The largest purchase most Americans will make in their life is their home. With so much on the line buying a home can be a stressful and difficult process, especially for first-time homebuyers. However, thanks to local economic factors like a stable mortgage market and affordable homes, some cities are better for first-time homebuyers who are hoping to make the change from renting to buying.

In total, SmartAsset compared data for seven factors to rank the best places for first-time homebuyers. Specifically, SmartAsset looked at the number of HUD-approved lenders, loan funding ratio, average price per square foot, affordability ratio, stability score, price variance and the number of negative quarters from the first quarter of 2012 to the fourth quarter of 2017. Check out our data and methodology section below to see where we got our data and how we put it together to create our final ranks.

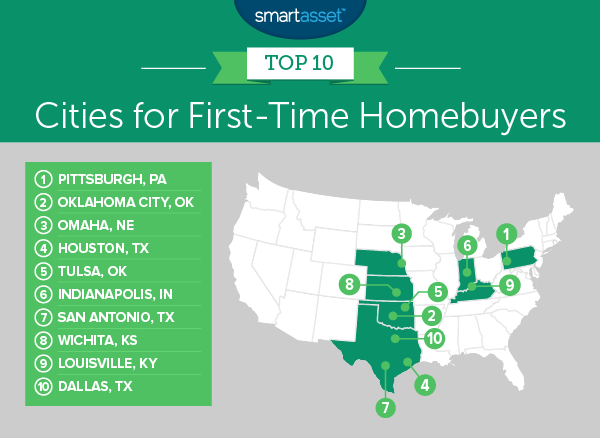

Key Findings

- Stable home markets – Many of last year’s top cities for first-time homebuyers ranked well in this year’s analysis. In total there are only two cities from last year’s top 10 – Colorado Springs, Colorado and Fort Worth, Texas – which did not rank again this year.

- Buy your first home in Texas – According to our data, the Lone Star State is the friendliest state for first-time homebuyers. In total this state contains eight of the top 25 best cities for first-time homebuyers.

This is the fourth annual study of the best cities for first-time homebuyers. Read the 2017 version here.

1. Pittsburgh, Pennsylvania

The Steel City secured the top spot as the best city for first-time homebuyers. First-time homebuyers in Pittsburgh should be excited about the affordability of local homes. According to our data, the average price per square foot of a home in Pittsburgh is only $91, 13th-lowest in our study.

First-time homebuyers can also feel relatively confident that their home won’t lose value right off the bat. Pittsburgh had zero quarters of negative growth in home values between 2012 and 2017. For that metric, the city is tied for first.

2. Oklahoma City, Oklahoma

Like in Pittsburgh, buying a home in Oklahoma City is a fairly safe investment. Our data shows that there have been zero year-over-year negative quarters between 2012 and 2017. Additionally many first-time homebuyers should be able to afford a decently sized home. Overall homes in Oklahoma City have a price per square foot of $83.75, eighth-lowest in our study.

Comparing household income to average home costs, property taxes, homeowners insurance and closing costs shows that Oklahoma City is the 12th-most affordable city in our data set.

3. Omaha, Nebraska

Omaha comes in third. This city has the highest loan-funding ratio in our study. Overall 82% of all homebuyers who applied for a conventional home loan had their mortgage processed. That shows that access to loans is widespread in Omaha, an important signal for first-time homebuyers.

This city also ranks in the top 15 for its affordability ratio and market volatility.

4. Houston, Texas

First-time homebuyers have no shortage of options when it comes to banks. According to our data, there are 227 HUD-approved mortgage lenders in the city. For that metric, Houston ranks first.

Houston has also seen zero year-over-year quarters of negative growth in home prices, according to the FHFA (Federal Housing Finance Agency).

5. Tulsa, Oklahoma

The second Oklahoma representative in our top 10 is Tulsa. This city has one of the lowest price per square foot scores in our study at $77.75.

However despite the low prices, Tulsa isn’t quite as affordable as other cities in our top 10 due to low incomes. Overall it ranks 14th in affordability. We estimate that Tulsa has a 5-year income-to-housing-costs ratio of 4.8.

6. Indianapolis, Indiana

First-time homebuyers looking for lots of room can’t go wrong in Indianapolis. This city has the fourth-lowest price per square foot, meaning each dollar you have buys more house.

Plus, relative to income, Indianapolis is a very affordable city. Indianapolis has a 5-year-income-to-housing-costs ratio of 5.48. For that metric, Indianapolis ranks fourth as well. The city does have a relatively low stability score, which it will need to improve if it wants to climb into the top 5.

7. San Antonio, Texas

San Antonio has 154 HUD-approved mortgage lenders, seventh-most in our study. So, first-time homebuyers here should have no trouble finding a mortgage. San Antonio is also affordable, ranking seventh for price per square foot and 11th for 5-year income-to-housing costs ratio.

According to FHFA data, there has only been a single year-over-year quarter between 2012 and 2017 with negative growth, so homebuyers in San Antonio can feel confident about their home investment.

8. Wichita, Kansas

Wichita is the eighth-best city for first time homebuyers. One good sign for first-time homebuyers in this city is that it has one of the highest loan funding rates. Over 82% of conventional mortgage applications here are funded. For that metric, Wichita ranks second.

Another reason why Wichita ranks well is affordability. This city has the third-highest income-to-housing costs ratio. One area where Wichita lags behind is the number of HUD-approved mortgage lenders. This city only has 47 HUD-approved lenders, which ranks 41st in our study.

Kansas residents who want some help managing their assets following the purchase of a new home should check out SmartAsset’s top financial advisor firms in the state.

9. Louisville, Kentucky

With only one negative year-over-year quarter from 2012-2017 and the seventh-best affordability score it is easy to see why Louisville is a great city for first-time homebuyers.

This city also does a good job finding funding for people looking to buy a home. According to our data, Louisville has the 15th-highest mortgage funding ratio in our study. That is a good sign for first-time homebuyers who might be nervous about qualifying for a mortgage.

10. Dallas, Texas

The top 10 list of the best places for first-time homebuyers ends in Dallas. This city has the third-most HUD-approved mortgage lenders so first-time homebuyers should have no trouble shopping for a mortgage.

Apart from the large number of lenders, the Dallas home market is a safe place to invest your money. According to data from the FHFA, this city has had zero negative year-over-year quarters between 2012 and 2017.

Data and Methodology

To find the best cities for first-time homebuyers, SmartAsset collected data for every U.S. city with a population of over 300,000. In total, we looked at 64 cities and ranked them across the following seven metrics:

- Mortgage lenders. We looked at the total number of HUD-approved mortgage lenders in each city. This data comes from the Department of Housing and Urban Development.

- Value per square foot. For most cities, we calculated an average value using 2017 data from Zillow. For cities for which we did not have data, we calculated the average using 2017 county data.

- Loan funding rate. This is the number of conventional mortgage loans originated in 2016 as a percentage of conventional mortgage loan applications. Data comes from the Mortgage Bankers Association.

- Affordability ratio. This is the ratio of median household income to median housing costs (within the first five years of ownership). It includes property taxes, closing costs and homeowners insurance. Data comes from the U.S. Census Bureau’s American Community Survey, government websites and the National Association of Insurance Commissioners.

- Market volatility. We looked at the standard deviation of quarterly annual housing price changes from the first quarter of 2012 to the fourth quarter of 2017. Data comes from the Federal Housing Finance Agency’s Home Price Index.

- Negative quarters. This is the number of quarters starting with the first quarter of 2012 and ending with the last quarter of 2017 in which home prices fell on a year-over-year basis. Data comes from the Federal Housing Finance Agency’s Home Price Index.

- Homeowner stability index. This metric measures homeowner stability by looking at the number of years homeowners stay in their homes and the number of homeowners with negative equity. This factor comes from SmartAsset’s analysis of the healthiest housing markets. Calculations are based on data from Zillow and the U.S. Census Bureau’s American Community Survey.

To create our final score, we ranked each city in each metric. Then we found each city’s average ranking, giving equal weighting to each metric. We used this average ranking to create our final score. The city with the best average ranking received a 100. The city with the worst average ranking received a 0.

Tips for First-Time Homebuyers Buying a Home

- Start saving early – Before you are even ready to buy a home you should start saving for a down payment. In many cities, saving up for a 20% down payment requires many years of work. So in order to be financially ready to buy a home when you are emotionally ready, you need to have a down payment saved up. That extra money you saved up will also come in handy when it’s time to pay closing costs, too.

- Watch out for extras – For anyone who has never owned a home, the extras costs outside of the mortgage can be surprising. Property taxes can make up a large chunk of housing costs not to mention homeowners insurance or condo fees. Make sure you know exactly how much you will be spending each month on your house before you buy it.

- Stay conservative – While it can be tempting to go all in on your dream home, it is best avoided if you are not sure you can afford it. It will not be worth buying your dream home if a few years down the line you find that you are struggling to make home payments and are forced to sell.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/JasonDoiy