help you make smarter financial decisions such as how to be in better control of your money as you navigate finding a new job or helping a loved one pay for educational costs. Finding the right financial advisor who fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in just five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/Anchiy