Credit card debt can destroy anyone’s finances if it is mishandled. According to data from TransUnion, the average credit card debt holder had $5,644 worth of credit card debt. While that number may not seem like a ton of debt, paying it off can be difficult due to high interest rates. Long-term credit card debt can not only hurt your credit score, it can also stop you from building your savings account.

For Americans who are serious about tackling their debt, we have run the numbers to find the best places to get out of credit card debt. We created a credit card pay off model using the latest credit card debt data, SmartAsset’s income tax calculator, rent data and median income data. To see where we got our data and better understand our model, check out our data and methodology below.

This is the 2018 version of this analysis. Check out the 2017 version here.

Key Findings

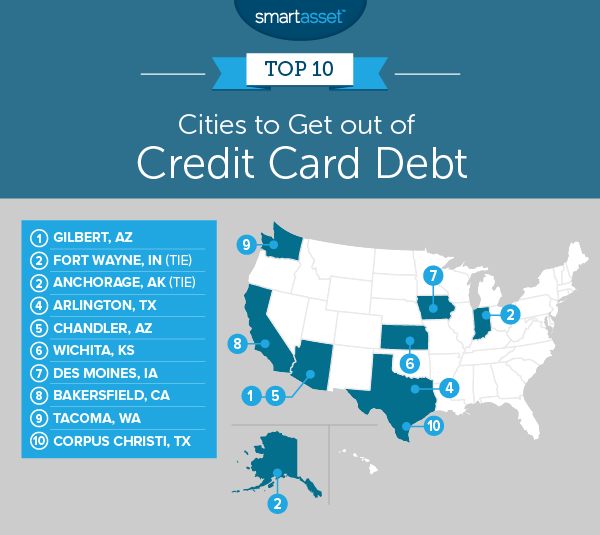

- Familiar places – Six of last year’s top 10 cities to get out of credit card debt secured a top 10 spot again this year. In fact, the top two finishers from our previous analysis – Gilbert, Arizona and Anchorage, Alaska – took the top two spots again this year.

- Credit card debt is expensive – Even across the top 25 cities where you can pay off credit card debt the fastest, the cost of credit card debt is still high. For example, in Gilbert, Arizona, where we estimate $5,644 worth of credit card debt could be paid off after 6.83 months, interest payment on that debt is worth nearly $320. Across our top 25, the average credit card debt holder ends up paying an extra $373 in interest charges.

1. Gilbert, Arizona

Gilbert, Arizona has jumped one spot since last year. In total we estimate that it would take someone 6.83 months to get out of debt here. The reason Gilbert ranks first is the high average salaries high school graduates earn. The average resident with a high school degree earns nearly $40,000 per year. Of that, $7,144 goes to federal income tax, Arizona income tax and local sales tax. That means, assuming someone here would spend 50% of their disposable income on debt, they could afford a monthly debt payment of $872.

One way Gilbert residents could pay off their credit card debt faster is if they lowered their interest rate by improving their credit score.

2. (tie) Fort Wayne, Indiana

You can find very affordable rent in Fort Wayne, Indiana. Our data shows that affordable apartments can be rented for only $5,600 per year. That leaves residents with plenty of disposable income to throw at their credit card debt.

The reason Fort Wayne falls behind Gilbert is the low average salary. The average high school graduate in Fort Wayne takes home less than $30,300 per year.

2. (tie) Anchorage, Alaska

Last year, Anchorage was the top city to pay off credit card debt. This year, it’s tied for second. Despite its high school graduates having higher incomes, Anchorage ends up tied with Fort Wayne because of higher taxes and rent.

The Census Bureau shows that lower quartile rent costs in Anchorage are over $11,100 per year. We estimate taxes in Anchorage including Alaska state income tax would cost over $5,700.

4. Arlington, Texas

We estimate that a high school graduate with $5,644 in credit card debt could pay it all off in under seven months in Arlington. Our data shows a high school graduate could expect to earn $30,700 per year which isn’t much compared to other cities.

However, thanks in part to the lack of Texas state income tax, a high school graduate here could expect to pay only $2,340 in taxes which helps increase their disposable income.

5. Chandler, Arizona

Chandler is the second city within the Phoenix metro area to claim a spot in this top 10. The cost of living here is relatively high by the standards of our study. We estimate that a high school graduate in Chandler would be paying nearly $16,700 per year in taxes and rent costs.

Despite the high costs, this city ranks fifth because of the high median earnings for high school graduates. The average high school graduate here earns just under $36,000 per year, the third-highest in our top 10. After plugging these values into our model we see that a high school graduate in Chandler could expect to pay off all their credit card debt in 7.45 months.

6. Wichita, Kansas

Wichita is another great landing spot for people looking to pay down credit card debt. All factors considered it would take just over 7.5 months for a high school graduate to pay off $5,644 in credit card debt, assuming they dedicated half of their disposable income to it.

The main reason Wichita looks so good in our model is the low rent costs. Affordable rent here can be found for under $5,500 per year.

7. Des Moines, Iowa

We estimate that the average Des Moines worker looking to aggressively pay down their credit card debt could dedicate $782 per month to their debt. That means someone committed to paying off their credit card debt could pay it off in a short 7.7 months.

One cost holding Des Moines back from rising up the ranks are the relatively high taxes. We estimate the average worker earning $31,500 per year could expect to pay around $5,900 in taxes, or about 19% of their income. This city ranks last for percent of income going to taxes.

8. Bakersfield, California

As far as California goes, Bakersfield is pretty affordable. The lower quartile of renters spend under $8,200 per year on rent. After factoring in taxes, we estimate a Bakersfield high school graduate has about $18,700 in disposable income. According to our model, a high school graduate could afford monthly debt payments of $778 per month.

After about 7.7 months of paying $778 to debt, a high school graduate in Bakersfield would be free from credit card debt.

9. Tacoma, Washington

Tacoma takes ninth. Our model predicts a high school graduate could pay off $5,644 in credit card debt in less than eight months. They would need to spend half of their monthly disposable income which is equal to $760 per month.

In total the average high school graduate earns $31,600 per year, and has about $18,250 in annual disposable income after paying taxes and rent costs.

10. Corpus Christi, Texas

Corpus Christi takes the 10th spot. Average pay for high school graduates is fairly low here by the standards of this study, but so are the costs of living. The average Corpus Christi high school graduate will pay only $4,100 in taxes and $7,500 in rent per year. That leaves about $18,200 in disposable income, good enough for a monthly debt payment of $759.

We estimate that just under eight payments of $759 would be enough to pay off the average credit card debt. In our model, a high school graduate would end up paying $350 in interest on top of their $5,644 worth of credit card debt.

Corpus Christi residents who would prefer to have professional help managing their finances might find it useful to work with a financial advisor in their area.

Data and Methodology

In order to find the best places to pay off credit card debt, we created a credit card debt payment model for 59 cities. To create our list of cities, we only included cities which had a population of at least 200,000. We also excluded any city which had a below-average unemployment rate among high school graduates who have no further education.

To complete the analysis, we first calculated the amount of disposable income a high school graduate could have in each city, assuming they earned the median salary for high school graduates with no further education. Using SmartAsset’s income tax calculator we found the after-tax income for local high school graduates. We then subtracted the annual lower-quartile rent. The lower quartile-rent is the lowest number under which 25% of renters pay for rent.

We then assumed that high school graduates would dedicate half of their disposable income to credit card payments. Using that figure, we calculated how long it would take to pay off $5,644 worth of credit card debt, which was the average amount held in the fourth quarter of 2017, according to a TransUnion report. We also assumed they would be paying interest of 17%, which was the average according to Bankrate analysis.

Data for population, median income for high school graduates and lower quartile rent comes from the U.S. Census Bureau’s 2016 1-year American Community Survey. Unemployment figures come from the 2016 5-year American Community Survey.

Tips for Managing Credit Card Debt

- Transfer balance card – If you are serious about tackling your credit card debt, consider a balance transfer credit card. Balance transfer credit cards allow you to consolidate credit card debt onto one card. Typically you won’t have to pay interest on that card for a pre-agreed period of time. However, make sure you use the interest-free period to actually tackle your debt. If you don’t, you will find yourself stuck in the same position you were before.

- Prioritize credit card debt – If you have multiple debt obligations on top of your credit card debt, it still makes sense to prioritize your credit card debt. That does not mean to ignore your student loan payments or car payments. What experts recommend is paying the minimum amount you are allowed on debt with relatively low interest rates, like your mortgage or your student loan, and aggressively pay down the debt that has high interest rates like your credit card debt.

- Get help – If you are in serious debt, it may make sense to seek expert help. A financial advisor can help you restructure your debt so you are making the most of your debt payments. SmartAsset’s financial advisor matching tool can help you find an advisor who suits your needs. First you’ll answer a series of questions about your financial needs and preferences and then you’ll be matched with up to three advisors in your area.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/valentinrussanov