Rent affordability is largely dependent on income. Guidelines from the Department of Housing and Urban Development (HUD) recommend that households not spend more than 30% of their monthly gross income on housing-related expenses, including rent and utilities, to comfortably afford other necessities like food and healthcare. But fluctuations in rent as a percentage of income can greatly affect individuals’ adherence to that rule and their ability to save.

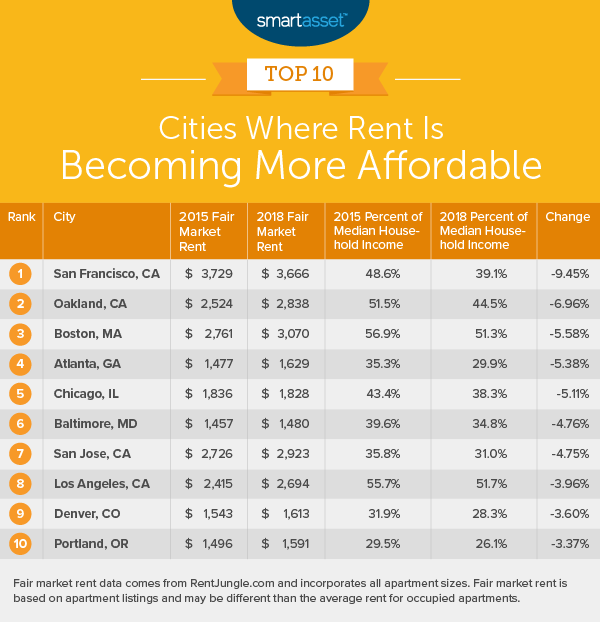

In this study, we looked at cities in the U.S. where rent is becoming more and less affordable by comparing average market rent to incomes in each place. Specifically, we compared rent prices from 2015 and 2018 to median household incomes over the same period. For details on our data sources and how we put the information together to create our final rankings, check out the Data and Methodology section below.

Key Findings

- Surprises in California. The housing market in California, particularly in its largest cities, is often thought of as one of the most expensive in the U.S. However, rent as a percentage of income is decreasing in six of the eight California cities in our study. Those cities are San Francisco, Oakland, San Jose, Los Angeles, San Diego and Fresno.

- Rent is still expensive in cities where it is becoming more affordable. Many residents remain housing cost-burdened in cities where rent is decreasing relative to income. In four of the top five cities where rent is becoming more affordable, the average household still spent more than the recommended 30% of its income on fair market rent in 2018.

Top 5 Cities Where Rent Is Becoming More Affordable

1. San Francisco, CA

Rent as a percentage of income fell by 9.45% in San Francisco, California between 2015 and 2018 as a result of an uptick in income and a slight decline in average market rent. Between 2015 and 2018, the average market rent decreased by 1.70% and the median household income increased by 22.02%. Despite this, roommates may be a good idea, since 2018 rent as a percentage of income was still 39.14%, squarely within housing-cost-burdened territory, according to HUD guidelines. In our study on what a roommate saves you in 50 U.S. cities, San Francisco takes the top spot. Using data from Rent Jungle, we found that residents may save more than $1,000 a month by having a roommate in San Francisco.

2. Oakland, CA

Median household incomes in Oakland, California have risen even faster than those in San Francisco. Between 2015 and 2018, the median household income rose from $58,807 to $76,469, an increase of 30.03%. Rent has also gone up, but at a much slower pace. In 2015, the average market rent in Oakland was $2,524 per month, and in 2018, it was $2,838, marking an increase of 12.46%. As a result, average market rent as a percentage of median household income fell from 51.49% in 2015 to 44.53% in 2018, a decrease of almost 7%.

3. Boston, MA

Between 2015 and 2018, average rent as a percentage of income for residents in Boston, Massachusetts decreased by 5.58%. In 2015, the average market rent was $2,761 and median household income was $58,263, and in 2018, rent was $3,070 and median income was $71,834. In percentage terms, rent rose by 11.18% over the four years and median household income rose by 23.29%.

Though increasing rent affordability is positive news for Boston residents, they are still spending a significant amount on rent. In 2018, rent as a percentage of income was 51.28%, the third-highest rate of any of the 50 cities in our study and signifying severe housing-cost burden.

4. Atlanta, GA

Increases in median household incomes have far outpaced increases in rent in Atlanta, Georgia over the past four years. Between 2015 and 2018, the median household income rose by 30.14% while average market rent grew by 10.31%. As a result, in 2018, rent as a percentage of income was 29.92%, which is 5.38% lower than it was in 2015.

5. Chicago, IL

While rent stayed relatively flat in Chicago, Illinois between 2015 and 2018, hovering around $1,830 per month, median household incomes increased by more than $6,500. Specifically, in 2015, the median household income in Chicago was $50,702, and in 2018, it was $57,238. As a result of increasing incomes, rent as a percentage of income decreased by 5.11% from 43.4% in 2015 to 38.3% in 2018.

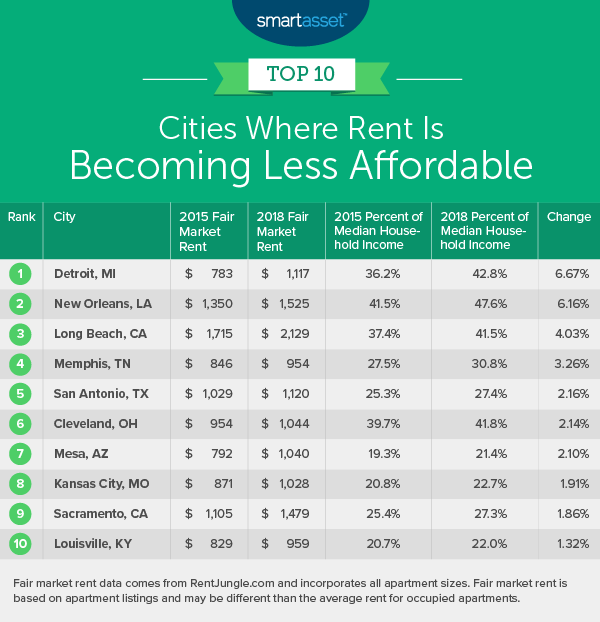

Top 5 Cities Where Rent Is Becoming Less Affordable

1. Detroit, MI

Like last year, rent has increased the most relative to incomes in Detroit, Michigan. Between 2015 and 2018, the average market rent grew by more than $330 per month, a 42.64% increase. Median annual household incomes grew by more than $5,300 but as a percentage increased by only 20.41%. As a result, in 2018, rent as a percentage of income was 42.84%, which is 6.67% more than it was in 2015.

2. New Orleans, LA

Rent as a percentage of income rose by 6.16% between 2015 and 2018 in New Orleans, Louisiana. In 2015, the average market rent was $1,350 per month, and the median household income was $39,077. Four years later, the average market rent was $1,525 per month and median household income was $38,423. In percentage terms, residents were spending 41.46% of their gross income on rent in 2015 and 47.62% in 2018.

The lowering rent affordability is particularly concerning in New Orleans as it already ranks as one of the most severely housing cost-burdened cities in the U.S., ranking eighth of the 126 cities we considered in that study. We found that 15.67% of the population in New Orleans spent 50% or more of income on housing costs in 2017.

3. Long Beach, CA

Like New Orleans, Long Beach, California is also home to a large percentage of housing cost-burdened residents. Data from 2017 shows that 16.10% of residents spend 50% or more of their income on housing costs. Moreover, data from the past four years suggests that the percentage of housing cost-burdened residents may continue to grow. Between 2015 and 2018, rent as a percentage of income rose by 4.03% in Long Beach, with average rent rising by 24.16% but median household incomes increasing by only 12.08%.

4. Memphis, TN

Though average market rent increased in Memphis, Tennessee by only about $100 per month between 2015 and 2018, that was an increase of 12.74% in percentage terms. Median annual household incomes also increased over that time period by almost $300, or just 0.79%. As a result, rent as a percentage of income increased from 27.51% to 30.78% over the four years.

5. San Antonio, TX

From 2015 to 2018, the average rental unit cost in San Antonio, Texas increased by 8.89%. With median household incomes increasing by only 0.32% over the same time period, rent as a percent of income grew by 2.16% to 27.43%, bringing that percentage closer to the housing cost-burden threshold. Despite the decrease in rent affordability relative to income, San Antonio still ranks toward the middle of all cities for rent as a percentage of income in 2018.

Data and Methodology

In order to rank the places with the largest rent decreases and increases relative to income, we looked at data for 50 of the largest U.S. cities. Specifically, we looked at data for the following two metrics:

- 2015 rent as a percentage of household income. This is average annual rent divided by median household income. Data comes from rentjungle.com and the Census Bureau’s 1-year American Community Survey.

- 2018 rent as a percentage of household income. This is average annual rent divided by median household income. Data comes from rentjungle.com and the Census Bureau’s 1-year American Community Survey.

To create the final rankings, we subtracted the 2015 rent as a percentage of household income from the 2018 rent as a percentage of household income. The cities with the largest negative difference, where relative cost decreased the most, ranked as our top cities where rent is becoming most affordable. The cities with the largest positive difference, where relative cost increased the most, ranked as our top cities where rent is becoming least affordable.

Tips for Managing Your Rent Savings

- Invest early. Find that your rent is more affordable relative to your income? Put that money to work. An early retirement requires early planning. By planning and saving early, you can take advantage of compound interest. But it’s important to speak to a professional too. Finding the right financial advisor who fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Buy or rent? – When you’re moving to a new city, you need to decide if you are going to rent or buy. If you are coming to a city and plan to stay for the long haul, buying may be the better option for you. On the other hand, if your stop in a new city will be a short one, you’ll likely want to rent.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/martin-dm