Last Friday, the Bureau of Labor Statistics (BLS) published its anxiously awaited April 2020 Employment Report, perhaps the first comprehensive look beyond jobless claims on how coronavirus and the attendant economic shutdowns have affected unemployment in America. The report paints an alarming picture. Between February 2020 and April 2020, nonfarm private employment fell by more than 20 million positions, and the unemployment rate jumped from 3.5% to 14.7% – a figure that exceeds the maximum unemployment rate during the Great Recession.

Last Friday, the Bureau of Labor Statistics (BLS) published its anxiously awaited April 2020 Employment Report, perhaps the first comprehensive look beyond jobless claims on how coronavirus and the attendant economic shutdowns have affected unemployment in America. The report paints an alarming picture. Between February 2020 and April 2020, nonfarm private employment fell by more than 20 million positions, and the unemployment rate jumped from 3.5% to 14.7% – a figure that exceeds the maximum unemployment rate during the Great Recession.

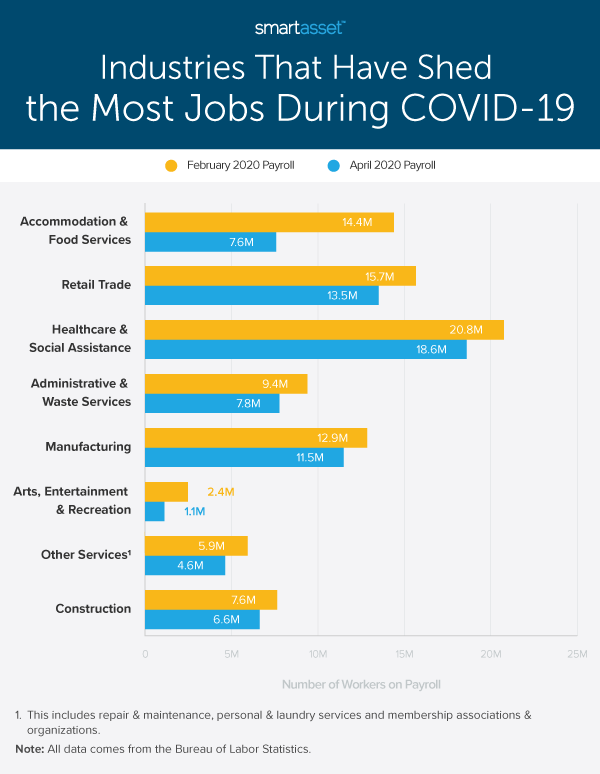

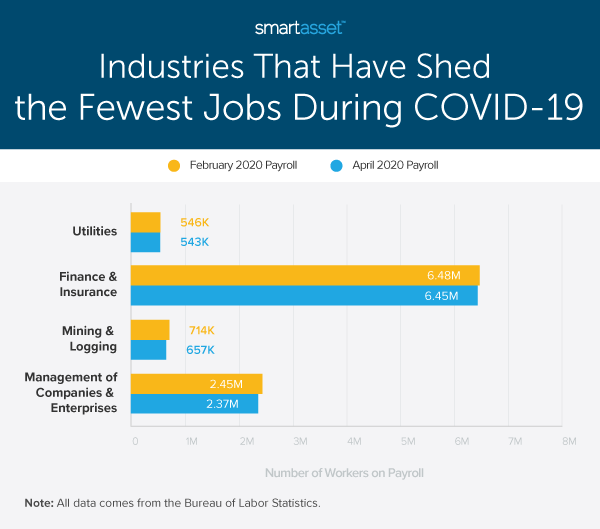

Though payrolls declined across all industries, some had more layoffs than others. In this study, SmartAsset identified the industries that shed the most and fewest jobs between February and April 2020. Using BLS data, we compared paid employment, i.e. payroll, between those two months for 18 industries. For details on our data sources and how we put all the information together to establish our findings, check out the Data and Methodology section below.

Key Findings

- The jobs report does not capture the full scope of unemployment in the U.S. In its April 2020 Employment Report, the BLS surveyed businesses for the week spanning April 12, 2020 through April 18, 2020. Since then, there have been more than 7 million initial unemployment claims. Additionally, in monthly BLS employment reports, workers who are paid by their employer for all or part of the pay period including the 12th of the month are counted as employed, even if they were not actually at their jobs. Thus, initial jobless claims for the week ending April 18, 2020 – totaling 4.4. million – may also not be fully included.

- Between February 2020 and April 2020, eight separate industries shed more than 1 million jobs. Though job losses within the accommodation & food services industry far exceed those in any other industry, seven additional industries saw job losses exceed 1 million over the course of those two months. Those industries are retail trade; healthcare & social assistance; administrative & waste services; manufacturing; arts, entertainment & recreation; construction as well as other services (including the sub-industries of repair & maintenance, personal & laundry services and membership associations & organizations).

- About one in two workers in two major service industries – accommodation & food services and arts, entertainment & recreation – lost their jobs. Between February and April 2020, payroll for the accommodation & food services industry fell by about 6.80 million, while payroll for the arts, entertainment & recreation industry fell by more than 1.35 million. In February, total payroll for each industry totaled roughly 14.39 million and 2.47 million, respectively. Decreases in payroll amount to more than 47% of the accommodation & food services industry and more than 54% of the arts, entertainment & recreation industry.

- Payroll decreased by fewer than 100,000 in four industries. Though payroll declined across all 18 industries in our study, four stand out as industries in which layoffs were more subdued. Fewer than 100,000 workers were laid off between February 2020 and April 2020 in each of the following industries: utilities, finance & insurance, mining & logging and management of companies & enterprises.

Industries That Have Shed the Most Jobs During COVID-19

The accommodation & food services industry saw the greatest decline in payroll between February 2020 and April 2020. According to the BLS, payroll fell by about 6.80 million over the course of the two months, with most of the drop occurring between March and April. In March, the BLS reported that there were 13.92 million workers in the accommodation & food services industry. In April, there were fewer than 7.59 million employed workers in the industry.

About 2.15 million jobs were lost between February and April in both the industries of retail trade and healthcare & social assistance. As a percentage of pre-coronavirus workforces, those cuts in payroll represent 13.73% of the retail trade industry and 10.36% of the healthcare & social assistance industry. Like in the accommodation & food services industry, retail trade has been hugely affected by stay-at-home orders and social distancing measures put in place to contain the spread of the virus. Within the healthcare & social assistance industry, workers in the sub-industries of dentist offices and child daycare services were most likely to be laid off. Dentist payrolls fell from close to 1 million in February to fewer than 500,000 in April, while child daycare services payrolls dropped by some 320,000, from roughly 1 million to about 680,000, over the same time period.

Administrative & wastes services ranks as the fourth industry that shed the highest number of jobs over the two-month period between February and April of this year. Payroll declined by about 1.62 million, with more than half of the decrease coming from a steep decline in the employment of temporary help service workers. In February, close to 3 million temporary help service workers were employed, according to estimates from the BLS. Over the course of two months, that number fell by about 900,000. As a result, in April, payroll for temporary help services was about 2.04 million.

The remaining four industries that shed more than 1 million jobs between February and April of this year include manufacturing; arts, entertainment & recreation; other services (including repair & maintenance, personal & laundry services and membership associations & organizations) and construction. The highest percentage of workers were affected within the arts, entertainment & recreation industry. About 1.35 million arts, entertainment & recreation workers lost their jobs between February 2020 and April 2020. With payroll at almost 2.50 million in February 2020, the two-month drop implies that 54.52% of arts, entertainment & recreation workers were laid off.

Industries That Have Shed the Fewest Jobs During COVID-19

In terms of layoffs during the coronavirus pandemic, the utilities industry has been the least scathed so far. In February and March of 2020, about 546,000 individuals were employed in the industry. That number fell by 3,000 between March and April, to 543,100.

The finance & insurance and mining & logging industries also shed relatively few jobs between February and April. In February, payroll for the finance & insurance industry consisted of 6,486,400 workers, and payroll for the mining & logging industry consisted of 714,000 workers. In April 2020, those figures dropped to 6,451,100 and 657,000, respectively, according to estimates from the BLS. Notably, the 57,000 jobs lost in the mining & logging industry represent a larger percentage of the industry workforce than the 35,300 jobs lost in the finance & insurance industry. Close to one in 10 mining & logging workers faced layoffs, while fewer than one in 100 finance & insurance workers did.

Finally, management of companies & enterprises ranks as the fourth industry with the fewest jobs shed during COVID-19. Management of companies & enterprises includes occupations such as accountants, auditors, financial managers and general operations managers. Payroll within the industry fell by 81,900 between February 2020 and April 2020. As a percentage of February 2020 payroll, this marks a less than 4% decline in the industry’s workforce.

Data and Methodology

Data for this study comes from the Bureau of Labor Statistics’ April 2020 Employment Report. We looked at a total of 18 nonfarm, private industries and found the difference in February 2020 payroll and April 2020 payroll. All payroll figures are seasonally adjusted. February figures from the BLS are finalized while March and April figures are both preliminary estimates.

Tips for Making it Through a Recession

- If you did lose your job, learn if you qualify for enhanced unemployment. Many unemployment benefits across states have been expanded as a result of the spread of coronavirus. Our guide on the Enhanced Unemployment Benefits for Coronavirus can help you figure out if you may be eligible for receiving a benefit and how much that benefit will be.

- Boost your emergency savings if you are still fortunate enough to have a job. One of the best ways to prepare for the unknown is by having an emergency fund. Though typical financial wisdom suggests you should have savings that can cover three months’ worth of expenses, six months’ may be a better figure to shoot for during a recession.

- Consider talking to a financial advisor about how to ride out a financial downturn. If you are nervous about your retirement account or what to do with money you are making, speaking with a financial advisor might not be a bad idea. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/Srisakorn