We all know that the cost of higher education is steep and getting steeper. If you’re not relying solely on student loans or grants and are instead paying some of your own money toward tuition and fees, you may be able to deduct those expenses from your income taxes. To do so, you’ll use IRS Form 8917, but only for expenses incurred in tax years 2018, 2019 and 2020. The deduction has since expired and the form isn’t of use for tax years after that.

A financial advisor could help you optimize your tax strategy for your education goals.

Who Can Use Form 8917?

Taxpayers can use Form 8917 to claim a deduction of up to $4,000 in qualified higher education expenses. While the deduction was set to expire at the end of 2017 it was extended through 2020. However, the deduction expired at the end of 2020.

According to IRS rules, you may be eligible to use Form 8917 if you, your spouse or a dependent claimed on your tax return was enrolled in a qualified educational institution in the relevant tax year. “Qualified” means the institution must be an institute of higher learning. In other words, the student must have obtained a GED or high school diploma before enrolling in courses. To meet attendance requirements for Form 8917, the student must have been enrolled in at least one course. There is no residency requirement or full-time study requirement.

The educational expenses you can deduct on the form depend on what you paid for academic periods beginning in the previous calendar year and/or in the first three months of the year you file your taxes. An academic period is a quarter, semester, trimester or other term of study used by a qualified educational institution.

Who can’t use Form 8917? Anyone whose filing status is married filing separately. Also, you can’t use Form 8917 if someone else claims an exemption for you as his or her dependent, even if the person who claims that exemption doesn’t use Form 8917. In other words, kids whose parents claim them as dependents can’t use Form 8917 themselves, regardless of whether their parents use Form 8917.

If your modified adjusted gross income (MAGI) is more than $80,000 (or $160,000 if you’re filing jointly), you can’t use Form 8917. If you were a nonresident alien for all or part of the year and didn’t elect non-resident alien tax status, you can’t use Form 8917.

Finally, you can’t use Form 8917 to claim deductions on the same educational expenses you used to apply for educational tax credits on Form 8863. While applying for a state education tax credit won’t disqualify you from claiming a tuition and fees deduction on Form 8917, claiming a federal education tax credit on Form 8863 will. You can’t use the same expenses to claim both a federal tax deduction and a federal tax credit. The IRS prohibits what it calls “double benefits.”

How Does Form 8917 Differ From Form 8863?

IRS Form 8917 and Form 8863 both deal with education expenses. Form 8917 offers a tax deduction called the Tuition and Fees Deduction, while Form 8863 offers two tax credits. The two tax credits you can claim on Form 8863 are the American Opportunity Tax Credit and the Lifetime Learning Credit.

A tax deduction reduces your taxable income, thus lowering your tax bill indirectly. A tax credit, by contrast, offers a dollar-for-dollar cut in your tax bill. If all or part of the tax credit is refundable and you’re eligible for tax credits that exceed your tax liability, you’ll get a bigger refund. The wealthier you are, the more valuable a tax deduction is to you because your higher marginal tax rate will be applied to a lower taxable income. Tax credits, particularly refundable tax credits, are valuable tools for low- and middle-income households. You can read more about tax credits vs. deductions here.

The IRS offers an interactive tool to help you answer the question, “Am I eligible to claim an education credit?” The tool should take about 10 minutes to use and can help you determine whether you’re eligible for the Tuition and Fees Deduction, the American Opportunity Tax Credit (AOTC) and/or the Lifetime Learning Credit (LLC), and which one you should claim.

Why is it so complicated? For one thing, there are different eligibility requirements for the deduction and the two tax credits. There are also different benefits. We mentioned the difference between a deduction and credit but there’s also an important difference between the AOTC and the LLC. The LLC is non-refundable, while 40% of the AOTC credit a filer is eligible for is refundable.

Here’s an IRS chart comparing the requirements and benefits of the Tuition and Fees Deduction, the AOTC and the LLC. Note that all of the three tax breaks are unavailable to those whose filing status is married filing separately.

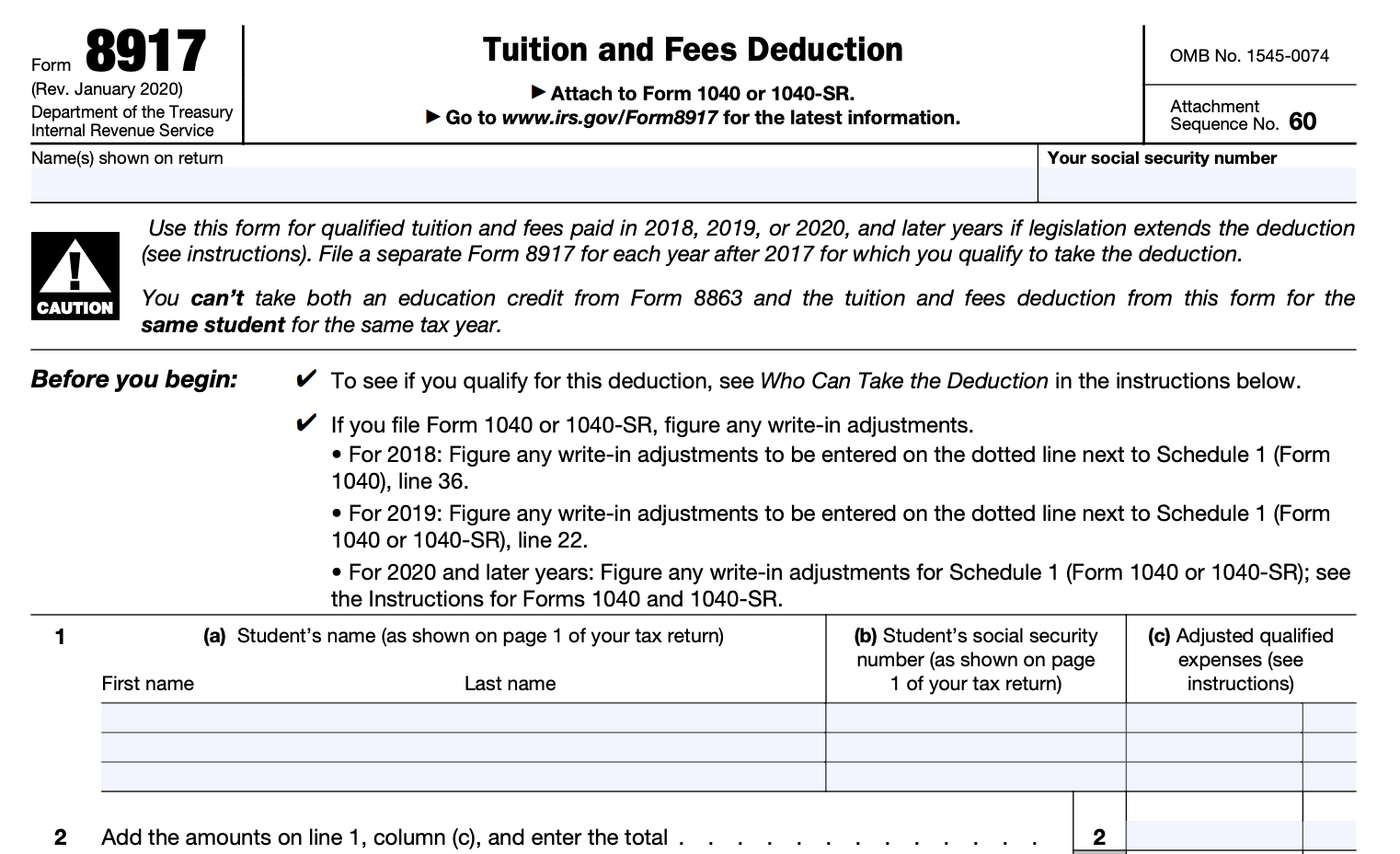

How to Fill out Form 8917

So you’ve decided to use Form 8917 and claim a tax deduction for education expenses? Now here’s the fun part – filling out the form. As with all IRS forms, it comes with its own instructions, but it’s still good to read up about the form before you get started. Before you spend time filling out the form, check the eligibility requirements attached to the form.

If you’re using IRS Form 1040, calculate any write-in adjustments to be entered on the dotted line next to line 36 of Form 1040. You’ll need that number for Form 8917 if you’re using Form 1040 to declare your income.

First up, on line 1 parts a) and b) of Form 8917 you’ll write the name(s) and Social Security Number(s) of the student(s) in your household. In part c) you’ll write the adjusted qualified expenses. To get this number, take the tuition and fees you paid in the relevant period(s) and “adjust” it by subtracting tax-free educational assistance. The IRS doesn’t want you claiming deductions for your full tuition if some of that tuition was paid with tax-free educational assistance. Doing so would be like getting the same tax break twice.

What’s tax-free educational assistance? It’s the tax-free part of any scholarship or fellowship grant (including Pell grants); the tax-free part of any employer-provided educational assistance, like a continuing education allowance from your boss; veterans’ educational assistance and “any other educational assistance that is excludable from gross income (tax-free), other than as a gift, bequest, devise, or inheritance.”

Subtract all tax-free educational assistance from your qualified educational expenses and enter the number in 1 c) for all students whose expenses you’re deducting. On line 2, total the entries in 1 c) and write the sum. Remember to include only tuition and fees in your educational expenses. You can’t claim a deduction for other education-related expenses like books, room and board.

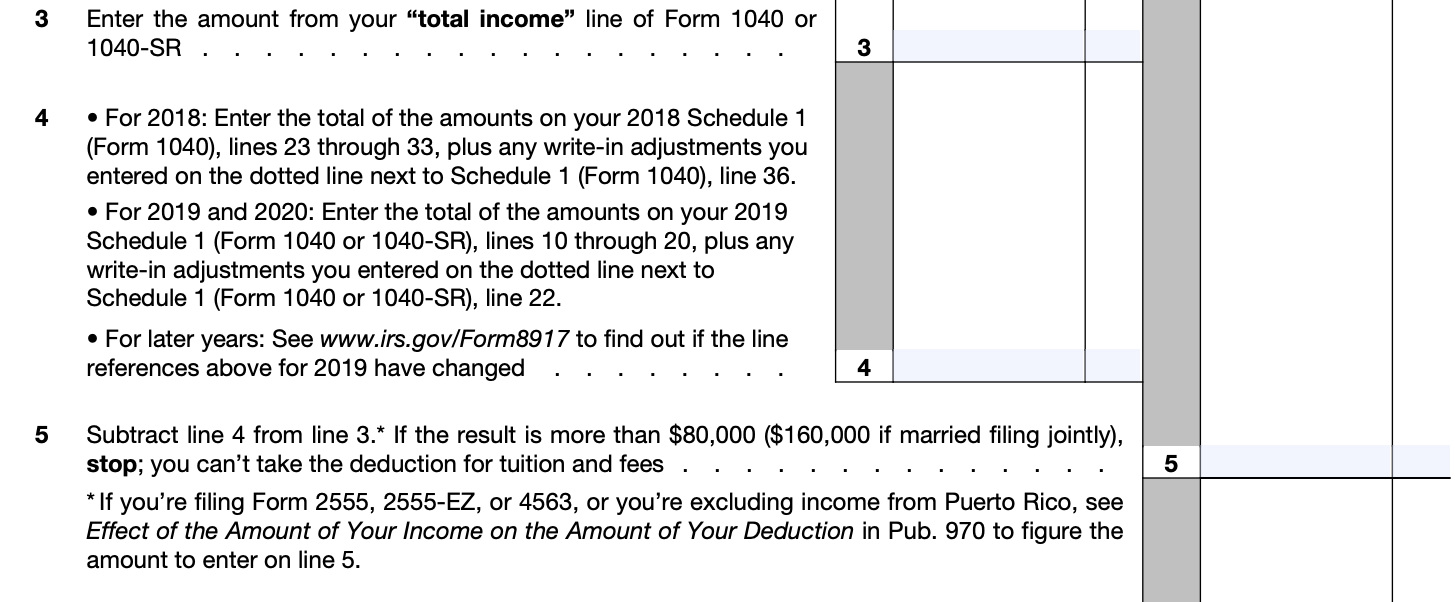

On line 3, enter the amount from line 22 of Form 1040 or line 15 of Form 1040A, whichever one you’re using to declare your income. On line 4, enter the total from either: Form 1040, lines 23 through 33, plus any write-in adjustments entered on the dotted line next to Form 1040, line 36 OR Form 1040A, lines 16 through 18.

Next, on line 5, subtract line 4 from line 3. If the result is more than $80,000 (or $160,000 if your filing status is married filing jointly), you can’t use Form 8917 to take the deduction for tuition and fees.

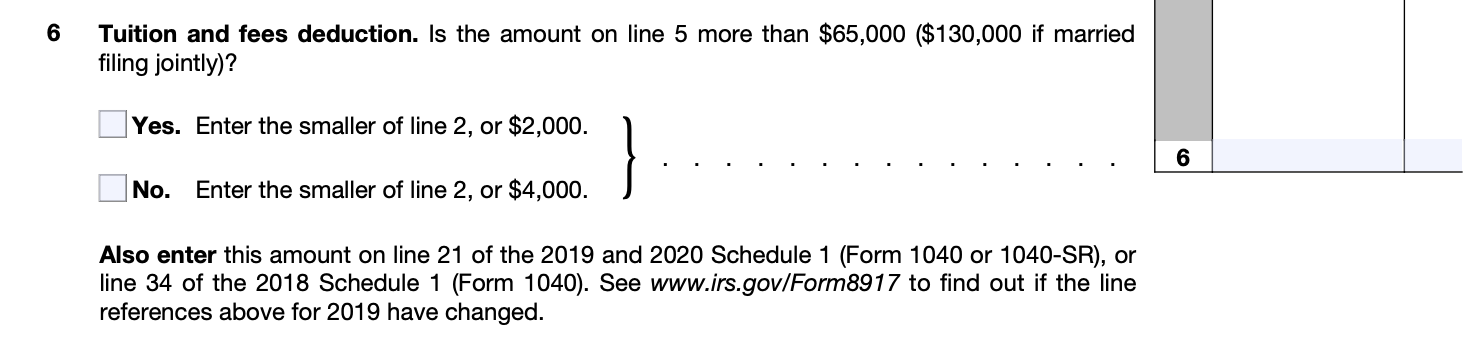

Line 6 is where the deduction comes in. First, determine whether the amount you entered on line 5 is more than $65,000 ($130,000 if your filing status is married filing jointly). If the answer is yes, go to line 6 and enter the smaller of line 2 or $2,000. If the answer is no, go to line 6 and enter the smaller of line 2 or $4,000.

As you can see, the maximum deduction you can get out of Form 8917 is $4,000. It’s not nothing, but it’s a small amount in comparison to the amount many households pay for higher education. Once you’ve filled out Form 8917 correctly and entered your deduction on line 6, take that deduction number and enter it on Form 1040, line 34 or Form 1040A, line 19, depending on which form you use (you can’t use Form 8917 with Form 1040EZ).

Bottom Line

Form 8917 can help eligible taxpayers reduce the cost of higher education by claiming the tuition and fees deduction, but it requires careful attention to detail. Understanding who qualifies, which expenses are eligible and how income limits apply can prevent costly mistakes or missed tax savings. Because tax rules surrounding education benefits can change and overlap with other credits, taking time to review your options is important.

Tips to Finance Education

- A financial advisor can help you manage the cost of college, set up college savings accounts and determine which deductions and credits you qualify for. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Opening a 529 plan early can boost your college savings faster. Use our investment calculator to find estimates of what your savings could look like in the future.

- SmartAsset’s student loan calculator will help you figure out how much your monthly payments will be and how much your loan will amortize over time.

Photo credit: ©iStock.com/monkeybusinessimages, IRS website, ©iStock.com/XiXinXing