Let’s start with the good news: your house has most likely increased in value over the last couple of years. While the recession knocked most property values down to early 2000s levels, most of the country has recovered and home values have increased each year. The bad news is that your property taxes probably jumped upwards as well. Fortunately, there are some actions you can take to limit the pain of rising property taxes.

Check out our property tax calculator

All About Your Property Tax Assessment

If you’ve owned your home more than a year, you’re likely aware that each year your county sends you a tax assessment with an estimation of your home’s value. The assessment helps determine how much property tax you’ll owe. The assessment is not the same thing as a home appraisal, as it’s for tax purposes rather than resale. For the most part, your assessment is based on general real estate market trends. However, local governments have different methods of assessing property from state to state.

For example, in New Jersey, your assessed value will be multiplied by an equalization ratio set by the Division of Taxation to ensure a tax district pays their fair share. In Washington state, home value is determined by market value as well as physical inspections. This means if you renovated your home and added a bedroom or more square footage, your tax assessment will generally increase.

If you want to find out exactly how your home is assessed, check with your local taxing authority. It’s generally the county assessor’s office.

You Can Challenge Your Tax Assessment

Look over the entire property tax assessment when you receive it. In some cases, your tax assessment might include an error that bumps the assessed value higher than it should be. Check the square footage and number of rooms listed on as well as any listed improvements. The last thing you want is to be charged taxes for a larger house than you actually own!

If you have refinanced recently, a full home appraisal would have been done on your house. The appraiser does an in-depth review of your home and the specifics of sales trends in your immediate neighborhood. If your new tax assessed value is higher than the appraised value, you have a strong case to dispute the assessed value.

If you want to challenge your tax assessment, you can generally find the details about how to do it on the assessment itself. This includes the paperwork you need to file to substantiate your dispute (such as an appraisal, or comparable market value sales) and the deadline.

The deadline to challenge your tax assessment varies from state to state, but will usually fall sometime in the spring. If you miss the deadline, you will be forced to pay taxes at the new assessment for the current year, and will not be able to challenge again until the next year’s tax cycle.

While you might hesitate to dispute a process you probably weren’t even aware was happening, if you have any evidence that the assessment is too high, you should raise a flag. After all, you have to pay the property taxes. If the assessment is too high, that means potentially thousands of extra taxes paid over the lifespan of your home.

Check Your State and County’s Tax Exemptions

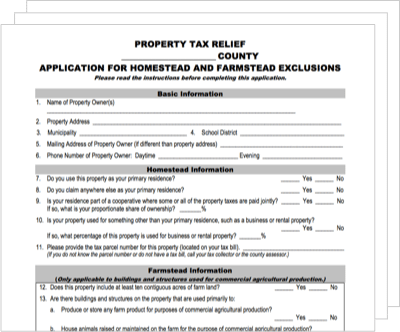

Another way to save money on property taxes is by applying any applicable tax exemption. Most states and some counties will offer property tax exemptions. You can find out what your local government offers by looking through online resources or calling. Common property tax exemption groups include senior citizen exemptions or discounts, veteran, disabled veteran, or disabled individuals.

The exemption that’s more commonly used and known in certain parts of the U.S. is the homestead exemption. In some states this can mean as much as a 50% reduction in your home’s assessed value if it’s your primary residence. Unfortunately, not all states offer this exemption. Check with your county or state government to see if the homestead exemption exists where you live.

Bottom Line

Taxes are also one of the biggest costs of homeownership. But by doing your homework — both to research the accurate value of your house and to find out if you are in any protected group or region — you can drastically reduce the sting. This can potentially save you thousands over the course of owning your home.

Tips for New Homeowners

- Thinking about moving to a neighboring town or even a new state? Use our cost of living calculator to get an idea of what food, housing and taxes look like across the U.S.

- You’re not limited to saving money just on property taxes. Consider itemizing your tax return so you can claim the mortgage interest deduction. Claiming this deduction means a reduction on your taxable income and can save you thousands of dollars.

Photo credits: ©iStock.com/sshepard, dced.pa.gov/, ©iStock.com/fstop123