USAA Mortgage is the home loan division of USAA Bank, a financial institution primarily serving military members, veterans and their families. USAA Mortgage offers VA loans, conventional mortgages, jumbo loans and a conventional mortgage loan option for those with at least a 3% down payments.

USAA Bank provides a full range of financial products and services like auto, property and life insurance, banking, investments, retirement, mortgage and loans. You need to be a member to take advantage of all its services. To be eligible for the free membership, you must be an active member or veteran of the U.S. military or cadets and midshipmen, or their families.

The bank, which is headquartered in San Antonio, was started in 1922 when 25 Army officers decided to insure each other’s vehicles. USAA has about 34,000 employees who serve 12.8 million members.

Today's Rates

| Product | Today | Last Week | Change |

|---|---|---|---|

| 30 year fixed | 5.50% | 5.66% | -0.16 |

| 15 year fixed | 4.75% | 5.04% | -0.30 |

| 5/1 ARM | 5.12% | 5.27% | -0.15 |

| 30 yr fixed mtg refi | 5.82% | 5.89% | -0.07 |

| 15 yr fixed mtg refi | 4.75% | 5.03% | -0.28 |

| 7/1 ARM refi | 5.18% | 5.30% | -0.13 |

| 15 yr jumbo fixed mtg refi | 3.06% | 3.10% | -0.04 |

National Mortgage Rates

Regions Served by USAA

Does USAA Operate in My Area?

USAA originates loans in all 50 states. The bank has physical locations in just seven cities nationwide. Mortgage agents conduct all business on the phone and online.

What Kind of Mortgage Can I Get With USAA?

USAA doesn’t have quite as many loan options as one of the big four banks, such as Wells Fargo, but you’ll still find a number of options, including:

Veteran's Affairs (VA) loan: To be eligible for this loan, you must meet one of several possible requirements including serving 90 straight days in wartime or serving 181 straight days during peacetime or more than six years in the National Guard or reserves. You may also qualify if you’re the spouse of a military member who died from a service-related disability or in action.

VA loans are backed by the Department of Veterans Affairs and come with a host of benefits including no down payment required, no private mortgage insurance, the ability to finance the funding fee and a reduced funding fee with 5% down payment. Veterans are exempt from the funding fee if they are receiving disability compensation. USAA specializes in this type of loan as its member base is generally eligible for VA loans. Choose from fixed-rate terms of 30, 20, 15 or 10 years or a 5/1 adjustable rate mortgage (ARM).

Jumbo loan: If you want to buy a home that exceeds $832,750, you’ll need to apply for a jumbo loan. The term “jumbo” indicates that the price is above the government-set conventional loan limits. VA jumbo loans require 25% down payment and come in 30-year terms (fixed rate or 5/1 ARM). Conventional jumbo loans are available in 30- or 15-year terms and require a 20% down payment. USAA finances home loans up to $3 million.

Conventional loan: These are non-government-backed loans that adhere to the loan limits set by Freddie Mac and Fannie Mae. USAA offers fixed-rate conventional loans. The interest rate stays the same for the duration of this loan, meaning that your monthly payments will also remain steady. Homebuyers who plan to stay put in their new homes for the long haul may appreciate the reliability of a fixed-rate loan and may find it easier to budget for payments that do not change. Thanks to its straightforward and secure nature, this loan is very popular. USAA offers fixed-rate conventional loans only in the following terms: 30 year, 20 year, 15 year or 10 year.

Conventional 97 loan: This loan is geared toward first-time homebuyers and can only be used for a home that will be the primary residence. The product is offered as a 30-year loan and requires just 3% down payment and is accompanied by a set interest rate, so buyers will have consistent monthly payments. The lender pays the private mortgage insurance needed for this loan (due to the low down payment), but the cost is passed to you with higher interest rates than a conventional loan.

Refinance: USAA also offers refinance options, including VA and conventional loans. You won’t find home equity lines of credit (HELOCs) at this bank.

What Can You Do Online With USAA?

While USAA Bank was one of the first banks to adopt the web as a customer interface tool, you won’t find the absolute best operation on the mortgage side. You can’t prequalify without logging into your account and you’ll have to speak to a mortgage representative to get an application started. There also isn’t a live chat feature, which is something you’ll find on other lender websites.

However, the good news is the information on the site is helpful, easy to find and presented in multiple formats. USAA hosts home-buying webinars, posts blog article about home buying, provides interactive tools and resources to give you your mortgage rate and other key information and gives you the option to prequalify in “just minutes.” However, prequalification isn’t preapproval - the more extensive process that can lock your rate in - so it’s similar to what you can get in minutes on many other lender websites.

When it comes time to apply, you can find documents from your loan officer in your USAA inbox. This is generally best accessed through desktop, but you do have some functionality on the bank’s mobile app. Once your mortgage loan is complete, you can arrange payments and monitor your loan via the app.

One last online feature is the “find an agent” program. The USAA Real Estate Rewards Network can save you money if you decide to use a realtor from the program.

Would You Qualify for a Mortgage From USAA?

While you don’t need a super high FICO score to qualify for a USAA home loan, you generally do need at least a 620 FICO score. This lender does not offer FHA loans, which can have lower credit score requirements. That means if you’re below the 620 benchmark, you should probably wait to apply until after you increase your credit score.

In addition to credit score, your loan agent will consider the home price, your income, down payment savings and debt-to-income ratio. If you’re applying for a VA loan, you don’t need a down payment, and if you’re applying for the Conventional 97 loan that requires just 3% down, your savings won’t need to be as significant as a conventional borrower. However, you still need to prove you have enough money to cover closing costs, mortgage payments and other household expenses. That said, if you’re applying for a jumbo home loan, you’ll need a 20% down payment for a conventional mortgage and 25% saved for a VA jumbo loan.

Another qualification consideration is cash flow. Your agent will look at your income and debt and calculate a percentage known as the debt-to-income ratio (DTI). Your DTI one of the ways your mortgage lender determines whether you’ll have enough money to pay your monthly loan bill. In general, most lenders look for a DTI of 36% or less for the most favorable loan terms. When you have a higher percentage, you don’t have enough free cash to afford a mortgage.

Find your own DTI by totaling your monthly debt payments, including your student loans, credit card payments, auto loans, child support, etc. Take that total and divide it by your pre-tax monthly income and multiply by 100 to find your percentage.

Down payment savings is another consideration. While you don’t need to put money down for a VA loan, you will have to pay the VA funding fee along with closing costs. This generally totals to thousands of dollars, so you need to have enough savings to cover those costs as well as a few months of mortgage payments.

What’s the Process for Getting a Mortgage With USAA?

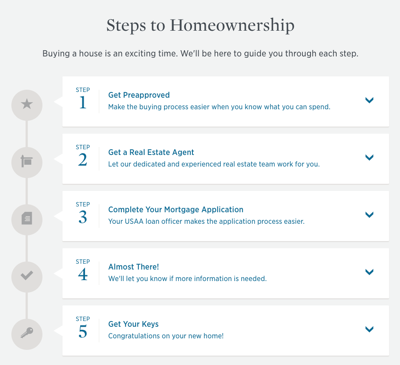

USAA sketches out five major steps to homeownership. The first is prequalification, a step that can take just minutes. The next step - getting a real estate agent through USAA - is optional. If you do work with an agent in the USAA Real Estate Rewards Network, you can receive a cash reward based on the sales price of your home.

Step three is your actual mortgage application. You’ll need income statements such as pay stubs or leave and earning statements (LESs), current bank statements and other supporting documents, as needed. If you’re applying for a VA loan, you’ll need to obtain a Certificate of Eligibility (COE) from the Department of Veteran Affairs website.

Since you have to be a USAA customer to apply for a mortgage, the mortgage application may be an easy process for you if you keep all your assets at the bank. Your loan officer will communicate with you during this step to ensure you upload or send all required documents.

The second-to-last step is application review. Your loan officer will evaluate your financial documents and check to see if the home title is clear. You may be asked to provide additional documents or to sign additional forms depending on your situation. VA loans require appraisals before closing. The appraiser will verify the home you’re trying to buy meets VA loan standards and that the price matches the home value. While this process is generally arranged for you, you’re responsible for arranging a home inspection and a termite inspection which are VA loan requirements. All inspections and appraisal fees are added to your closing costs.

If all goes well, you’ll arrange for a homeowners insurance policy and proceed to closing. During this last step you’ll need identification and a cashier’s check or wire transfer to cover your closing costs and down payment.

How USAA Mortgage Stacks Up

Since USAA membership is limited to qualified service members and veterans, this mortgage option self-selects its audience. More than half of the mortgages originated by USAA are VA loans, making that a specialty of the company. That means your loan agent will be familiar with the process and you have a better chance of an expert to help you through the particulars on the loan. If you’re stuck between choosing a small regional bank that has limited experience dealing with VA requirements, USAA is likely the better option in that scenario. The bank also advertises low fees (just one origination fee, no document or other closing cost add-ons) and very competitive rates.

However, when compared to the lenders that dominate the market, such as Quicken Loans and Wells Fargo, you may find a better experience with one of those industry giants. For one, Quicken has mastered the online application process, and with its online program Rocket Mortgage, you never have to deal with a loan officer over the phone unless you choose to. USAA is not quite fully integrated yet, so you will need to arrange some details over the phone or email, instead of a self-service portal. The large banks also generally offer USDA and FHA loans too, which are two alternate government-backed loan options not offered by USAA.

However, there are plenty of lenders that offer VA loans; you shouldn’t feel as if USAA is the only lender in that arena. In fact, if you want to meet a loan officer in person to discuss applying for a VA loan, USAA can’t help you. While the bank has four locations, services are limited at each and for the most part, you’ll deal with people over the phone or online, rather than in person. For some home buyers, this may be a problem if they prefer the interactive, in-person experience. That’s just not part of USAA’s business model.

But, if you’re a USAA member, would like to keep all your finances in one spot, and don’t mind a little back and forth with your loan agent over phone or email, then this lender may be a decent fit. The company prides itself on its customer service and has a depth of experience with VA loans you won’t find at many other banks.

Tips for Mortgage Newbies

- A financial advisor can help you choose a mortgage that fits into your financial plan. SmartAsset free tool matches you with vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- While interest rates get most of the attention when it comes to the mortgage hunting process, annual percentage rates (APRs) sometimes hold even more insight. This is because an APR takes into account closing costs, taxes and other fees that will be included outside of your normal interest payments.