Owning real estate has traditionally been viewed as an effective way to hedge against inflation. The logic is simple: as the price of goods and services increases, so does property value. Like other types of real estate, rental properties stand to appreciate in value, but that’s hardly the only benefit of this asset class. Landlords earn passive income or cash flow from their properties, benefit from certain tax breaks and build equity while paying down loans (if they’re using mortgages). With inflation on the rise in the U.S. in 2021, investors may be searching for new real estate markets to invest their money. With that in mind, SmartAsset set out to find the places that are best for buying and owning long-term rental properties.

To do this, we looked at data from the 120 U.S. cities with populations of 200,000 or more to gauge home investment favorability, home affordability and the health of the rental market in each. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

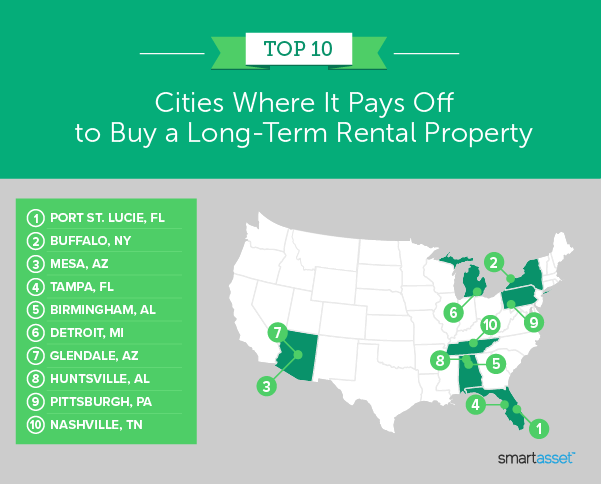

Key Findings

- Rental markets in Florida populate the top of the study. The Sunshine State has five cities in the top 20, including the No. 1 place for buying and owning long-term rental properties: Port St. Lucie. Tampa (No. 4), St. Petersburg (No. 12), Jacksonville (No. 15) and Orlando (No. 18) all earned high marks in our study, as well. All five cities rank within the top 25 (out of a total of 120 cities in the study) for the Home Investment Favorability category.

- Invest in properties in Southern and Western states. Across the top 30 of the study, 14 cities are in the South and 11 cities are in the West, according to Census regional divisions. After Florida, mentioned above, Texas is the next Southern state with the highest number of cities (four) in the top 30. Arizona leads the Western states, with five cities in the top 30.

1. Port St. Lucie, FL

Port St. Lucie, Florida is the best place in the U.S. to buy and own long-term rental properties. It ranks first for Home Investment Favorability, an index in our study that comprises price-to-rent ratio, four-year change in median home value and estimated annual cash flow. Rental property investors have an estimated annual cash flow of $6,096, the fourth-best among all cities in our study. And home values have jumped more than 54% between 2015 and 2019, the fifth-largest increase out of all 120 cities studied.

2. Buffalo, NY

Buffalo, New York has the fourth-highest Home Investment Favorability score, in part because median home values shot up 55% between 2015 and 2019, the fourth-largest increase in the study. This Rust Belt city also has the eighth-best price-to-rent ratio, which is calculated by dividing the median home value by median annual rent (the lower the price-to-rent ratio, the better for the investor). And, median housing costs (mortgages, taxes, utilities, etc.) in Buffalo are only 13.17% of the median national household income, the third-lowest out of all 120 cities.

3. Mesa, AZ

Mesa, Arizona ranks high in our study in large part due to the housing needs of the city. Between 2015 and 2019, Mesa’s population grew 5.46% faster than the growth of its housing stock, the sixth-largest difference in our study. Median rents also increased by 26.46% from 2015 to 2019, which is the 17th-largest jump out of all 120 cities. Rental properties, meanwhile, have an estimated annual cash flow of $2,880.

4. Tampa, FL

While Port St. Lucie, Florida, tops our list, Tampa is not far behind. Located on the state’s western coast, Tampa has the 10th-best Home Investment Favorability score and fifth-best Rental Opportunities score. Median rents increased by more than 23% between 2015 and 2019, while unemployment was relatively low as of May 2021 (4.6%), making Tampa one of the most attractive places for rental property investment. The median value of a home in Tampa was $265,700 in 2019, smack dab in the middle (59th) of all 120 cities in our study.

5. Birmingham, AL

The capital city of Alabama has the highest Home Affordability index score of all 120 cities in our study. Properties are relatively cheap in Birmingham, which had the fifth-lowest median home value in 2019 ($98,800). Median housing costs were also relatively low compared to the median national household income (14.39%), fifth-lowest in our study.

6. Detroit, MI

With the cheapest median home values ($58,900) and best price-to-rent ratio (5.67) across all 120 cities in our study, Michigan’s Motor City is a viable place to invest in rental properties. Housing costs in Detroit are just 9.90% of the median national household income, also lowest in our study. With low housing costs, Detroit rental properties generate an estimated $5,616 in cash flow per year, seventh-best overall.

7. Glendale, AZ

Glendale ranks ninth overall for Home Affordability, thanks in part to a low average effective property tax rate (0.56%), 15th-lowest across our study. Home prices are also relatively affordable ($241,100 in 2019). Glendale rental properties also had an average cash flow of $2,712 per year, which puts the city in the top third of the study for that metric.

8. Huntsville, AL

Huntsville, Alabama has a particularly affordable housing market. In 2019, the median value of a home in the city was $185,200 (34th-lowest), while the average effective property tax rate was just 0.54%, good for 11th overall. The city’s population is also growing faster than housing units are being built. In fact, Huntsville saw population growth outpace housing unit growth by nearly 5% between 2015 and 2019, the ninth-highest rate for this metric in the study.

9. Pittsburgh, PA

Pittsburgh, Pennsylvania – the third Rust Belt city to crack the top 10 – ranks ninth overall for price-to-rent ratio (12.26) and third overall for estimated annual cash flow ($6,276). Real estate investors may also be attracted to the Steel City for relatively cheap homes: the median home value in 2019 was just $149,200, 14th-lowest in our study.

10. Nashville, TN

Nashville, Tennessee saw the third-highest increase in median home values from 2015 to 2019, when home prices jumped over 55%. While homes in the Nashville area are more expensive ($287,300 in 2019) than nearly 60% of all places in our study, real estate investors may be drawn to Music City and its surroundings by an average annual cash flow of nearly $4,300 and median rents that increased by almost 30% between 2015 to 2019.

Data and Methodology

In order to rank the best places to buy and own long-term rental properties, we looked at data from all cities with populations of at least 200,000. That left us with 120 in total. We then compared them across these three categories:

- Home Investment Favorability. This is an index that comprises the following three metrics: price-to-rent ratio (median home value divided by median annual rent), the percentage change in median home values between 2015 and 2019 and estimated annual cash flow (75th percentile of rent minus median housing costs). We gave a double weighting to estimated annual cash flow, making it the most important metric in our study.

- Home Affordability. This is an index that comprises the following three metrics: 2019 effective property tax rate (annual property taxes divided by median home value), 2019 median home value and housing costs as a percentage of the national median household income.

- Rental Opportunities. This is an index that comprises the following three metrics: percentage point difference between population growth and housing unit growth from 2015 to 2019, the May 2021 unemployment rate and the four-year change in median rent between 2015 and 2019.

With the exception of unemployment, data for all metrics comes from the Census Bureau’s 2015 and 2019 1-year American Community Surveys. The May 2021 unemployment rate comes from the Bureau of Labor Statistics.

Tips for Investing in Real Estate

- It pays off to seek out professional financial advice. A financial advisor can help guide you through the process of investing in real estate or even invest your capital in a real estate investment trust (REIT). SmartAsset’s free matching tool will connect you with up to three advisors in just five minutes. If you’re ready to find an advisor for your financial needs, get started now.

- How much can you afford? If you’re looking to take out a mortgage to buy a rental property, our mortgage calculator can help you figure out how much you can afford and how much your monthly payments will be. Just remember, if the property isn’t going to be owner-occupied, you’ll typically need to put at least 20% down. Also, don’t forget to factor in closing costs by using our closing costs calculator.

Questions about our study? Contact press@smartasset.com.

Photo credit: ©iStock.com/ejs9