Housing is one of the biggest stressors for many Americans across the country, since it often constitutes the majority of a household’s expenses. Housing costs have become increasingly burdensome due to the coronavirus crisis, which has impaired so many people’s ability to cover mortgage payments, let alone sock away money into their savings. In light of these factors, SmartAsset analyzed the data to see where homeowners in the U.S. are the most and least severely housing cost-burdened.

Housing is one of the biggest stressors for many Americans across the country, since it often constitutes the majority of a household’s expenses. Housing costs have become increasingly burdensome due to the coronavirus crisis, which has impaired so many people’s ability to cover mortgage payments, let alone sock away money into their savings. In light of these factors, SmartAsset analyzed the data to see where homeowners in the U.S. are the most and least severely housing cost-burdened.

To find these cities, we compared the number of households spending more than 50% of their income on housing costs to the total number of households. According to the Department of Housing and Urban Development (HUD), “housing cost-burdened” means spending more than 30% of household income on housing costs. “Severely housing cost-burdened” means spending more than 50% of household income on housing costs. For details on our data sources and how we put the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s fourth study on the most and least severely housing cost-burdened cities. Check out our 2019 version here.

Key Findings

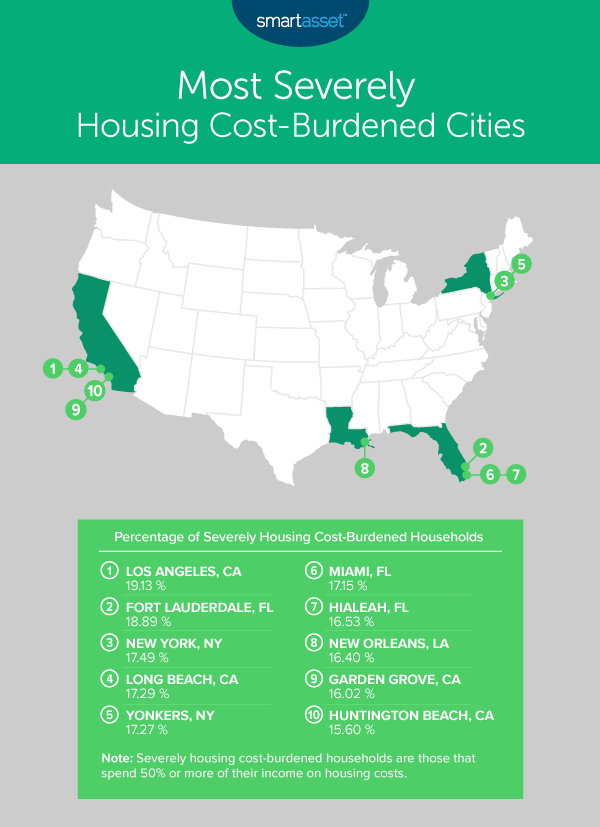

- Western cities fare the worst. Of the 25 cities in our study that have the highest percentages of severely housing cost-burdened households, 16 are in the West, according to Census regional divisions. And of those 16 cities, 14 are in California. On average across these 14 California cities, 15.04% of households must set aside more than 50% of their income to cover housing costs. Los Angeles has the highest percentage of severely housing cost-burdened households, at 19.13%.

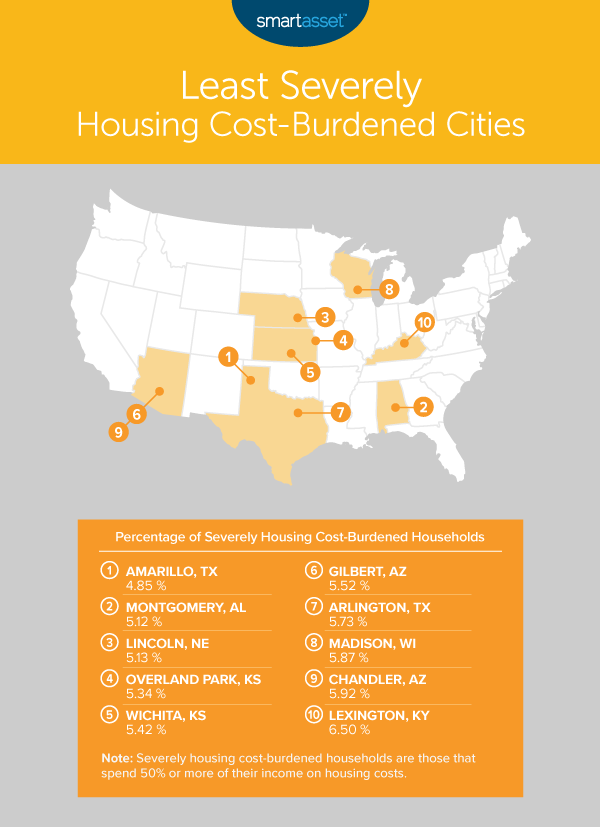

- Residents in the South and Midwest are less severely burdened by housing costs. Of the 25 cities in our study that have the lowest percentages of severely housing cost-burdened households, 12 are in Southern states and eight are in Midwestern states.

The 10 Most Severely Housing Cost-Burdened Cities

1. Los Angeles, CA

According to data from the Census Bureau, Los Angeles, California is the most severely housing cost-burdened city in the country. Of a total 501,962 households, a little more than 19% – or 96,044 – are severely housing cost-burdened, while 39.88% of them – or 200,076 – are housing cost-burdened.

2. Fort Lauderdale, FL

In Fort Lauderdale, Florida, 18.89% of households – or 7,912 of a total 41,878 households – have to allocate more than 50% of their income to housing costs, meaning that they are severely housing cost-burdened. Housing cost-burdened households, who have to set aside more than 30% of their income for housing costs, reach 35.23% of total households in the city.

3. New York, NY

Given its high cost of living, it’s perhaps unsurprising to see New York City on our list of the most severely housing cost-burdened cities in the country. Roughly 352,319 of the 1,042,956 total households, or 33.78%, are housing cost-burdened, meaning that more than 30% of their income goes toward housing costs. Additionally, more than 17% of the city’s households – or 182,447 – have to allocate more than half of their income to cover housing costs.

4. Long Beach, CA

Long Beach, California is the second of four California cities on our list of America’s 10 most severely housing cost-burdened cities. The total number of households in the city is 70,749. More than a sixth of these households – 12,235 – are severely housing cost-burdened, meaning they need to set aside more than 50% of their income for housing costs.

5. Yonkers, NY

In Yonkers, New York, a suburb directly north of New York City, 6,055 of the total 35,069 households – or 17.27% – are spending more than 50% of their income on housing costs. Additionally, roughly a third of households in the city spend more than 30% of income on housing costs.

6. Miami, FL

Miami, Florida is the second of three Sunshine State cities on this list. In Miami, 17.15% of households are severely housing cost-burdened and 36.29% of households (or 20,287 of a total of almost 56,000 households) are housing cost-burdened.

7. Hialeah, FL

In Hialeah, Florida, housing cost-burdened households make up 36.07% of total households, or 12,409 of 34,405. Severely housing cost-burdened households constitute 16.53%, or 5,686, of that total.

8. New Orleans, LA

According to Census Bureau data, 12,300 of a total 74,982 households in New Orleans, Louisiana are severely housing cost-burdened. That means 16.40% of local households spend more than half of their income goes toward housing costs.” Furthermore, 33.45% of all New Orleans households are housing cost-burdened, meaning that more than 30% of their income has to be set aside for housing costs.

9. Garden Grove, CA

In Garden Grove, California, 8,586 households of a total 24,331 (35.29%) are housing cost-burdened. Furthermore, 16.02% of those households need to set aside more than half of their income for housing costs, making them severely housing cost-burdened.

10. Huntington, CA

Huntington, California rounds out our list of the 10 most severely housing cost-burdened cities in the country. Around 15.60% of the total 43,446 households in Huntington – or 6,778 households – have to spend more than 50% of their income on housing costs. About twice that amount, or 31.16% of the city’s households, are housing cost-burdened, meaning that more than 30% of their income goes toward housing costs.

The 10 Least Severely Housing Cost-Burdened Cities

1. Amarillo, TX

The least severely housing cost-burdened city in the U.S. is Amarillo, Texas. Roughly 21% of its total households – or 9,403 of 45,691 – are housing cost-burdened, but only 4.85% – just 2,218 of that total – are severely housing cost-burdened.

2. Montgomery, AL

Montgomery, Alabama actually has a lower percentage of housing cost-burdened households than Amarillo, Texas, at 15.08%. But Montgomery has a higher rate of households that are severely housing cost-burdened, meaning that more than half of their income needs to be allocated to housing costs. Of a total of 40,401 households in Montgomery, only 2,070 of them – or 5.12% – are severely housing cost-burdened.

3. Lincoln, NE

Lincoln, Nebraska’s rate of severely housing cost-burdened households is relatively low, at 5.13% (3,367 of roughly 65,600 households), while the percentage of households that are housing cost-burdened at all is 17.66% – 11,582 of that total.

4. Overland Park, KS

Overland Park, Kansas takes the No. 4 spot in our list of the 10 least severely housing cost-burdened U.S. cities. Of the total 50,124 households in this town, only 5.34% (or 2,679) need more than 50% of their income to cover housing costs, while 17.28% need more than 30% of their income to do so.

5. Wichita, KS

In Wichita, Kansas, housing cost-burdened households constitute 17.01% of total households, or 15,712 of 92,355. Severely housing cost-burdened households constitute only 5.42% of that total, or 5,004.

6. Gilbert, AZ

In Gilbert, Arizona, 16.62% of all 60,562 households need to set aside more than 30% of their income to cover housing costs, and just 5.52% – or 3,344 of 60,562 households – must spend 50% of income to cover housing costs.

7. Arlington, TX

Arlington, Texas, located in the larger Dallas metro area, has a total of roughly 74,100 households. Just 5.73% of these households – or 4,250 – are severely burdened by housing costs, and 16.65% are housing cost-burdened.

8. Madison, WI

Madison, Wisconsin takes the No. 8 spot in our list of the 10 least severely housing cost-burdened cities in the U.S. The total number of households in the city is 51,248. Of this total, just 3,007 – or 5.87% – spend more than 50% of their income on housing costs. Furthermore, 19.82% of households in the city are housing cost-burdened, meaning they need more than 30% of their income to cover housing costs.

9. Chandler, AZ

Chandler, Arizona actually has the lowest rate of housing cost-burdened households in this study. Just 15.06%, or 9,118 of its total 60,526 households, are spending more than 30% of their income on housing costs. But the city comes in ninth overall as a result of its severe housing-cost burden rate, with 3,581 of 60,526 households (or 5.92%) spending more than 50% of income to cover these costs.

10. Lexington, KY

The final city in this list is Lexington, Kentucky. In this area, just 6.50% of households – 4,755 of a total 73,100 households – are severely housing cost-burdened, and 15.39% are burdened by housing cost overall.

Data and Methodology

To find where homeowners in the U.S. are the most and least severely housing cost-burdened, we examined 124 cities for which data was available. For each of these cities, we found the total number of homeowner households, the number of homeowner households spending between 30% and 50% of their income on housing and the number of homeowner households spending more than 50% of their income on housing.

We took the number of households in each city paying more than 50% of their income on housing and divided it by the total number of households in that city in order to calculate the percentage of households that are severely housing cost-burdened. We then ranked each city based on this percentage. We also calculated the percentage of households in each city paying more than 30% of their income on housing, but this did not impact the ranking.

Data comes from the U.S. Census Bureau 2018 1-Year American Community Survey.

Tips for Managing Your Housing Costs

- Coronavirus relief. If you’re burdened by the economic fallout of COVID-19 and need more information on programs such as mortgage relief, take a look our guide here.

- Reassess your budget if possible. Making a budget is a great way to fit your housing costs and all other essential spending into your income. If you’re receiving a federal economic impact payment in light of the recent coronavirus crisis, it might be a good time to take another look at your budget. Use our free budget calculator to understand how best to allocate your income.

- Don’t handle the burden alone. A financial advisor can help you how to best manage your housing costs while still doing what you need in order to achieve your other financial goals. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/wichayada suwanachun