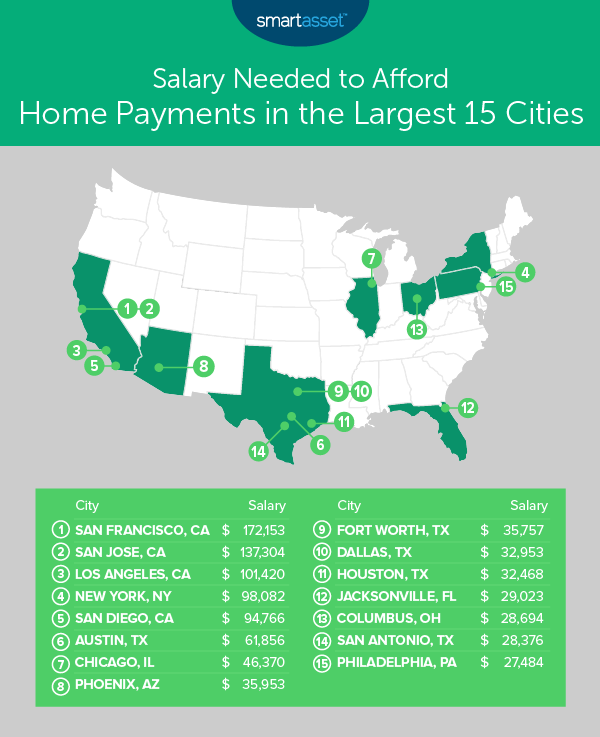

Even though many people picture the high cost of living when they think of America’s biggest cities, the housing markets in these areas actually vary quite a bit. Part of that range comes from particular local factors such as property taxes. It is helpful to be aware of a city’s reputation as expensive or affordable, but in order to make the step from renter to homeowner in a responsible fashion, it’s a good idea to have a plan. To help people make the most of their savings, below we model the salary needed to afford the average home in America’s largest cities.

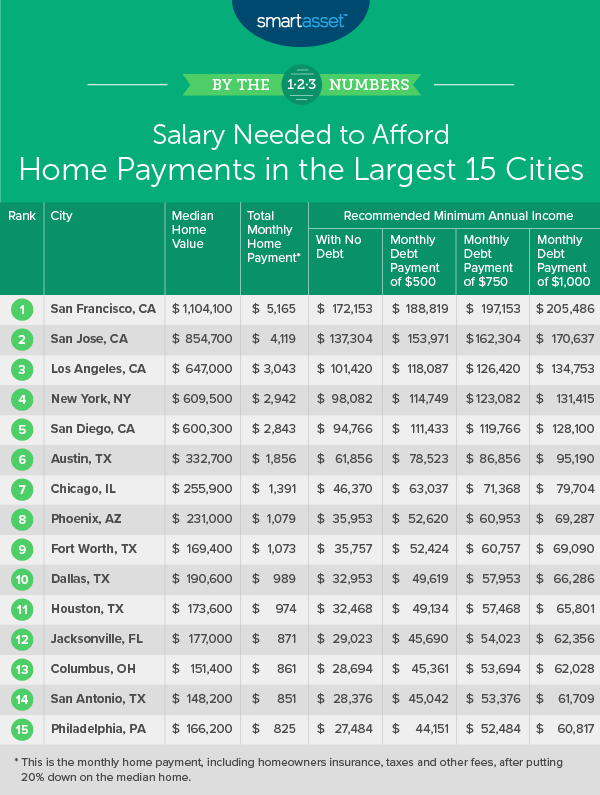

In order to model the salary needed to afford home payments, we used five inputs: home value, down payment, property tax rate, homeowners insurance and other monthly debt payments. The Data and Methodology section below shows our sources and how we put the data together to create our final rankings.

Key Findings

- California homes cost the most – Homes in California’s largest cities are expensive. In three of California’s largest cities, households need an income of at least six figures under the best circumstances just to afford the median home. Those who are carrying substantial debt payments will need to make significantly more than $100,000.

- Bargains are still out there – Homeownership is still an option for middle-class Americans in some cities. In cities like Philadelphia, Pennsylvania; San Antonio, Texas and Columbus, Ohio, residents can afford the median home for less than $65,000, even if they have other debt obligations like student and auto loans.

1. San Francisco, CA

Median home value: $1,104,100

Salary needed to afford home payments: $172,153

Salary needed to afford home payments with $500 in monthly debt payments: $188,819

Salary needed to afford home payments with $750 in monthly debt payments: $197,153

Salary needed to afford home payments with $1,000 in monthly debt payments: $205,486

2. San Jose, CA

Median home value: $854,700

Salary needed to afford home payments: $137,304

Salary needed to afford home payments with $500 in monthly debt payments: $153,971

Salary needed to afford home payments with $750 in monthly debt payments: $162,304

Salary needed to afford home payments with $1,000 in monthly debt payments: $170,637

3. Los Angeles, CA

Median home value: $647,000

Salary needed to afford home payments: $101,420

Salary needed to afford home payments with $500 in monthly debt payments: $118,087

Salary needed to afford home payments with $750 in monthly debt payments: $126,420

Salary needed to afford home payments with $1,000 in monthly debt payments: $134,753

4. New York, NY

Median home value: $609,500

Salary needed to afford home payments: $98,082

Salary needed to afford home payments with $500 in monthly debt payments: $114,749

Salary needed to afford home payments with $750 in monthly debt payments: $123,082

Salary needed to afford home payments with $1,000 in monthly debt payments: $131,415

5. San Diego, CA

Median home value: $600,300

Salary needed to afford home payments: $94,766

Salary needed to afford home payments with $500 in monthly debt payments: $111,433

Salary needed to afford home payments with $750 in monthly debt payments: $119,766

Salary needed to afford home payments with $1,000 in monthly debt payments: $128,100

6. Austin, TX

Median home value: $332,700

Salary needed to afford home payments: $61,856

Salary needed to afford home payments with $500 in monthly debt payments: $78,523

Salary needed to afford home payments with $750 in monthly debt payments: $86,856

Salary needed to afford home payments with $1,000 in monthly debt payments: $95,190

7. Chicago, IL

Median home value: $255,900

Salary needed to afford home payments: $46,370

Salary needed to afford home payments with $500 in monthly debt payments: $63,037

Salary needed to afford home payments with $750 in monthly debt payments: $71,368

Salary needed to afford home payments with $1,000 in monthly debt payments: $79,704

8. Phoenix, AZ

Median home value: $231,000

Salary needed to afford home payments: $35,953

Salary needed to afford home payments with $500 in monthly debt payments: $52,620

Salary needed to afford home payments with $750 in monthly debt payments: $60,953

Salary needed to afford home payments with $1,000 in monthly debt payments: $69,287

9. Fort Worth, TX

Median home value: $169,400

Salary needed to afford home payments: $32,953

Salary needed to afford home payments with $500 in monthly debt payments: $49,619

Salary needed to afford home payments with $750 in monthly debt payments: $57,953

Salary needed to afford home payments with $1,000 in monthly debt payments: $66,286

10. Dallas, TX

Median home value: $190,600

Salary needed to afford home payments: $35,757

Salary needed to afford home payments with $500 in monthly debt payments: $52,424

Salary needed to afford home payments with $750 in monthly debt payments: $60,757

Salary needed to afford home payments with $1,000 in monthly debt payments: $69,090

11. Houston, TX

Median home value: $173,600

Salary needed to afford home payments: $32,468

Salary needed to afford home payments with $500 in monthly debt payments: $49,134

Salary needed to afford home payments with $750 in monthly debt payments: $57,468

Salary needed to afford home payments with $1,000 in monthly debt payments: $65,801

12. Jacksonville, FL

Median home value: $177,000

Salary needed to afford home payments: $29,023

Salary needed to afford home payments with $500 in monthly debt payments: $45,690

Salary needed to afford home payments with $750 in monthly debt payments: $54,023

Salary needed to afford home payments with $1,000 in monthly debt payments: $62,356

13. Columbus, OH

Median home value: $151,400

Salary needed to afford home payments: $28,694

Salary needed to afford home payments with $500 in monthly debt payments: $45,361

Salary needed to afford home payments with $750 in monthly debt payments: $53,694

Salary needed to afford home payments with $1,000 in monthly debt payments: $62,028

14. San Antonio, TX

Median home value: $148,200

Salary needed to afford home payments with no other debt: $28,376

Salary needed to afford home payments with $500 in monthly debt payments: $45,042

Salary needed to afford home payments with $750 in monthly debt payments: $53,376

Salary needed to afford home payments with $1,000 in monthly debt payments: $61,709

15. Philadelphia, PA

Median home value: $166,200

Salary needed to afford home payments with no other debt: $27,484

Salary needed to afford home payments with $500 in monthly debt payments: $44,151

Salary needed to afford home payments with $750 in monthly debt payments: $52,484

Salary needed to afford home payments with $1,000 in monthly debt payments: $60,817

Data and Methodology

In order to estimate the salary needed to afford home payments in the 15 largest cities (by population) in the country, we gathered data from the U.S. Census Bureau. We started with the median home value in each city and calculated how much a 20% down payment would cost. Then we plugged that data into our mortgage calculator. We assumed that each prospective homebuyer would get a 30-year mortgage with a 4% interest rate for 80% of the home value (the balance after paying a 20% down payment). We also assumed that buyers would have annual homeowners insurance of 0.35%. For the purpose of this study, we assumed prospective homebuyer debt levels that ranged from no monthly debt payments to debt payments totaling $1,000 per month.

We then added up the total monthly payments on the mortgage, real estate taxes and homeowners insurance. Our calculator recommended a minimum income needed to make these payments. We ranked each city from the highest minimum income to the lowest minimum income. Median home values and median household incomes are from the U.S. Census Bureau’s 2017 1-year American Community Survey.

Tips for Buying a Home

- Don’t stretch yourself too thin – The dream of homeownership is an alluring one. You may find yourself wondering if you can maybe cut a few things out of your budget so that you can buy a nicer home. It is generally a good idea to stay within your means rather than splurging on the nicest home possible. The economy is unpredictable; not living within your means may leave you struggling if something unfortunate should happen.

- Ask an advisor – Renting for life is not necessarily a bad thing. Renters have greater mobility than homeowners and are not tied down by a mortgage. Depending on the housing market, it may make more financial sense to rent. But before you decide, why not check in with a financial advisor who can make sure your financial plans align with your long-term goals? If you are not sure where to find a financial advisor check out SmartAsset’s financial advisor matching tool. It will pair you with up to three local financial advisors who fit your investing needs.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/monkeybusinessimages