Selling a home can put a large sum of money in your pocket but there’s one important thing to consider: Taxes. Whether the sale of a home is taxable or not can depend on the amount of the gain realized and the property’s adjusted basis. The last thing you want is to get hit with a surprise tax bill so it’s important to understand what is the adjusted basis of a home sold for a profit.

A financial advisor could help optimize your financial plan to mitigate your tax liability.

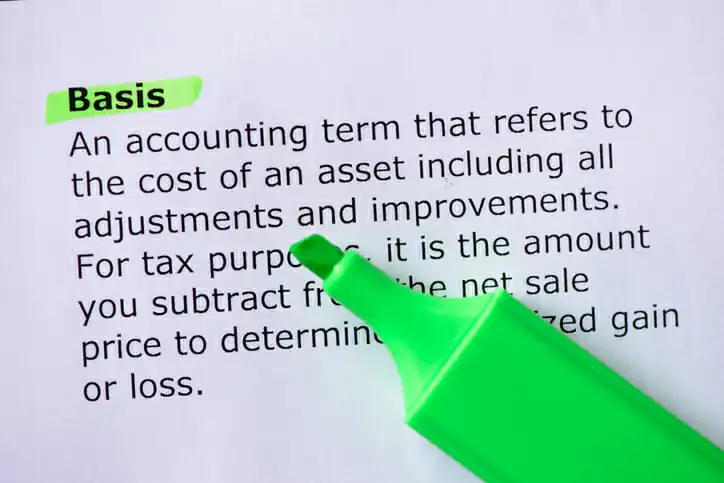

What Is Adjusted Basis?

Generally speaking, an adjusted basis is the cost of an asset when changes to its value are taken into account. When you buy an asset, you establish its basis. For example, if you’re buying a home the basis would include the purchase price as well as closing costs and settlement fees. If you’re building a home, the cost of the land would be included in the basis.

When you adjust the basis of an asset, you’re adjusting its value up or down. The adjusted basis is used to determine the capital gain or capital loss that will result from the sale of the asset. Capital gains are taxable while capital losses can be deducted on a tax return.

Adjustments can increase or decrease your basis in an asset. An asset that has a higher basis typically results in a smaller capital gains tax bill when sold. That’s a good thing from a tax perspective as it can shrink your tax bill. Reducing your basis, meanwhile, could increase your tax liability when selling assets with capital gains.

What Is the Adjusted Basis of a Home Sold?

Under IRS guidelines, if the amount you realize from the sale of a home is more than your adjusted basis in the property, then you have a capital gain. To find the adjusted basis of a home, you need to know three things:

- The cost paid to acquire the home

- Cost of capital improvements made

- Casualty loss amounts and other decreases

So, for example, say you purchase a home for $300,000. You pay 2% of the purchase price in closing costs, which works out to $6,000. You also spend $20,000 to upgrade the heating, ventilation and air-conditioning system (HVAC) and replace the roof. Your total adjusted basis in the property is now $326,000.

You decide to sell after five years. You estimate that it will cost you $10,000 to sell the property but you’re able to secure a price of $400,000. During the time you own the home, the property depreciates in value by $50,000. When you add the $10,000 for the costs to sell the home and deduct the $50,000 in depreciation from the $400,00 you sell the property for you end up with a gain of $114,000.

Again, a higher adjusted basis can work in your favor for reducing the amount you pay in capital gains tax on the sale. Going back to the previous example, not making the $20,000 in improvements would increase your gain to $134,000 instead. That means a bigger profit that you’d have to pay taxes on when you sell.

What Can Increase Adjusted Basis in a Home?

If you’re interested in increasing your adjusted basis in a home prior to its sale to reduce capital gains tax, there are a few ways you can do it. Some of the things the IRS allows you to include for adjusted basis calculations include:

- Home improvements

- Additions to the property

- Amounts spent to restore the home if it’s damaged because of fire, floods, theft or other perils

- Costs related to running or extending utility service lines to the home

- Legal fees you incurred that are directly related to the property

- Assessments that result in an increase to your property’s tax value

The simplest way to increase your adjusted basis may be to make capital improvements to the home. Some of the home improvement projects that can increase your basis include kitchen renovations, adding on a room or porch, upgrading the bathroom, installing fencing and repaving the driveway.

Keep in mind that any improvements you later undo or remove cannot be included in the adjusted basis of the home sold. Also, consider carefully which improvements are likely to yield the biggest increases in the home’s value. The more valuable an improvement is, the more you might be able to ask for the property when it’s time to sell.

What Can Reduce Adjusted Basis in a Home?

Adjusted basis calculations must include any amounts for costs returned to you. So some of the things that can reduce basis include:

- Depreciation

- Insurance payouts received as the result of a claim for damages or loss

- Deductible casualty losses that are not covered by your homeowner’s insurance policy

- Amounts you receive in exchange for granting an easement

A lower basis can mean paying more in taxes if the sale of a home results in a capital gain. So if you anticipate reductions to the adjusted basis in a property you own, whether it’s a primary home or a rental property, you could potentially offset them by making improvements.

Excluding Gains on the Sale of a Home

The IRS allows you to exclude from income some or all of the gains on a home sale under certain circumstances. If you’re able to exclude all of the gains you don’t even need to report the sale on your tax return. The only exception to this rule is if you receive Form 1099-S, Proceeds From Real Estate Transactions. Any capital gain that can’t be excluded must be reported on your tax return as taxable income.

To qualify for the exclusion, you’ll need to meet an ownership test and a use test. Under the ownership test and use test, you’re eligible for the exclusion if you’ve owned and used the home as your main home for an aggregate of at least two years out of the five years leading up to the date of the sale.

You don’t have to meet the ownership and use tests for the same time period. But you have to meet both tests within the five years prior to the sale. The IRS generally doesn’t allow you to take the exclusion if you excluded gains from the sale of another home during the two-year period prior to the sale of your current home.

Bottom Line

Determining the adjusted basis of your home is something you might not think twice about if you have no plans to sell. But if a life change prompts a move, then it’s important to understand how an adjusted basis works and what it might mean for you in terms of tax liability.

Mortgage Planning Tips

- Consider talking to a financial advisor about how to find the adjusted basis of a home if you’re thinking of selling. If you don’t have a financial advisor yet, finding one doesn’t have to be complicated. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Property taxes in America are collected by local governments and are usually based on the value of a property. The money collected is generally used to support community safety, schools, infrastructure and other public projects. Use SmartAsset’s no-cost property tax calculator to get a quick estimate of what you’ll owe.

- If you’re interested in buying a home to rent out, calculating the adjusted basis can be helpful should you decide to sell it later. You’ll also want to calculate how much cash flow you can expect a rental property to generate, based on what you can rent it for and how much you’ll spend to maintain it. Running the numbers can help you decide if investing in rental property is right for you.

Photo credit:©iStock.com/jacoblund, ©iStock.com/busracavus, ©iStock.com/Sohel_Parvez_Haque