You can open two different bank accounts through Charles Schwab Bank: a savings account and a checking account. Both accounts earn interest, though rates are a bit lackluster. You’ll also have the opportunity to open a Schwab One® brokerage account with your checking account so you can start investing while you bank.

If you’re looking for a wide variety of bank accounts, this isn’t the bank for you. You may also want to look elsewhere if you want the highest interest rates the industry can offer. But Charles Schwab could be the bank for you if you’re looking for easy savings, simplicity and the opportunity to work with a big investing name.

Banking and investing go hand in hand at Schwab more so than almost any other financial institution. This presents a unique opportunity for customers of Schwab Bank to easily shift their savings and checking funds into investments. That feature, coupled with the fact that Schwab does not institute any minimums or charge any fees, makes this bank a solid place to consolidate your financial accounts.

Regardless of whether you're looking for help managing your investments, or you want some advice about planning for your retirement or your children's college fund, a financial advisor in your area can help. SmartAsset's free matching tool will take your answers to a short questionnaire and pair you with suitable, local financial advisors.

| Product | Key Details |

| High Yield Investor Savings® Account |

|

| High Yield Investor Checking® Account |

|

Charles Schwab Bank Interest Rate Comparison

Charles Schwab Bank Overview

As a business, Charles Schwab began small in 1963 when Chuck Schwab and two partners launched Investment Indicator, an investment advisory newsletter. In 1975, Schwab opened its first branch in Sacramento and began offering discount brokerages. Already a big name in the investing world, the company added on Charles Schwab Bank in 2003 to offer a wider range of products for its customers.

Today, Charles Schwab operates in 46 U.S. states. It strives to offer clients more value and better financial experiences so clients can better understand and manage their own finances.

Charles Schwab Bank Account Features

Largely an investing firm, Charles Schwab offers only two banking accounts, the Schwab Bank High Yield Investor Savings® Account and the Schwab Bank High Yield Investor Checking® Account. Both accounts earn interest at decent rates. You can access your money from either account with a Schwab Bank Visa® Platinum Debit Card at any ATM.

Regardless of the account you have, you’ll have constant and convenient online and mobile access to your money, a customer representative and financial services.

Charles Schwab Bank High Yield Investor Savings® Account

| Key Features | Details |

| Minimum Deposit | $0 |

| Access to Your Savings Account | Online, mobile, over the phone and physical branches |

| Security | FDIC insurance up to the maximum amount allowed by law |

| Fees | No monthly fees |

| Current Terms and Rates | 0.15% APY |

Charles Schwab offers only one savings account: the Schwab Bank High Yield Investor Savings® Account. This account earns interest at a somewhat disappointing rate considering its "High Yield" title. Luckily, there are no account fees or minimums so your money can grow uninterrupted by the bank.

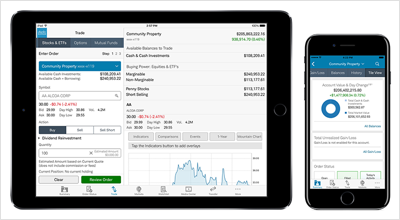

Once you have an account, Charles Schwab offers an easy way to access, transfer and manage your money online and on the bank’s mobile app. The mobile app has the ability to deposit a check on the go with Schwab Mobile Deposit™. You can even access this savings account with a Schwab Bank Visa® Platinum Debit Card at any ATM. You won’t have to worry about ATM fees either, since Charles Schwab will reimburse any ATM fees you incur.

Compare Charles Schwab Bank to Other Competitive Offers

Charles Schwab Bank High Yield Investor Checking® Account

| Key Features | Details |

| Minimum Deposit | $0 |

| Access to Your Checking Account | Online, mobile, over the phone and branches |

| Security | FDIC insurance up to the maximum amount allowed by law |

| Fees | No monthly fees |

| Current Terms and Rates | 0.05% APY |

Charles Schwab's lone checking account is the Schwab Bank High Yield Investor Checking® Account, which earns interest at a pretty minuscule rate compared to other rewards checking accounts. Again, there are no minimums or fees to meet, which means all of your money will stay in your pocket.

It’s important to note that when you open a Schwab Bank High Yield Investor Checking® Account, you must also open a Schwab One® brokerage account. Each account will have its own account number. However, you can access both accounts with a single login. You can also easily transfer funds between the two accounts for free.

This account comes with a Schwab Bank Visa® Platinum Debit Card and free standard checks. You can enroll your debit card with Visa Checkout for more convenient and secure online purchases. The account also enables free bill pay online and on the Schwab mobile app. You also have the ability to deposit checks on the go with Schwab Mobile Deposit™.

Unlike the Schwab savings account, you can open this checking account online. Of course, you can still open an account by downloading and mailing in an application or over the phone, if you so choose.

Where Can I Find Charles Schwab Bank?

You can find Charles Schwab online, on mobile, over the phone or at one of its brokerage branches. The bank has at least one branch in every state but Montana, North Dakota and West Virginia. Schwab operates locations in the District of Columbia and Puerto Rico too.

What Can You Do Online With Charles Schwab Bank?

You can do just about anything you need online with Charles Schwab Bank. You can open a Schwab Bank High Yield Investor Checking® Account, log into your existing accounts, find a branch, chat with a representative and more.

Just remember that you cannot apply for a Schwab Bank High Yield Investor Savings® Account online.

If you want to access more Charles Schwab products, you can also do so online. This includes investing products, trading support and more.

How Do I Access My Money?

You can access your money in the same places you can find Charles Schwab. This includes the bank’s website, Schwab Mobile, over the phone and at a brokerage branch. You can download Schwab Mobile onto your iPhone, Apple Watch, iPad, Android devices and Kindle Fire. There, and online, you can manage your account(s), track your money, make deposits, pay bills and more. To access your money, you’ll need to provide your login information and/or account information.

You can also access your money, whether in a savings or checking account, at any ATM with your Schwab Bank Visa® Platinum Debit Card. Luckily, the bank will reimburse any ATM fees you pay for foreign ATMs.

How Can I Save More Money With a Charles Schwab Bank Account?

One way to save with Charles Schwab Bank is with its decent savings rates on its savings and checking account. They’re not the highest rates in the industry, but they still perform well. This is doubled with the lack of a monthly maintenance fee, which means you don’t have to worry about paying a fee to keep saving.

Plus, when you open a Schwab Bank High Yield Investor Checking® Account, you also have to open a Schwab One® brokerage account. This means you get to invest more money and grow those funds according to your risk tolerance and investing goals.

What’s the Process for Opening an Account With Charles Schwab Bank?

To open a Schwab Bank High Yield Investor Savings® Account, you’ll need to download an application online. Just click the “Download an Application” button and it will take you to a .PDF version of the application. You can fill it out on the webpage and print it, or you can print it and fill it out by hand. Either way, you’ll have to print it out and mail it in. You also have the option of calling the bank at (800) 540-6718.

On the other hand, you can easily open a Schwab Bank High Yield Investor Checking® Account online. The process typically takes about 10 minutes. You could also download and email an application or call the same phone number to apply if you don’t want to apply online.

What’s the Catch?

Banking with Charles Schwab may not be right for you if you’re looking for the highest interest rates a bank can offer. Typically, online banks offer the highest-earning savings accounts. However, Charles Schwab Bank still provides higher rates than big bank competitors.

Largely focused on investing, Charles Schwab also has a limited banking spread. In fact, there’s only one savings account and one checking account. If you’re looking for more banking options, Schwab likely won't suffice.

Bottom Line

There’s not much Charles Schwab can offer when it comes to bank accounts since it only has two. However, each account is a pretty solid offering with decent interest rates and features that make saving even more convenient and easy. On the whole, the checking account may be your best choice since you can apply online, manage your money and open a brokerage account, as well.