Despite various government relief programs, the coronavirus crisis has already affected the finances of many Americans. Over the past eight weeks, more than one in four individuals filed for unemployment. Though unemployment benefits are expanded under the CARES Act, enhanced benefits are scheduled to end on July 31, 2020. Additionally, though many businesses say they will rehire workers as the virus becomes contained, University of Chicago economists have theorized that more than 40% of recent layoffs will result in permanent job loss. Beyond unemployed workers, Americans who are still working may face financial pressure as well. According to a National Endowment for Financial Education (NEFE) April 2020 survey, nearly nine in 10 Americans say the COVID-19 crisis is causing stress on their personal finances.

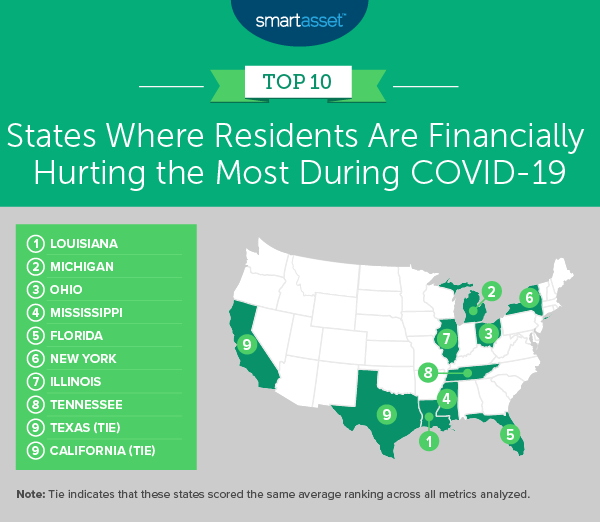

Like the spread of the virus, financial shocks have been felt more in some places than others. In this study, SmartAsset looked at the states where residents have been financially hurting the most during COVID-19. We compared the 50 U.S. states across six metrics. They include recent measures of unemployment along with measures of housing and food insecurity. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

Key Findings

- Residents in populous states may be experiencing the largest financial fallout. California, Texas, Florida and New York are the most populous states in the U.S. Those four states all rank within the top 10 states where residents are financially hurting the most due to the coronavirus pandemic, according to our findings. More specifically, they all fall within the 15 states in the study with the highest recent housing insecurity, and within the 25 states in the study with the most recent food insufficiency.

- Housing insecurity varies widely across states. The Census Bureau’s new Household Pulse Survey asks respondents if they missed last month’s rent or mortgage payment or if they were not confident that their household can pay next month’s rent or mortgage on time. In Iowa, fewer than 15% of residents expressed concern about making housing payments during mid-May. By contrast, close to one in two Mississippi residents replied that they either missed last month’s payment or expected to be unable to pay the coming month’s bill.

1. Louisiana

Residents in Louisiana have been hit hard financially during the coronavirus pandemic. With the third-highest poverty rate in the nation, close to 16% of adults in Louisiana recently did not have enough food over the course of a week. Additionally, Louisiana had the 12th-highest percentage of residents, at approximately 29%, report that they either missed last month’s rent or mortgage payment or were not confident that they could make next month’s payment on time.

2. Michigan

Many Michigan residents have been laid off in recent weeks. According to Bureau of Labor Statistics (BLS) data, Michigan had the second-highest April 2020 unemployment rate (22.7%) of all 50 states, following only Nevada, for which a rate of 28.2% was reported. Michigan’s unemployment rate increased the third-most of any state during COVID-19; its April 2020 unemployment rate marks a 19.1 percentage point increase from February 2020.

Unemployed persons in Michigan receive less in jobless compensation relative to those in other states. The unemployment replacement rate in the state under the CARES Act, or the ratio of average unemployment benefits received to the average worker’s salary, in Michigan is the 11th-lowest of all 50 states. According to data published by the University of Chicago, the average pre-COVID weekly unemployment benefit was $362. With the additional $600 per week, the pandemic unemployment replacement rate is 133%.

3. Ohio

Unemployment and food insufficiency in Ohio have been high in recent months according to BLS and Census data. The unemployment rate in April 2020 was 16.8%, the sixth-highest of all 50 states. Moreover, in mid-May, 12.8% of residents reported that they either sometimes or often did not have enough to eat during the previous seven days. This is the fifth-highest rate of residents reporting food insufficiency.

4. Mississippi

In 2018, 19.7% Mississippi residents fell below the poverty line, the highest percentage of residents for this metric in any state. The coronavirus pandemic seems to have exacerbated some common measures of poverty within the state. According to Census Bureau survey data collected in mid-May, more than 46% of adults reported that they either missed last month’s rent or mortgage payment or have slight or no confidence that their household can pay next month’s rent or mortgage on time. Moreover, close 18% of adults said that within the last week they either sometimes or often did not have enough to eat.

5. Florida

Historically, a high percentage of residents across many Florida cities have been housing-cost burdened. Housing burdens in Florida may be exacerbated due to COVID-19. According to Census Bureau data from the Household Pulse Survey, more than 32% of adults recently reported that they are facing housing insecurity, the second-highest rate of across all 50 states. Florida residents also reported the fourth-highest rate of food insufficiency during the same survey week.

6. New York

Though an individual filing for unemployment in New York could receive a weekly benefit of up to $504, the average benefit is $417. With the average worker earning about $800 per week, the pandemic unemployment replacement rate (with the additional $600) is 127%, the seventh-lowest in our study. More than one in eight New Yorkers may be currently filing for unemployment. April 2020 BLS data shows that 14.5% of New York’s labor force is unemployed. This marks a 10.8 percentage point increase from pre-COVID levels.

7. Illinois

Unemployment in Illinois rose sharply between February 2020 and April 2020, increasing by 13.0 percentage points, the eighth-largest jump in our study. With that rise, Illinois’ April 2020 unemployment rate was 16.4%, 1.7 points higher than the national average and the seventh-highest of all 50 states.

Despite low historic poverty rates, recent survey data compiled on residents in Illinois shows a different picture. More than one in four adults recently reported housing insecurity, while about one in eight were experiencing food insufficiencies.

8. Tennessee

In 2018, Tennessee had the ninth-highest poverty rate of all 50 states, with 15.3% of residents falling below the federal poverty line. Economic changes due to coronavirus may exacerbate poverty within the state. Over the past two months, Tennessee saw the 14th-largest increase in unemployment, and its most recent unemployment rate from April 2020 (14.7%) is the 18th-highest in the nation. Recent survey data from the Census shows that close to 25% of Tennessee residents are housing insecure, while more than 11% are food insufficient.

9. Texas (Tie)

Though the April 2020 unemployment rate in Texas was about two percentage points lower than the national rate, a high percentage of Texan residents have reported recent financial stress. In mid-May, more than 30% of residents said that they either missed last month’s housing payment or did not have confidence they would be able to make the coming month’s payment. Additionally, close to 13% of adult survey respondents said they did not always have enough to eat during the previous week. Relative to other states, that is the seventh-highest rate of housing insecurity and sixth-highest rate of food insufficiency.

9. California (Tie)

California had the 10th-highest April 2020 unemployment rate of any state, at 15.5%. Beyond this, the unemployment replacement rate under the CARES Act in California is lower than in 10 other states. The average California worker earns $723 each week. Though the maximum weekly unemployment benefits in California is $450, the average weekly benefit is $361. Thus, the typical replacement rate is 50% while the pandemic unemployment replacement rate, with the additional $600 federal benefit, is 133%.

Data and Methodology

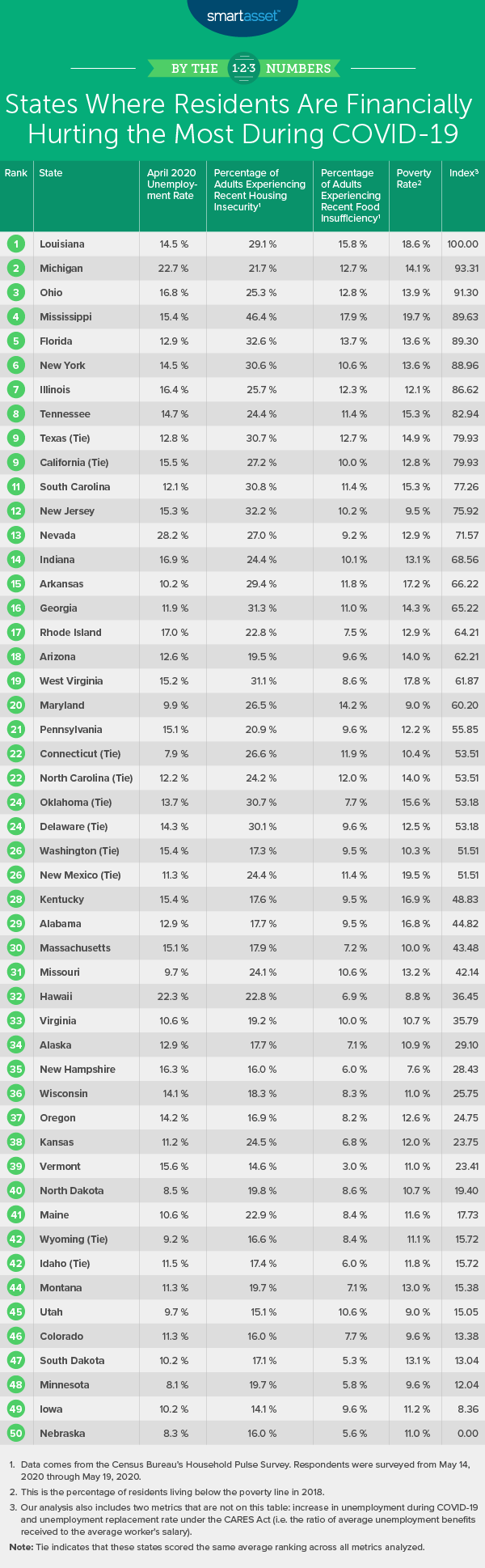

To find the states where residents are financially hurting the most during COVID-19, SmartAsset looked at data for all 50 U.S. states. We compared them across six metrics:

- April 2020 unemployment rate. Data comes from the Bureau of Labor Statistics’ Local Area Unemployment Statistics.

- Increase in unemployment during COVID-19. This is the percentage point difference between the February 2020 unemployment rate and April 2020 unemployment rate. Data comes from the Bureau of Labor Statistics’ Local Area Unemployment Statistics.

- Unemployment replacement rate under the CARES Act. This is the ratio of average unemployment benefit received to the average worker’s weekly salary. The average unemployment benefit includes the additional $600 weekly benefit under the Pandemic Unemployment Assistance (PUA) Program as part of the CARES Act. Data comes from the University of Chicago’s Unemployment Insurance Calculator.

- Percentage of adults experiencing recent housing insecurity. This is the percentage of adults who missed last month’s rent or mortgage payment, or who have slight or no confidence that their household can pay next month’s rent or mortgage on time. Data comes from the Census Bureau’s Household Pulse Survey. Respondents were surveyed from May 14, 2020 through May 19, 2020.

- Percentage of adults experiencing recent food insufficiency. This is the percentage of adults in households where there was either sometimes or often not enough to eat in the last seven days. Data comes from the Census Bureau’s Household Pulse Survey. Respondents were surveyed from May 14, 2020 through May 19, 2020.

- Poverty rate. This is the percentage of residents living below the poverty line. Data comes from the U.S. Census Bureau’s 1-year American Community Survey.

We ranked each state in every metric, giving a half weight to the first two metrics: April 2020 unemployment rate and increase in unemployment during COVID-19. We gave a full weight to all other metrics. Using those rankings, we found each state’s average ranking and used the average to determine a final score. The state with the highest average ranking received a score of 100. The state with the lowest average ranking received a score of 0.

Tips to Protect Yourself Financially From the Impact of Coronavirus

- Boost your emergency savings. Though having an emergency savings account is one of the best ways to prepare for the unknown, AARP found in an October 2019 study that 53% of U.S. households don’t have one. Take a look at our best savings accounts in 2020 to see where you can start saving. Typical financial wisdom suggests you should have savings that can cover three months’ worth of expenses, but six months’ may be a better figure to shoot for during a recession.

- Keep your budget top of mind. One of the best ways to save more is through budgeting. Our budget calculator can help with this. Beyond letting you see how much you spend each month and what sixth months of expenses would look like, you can see how cutting back on discretionary expenses can increase your savings rate.

- Consider talking to a financial advisor about how to ride out a financial downturn. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors who will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/AlenaPaulus