Almost one in every 25 households in America consists of three or more generations living under the same roof. Specifically, in 2018, of the roughly 122 million households in the U.S., about 4.61 million of them were multigenerational. Though this number has remained flat nationally over the past several years, states have seen wide variations in the prevalence of multigenerational households.

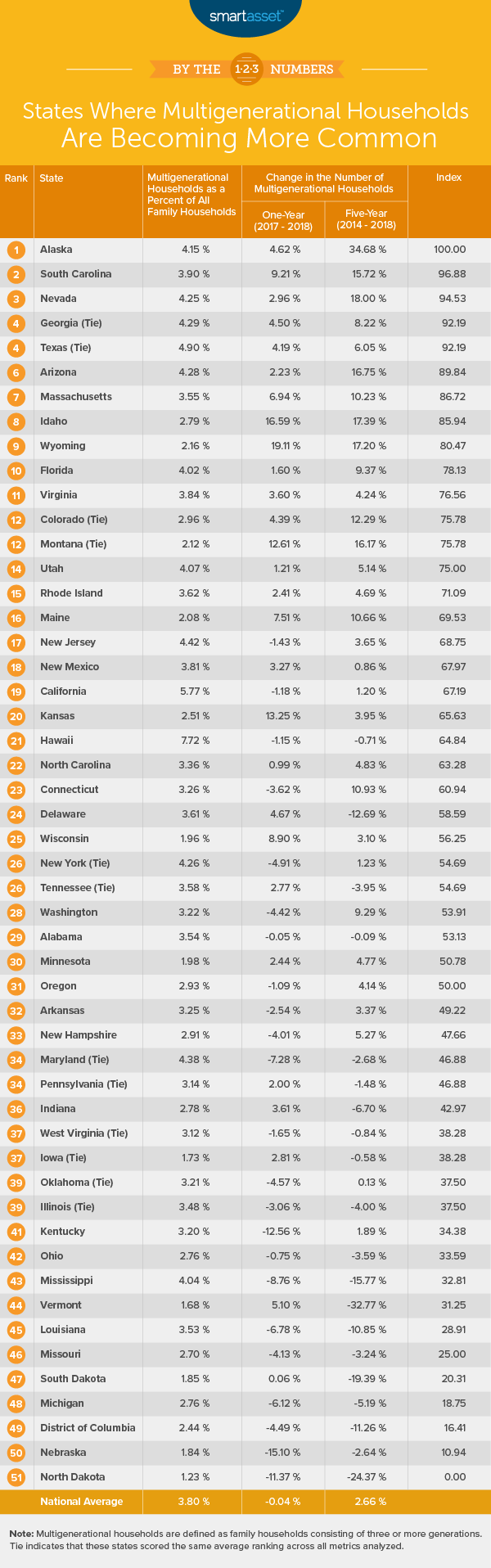

In this study, SmartAsset uncovered the states where multigenerational households are becoming more common. Specifically, we considered data for all 50 states and the District of Columbia across three metrics: the five- and one-year percentage changes in multigenerational households and the number of multigenerational households as a percentage of all households in 2018. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

Key Findings

- Multigenerational households saw sharp increases and declines. Between 2014 and 2018, Alaska saw the biggest increase in multigenerational households (34.68%). In stark contrast, multigenerational households in Vermont declined by 32.77% over the same time period. While seven states saw increases exceeding 15%, four saw declines of equal or similar percentages.

- Western and Southern states stand out. Of the top 10 states where multigenerational households are becoming more common, half are in the West: Alaska, Nevada, Arizona, Idaho and Wyoming. In all five states, the number of multigenerational households rose by more than 16% over the five-year period from 2014 through 2018. Additionally, another four states in our top 10 are in the South, according to Census regional divisions: South Carolina, Georgia, Texas and Florida. Each of these states ranks within the top 30% of the study for five-year percentage change in the number of multigenerational households.

1. Alaska

Over the five-year period from 2014 through 2018, the number of multigenerational households in Alaska increased by almost 35%. In 2014, there were 7,840 multigenerational households in the state, and in 2018, there were 10,559, according to the Census Bureau. As a result of that rapid increase, an estimated 4.15% of households in Alaska in 2018 were multigenerational, the 10th-highest concentration in the study overall.

Alaskan families seeking advice on wills and estate taxes in the state may wish to take a closer look at our guide to Alaska inheritance laws.

2. South Carolina

There have been steep increases in the number of multigenerational households in South Carolina in recent years. In the five-year period from 2014 through 2018, multigenerational households increased by 15.72%, with more than half of that increase happening in the fifth year alone. Specifically, between 2017 and 2018, multigenerational households in South Carolina increased by 9.21%, from about 68,800 to more than 75,100.

3. Nevada

In recent years, the number of multigenerational homes in Nevada, a relatively tax-friendly state for retirement, grew by 18.00%, from about 40,700 in 2014 to almost 48,000 in 2018. With that increase, 4.25% of households in Nevada were multigenerational in 2018, the ninth-highest percentage across all 50 states and the District of Columbia.

4. Georgia (tie)

From 2014 through 2018, the number of multigenerational households in Georgia rose by 8.22%. As a result, in 2018, 4.29% of households were multigenerational, the sixth-highest percentage in our study. By comparison, less than 4% of households nationally were multigenerational in the same year.

4. Texas (Tie)

Texas ties with Georgia, ranking as the fourth state where multigenerational households are becoming more common. It has the highest 2018 gross number and concentration of multigenerational households of any state in our top 10. In 2018, there were a total of almost 479,000 households consisting of three or more generations in the state, meaning that 4.90% of all households fell under this category.

6. Arizona

More multigenerational families are living together in Arizona. From 2014 through 2018, the number of multigenerational households in the state rose by more than 16%, the fifth-highest rate for this metric in the study.

If you live in Arizona and are hoping to improve your financial situation, consider taking a look at our list of the top financial advisors in the state.

7. Massachusetts

Massachusetts ranks in the top 40% of states across all three metrics. It had the 11th-highest five-year percentage change in multigenerational households and the eighth highest one-year percentage change. In 2018, 3.55% of households housed three or more generations, the 20th-highest concentration in our study.

8. Idaho

Ranking at No. 8 overall, Idaho had the second-highest one-year percentage change in multigenerational households of any state. In 2017, there were about 15,300 multigenerational households, and in 2018, there were close to 17,900, marking a 16.59% increase. Idaho falls behind other states as it still has a relatively low number of multigenerational households compared to all households. In 2018, 2.79% of households in Idaho included three or more generations.

9. Wyoming

Wyoming saw the steepest increase in multigenerational households over the one-year period from 2017 to 2018. In 2017, there were about 4,200 multigenerational households in the state, and in 2018, there were almost 5,000, marking a percentage change of 19.11%. Despite this change, Wyoming falls farther down in our rankings due to a lower concentration of multigenerational homes in 2018 compared to other states.

10. Florida

Florida ranks in the top half of states for each of the three metrics. In 2018, Florida had the 13th-highest percentage of multigenerational households relative to all households, at 4.02%. From 2014 through 2018, multigenerational households increased by 9.37%, the 12th-highest rate for this metric. Additionally, from 2017 to 2018, they increased by 1.60%, the 25th-highest rate for this metric. If you seek comprehensive guidance on how to better manage the finances of your growing family, consider speaking to a local financial expert today.

Data and Methodology

To find the state where multigenerational households are becoming more common, SmartAsset looked at data for all 50 states and the District of Columbia across the following three metrics:

- Multigenerational households as a percentage of all households in 2018. Data comes from the Census Bureau’s 2018 1-year American Community Survey.

- One-year percentage change in the number of multigenerational households. This is for 2017 through 2018. Data comes from the Census Bureau’s 2017 and 2018 1-year American Community Surveys.

- Five-year percentage change in the number of multigenerational households. This is for 2014 through 2018. Data comes from the Census Bureau’s 2014 and 2018 1-year American Community Surveys.

We ranked each state in every metric, giving a full weighting to all three metrics. We then found each state’s average ranking and used the average to determine a final score. The state with the highest average ranking received a score of 100. The state with the lowest average ranking received a score of 0.

Saving Tips for Families

- Follow a budget. One of the best ways to save more is through budgeting. Our budget calculator can help with this. Beyond letting you see how much of your monthly and annual income goes towards housing costs, you can see how cutting back on discretionary expenses can increase your savings rate.

- Invest early. By planning and saving early, you can take advantage of compound interest. Take a look at our investment calculator to see how your investment can grow over time.

- Consider a financial advisor. A financial advisor can help you make smarter financial decisions to be in better control of your money and keep you on track in terms of your saving. Finding the right financial advisor that fits your needs doesn’t have to be hard though. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/monkeybusinessimages