The Internal Revenue Service has been keeping busy these past few weeks with alterations to next year’s standard deduction, a Social Security boost and now an increase in 401(k) and other retirement contribution limits — all of which directly result from the sky-high inflation we’ve suffered over the last year.

The Internal Revenue Service has been keeping busy these past few weeks with alterations to next year’s standard deduction, a Social Security boost and now an increase in 401(k) and other retirement contribution limits — all of which directly result from the sky-high inflation we’ve suffered over the last year.

The idea behind these changes is to ease the growing burden of living costs on consumers amid rampant inflation. This comes as we approach what experts deem an all-but-inevitable recession. And while retirement contributions won’t reflect in your current day-to-day savings, it’s an attempt to keep pace with future costs. Let’s discuss the contribution updates as well as what these contributions could mean for you.

If you need help maximizing your retirement savings, a financial advisor can help.

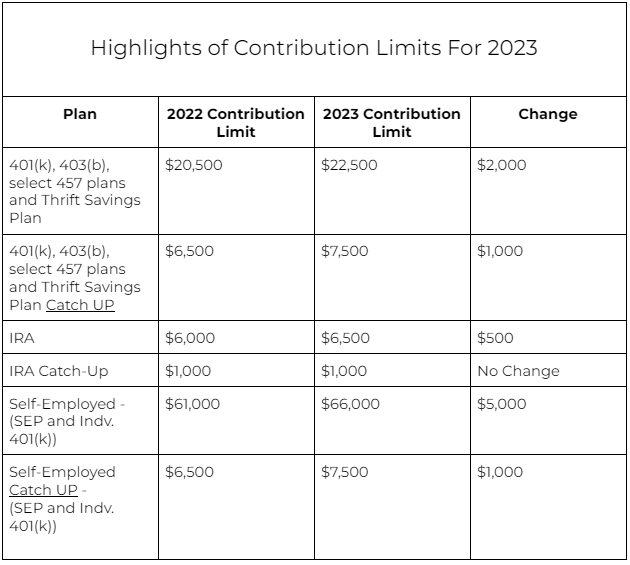

Highlights of Contribution Limits For 2023

Among the changes implemented by the IRS, a significant increase in contribution limits was provided for 401(k)s and other tax-deferred plans. These included:

- 403 (b)

- Select 457 plans

- Thrift Savings Plan

- Employee catch-up contributions

- IRAs

2023 Employee 401(k) Contribution Limit

Employees who contribute to a company 401(k) plan now have the option to contribute a maximum of $22,500 annually, a raise of $2,000 from the previous year’s $20,500 cap. This raise is also allowed for employees who partake in a 403(b) plan, many of the 457 plans or the government’s Thrift Savings Plan.

The 401(k) catch-up contribution for people 50 and older also rose from $6,500 to $7,500 for 2023, meaning people 50 and older can contribute $30,000 annually to their 401(k). Employees who contribute to 403(b) plans, some 457 plans or a Thrift Savings Plan are allowed the same catch-up contribution boost.

2023 Individual Retirement Account (IRA) Limit

Annual contributions to an IRA will also see a boost with the new limit raised to $6,500 from $6,000. The IRA catch-up limits for persons aged 50 and over did not see a raise this year, the maximum remains at $1,000.

2023 401(k) Catch-Up Contribution Limit

Catch-up contributions for 401(k) contributors over the age of 50 increased to $7,500, up from $6,500. This also includes catch-up contributions for other plans such as the 403(b), most 457 plans, as well as the Thrift Savings Plan. In total, contributors 50 and up will be able to contribute a maximum of $30,000 in 2023.

2023 Retirement Contribution Limits For The Self-Employed

If you are self-employed and contribute to a SEP retirement plan or an individual 401(k) you now have a maximum annual contribution limit of $66,000. The catch-up contribution for ages 50+ also applies to the self-employed who will see the same $1,000 increase.

What A Retirement Contribution Limit Increase Can Do For You

It may not be surprising to learn, but most Americans pass on contributing the maximum allowed amount to their retirement plans. Back in 2021, only 12% reported making the maximum contribution to their 401(k) plans. For 2022, Vanguard showed this number had risen to 14%. Given the current state of the economy and pending recession, this was a welcomed uptick but still relatively low in the grand scheme of participants involved in a 401(k) plan.

The few, but wise who do contribute the maximum amount will be the only ones who see any benefit from this contribution increase and it will make the difference of significant savings in the long term. Now, this depends on a variety of factors which include your age, the amount you have already saved, and of course the trajectory of the market which influences return rates.

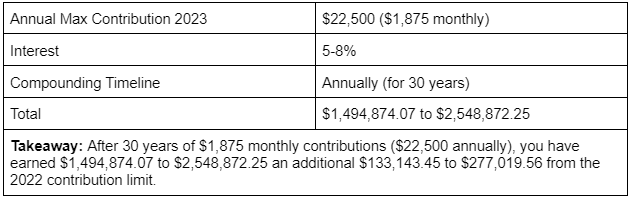

Just as an example, let’s see what difference this increase can make for an employer-sponsored 401(k) plan over the next 30 years.

The Bottom Line

If you have the ability to afford an increase in your 401(k) or any retirement contribution, it’s wise to make the commitment. Even if you aren’t maxing out your efforts, any extra can mean huge returns in the future. Those who aren’t making contributions or aren’t increasing their contributions to combat the cost of living increases will likely feel greater repercussions in retirement or have to prolong retirement to save more.

Tips for Contributing to Your 401(k)

- If you’re struggling to get started or stay on track, consider working with a financial advisor. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- If you switch jobs, you can no longer contribute to a previous employer’s 401(k) plan. You don’t want to lose the hard work you did to save that money, so you should look to make a direct 401(k) rollover to your new employer’s plan.

- A traditional IRA and a 401(k) offer similar tax benefits. You might wonder whether one is a better option for you. Here’s an article to help you think about an IRA vs. a 401(k).

- You should always avoid early withdrawals from your 401(k). Not only will you have to pay the income tax, but you’ll also have to pay a 10% penalty. There are a couple of ways you could avoid that big penalty though. If you really think you need to withdraw money early, here’s more information on 401(k) withdrawals.

Photo credit: ©iStock.com/AndreyPopov , Photo credit: ©iStock.com/Cn0ra