Affording home payments is a struggle many homeowners face, especially in a large city with high living costs. Questions of budgeting and saving come into play, as well as how much additional debt – from the likes of car loans and credit card bills – a homeowner can comfortably afford. To budget housing costs appropriately, it’s important to understand what your financial picture as a homeowner could look like from month to month. That’s why SmartAsset decided to examine how much you’d need to make in order to afford home payments in different cities across the country.

To find the salary needed to afford home payments, we looked at data for the 15 largest U.S. cities across five factors: median home value, property tax rate, down payment, homeowners insurance and other monthly debt payments. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s third study on the salary needed to afford home payments in the 15 largest U.S. cities. Check out the 2019 version of the study here.

Key Findings

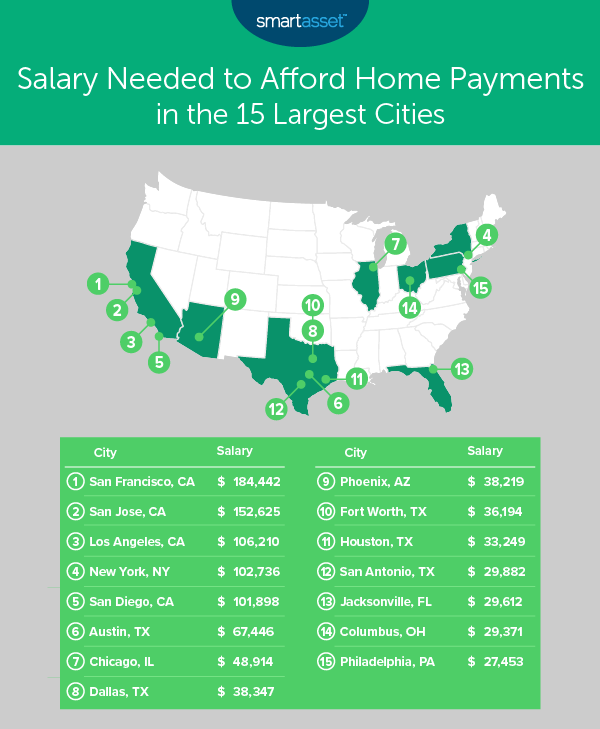

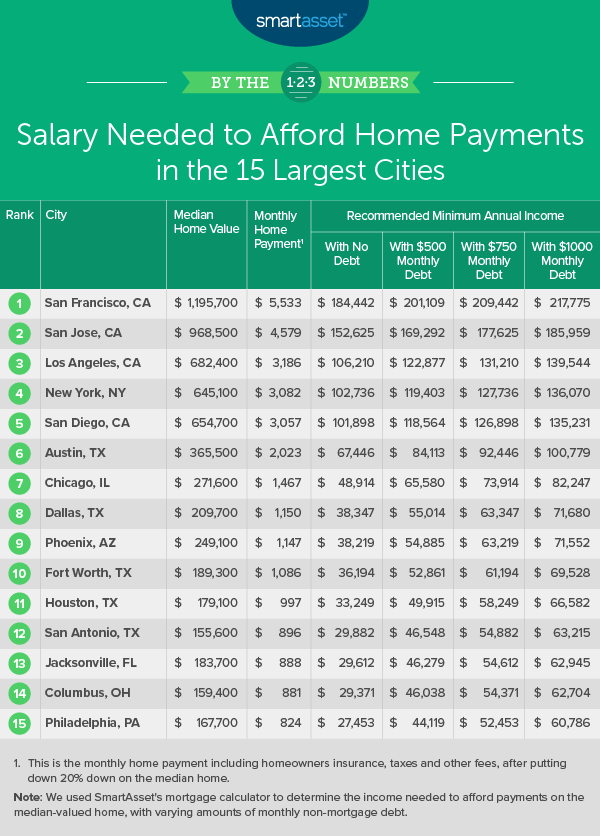

- Home values vary across the largest U.S. cities. On average, the median home value across the largest 15 cities in the country is roughly $418,500. However, the median home value ranges from almost $1.2 million in San Francisco, CA to less than $170,000 in Philadelphia, PA.

- Homeowners with additional debt need to make between $17,000 and $34,000 more. The average resident who lives in one of the 15 largest U.S. cities would need to make $68,440 on average to cover home payments, assuming that the person owed no additional monthly non-mortgage debt. If the homeowner’s debt payments were $500 per month, he or she would need a salary of more than $85,000. Furthermore, if the person’s other debt payments were $1,000 per month, he or she would need a salary of at least $101,800 to fully pay for this expense.

1. San Francisco, CA

The median home value in San Francisco, California is $1,195,700, the highest of any city in our study. Our mortgage calculator estimates that the total monthly payment on this home, including the mortgage, real estate taxes and homeowners insurance, would be $5,533, assuming you have a 30-year mortgage at a 4% interest rate after paying a 20% down payment. With no additional non-mortgage debt, a homeowner would need a salary of $184,442 to afford those monthly payments and not be housing-cost burdened. Factoring in a monthly debt payment of $500, a homeowner would need a salary of $201,109. With monthly debt of $750, the homeowner would need a salary of $209,442, and with monthly debt of $1,000 he or she would need to be making almost $218,000.

2. San Jose, CA

In San Jose, California, the median home value is $968,500. Given a 30-year mortgage, median real estate taxes of $7,157 and a 20% down payment of $193,700, our mortgage calculator estimates that the total monthly payment would be $4,579. With no additional non-mortgage debt, a homeowner in San Jose would need a salary of $152,625. With a monthly debt payment of $500, this person would need to make $169,292.

3. Los Angeles, CA

The median home value in Los Angeles, California is $682,400. According to SmartAsset’s mortgage calculator, after putting down 20% on this home, the monthly home payment including homeowners insurance, taxes and other fees would be $3,186. A homeowner would need a salary of $106,210 to afford this monthly home payment, assuming that he or she had no additional non-mortgage debt. With monthly non-mortgage debt payment of $500, the homeowner would need about 16% more, or $122,877. Furthermore, with monthly debt of $750 the person’s salary would have to be $131,210, and with monthly debt of $1,000, it would have to be almost $140,000.

If you’re a homeowner in Los Angeles who needs some professional help with managing your home payments better, consider reaching out to a financial advisor.

4. New York, NY

A homeowner in New York City, which requires the fourth-highest salary to afford home payments, would need a salary of $102,736 to cover monthly payments of roughly $3,000, assuming that the person has no additional non-mortgage debt each month. With additional non-mortgage monthly debt of $500, the same homeowner would need a salary of $119,403. At a monthly debt payment of $750, a homeowner’s salary would have to be nearly as much as a 20% down payment on the home, at $127,736. And with an additional monthly debt payment of $1,000 for student loans or credit card bills, the person would need a salary of $136,070.

5. San Diego, CA

Even though the median home value in San Diego, California, at $654,700, is higher than the median home value in New York City, the salary needed to afford home payments in San Diego is less than in New York due to a lower average property tax rate. San Diego has an average property tax rate of 0.67%, compared to 0.80% in New York. Assuming a 30-year mortgage and a 20% down payment of about $131,000, a homeowner in San Diego would need a salary of $101,898 to cover monthly home payments. With additional non-mortgage debt of $500, $750 and $1,000, homeowners would need $118,564, $126,898 and $135,231, respectively, to cover their payments.

6. Austin, TX

In Austin, Texas, the median home value is less than one-third of the value of the median home value in San Francisco. Given a relatively high property tax rate of 1.71%, average annual real estate taxes paid are $6,257 on the median home of $365,500. Using that property tax and an annual home insurance rate of 0.35%, we found that the average monthly home payment in Austin is $2,023. Assuming no additional non-mortgage debt, a homeowner would need a salary of $67,446 to afford home payments comfortably – a goal that a young professional in the city could very likely achieve. Assuming a monthly debt payment of $500, a homeowner’s salary would need to increase approximately $17,000 to $84,113. If the person had monthly non-mortgage debt of $750, he or she would need a raise of another $8,000 or so, to $92,446. Finally, if the person’s monthly non-mortgage debt payment were $1,000, this homeowner would need almost $101,000 to cover monthly payments on his or her home.

7. Chicago, IL

Chicago, Illinois ranks in the No. 7 spot in our study. The median home value in Chicago is $271,600, which makes a 20% down payment on the home $54,320. Factoring in homeowners insurance, taxes and other fees, the monthly home payment on the median Chicago home is $1,467, which is 73% less than the monthly payment in the highest-ranking city in our study (San Francisco) and 78% more than the monthly payment in the lowest-ranking city in our study (Philadelphia). The salary needed to cover this monthly payment assuming no additional non-mortgage debt is close to $50,000.

8. Dallas, TX

The median home value in Dallas, Texas is $209,700 and average real estate taxes paid are $3,468. Assuming a 30-year mortgage at a 4% interest rate and 20% down payment on the home, our mortgage calculator estimates that if the average homeowner in Dallas had no additional non-mortgage debt, the person would need to make $38,347 a year to meet monthly home payments of $1,150. If the person’s monthly debt payment were $500, he or she would need to make $55,014. If the homeowner’s monthly debt payment rose to $750, the person’s salary would need to be $63,347 to meet those additional costs. Finally, with a monthly debt payment of $1,000, a Dallas homeowner’s salary would have to be $71,680 in order to make payments on the property while also keeping debt below the recommended maximum debt-to-income ratio of 36%.

9. Phoenix, AZ

The average homeowner in Phoenix, Arizona has monthly payments of $1,147. To cover these costs, the salary needed without any additional non-mortgage debt would be $38,219. With monthly debt payments of $500, $750 and $1,000, the salary needed would be $54,885, $63,219 and $71,552, respectively. And even if you’re already a seasoned homeowner, it’s always good to brush up on what to know if you’re investing in a second property.

10. Fort Worth, TX

The median home in Fort Worth, Texas is worth $189,300. While the property tax rate for a home in Fort Worth is the second-highest rate in the study at 1.95%, the relatively low average home value results in lower average real estate taxes paid, at $3,698. With a down payment of $37,860, a 0.35% home insurance payment of $663 and other fees on a 30-year mortgage, we estimate that monthly payments on the typical home would be $1,086. A homeowner with a monthly debt payment of $1,000 would need $69,528 to cover these costs. If the average Fort Worth homeowner is lucky enough to have no additional non-mortgage debt, then the person’s salary would have to be about $36,000 in order to afford home payments each month.

11. Houston, TX

The median home value in Houston, Texas is $179,100. According to our mortgage calculator, the monthly payment on the median home in this city would be $997, assuming a 30-year mortgage. In order to afford this monthly payment, the average homeowner in Houston would need a salary of $33,249 if he or she is not tackling additional debt. With monthly debt of $500, the person would need almost $17,000 more, or $49,915. With monthly non-mortgage debt of $750 or $1,000, the person’s salary would have to increase to $58,249 or $66,582, respectively.

12. San Antonio, TX

San Antonio, Texas is the seventh-largest city in the U.S. and has a median home value of $155,600. To afford monthly home payments of about $900 on this type of property, the average homeowner with no other debt would need a salary of $29,882. If this homeowner owed $500 in non-mortgage debt per month, his or her salary would need to be $46,548. Additionally, with monthly non-mortgage debt of $750 or $1,000, the average San Antonio homeowner would need a salary of $54,882 or $63,215 to cover housing costs, respectively.

13. Jacksonville, FL

The median home value in Jacksonville, Florida is $183,700. Our mortgage calculator estimates that the monthly payment for this home would be $888, assuming a 30-year mortgage at a 4% interest rate, a 20% down payment, real estate taxes, home insurance and other fees. If the average homeowner had $1,000 in additional non-mortgage debt per month, he or she would need a salary of $62,945 to cover housing costs. With lower monthly debt payments of $750 or $500, the person would need a salary of at least $54,612 or $46,279, respectively. Finally, with no additional non-mortgage debt, a homeowner in Jacksonville would need a salary of $29,612 to afford monthly payments.

Remember that it’s important to further understand these amounts within your vision for your retirement funds as well. Take a look at SmartAsset’s retirement calculator to see how much you’d need to live comfortably in your post-work life.

14. Columbus, OH

We estimate that the median monthly home payment on the typical home in Columbus, Ohio is about $880. With a monthly non-mortgage debt of $1,000, the average homeowner in Columbus would need to make more than $62,700 to remain below a 36% debt-to-income ratio. If the debt were lower, at $750 a month, this homeowner would need $54,371 per year, and if the debt were even lower at $500 a month, he or she would need a salary of about $8,000 less. If there were no additional non-mortgage debt owed, this homeowner would need a salary of $29,371. As time moves onward, refinancing might be an option homeowners can consider to adjust their home payments.

15. Philadelphia, PA

Although the median home value in Philadelphia, Pennsylvania is not the lowest in the study, the salary required to afford home payments in this city is the lowest due to lower average property taxes. With $1,000 in additional non-mortgage debt, the average Philadelphia homeowner would need to make $60,786 to stay above water. If the person had $750 in debt, he or she would need to make $52,453, and if the homeowner had $500 in monthly debt, he or she would need a salary of $44,119 to afford home payments. Finally, with no additional non-mortgage debt, this homeowner would need to make at least $27,453 a year to cover monthly home payments of $824. Our figures assume a median home value of $167,700 and median real estate taxes of $1,602, as reported by the Census.

Data and Methodology

To find the salary needed to afford home payments in the 15 largest U.S. cities, we used data from the U.S. Census Bureau. Beginning with the median home value in each city, we calculated the cost of a 20% down payment. We also used the average real estate taxes paid in each city and the median home value to find the average property tax rate. Using those figures and our mortgage calculator, we found the average monthly home payment in each city assuming a homebuyer would get a 30-year mortgage with a 4% interest rate for 80% of the home value (the balance after paying a 20% down payment). We also assumed the person would have an annual homeowners insurance of 0.35%.

After finding the average monthly home payment, we calculated the income needed to make those payments while not exceeding a 36% debt-to-income ratio. We also considered the necessary income to make home payments based on prospective homebuyer debt levels, which ranged from no monthly debt payments to debt payments totaling $1,000 per month.

We ranked each city from the highest minimum income needed to afford home payments to the lowest minimum income. Median home values and median household incomes are from the U.S. Census Bureau’s 2018 1-year American Community Survey.

Tips for Managing Your Home Payments

- Are you ready to buy? Depending on your salary and financial liabilities, it might first be wise to ensure that your current income and savings can cover the costs of homeownership without cutting too far into the money you might already have socked away for retirement. You can get a sense of what your situation could look like using our Rent vs. Buy calculator.

- Understand additional costs. Though a mortgage is typically the largest expense for homeowners, other costs like closing costs, property taxes and home insurance can add up. It is important to understand what monthly costs are made up of. Our comprehensive home buying guide has a property tax calculator, budget calculator and many informative articles that can help you better understand the range of costs that go into owning a home.

- Get some help building a solid financial foundation. A professional advisor might have a different perspective or the analytical skills you need to get your money matters in the right shape for homeownership. And finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/RichVintage