Set by the Federal Open Market Committee (FOMC), the federal funds rate directly controls whether banks will lend any excess reserves to meet federal requirements. This rate has a huge impact on inflation, short-term borrowing and even investing. In this guide, we explore the federal funds rate and explain how it works.

A financial advisor can help optimize your financial plan to get through economic uncertainty.

Federal Funds Rate Defined

The federal funds rate is an interest rate determined by the Federal Open Market Committee (FOMC). The FOMC is a committee within the Federal Reserve System that handles the nation’s monetary policy.

The rate, however, represents the percentage at which banks and other financial institutions charge when lending each other money overnight. But why would banks lend to each other? This is because of something known as the reserve requirement. The reserve requirement mandates that banks have a certain percentage of money (that earns no interest) in their reserves each night. This is why banks lend to other banks, credit unions and financial institutions. Overnight lending helps banks make sure they aren’t too far above or below the federal reserve requirement.

How the Federal Funds Rate Works

The FOMC uses the federal rate to manage economic issues such as inflation. This rate plays a major role in how much it costs to borrow, and it also affects short-term interest rates and the prime interest rate.

Federal funds rate fluctuations directly affect borrowing among businesses and consumers. For instance, a lower federal funds rate would make it less expensive to borrow, thus decreasing short-term interest rates. A higher rate, however, would increase short-term interest rates, making it more difficult for businesses and institutions to access money.

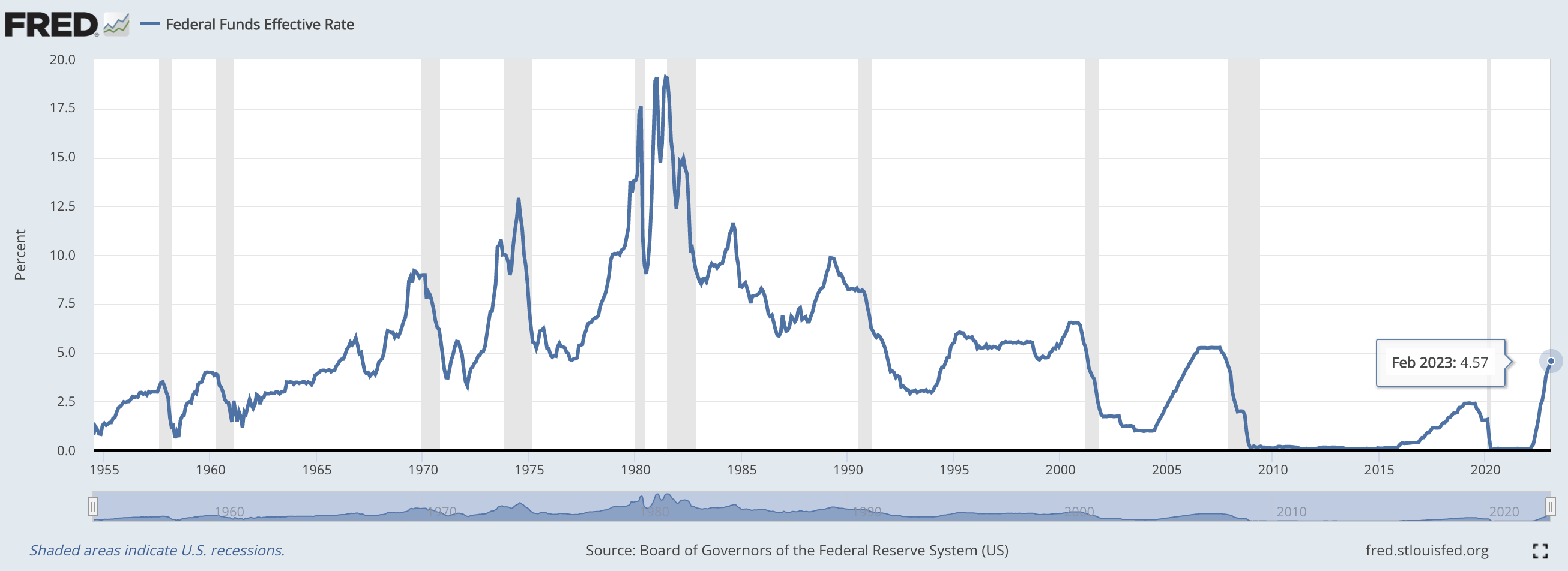

In the chart above, you can see how fed rates either went down to stimulate economic growth or went up to slow inflation and bring growth down to sustainable levels.

For reference, the lowest fed rates can be seen after the 2008 financial crisis, which dropped below 0.25% between 2009 and 2015. The next dip happened during the coronavirus pandemic, falling to similar levels again from April 2020 to March 2022.

Comparatively, the highest fed rate hit double-digit inflation up to 20% in 1980 and 1981. More recently, the fed rate has continued to climb with the rise of inflation after the coronavirus pandemic. In February 2023, it was 4.57%.

Bottom Line

The federal funds rate ultimately determines whether banks will lend or borrow from each other overnight. Banks that have exceeded their reserve requirements may lend to other institutions through overnight transactions. But banks with end-of-day balances that fall beneath the required reserve level will typically borrow to get as close to that requirement as possible. This interest rate is set by the FOMC, and it has a large impact on inflation and economic activity.

Tips for Navigating Times of Economic Uncertainty

- A financial advisor can help with your investing strategy during times of economic uncertainty. Finding the right financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Interest rate fluctuations can have a huge impact on your investments. When the federal funds rate changes, it significantly alters the lending and borrowing practices of companies, thereby affecting the stock, bond and currency markets. Consider our guide on investing during the coronavirus pandemic.

Photo credit: ©iStock.com/marchmeena29, @Federal Reserve Bank of St. Louis, ©iStock.com/primeimages