Amazon is a Seattle-based retailer and technology company primarily involved in e-commerce, cloud computing (Amazon Web Services), digital streaming and artificial intelligence. It owns dozens of diversified subsidiary companies, with large investments in others. Amazon’s stock is listed on NASDAQ under the ticker symbol $AMZN and is part of the S&P 500 index.

Here’s what you should know about how Amazon became one of the largest companies in the world.

There’s alpha in information. Sign up for the Market Minute newsletter to get summaries of stock market and economic news delivered right to your inbox.

History of Amazon

Amazon was launched out of the garage of founder Jeff Bezos in 1994. The company began operations in April, 1995 when, early on, Bezos famously hand-delivered orders to the post office. Originally called “Cadabra,” for “Abracadabra,” Bezos changed the name to “Amazon” before launch.

Amazon started as an online bookstore because Bezos saw a potential opening in the world of bookselling. However, Bezos says that he always intended the store to offer a wide range of products. Amazon was also one of the first companies to argue that it was a “technology” firm regardless of underlying operations or revenue, establishing a trend that many online companies would later embrace. This position gave Amazon its early arguments for not charging state and local sales taxes, which many analysts believe gave it a key initial advantage against legacy competitors.

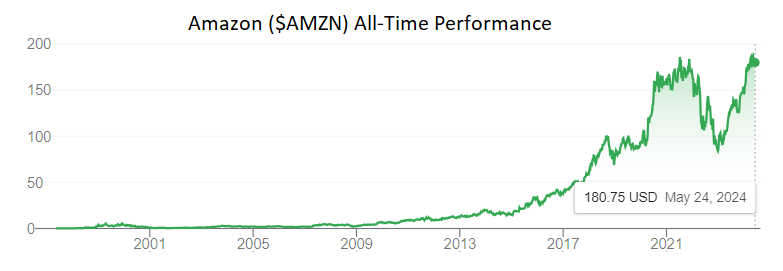

The company went public in 1997 with an initial, inflation-adjusted share price of $2. It operated at a loss for years, with Amazon heavily investing in growth rather than profits. Amazon recorded its first profitable year in 2003.

Amazon’s other largest current brands emerged in the early 2000s. It began accepting third party sellers for the first time in 2000. Amazon Web Services launched in 2002, having emerged from a series of internal tools used to run the company’s website. Amazon Prime launched in 2005, initially as a subscription service for fast, efficient delivery. In 2009 the company made its first major acquisition with Zappos, beginning its modern practice of making significant corporate expansions through acquisition.

Products and Business

It is difficult to briefly summarize all of Amazon’s product and business lines because of the company’s vast area of operations. Just some of its most relevant business lines include:

- Online retail

- Large scale physical retail, most notably through Whole Foods

- Logistics and delivery

- Medicine, including through PillPack

- Technology devices such as the Kindle and Echo

- Data services through Amazon Web Services

- Artificial intelligence development (Amazon is one of NVIDIA’s largest customers)

- Movies and media, most notably through Prime streaming and Metro Goldwyn Mayer

- Web publication

- Clothing and fashion

Within this vast range of operations, three particularly stand out:

1. Online Retail

Amazon is arguably best known for its online retail business. This is where the company started and, historically, has been the company’s largest public profile. This business is split into two parts. Approximately 40% of Amazon’s retail sales come from the company’s traditional retail operations, in which it sells products directly to consumers. The majority of these sales are third party products although not all, most notably with Amazon-produced devices such as the Kindle and Echo.

Another 60% of the company’s retail sales come from third-party, or “platform,” sales. In this line of business, Amazon allows other individuals and companies to list products for sale on its site. It then collects a percentage of each sale, passing the rest along to the seller. Outlets have reported that this percentage is typically 50%.

Although Amazon began as a bookseller, the company today operates as an “everything” store. There is no category limit on what Amazon sells and the company advertises its broad selection as one of the site’s main features.

Sign up for the Market Minute newsletter for summaries of the latest stock and economic news, including updates on Amazon.

2. Prime and Media

Currently, Amazon’s brand has increasingly become synonymous with its “Prime” service. This is a subscription that costs $14.99 per month. Through Prime, Amazon offers fast delivery of products, often next-day or even same-day. This requires a massive logistics operation and Amazon operates a wide range of warehouses, distance shipping and last-mile delivery, all to ensure that products are as close as possible to potential customers.

The Prime service is also associated with Amazon’s streaming video service. This media operation has quietly become a significant portion of Amazon’s reputation and operations, including the company’s 2021 acquisition of movie studio Metro Goldwyn Mayer. Depending on how one measures subscriptions, Amazon Prime is the second-largest streaming service in the world, behind Netflix.

It is difficult to judge exactly how significant Amazon’s media operations are as a revenue source. The company’s high costs for original and licensed programming are specific and knowable. Its media revenue is more ambiguous, though. This money comes from Prime subscriptions, and its unclear on a per-customer basis how much enrollments are driven by media demand vs. Prime’s associated retail benefits.

Either way, media, streaming and Prime have become highly visible parts of Amazon’s current brand.

3. AWS

Most of Amazon’s current operating income ($15.3 billion in Q1 2024) comes from Amazon Web Services, or “AWS.” This segment of Amazon’s business currently accounts for more than half of the entire company’s operating income at $9.4 billion in Q1 2024, and more than a fifth of its sales.

Amazon Web Services is a cloud computing, data storage and analytics service. At its most basic, customers rent out storage space and processing power from Amazon. This means that they can store data on Amazon’s servers and process customer requests on Amazon’s computers. For example, when a customer watches Netflix, that video is stored on Amazon’s hard drives and the company’s processors stream the video out. Beyond that, the company offers more than 200 different tools and services to help customers analyze data and monitor business operations.

Among other reasons, AWS has succeeded by offering efficient scalability to its customers. Startup companies don’t need to purchase large stacks of expensive equipment, they can simple rent space on Amazon’s computers. Existing firms can elastically expand or contract their monthly subscription based on current needs which, again, is less expensive than investing in capital equipment.

Financials and Leadership

Amazon’s current financial era began in the fourth quarter of 2017.

Before 2017, the company steadily reported net incomes within a range of several hundred million dollars. For example, a representative swing was between Amazon’s $249 million positive net income in Q4 2013 and its $57 million net losses in Q1 2015. This range typifies the company’s performance between 2003 and 2017, with most quarters posting positive net income.

Between the third and fourth quarter of 2017, Amazon’s reported net income jumped by more than 700%. In Q3, 2017, Amazon reported $256 million income compared with $1.85 billion in Q4, 2017. This became the new normal. Except for Q1 and Q2, 2022, Amazon has reported billions of dollars in net income every quarter since.

This history is important for two reasons. First, Amazon’s era of billion-dollar income did not begin until the same quarter that a very large, top-oriented tax cut took effect. According to the company’s SEC filings, approximately half of the Q4 2017 income surge was due to taxes.

Second, Amazon’s net income swung from $14.3 billion in Q4 2021 to a loss of $3.8 billion in Q1 2022. It posted losses for two quarters in 2022 before regaining positive net income. This coincided with the Federal Reserve’s campaign to increase interest rates to push down inflation.

While this does not give reason to believe that Amazon’s business model is unstable, together these two events suggest that the company is significantly exposed to the political and financial climate. Changes in tax and interest policies appear able to swing Amazon’s financial performance by billions of dollars in a single quarter.

At time of writing, the Amazon most recently reported $10.4 billion in quarterly profits (Q1, 2024).

Money is always in motion. Get the latest news affecting the markets, including the latest on Amazon, right to your inbox with the Market Minute newsletter.

Amazon Stock Split History

$AMZN has undergone a total of four stock splits, with the most recent taking effect on June, 3, 2022. There was nearly 23 years between this and the previous split.

| Date | Split Ratio |

| June 3, 2022 | 20-for-1 |

| September 2, 1999 | 2-for-1 |

| January 5, 1999 | 3-for-1 |

| June 2, 1998 | 2-for-1 |

Amazon-Owned Companies and Investments

Amazon has extended its reach to multiple companies to better implement vertical integration and business expansion over time. These include:

- Whole Foods (groceries)

- MGM (media)

- One Medical (medical)

- Pill Pack (medical)

- Zappos (shoes and apparel)

- Ring (home security)

- Twitch (streaming)

Some notable companies it’s invested in include:

- Anthropic (artificial intelligence)

- Diamond Sports (sports media)

Amazon Executive Team

Amazon has a sprawling corporate leadership. This reflects not only the company’s financial size, but also its scope of operations. Amazon owns more than 100 different companies and operates around the world. It has a leadership team which reflects this. The company’s current CEO is Andy Jassy, the founder of AWS, and its Chief Financial Officer is Brian Olsavsky, who has worked in finance for Amazon for several decades. Founder Jeff Bezos remains involved with the company as its Executive Chair.

The full list of officers includes:

- Jeffrey P. Bezos, Executive Chair

- Andy Jassy, President and Chief Executive Officer

- Brian T. Olsavsky, Senior Vice President and Chief Financial Officer

- Douglas J. Herrington, Chief Executive Officer, Worldwide Amazon Stores

- Shelley L. Reynolds, Vice President, Worldwide Controller

- Adam N. Selipsky, Chief Executive Officer, Amazon Web Services

- David A. Zapolsky, Senior Vice President, Global Public Policy & General Counsel

The Bottom Line

Amazon operates in a very wide range of industries, from retail to media to medicine, and has grown to become one of the most profitable companies in the world.

More Resources

- Amazon’s investor relations page offers past press releases and other information for current and potential investors.

- For more history on the world’s largest companies, check out the history of NVIDIA.

- A financial advisor can help you build a comprehensive retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Money is always in motion. Sign up for the free Market Minute newsletter to get news that may affect your portfolio, the stock market and the economy summarized and right to your inbox.

Photo credit: ©iStock.com/Sundry Photography, ©iStock.com/Julie Hopper, Google