As a result of the coronavirus pandemic, many Americans have had trouble covering expenses – especially rent – in recent months. According to data from the National Multifamily Housing Council, less than 88% of apartment households made a full or partial July rent payment as of the 13th of the month. Though this marks an increase relative to April 2020, it is roughly three percentage points lower than one year earlier. In July 2019, 90.1% of rent payments were made by the 13th of the month.

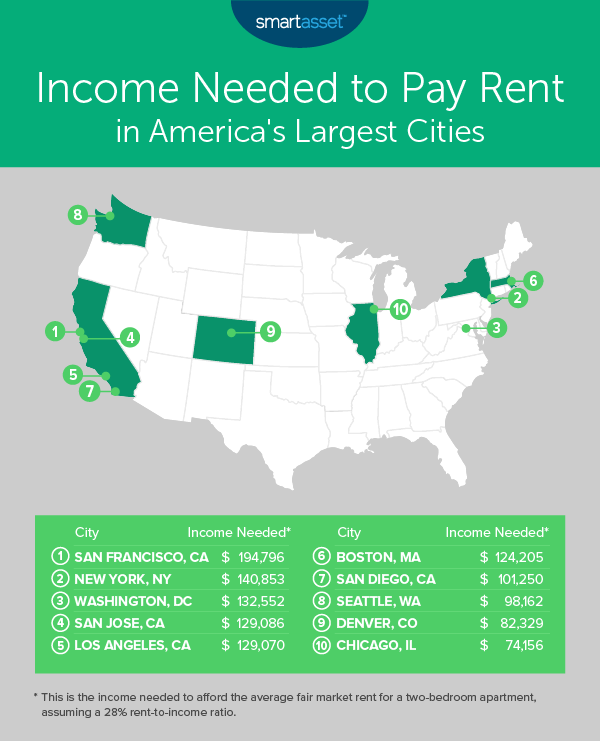

The U.S. Department of Housing and Urban Development (HUD) recommends a rent-to-income ratio of less than 30% and considers households who spend more than 30% of their income on housing to be housing cost-burdened. Using HUD’s guidelines, SmartAsset set a 28% rent-to-income ratio and examined the income needed to pay rent in America’s largest cities in this study.

We used data from Zumper to look at the average two-bedroom apartment rent from January 2020 through April 2020 in the 25 largest cities across the country. Using that figure, we calculated the household income renters would need to afford the average two-bedroom apartment while paying no more than 28% of their total income in rent. For details on our data sources and how we analyzed the information to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s sixth annual study on the income need to pay rent in America’s largest cities.

Key Findings

- In more than one in four large U.S. cities, renters need to earn six figures annually to avoid being housing-cost burdened. We found that in seven of the 25 cities in our study, the income needed to pay rent on the average two-bedroom apartment is $100,000 or more. San Francisco, California has the highest income needed to pay rent, at $194,796.

- But there are some affordable options. In 10 of the 25 cities in our study, the median household income exceeds the income needed to pay rent, indicating that the average household can afford a two-bedroom apartment in the area. El Paso, Texas has the highest median household income relative to its income needed to pay rent. Census Bureau data shows that the 2018 median household income was about $45,000. Meanwhile, between January 2020 and April 2020, the average two-bedroom apartment rent was less than $800 and we calculated that the income needed to pay rent is roughly $34,100.

1. San Francisco, CA

Like last year, San Francisco, California takes the top spot in our study. Our data shows that the average monthly rent for a two-bedroom apartment in the city exceeds $4,500, or more than $54,000 annually.

Assuming a maximum 28% rent-to-income ratio, a household of renters in San Francisco needs to earn roughly $194,800 annually to avoid being housing-cost burdened. Though San Francisco has the second-highest median household income of the largest U.S. cities, that figure ($112,376) falls well below the estimated income needed to pay rent.

2. New York, NY

Between January 2020 and April 2020, the average two-bedroom monthly rent was roughly $3,300. This means that a two-bedroom costs about $39,400 annually and a household needs to make close to $140,900 to pay rent while not being housing-cost burdened.

3. Washington, DC

The income needed to pay rent on the average two-bedroom in the District of Columbia is about $132,600. This figure is more than 55% higher than the 2018 median household income in the city, which is $85,203.

4. San Jose, CA

Census Bureau data shows that in 2018, the median household income in San Jose, California was $113,036 – the highest in our study. Despite this, the income needed to pay rent on an average two-bedroom apartment in the area – $129,086 – is still 14.20% higher than the median household income.

5. Los Angeles, CA

Los Angeles is the third of four California cities that rank in our top 10. Between January 2020 and April 2020, the average two-bedroom monthly rent in Los Angeles was about $3,000, which makes the average annual rent roughly $36,100. Los Angeles residents need to earn roughly $129,100 annually to have a rent-to-income ratio of 28% or lower.

6. Boston, MA

Housing costs in Boston, Massachusetts tend to be high. Between January 2020 and April 2020, the average rent for a two-bedroom apartment in the city was about $2,900, according to data from Zumper. To cover that and not spend more than 28% of income on rent, a household must earn upwards of $124,200.

7. San Diego, CA

The average monthly rent for a two-bedroom apartment in San Diego, California is roughly $2,400, according to Zumper data. Assuming a maximum 28% rent-to-income ratio, a San Diego household of renters needs to earn six figures – specifically, $101,250 – to avoid being housing-cost burdened.

8. Seattle, WA

The income needed to pay rent on the average two-bedroom apartment in Seattle, Washington and not be housing-cost burdened is $98,162. With a 2018 median household income of $93,481, Seattle comes the closest of any city in our top 10 to having a median household income that matches up with the income needed to pay rent. Specifically, the income needed to pay rent is only about 5% higher than the median household income.

9. Denver, CO

The income needed to pay rent in Denver, Colorado without being housing-cost burdened is about $82,300. Between January 2020 and April 2020, the average two-bedroom monthly rent was roughly $1,900.

10. Chicago, IL

The average two-bedroom rent in Chicago, Illinois is $1,730 per month. To pay 28% or less of one’s income on rent, an individual must earn more than $74,000 per year, or about $6,200 per month.

Data and Methodology

In this study, SmartAsset looked at rent data on the 25 largest U.S. cities. We estimated the household income renters would need to afford the average two-bedroom apartment while paying no more than 28% of their total income in rent. To find this number, we divided the average annual cost of a two-bedroom apartment by 0.28. We ranked cities from highest to lowest according to the resulting figure, i.e. the annual income needed for rent costs to be equal to or less than 28% of household income.

Data on two-bedroom rents for each city is the average from January 2020 through April 2020 and was pulled from Zumper, a company that publishes research on houses and apartments for rent throughout the U.S.

Tips for Managing Your Savings

- To rent or to buy? Sometimes it’s not worth it to jump right into homeownership. Understand whether continuing to rent is the right choice for you using SmartAsset’s rent vs. buy calculator. No matter what your homeownership status, it might be useful to learn about the ways that the recent Coronavirus Aid, Relief and Economic Stablility (CARES) Act passed by the government directly and indirectly protects homeowners and renters.

- Consulting an expert could save you time and money in the long run. If you’re looking for guidance and are able to do so, it might be useful to enlist the help of an expert advisor. Finding the right financial advisor who fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/JannHuizenga