If you’re claiming an exemption from healthcare coverage, you used to need to fill out IRS Form 8965 when you filed your federal income taxes. However, Form 8965 is no longer in use. This form was tied to Affordable Care Act rules that once required most Americans to maintain health insurance coverage or claim an exemption. Because the federal individual mandate penalty has been eliminated, taxpayers no longer need to file Form 8965. Here’s everything you need to know about what Form 8965 was used for and why it no longer applies today.

A financial advisor could help optimize your tax strategy for your financial needs and goals.

Who Needed Form 8965?

You probably know that the passage of the Affordable Care Act ushered in an era when every American had to have “minimum essential coverage” or pay a penalty (although there were exemptions). That requirement existed for tax years prior to 2019. For each month of the tax year, taxpayers once had to either have health coverage, claim a coverage exemption or pay the penalty.

However, starting with the 2019 tax year, the federal shared responsibility payment was reduced to $0. As a result, taxpayers are no longer required to have health insurance or claim an exemption on their federal return. The penalty was known as the shared responsibility payment but since it no longer applies, Form 8965 is now obsolete.

Health Coverage Exemptions

Here are some of the categories of exemptions taxpayers could claim in years when the individual mandate was in effect:

- Your income was below the tax filing threshold.

- You were living abroad for at least 330 days.

- You were a member of a healthcare-sharing ministry.

- You were incarcerated.

- You’re a member of a Native American Tribe.

- You were unable to renew your existing coverage.

- You can’t afford coverage.

- You live in a state that didn’t expand Medicaid and your income is less than 138% of the federal poverty line for your family size.

- You went without coverage for less than three consecutive months.

- A member of your household was born, died or adopted so you can’t check the box saying the whole household had 12 months of health insurance coverage.

- You’re a member of certain qualified religious sects.

- You were turned down for Medicaid in a state that didn’t expand Medicaid.

- You experienced “general hardship.”

- You participated in certain Medicaid programs that aren’t considered minimum essential coverage.

These exemptions are no longer claimed on a federal tax return, because Form 8965 has been retired.

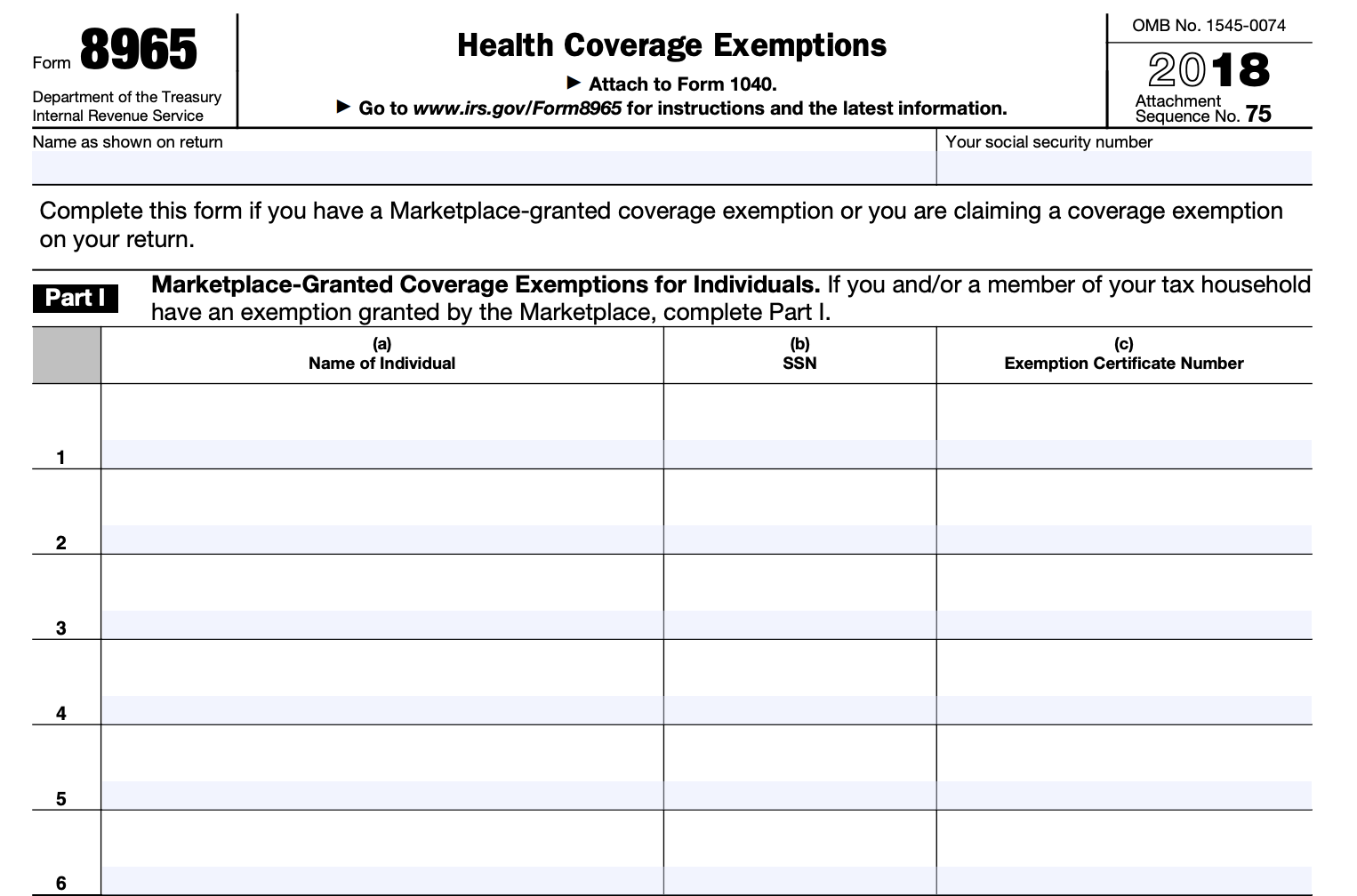

How to Fill Out Form 8965

When Form 8965 was in use, taxpayers who qualified for a coverage exemption documented that information on the form and attached it to their federal tax return. First, filers wrote their name and Social Security number at the top of the form. From there, they determined whether they needed to complete Part I, Part II or Part III.

If a taxpayer or a member of their household had a Marketplace-granted exemption, they entered each exemption-claiming person’s name, Social Security number and exemption certificate number in Part I of the form.

What’s a Marketplace-granted exemption and what’s an exemption certificate number? At the time, some exemptions from the minimum essential coverage requirement could be claimed directly on Form 8965 when filing a tax return.

However, other exemptions had to be applied for in advance and granted by the Health Insurance Marketplace, which issued an exemption certificate number if the application was approved. The exemptions that required an advance Marketplace application included:

- General hardship

- Certain religious sect members

- Not being able to afford coverage

- Being ineligible for Medicaid in a state that did not expand Medicaid coverage

- Being unable to renew existing coverage

- Having AmeriCorps coverage

IRS guidance at the time included charts showing which exemptions required Marketplace approval, which could be claimed on a tax return, and which were available through either method.

If a taxpayer or household member received a Marketplace-granted exemption, they listed the exempt household member’s name, Social Security number and exemption certificate number in Part I. If a Marketplace exemption application was still pending, filers wrote “pending” in Section C under “Exemption Certificate Number.”

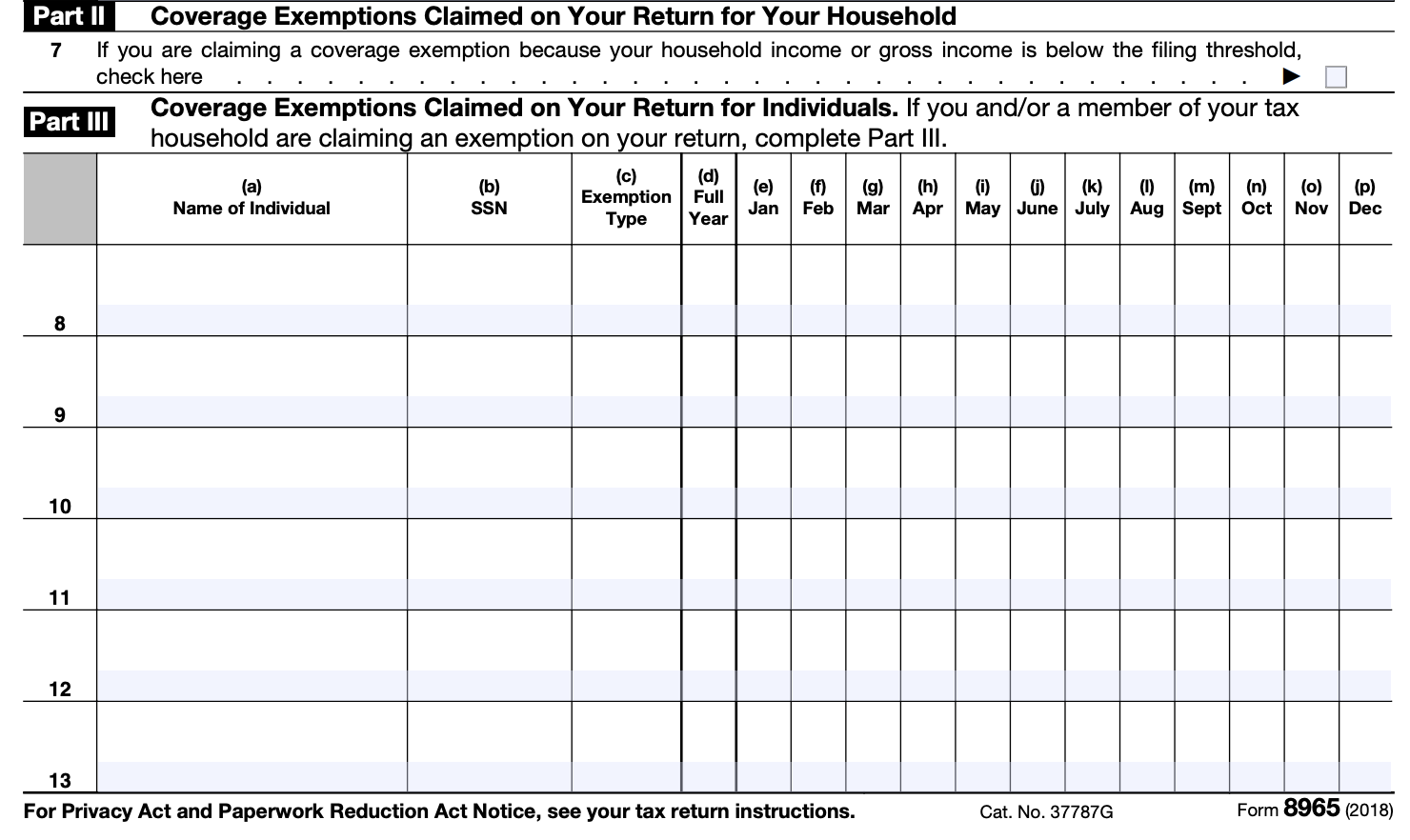

If no Marketplace-granted exemption applied, filers moved on to Part II or Part III, depending on their situation.

Part II of Form 8965 was used by taxpayers whose income was below the filing threshold. If income was low enough that filing a tax return was not otherwise required, no Form 8965 was necessary, as the taxpayer was automatically exempt from the shared responsibility payment. However, if a taxpayer chose to file anyway (to claim refundable credits), they checked the applicable box in Part II.

Part III was used for exemptions that were neither Marketplace-granted nor based on income below the filing threshold. These included exemptions for short coverage gaps and for individuals living abroad. Filers used IRS instructions to identify the appropriate exemption code and entered it in Part III.

For each household member claiming a Part III exemption, filers entered the name, Social Security number, exemption type and exemption period. They indicated whether the exemption applied for the full year or for specific months. For example, a one-month coverage gap in July was reported by entering the appropriate exemption code and checking July on the form.

Bottom Line

IRS Form 8965 is no longer used, and taxpayers do not need to file it for current or future tax years. The federal individual mandate penalty was eliminated beginning in 2019, which removed the requirement to report health coverage or claim exemptions on a federal tax return.

Whether you had qualifying health coverage for the full year or no coverage at all, you will not face a federal penalty and do not need to attach Form 8965 to your Form 1040. While some states have enacted their own health insurance mandates, those rules are handled at the state level and do not involve Form 8965.

If you’re unsure how healthcare rules affect your taxes today, working with a tax professional or financial advisor can help you stay compliant and avoid confusion stemming from outdated forms and requirements.

Tips for Navigating Tax Season

- A financial advisor can be a key resource in helping you figure out your taxes. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- If you don’t know whether you’re better off with the standard deduction versus itemized, you might want to read up on it and do some math. Educating yourself before the tax return deadline could save you a significant amount of money.

- SmartAsset has you covered with several free online tax resources to help you during tax season. Check out our income tax calculator and get started today.

Photo credit: ©iStock.com/marekuliasz, Images of Form 8965 from IRS.gov, ©iStock.com/sturti