Invstr is an investing mobile app and an educational resource. The platform gives you access to stocks, ETFs, American depositary receipts (ADRs) and fractional share investing. It also features virtual stock trading games and an investing fantasy league. The app is free to download, with a paid tier that gets you access to additional educational content. It also offers commission-free trading on certain securities. Here’s how it compares to the competition.

A financial advisor can help you make smart financial investments based on your goals, risk tolerance and timeline.

Invstr Overview

Invstr has been in business since 2013 when it was founded by Kerim Derhalli. While the app is free to download, you’ll have to pay up for the Invstr pro premium plan if you want expanded access. You’ll also be subject to various service fees.

| Invstr Overview | |

|---|---|

| Pros | – Well-rated mobile app – No-risk virtual trading – Low fees |

| Cons | – Limited functionality – Customer service limited to email and in-app message |

| Best For | – Anyone looking to learn more about and start investing |

Fees Under Invstr

The Invstr platform by itself is low cost. The app is free to both download and use, and there are no costs for the educational resources or the Invstr fantasy league. However, you’ll need to pay $3.99 per month for the Invstr pro subscription plan, which provides access to additional features like:

- The ability to personalize investments with an automated portfolio builder

- The ability to track performance with Invstr stats

- An 85-lesson investment course from Invstr Academy

- Unlimited fantasy finance features

Invstr offers commission-free trading on thousands of U.S.-listed stocks and cryptocurrencies. And you can begin trading with as little as $5. You can also invest in fractional shares with a minimum of $5.

| Invstr Fee Schedule | |

|---|---|

| Fee Type | Rates |

| Fantasy Finance | – Fantasy Finance, Charts & News, Leagues, Feed, Chat: Free – 10 trades: $0.99 – 50 trades $3.99 – 10 undos: $7.99 – 1MM Safety Net: $0.99 – 10 2x Power Ups: $7.99 – 10 4x Power Ups: $15.99 |

| Transfers | – ACH Bank Transfer, Deposit or Withdrawal: Free – Returned ACH, Wires, Checks (insufficient funds), Recall/Stop Payment: $30 – ACH Notice of Change and Paper Check Drafts: $5 – Wire Transfer Deposits: $8 – Wire Transfer Withdrawals: $25 |

| Regulatory Fees | – SEC Transaction Fee: $0.0000221/share – FINRA Trading Activity Fee: $0.000119/share |

| Account Maintenance | – Electronic Statements and Trade Confirms: Free – Paper statements: $5 – Paper confirmations: $2 – ACAT Outgoing: $75 – Paper prospectus: $2.50 |

Invstr: Services and Features

Invstr began as an educational platform designed to help users learn about stock trading and financial markets. Through Invstr Academy, users gain access to nearly 100 educational articles, market blogs and podcasts, making it an excellent resource for beginner investors who want to build knowledge before investing real money.

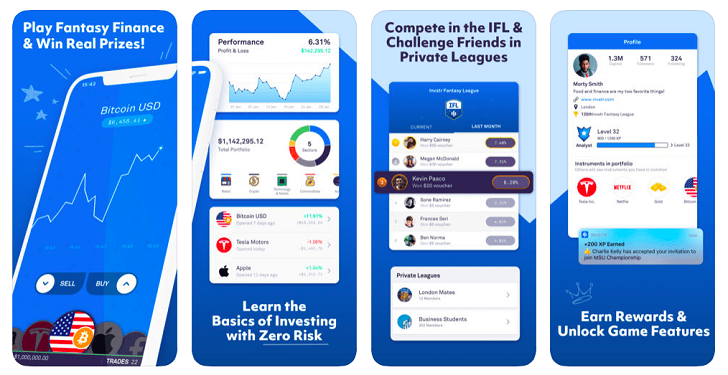

A key feature of Invstr is Fantasy Finance, a virtual trading platform that allows users to manage $1 million in simulated capital without financial risk. This hands-on experience helps investors develop trading skills while tracking performance on a leaderboard. Top players are rewarded with additional credits, and users can earn or purchase more virtual funds to continue refining their strategies.

In its effort to become a comprehensive financial platform, Invstr also offers banking services through its partnership with Vast Bank. Users can open an FDIC-insured checking account, access 56,000 ATMs nationwide, and enjoy the convenience of a debit card for everyday transactions, all within the Invstr ecosystem.

Invstr: Mobile and Online Experience

Invstr is an entirely mobile platform, so you’ll need to download the app to use any of its features. The Invstr app holds strong ratings on both the Apple and the Android app stores. More specifically, as of the time of this writing, Android users rate the app 3.7 stars out of 5, while Apple users rate it 4.6 stars out of 5.

The app is easy to use and navigate, whether you use the free version, pay for the premium package or use Invstr pro. You can easily toggle between educational resources, virtual investing and real investing. The app also seamlessly displays your investing stats so you can see how your money is doing.

Is There a Catch?

The biggest catch here is that the Invstr mobile app is available only to U.S. investors. The platform’s educational resources are solid and comprehensive, though they’re better for beginners than expert investors.

Another potential drawback is Invstr’s relatively more narrow range of investments. While users can trade stocks and ETFs, the platform doesn’t offer the broader asset selection (such as mutual funds, bonds or complex options strategies) that many full-service brokerages provide. For investors who want a one-stop shop for diversified portfolio building, this limitation may become more noticeable over time.

Invstr is built with simplicity in mind, which can be a plus for beginners but a downside for more experienced traders. Advanced charting, in-depth analytics and customizable trading tools are fairly limited compared with established online brokers. Investors who rely heavily on technical analysis or active trading strategies may find the platform too basic for their needs.

How Invstr Compares to Other Brokerages

Invstr currently occupies an interesting niche in the stock-picking and brokerage market. It not only serves as an educational resource, but also as a place where you can trade real stocks. The fact that it adds in an element where you can virtually trade stocks makes it fairly unique among brokerage platforms right now.

Invstr definitely doesn’t have as many bells and whistles as platforms like Charles Schwab or even Robinhood. It’s still a solid option, though, with fractional shares being a major part of that. As for the rest of the platform, Invstr’s educational resources are on par with or even slightly better than some of its competition.

| Brokerage Comparison | |||

|---|---|---|---|

| Brokerage Firm | Fees | Minimum | Best For |

| Invstr | $0 for stocks, ETFs and ADRs | $1 | – Beginner and intermediate traders |

| Robinhood | $0 for stocks, ETFs and options | $0 | – Mobile traders |

| Charles Schwab | $0 for stocks, ETFs and options | $0 | – Advanced investors |

Bottom Line

Invstr is a solid investment platform that’s easy to use and provides several different features that make it a worthwhile choice. The ability to learn about stocks and markets, practice with virtual money and ultimately set up your own brokerage account to trade for real is a fantastic trifecta. While Invstr doesn’t have as much functionality as other brokerage services, it’s still a great place to start. Its free educational resources and user interactions can easily help beginner investors blossom into more serious traders.

Investing Tips

- Investing isn’t easy, so it pays to have someone in your corner who has more experience than you, like a financial advisor. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- SmartAsset has a number of free online resources to help you figure out how to invest your money. If you want help planning out your investments, use our free investment calculator.

Photo credit: MobileAppDaily, AppNews, Cadalyst, Invstr