Despite its status as a large bank, Bank of America (BoA) does not offer high-earning interest rates. In fact, the bank often doesn't even coming close to the high rates that many online banks provide. Because of this, opening a savings account with Bank of America may be better for those that are not deterred by low interest rates. That makes BoA better suited to be an accompanying account to a bank account you already have.

However, it is worth noting that Bank of America has one of the largest suites of banking products in the entire banking industry. In fact, the bank offers a plethora of certificates of deposit (CDs), savings accounts, basic, student and business checking accounts, individual retirement accounts (IRAs) and more. This means that no matter your spending or saving needs, there’s likely an account available at BoA for you. If you’re eager to save big, though, you’ll want to look elsewhere.

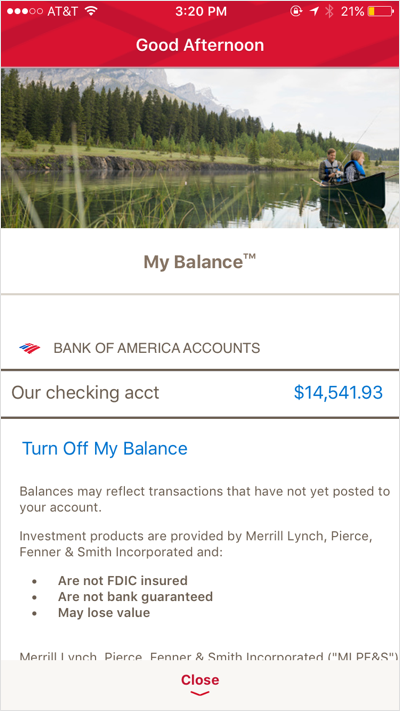

Perhaps the strongest feature that Bank of America offers customers is its Apple and Android mobile apps. Through these platforms, users can review their account activity and balances, order new checks, order debit card replacements, find ATMs and branches in their area, set up secure login procedures and more.

You can quite easily manage your money through the bank's apps, as the BoA apps also include mobile check deposit, mobile bill pay, internal account transfers and money transfers to friend and family through Zelle®. Current BoA customers are apparently happy with the bank's mobile apps, as the app holds a 4.7-star out of 5 rating on the Google app store and a 4.8-star out of 5 rating on the Apple app store.

Read on below to find out about Bank of America's banking options.

| Product | Key Details |

| Savings Accounts |

|

| Certificates of Deposit |

|

| Checking Accounts |

|

| IRAs |

|

Bank of America Interest Rate Comparison

Bank of America Overview

With humble beginnings in 1904 as the Bank of Italy, the Bank of America of today has expanded worldwide. Not only that, but its offerings of banking products have grown to include home loans, auto loans, investment opportunities with Merrill Lynch and more. This aligns with the company’s goal to provide financial products and insights for customers’ every financial need.

Bank of America Advantage Savings Account

| Key Features | Details |

| Minimum Deposit | $100 |

| Access to Your Savings Account | Online, mobile, text, ATMs and branches |

| Security | FDIC-insured deposits up to the legal limit |

| Fees |

|

| Current Terms and Rates |

|

The Bank of America Advantage Savings Account, previously the Bank of America Rewards Savings Account, provides an opportunity to save at Bank of America. You can gain access to slightly higher rates when you are a BoA Preferred Rewards member. Plus, you can avoid the account's $8 monthly maintenance fee as a Preferred Rewards member. You can also avoid this fee by maintaining a minimum daily balance of at least $500 or linking your account to your Bank of America Advantage Relationship Banking account.

Bank of America Certificates of Deposit (CDs)

| Key Features | Details |

| Minimum Deposit |

|

| Access to Your CD | Online, mobile, text, ATMs and branches |

| Security | FDIC-insured deposits up to the legal limit |

| Fees | No account maintenance fees. You will face a penalty if you choose to withdraw from your CD before its maturity date. |

| Current Terms and Rates |

|

Bank of America offers two certificate of deposit (CD) accounts: the Featured CD Account and the Fixed Term CD Account. If you’re unfamiliar with CDs, they are another way to put money away to grow for future use. You make one original deposit to the account and you cannot withdraw any of the savings until the CD's specific term is over.

The Bank of America Featured CD Account carries a term length of anywhere from 7 months to 37 months. This means that after your initial deposit, you cannot touch the account’s funds until your term length is over. While its APY lands higher than the Regular Savings Account, other banks have higher-earning accounts. The same goes for the Bank of America Fixed CD rates. The highest APY you can get with the longer CD terms is 0.03%, while many other banks offer much higher rates for shorter terms.

To gain access to a Bank of America CD, you will need to meet the minimum deposit amounts, which are a bit high. The Featured CD and the Fixed Term CD both have a $1,000 minimum.

Whichever CD you choose to open, it will automatically renew for another term length after maturity unless you take action to withdraw your funds. If it’s been a while since you opened your CD and you don’t know its maturity date, no need to worry. The bank will send you a notice before the date so you can take any necessary steps. These notices may also inform you of any changes the bank has made to the terms of your CD.

Don’t forget that you can only withdraw your savings after the account’s maturity. If you choose to bypass that rule, you’ll meet early withdrawal penalties. For CDs of less than 90 days, the penalty will be the greater of all interest earned on the amount withdrawn or an amount equal to seven days’ interest on the amount withdrawn. For CDs between 90 days and 12 months, the penalty equals the amount of 90 days’ interest on the amount withdrawn. For CDs with terms of 12 months to 60 months, the penalty is an amount equal to 180 days’ interest on the amount withdrawn. Finally, for CDs of 60 months or longer, the penalty equals 365 days’ worth of interest on the amount withdrawn. It’s good to keep in mind that you’ll lose much of what you earned in interest if you withdraw early.

Compare Bank of America to Other Competitive Offers

Bank of America Advantage Banking Checking Accounts

| Key Features | Details |

| Minimum Deposit |

|

| Access to Your Checking Account | Online, mobile, text, ATMs and branches |

| Security | FDIC-insured deposits up to the legal limit |

| Fees |

|

| Current Terms and Rates |

|

Bank of America technically only offers a single checking account program called Bank of America Advantage Banking. However, this account comes in three variations: Bank of America SafeBalance Banking®, Bank of America Advantage Plus Banking® and Bank of America Advantage Relationship Banking®.

SafeBalance Banking is the lowest tier, which means it comes with the least features. For example, while account holders will be able to take advantage of a free debit card and Zelle® money transfers, paper checks and overdraft protection are not included. However, because this account is fairly basic, it comes with the lowest monthly maintenance fee, which is $4.95. This fee can be waived if you're enrolled in BoA's Preferred Rewards program or you're a student under the age of 24 that's currently enrolled in school. This is not an interest-bearing account.

The Plus Banking tier of this BoA program includes everything SafeBalance Banking does, only it adds in paper check availability and overdraft protection. Again, this is not an interest-bearing account, and a minimum initial deposit of $100 is required to open it. The monthly maintenance fee for this account is also higher, as it starts at $12. Again, you can waive this fee if you maintain at least a $1,500 minimum daily balance, receive at least one direct deposit of at least $250, are enrolled in the Preferred Rewards program or are a student under the age of 24.

Lastly, the Relationship Banking tier is the only BoA checking account that earns interest. However, the account's rates are quite low, as all balances less than $50,000 receive just a 0.01% APY and all balances of $50,000 and up receive an equally unimpressive 0.02% APY. Otherwise, this account also calls for a $100 minimum opening deposit, and its features are the same as the Plus Banking tier. The monthly fee is much higher than the aforementioned mid-tier account, though, as it starts at $25 per month. To waive this charge, you can enroll in the Preferred Rewards program or maintain a combined balance of $10,000 across all of your eligible linked accounts.

All three checking accounts do offer some ease in saving through two programs. The Keep the Change® program links your checking account to your savings account. When you make purchases with your debit card, Bank of America will round that purchase up to the nearest dollar. The extra change will go right to your savings account. You also have access to BankAmeriDeals® which provides cash back deals. When you pay for purchases with your debit or credit card you can earn cash back that is debited to your account by the end of the following month. You can access both of these programs through Online and Mobile Banking.

Bank of America Savings IRAs

| Key Features | Details |

| Minimum Deposit |

|

| Access to Your IRA | Online, mobile, text, ATMs and branches |

| Security | FDIC-insured up to the legal limits |

| Fees | No account maintenance fees |

| Current Terms and Rates |

|

Bank of America’s IRA products mirror the bank’s other savings accounts like the Advantage Savings Account, the Featured CD and the Fixed CD, respectively. This means that terms and conditions for each account will most likely apply to its IRA counterpart. However, the IRA products will see more tax benefits than a non-retirement savings account. The bank’s IRAs also help you avoid annual and custodial fees, so your retirement savings can go even further.

You can easily apply for a Bank of America IRA online if you are already enrolled in online banking. If you are not enrolled or don’t have an existing bank account, you can visit your local bank branch to open an IRA.

Should you have questions about IRAs or saving for retirement in general, you may want to speak to a financial advisor. Finding the right financial advisor doesn’t have to be hard. SmartAsset’s free tool will pair you with as many as three financial advisors in your area in five minutes. Get started now.

Where Can I Find Bank of America?

Bank of America is a nationally recognized financial institution, largely due to its widespread presence. You can find the bank at thousands of ATMs or physical branches throughout over 30 states and the District of Columbia. You can open or manage any account at the location nearest to you.

Even if there is no physical location nearby, you can easily head to the Bank of America website to open and manage the bank account(s) you want. Bank of America also has a smartphone app so you can conveniently bank on the go.

What Can You Do Online With Bank of America?

You can do a lot of your banking online with Bank of America. Unlike many online banks that we review, Bank of America has brick and mortar locations to visit. However, if you want to open an account at your kitchen counter or deposit a check while on your couch, you can do that too.

Bank of America has upgraded its online offerings, especially on mobile, to make banking on the go easier and more convenient. You can even pay through your mobile device or lock/unlock your card in the event it gets lost or stolen. The bank’s app also includes Zelle with which you can quickly send and receive money from friends and family even if they don’t bank with Bank of America.

How Do I Access My Money?

There are a number of ways to access your money in a Bank of America bank account. For starters, you have access to thousands of ATMs and physical branches throughout most of the country. As an alternative, you can take advantage of the bank’s 24/7 online access, call a customer service representative or even send a direct message on Twitter or Facebook. If you go the social media route, however, you shouldn’t share any personal or financial information until you reach a more secure form of communication.

If you don’t need the assistance of a customer service representative, you can easily manage and access your money online or on the bank’s mobile app. You can deposit checks on the app by taking a picture of both sides of the check. You can transfer money, pay bills, locate ATMs and branches and receive customized alerts on your mobile app, as well. Shown here is an example image of your mobile account. You can see your checking account balances, your transactions and other balances.

How Can I Save More Money With a Bank of America Account?

When compared to many of the banks we have reviewed, Bank of America’s savings products don’t have much to offer. The bank’s interest rates don’t really compete with the high rates of many online banks. Essentially, you won't necessarily save more with a Bank of America Account than with a savings account at a competitor bank.

Bank of America also charges monthly fees for simply holding an account. Many competitors do not charge maintenance fees and offer higher interest rates. It is a plus, though, that when Bank of America does charge monthly account maintenance fees, there are often steps you can take to waive the fee.

The bank does offer an opportunity to snag deals and save money with its BankAmeriDeals® program. It provides cash back deals when you pay for purchases with your debit or credit card. The cash back is then debited to your account by the end of the following month. Plus, your mobile app shows you exactly where you can earn these rewards with an interactive map tool. You can also access the program through your online account.

What’s the Process for Opening an Account With Bank of America?

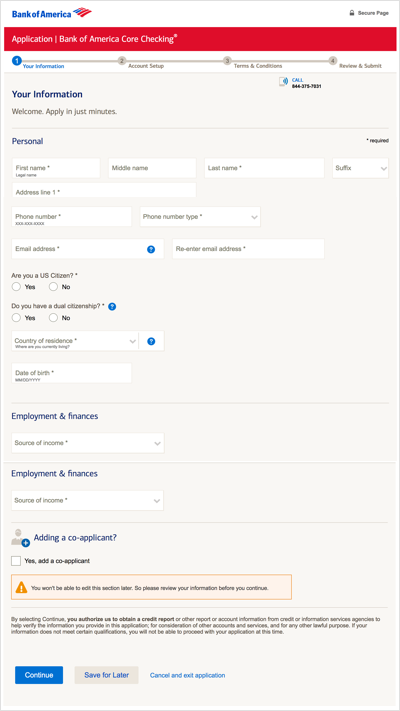

Bank of America provides a few different ways for you to open an account. For starters, you can easily apply online, which will take around 10 minutes. All you have to do is find the account you want to open and click the “Open Now” button on the page. This will take you to a page confirming the account you want to open among other choices depending on the account type. This is where you can add an offer code if you have one or log in as an existing Bank of America Online Banking customer. If you are an existing customer, you can log in to prefill and customize your application. Once you fill in your information on the following page and click Continue, you authorize the bank to obtain a credit report and other information to confirm that the information you provided is all correct.

The bank states that you should visit a physical branch to open an account if you have limited credit history. This way, you can speak with a representative rather than wait for applications and inquiries to go through online. You should also visit a branch if you have had issues with your checking history or if you’re depositing more than $100,000 into your new account.

You can also always give the bank a call at (844) 375-7027. No matter which method you choose, you will have to provide personal information to open an account. This includes your Social Security number, your date of birth, phone numbers and addresses (no P.O. boxes) and funding information.

What’s the Catch?

The catch to banking with a big bank name like Bank of America is that you don’t get the highest savings rates. On one hand you can consolidate your banking accounts to one institution which offer convenience and ease, but the effort of opening and managing savings account may not be worth the results you see with the bank’s low APYs. Especially in today’s economy, where saving for retirement or your next big expense is increasingly important, you may want to look elsewhere for bigger savings returns.

Bottom Line

If you’re looking to open a number of bank accounts with the same big name institution, Bank of America could be the right choice for you. Not only can you choose between a few simple checking and savings accounts, but you can also start funding your retirement with one of the bank’s IRAs.

If you want to maximize your savings, however, you should look elsewhere for a high-earning savings rate. Unfortunately, Bank of America doesn’t offer the most competitive rates, meaning your savings will take a while to grow.