In the past SmartAsset has analyzed gender income inequality through the lens of earnings. As of 2016, the Census Bureau estimates that the average full-time working female earns 80% of what the full-time working male earns. When women consistently earn less than men for the same work that has pernicious long-term effects on their ability to afford homes, save for retirement and balance budgets. This is especially true for single women. Our data shows that a man is 50% more likely to buy a home without a cosigner than a woman.

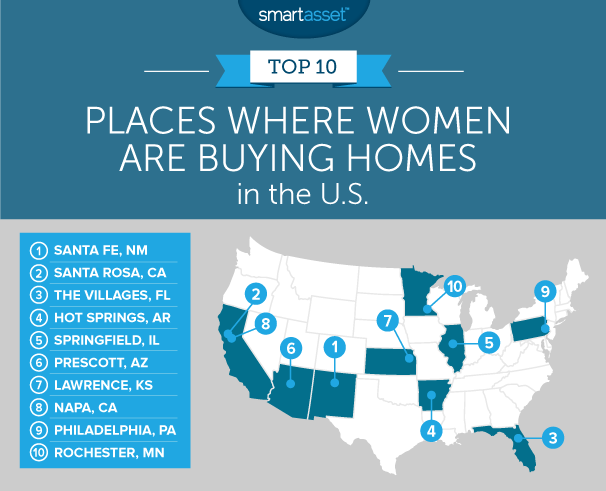

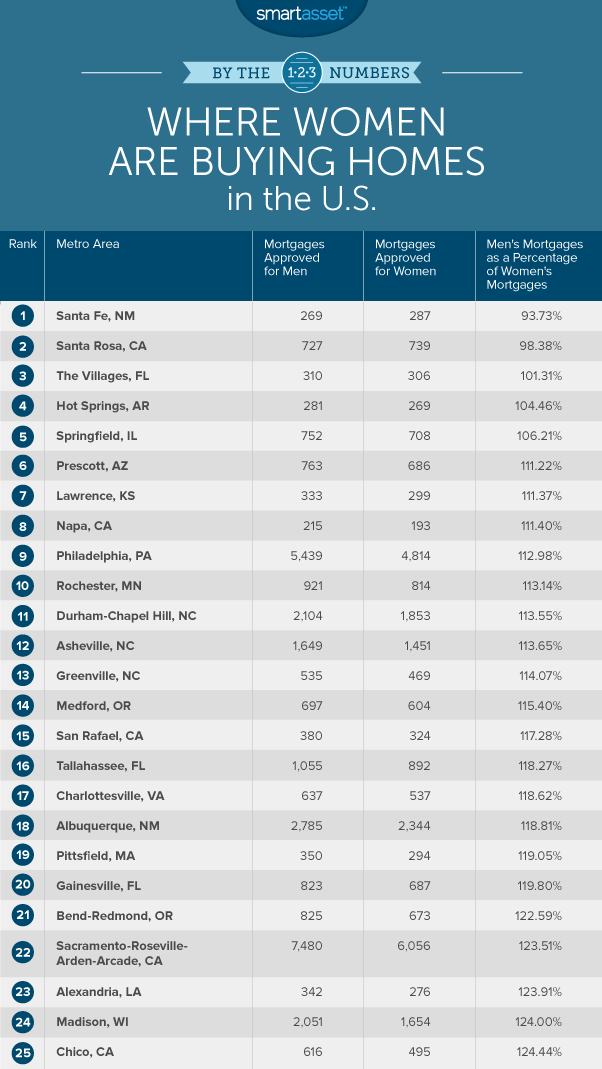

But not all cities share this home buying imbalance. Below SmartAsset looks at the places where women are buying homes. For this study, we looked at data on two factors. We looked at the number of men buying homes in a metro area and the number of women buying homes in a metro area. Check out our data and methodology section below to see where we got our data and how we put it together.

Key Findings

- Financial flexibility – One of the worst home buying mistakes you can make is to buy a home you cannot afford. Of course, both you and the home loan originator will work to make sure you can afford your mortgage but sometimes mistakes happen. Our data suggests women are more likely to buy a home which limits their long-term financial flexibility than men are. On average women have mortgage-to-income ratios 7% larger than men. For women the mortgage-to-income ratio goes over 3.5 in metros like Santa Rosa, California or Los Angeles, California. If we assume a 20% down payment for women in Santa Rosa, that means the average woman there is buying a home worth 4.4 times their income. Many experts recommend purchasing a home worth no more than 2.5 times your income.

- Income inequality – Only in Grand Forks, North Dakota-Minnesota did the average female homebuyer have a larger income than the average male homebuyer. However even in this metro area, men were twice as likely to buy a home as women were. Overall men were 50% more likely to buy homes without cosigners compared to women.

1. Santa Fe, New Mexico

According to our data, 287 women bought homes in Santa Fe in 2016 without a cosigner, compared to 269 men. This means women bought homes around 6.7% more than men, the highest rate in our study. Men who bought homes in Santa Fe still had higher average incomes and as a result tended to buy more expensive homes.

The average female who bought a home in Santa Fe had an income of $81,100 and took out a mortgage of $239,500. The average male had an income of $92,400 and took out a mortgage of $255,300. This state is also a good place for women to buy homes, as New Mexico has some of the lowest property tax rates in the country.

2. Santa Rosa, California

Santa Rosa is the second and last metro area in our data set where women bought more homes than men. With 739 mortgages going to women and 727 going to men, women outbought men by about 1.6%.

Both men and women in Santa Rosa earn large sums. The average single man buying a home without a cosigner earned $126,000 and the average woman in the same context earned $109,300. Both men and women in this metro may be buying homes they cannot afford. The average mortgage-to-income ratio in Santa Rosa was 3.5 for women and 3.45 for men. Assuming a 20% down payment, this would mean the total home value is 4.4 times women’s average income and 4.3 for men. As we mentioned earlier, this is higher than most experts recommend.

3. The Villages, Florida

The Villages is a retirement community located in central Florida. Men without a cosigner bought homes 1.3% more often than women did.

Income inequality for homebuyers in The Villages is slightly better than the national average. Data for homebuyers without a cosigner shows that the average home-buying female had an income equal to 89% of the average home-buying male income. While that figure isn’t ideal, it is the second-lowest figure in our top 10.

4. Hot Springs, Arkansas

The effects of income inequality become more apparent in Hot Springs, Arkansas. Men only buy homes 4.5% more than women here. However, the average home a man buys without a cosigner is worth 20% more than the average home a woman with the same background buys.

And that number probably undersells the issue. The average male without a cosigner takes out a home loan worth 1.9 times his income. For a woman that number is 2.4.

5. Springfield, Illinois

Illinois’ capital takes fifth. Here men without a cosigner buy homes 6.2% more often than women without a cosigner. Unfortunately for women, they are not only less likely to be buying homes, they are also likely to be earning less than men. The average man buying a home without a consigner had an income of $68,200 compared to $53,200 for the average woman.

This leads to men being able to invest more in the real estate market. The average man without a cosigner took out a mortgage of $128,000. For the average woman that number was $110,000.

6. Prescott, Arizona

At number six we start to see a large difference between the number of men and women buying homes. In Prescott, men without cosigners bought 763 homes while women bought 686 homes. That yields a percent different of 11.2% in favor of men.

The average home-buying woman here took in an income worth around 77% of what the average home-buying man did. One effect of this income inequality is a large mortgage-to-income ratio for women. The average woman here who bought a home without a cosigner took out a mortgage worth 3.2 times their income. That number is only 2.6 for men.

7. Lawrence, Kansas

The average home-buying woman in Lawrence has an income of $66,200 and takes out a mortgage of $158,500. Men show similar financial prudence. They have a mortgage-to-income ratio of 2.1.

However, Lawrence men are more likely to buy homes than women: In 2016, men without cosigners took out 333 home loans, compared to 299 for women.

8. Napa, California

In Napa, California we find one of the widest differences between women’s incomes and men’s incomes. The average man who bought a home without a cosigner earned $170,000. For women that number is $121,000. On average women buying homes without a cosigner in Napa earned only 71% of what men buying homes without a cosigner earned.

Napa homes are also expensive, and both men and women may be stretching their budgets thin to afford homes in here. The average woman took out a mortgage worth 3.42 times her income. The average man took out a mortgage worth 2.96 times his income.

9. Philadelphia, Pennsylvania

Philadelphia is known as one of the more affordable big cities in the country. Men without a cosigner were about 13% more likely to buy a home than women without a cosigner in the Philadelphia metro area. Women buying homes here earned about 79% of what men buying homes earned.

10. Rochester, Minnesota

One of the best places for working women is also one of the places where women are buying homes the most. Of the 1,735 homes bought in Rochester without cosigners, 814 went to females and 921 went to males.

This city also has the lowest gender pay gap in our top 10. This has led to women and men taking out similar-sized home loans. The average women took out a mortgage of $161,000 while the average man took out a home loan worth $171,000.

Data and Methodology

In order to find the places where women are buying homes, we looked at data for 402 metro areas. Specifically, we compared them across the following two metrics:

- Number of mortgages originated to women.

- Number of mortgages originated to men.

For each metric we only counted mortgages which were used to purchase homes which were to be occupied by the owner and were secured by first lien. In order to isolate men and women to create a comparison we also only analyzed home loans which were secured without a cosigner. Data for both metrics comes from the Consumer Finance Protection Bureau’s Home Mortgage Disclosure Act database.

In order to rank our metro areas, we divided the number of mortgages originated to men divided by the number of mortgages originated to women. We then ranked the metro areas according to where women were more likely to be buying homes relative to men.

Tips for Buying a Home Without a Cosigner

Buying a home can be a long process, especially without the help of a cosigner. Here are some tips to make the transition from renting to owning as smooth as possible.

- Choose your number and stick to it. When you go house hunting it is a good idea to have a firm price point in mind. Typically, homebuyers can afford a home worth around 2.5 times their income. Experts also recommend spending no more than 30% of income on housing costs. Housing costs are more than just your mortgage. You need to factor in real estate taxes, homeowners insurance and maintenance costs. By having a firm idea of what your price point is, you are much less likely you buy something you can’t afford.

- Make sure your credit report is in solid shape. One of the first things a potential lender will look at is your credit report. If you have any outstanding debts it’s a good idea to deal with those first. If you have not checked your credit report you may be surprised by what you find. Taking care of adverse accounts can raise your credit score and make you a better candidate for a low mortgage rate.

- Don’t forget to negotiate. While everyone knows to negotiate on the price of the home, there are other things which can be negotiated. For example, who pays the closing costs is up for negotiation, or maybe having the seller pay for a repair which needs to be made to the house. These are little ways of moving some of the costs of buying of a home onto the seller.

- If you get stuck in a protracted negotiation and find the price of the home creeping above your budget, you may need to move on. Buying your dream home won’t be worth it if down the line you find that you are unable to afford it.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/kali9