The IRS credit for the elderly or the disabled is a tax benefit designed to help older adults and individuals with qualifying disabilities reduce their income taxes. Outlined in IRS Publication 524, this credit is available to individuals who meet specific age, income and disability criteria. The goal is to provide financial relief to those with limited income and significant medical or living expenses. Working with a financial advisor can help you simplify the process and maximize potential tax benefits.

IRS Publication 524

IRS Publication 524 is the official document that explains the credit for the elderly or the disabled. It breaks down who qualifies, how to calculate the credit and how to claim it. The publication is intended to help taxpayers understand eligibility requirements, such as income limits and age or disability criteria. This document also includes worksheets and examples to help taxpayers determine how much credit they qualify for when filing a tax return.

Who Qualifies for the Credit for the Elderly or the Disabled?

Eligibility for the Credit for the Elderly or the Disabled depends on specific criteria:

- Age: You must be at least 65 years old by the end of the tax year.

- Disability: If under 65, you may qualify if you are permanently and totally disabled, as defined by the IRS.

- Income limits: Your adjusted gross income (AGI) or the total of your nontaxable Social Security and other nontaxable pensions, annuities or disability income must fall below specific thresholds.

- Filing status: The credit is available for single, married and head-of-household filers, but income limits vary by filing status.

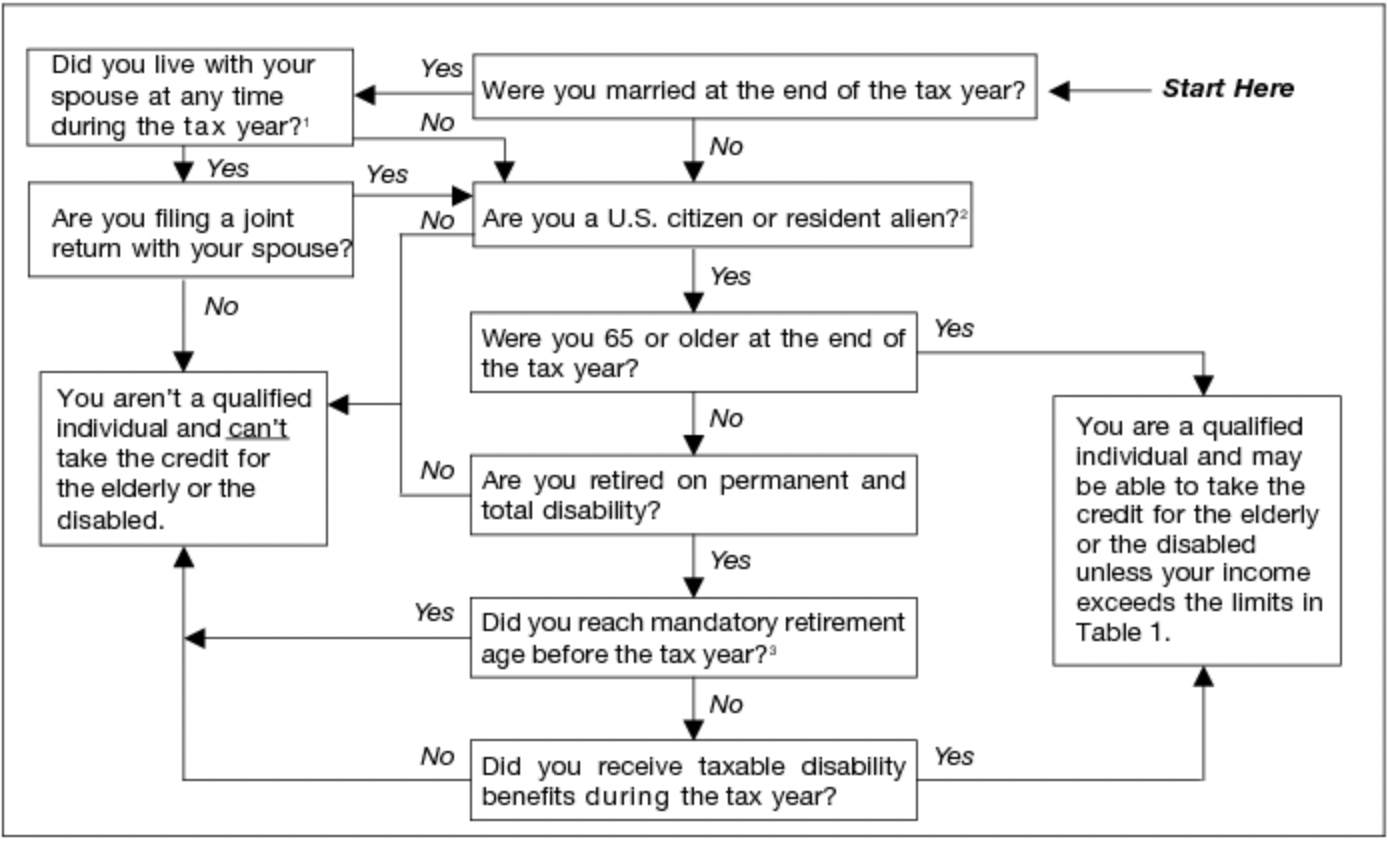

To help you determine your eligibility, here is the flow chart in Publication 524:

If your AGI is higher than the following limits, you are not eligible for the credit:

| Filing Status | Adjusted Gross Income Limit | Nontaxable Income Limit |

| Single, Head of Household, or Qualifying Surviving Spouse | $17,500 | $5,000 |

| Married Filing Jointly (One Qualifying Spouse) | $20,000 | $5,000 |

| Married Filing Jointly (Both Spouses Qualify) | $25,000 | $7,500 |

| Married Filing Separately (Lived Apart All Year) | $12,500 | $3,750 |

How to Claim the Credit for the Elderly or the Disabled

Here are four common steps to help you get started:

- Verify eligibility: Confirm that you meet all the criteria for age, disability, and income limits.

- Complete Schedule R: Use IRS Schedule R to calculate your credit amount. The schedule includes step-by-step instructions and worksheets.

- Attach Schedule R to Form 1040: Submit the completed schedule with your federal income tax return.

- Maintain documentation: Keep records proving your eligibility, such as disability statements from a physician or documentation of income sources.

If you’re unsure about the process, a tax consultant or financial advisor can help ensure accurate filing and maximize your credit.

Frequently Asked Questions About the Credit for the Elderly or the Disabled

What Is the Credit for the Elderly or the Disabled Worth?

The value depends on your filing status, income and other qualifying factors. Generally, the maximum credit amount ranges from $3,750 to $7,500.

How Do I Prove Permanent and Total Disability?

To prove disability, you must provide a physician’s statement that confirms your condition prevents you from engaging in substantial gainful activity and is expected to last indefinitely or result in death.

Can Married Couples Both Claim the Credit?

Yes, if both spouses qualify, they can claim the credit jointly. The combined income and nontaxable thresholds for eligibility will apply to both individuals.

What Income Is Considered for Eligibility?

Income includes your adjusted gross income and nontaxable income such as Social Security benefits, pensions or annuities. The IRS sets specific limits for eligibility based on filing status.

Do I Need to File a Tax Return to Claim the Credit?

Yes, you must file a federal income tax return and attach Schedule R to claim the credit, even if your income is below the threshold for mandatory filing.

Bottom Line

The IRS credit for the elderly or the disabled can provide valuable tax relief for qualifying individuals with limited income and resources. By understanding the criteria outlined in IRS Publication 524, taxpayers can determine their eligibility and potentially reduce their tax burden. A financial advisor or tax professional can help you simplify the process and create a plan to maximize the benefits of this credit.

Tax Planning Tips

- A financial advisor who specializes in taxes can work with you to create a plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- SmartAsset’s tax return calculator can help estimate your next refund or balance due.

Photo credit: ©iStock.com/Prostock-Studio, ©iStock.com/IRS, ©iStock.com/Deagreez