A 2022 study from the Bank of America says that 30% of current women homeowners bought their home while single. And almost two-thirds of women surveyed said they would buy a home before getting married. As more women poise themselves to become homebuyers, SmartAsset analyzed data to identify and rank the metro areas where they were approved for the most mortgages.

Using 2020 data from the Consumer Financial Protection Bureau (CFPB), we compared the number of approved mortgages for women with the number of approved mortgages for all homebuyers in almost 400 U.S. metro areas. For more details on our data sources and how we ranked metro areas, read the Data and Methodology section below.

This is SmartAsset’s 2022 study on where women are buying homes. Check out the 2021 version here.

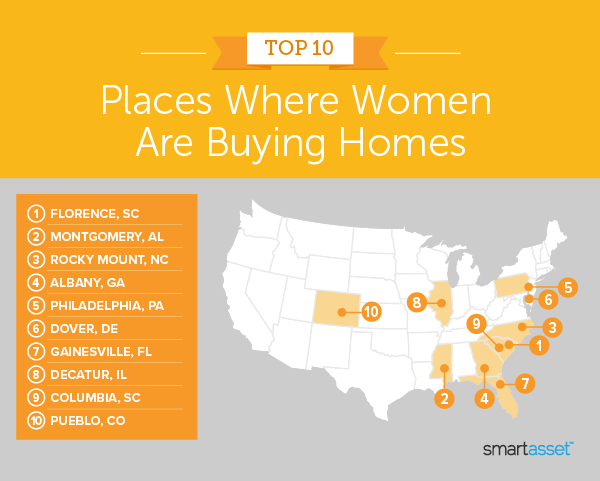

Key Findings

- Six metro areas in the South rank in the top 10. These metro areas are spread across five Southern states, including South Carolina, Alabama, North Carolina, Georgia and Florida. In all six areas, mortgages for women accounted for more than 27% of all approved mortgages in 2020.

- Women were approved for at least 25% of all mortgages in the top 40 metro areas. On average, women were approved for 26.43% of all mortgages in the top 40 metro areas. Across all 394 metro areas, women homebuyers in Florence, South Carolina made up the highest percentage of all homebuyers (30.05%), while they made up the lowest percentage of homebuyers in Logan, Utah-Idaho (12.14%).

1. Florence, SC

There were 1,401 mortgages approved in Florence, South Carolina in 2020. Of those, 421 were approved for women, the highest share in this study, at 30.05%. This year’s ranking is a big jump for Florence – last year it placed 20th in this study, with mortgages for women accounting for only 25.95% of all approved mortgages.

2. Montgomery, AL

In Montgomery, Alabama, 949 out of 3,313 approved mortgages in 2020 were for women, or 28.64%. There were 1,121 mortgages approved for men, with the remaining mortgages going to couples or other joint signers.

3. Rocky Mount, NC

In Rocky Mount, North Carolina, a total of 978 mortgages were approved in 2020 and 28.32% of those were for women. This is the second straight year Rocky Mount has placed in the top five places where women are buying homes.

4. Albany, GA

The Albany, Georgia metro area had 27.96% of its mortgages approved for women homeowners in 2020. CFPB data reveals that 208 out of 744 mortgages were taken out by women without co-signers.

5. Philadelphia, PA

Philadelphia, Pennsylvania is the largest city in our top 10. Women in the area had 4,561 mortgages approved in 2020, which makes up 27.76% of the total 16,428 approved mortgages. That represents the highest number of approved mortgages in the top ten ranking metro areas.

6. Dover, DE

The Dover, Delaware metro area had 339 mortgages approved for women in 2020. That means 27.70% of 1,224 total mortgages were taken out by women without co-signers. Dover did not rank in the top 25 metro areas in last year’s version of this study.

7. Gainesville, FL

Gainesville, Florida claims the seventh spot out of all 394 metro areas in our study. In 2020, 935 mortgages were approved for women without co-signers. This makes up 27.26% of the total 3,430 mortgages. Approved mortgages for men without co-signers account for only a few more than those for women, a total of 997.

8. Decatur, IL

In 2020, women represented 27.18% of all those approved for mortgages in the Decatur, Illinois metro area. Of the total 964 mortgages approved, 262 were for women without co-signers. Of the remaining, there were 292 mortgages approved for men without co-signers and 410 went to joint signers.

9. Columbia, SC

In Columbia, South Carolina, a total of 8,625 mortgages were approved in 2020. Women were approved for 2,340, which makes up 27.13% of total new mortgages. Columbia moved up a few spots in this year’s study – it ranked 16th in our 2021 edition.

10. Pueblo, CO

The Pueblo, Colorado metro area rounds out our top 10. Women in Pueblo, Colorado were approved for 384 out of 1,423 mortgages in 2020. This makes up 26.82% out of all approvals. There were 446 mortgages approved for men and 593 approved for joint signers.

Data and Methodology

To find the places where women are buying the most homes, we looked at data for 394 metro areas and compared them across the following two metrics:

- Mortgages approved for women in 2020.

- Total number of mortgages approved in 2020.

Data comes from the Consumer Finance Protection Bureau’s Home Mortgage Disclosure Act database.

For each metric, we counted only mortgages that were used to purchase homes rather than refinance an existing mortgage or those used for home improvements. We also only included conventional, first-lien mortgages. To isolate homes bought by single women, we analyzed home loans secured by women without a co-signer.

To rank metro areas, we divided the number of mortgages originated to women by the total number of mortgages approved in 2020. We then ranked places based on this figure.

Tips for Homebuyers

- A financial advisor can help you create a financial plan for your home buying needs and goals. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Mortgage management. When purchasing a home, it is important to know what you’ll be paying each month and for how long. Use SmartAsset’s free mortgage calculator to get a sense of what your monthly payment might look like if you decide to buy a new home.

- Buy or rent? Even if you have the savings to buy a first home, be sure the switch makes sense. If you are coming to a city and plan to stay for the long haul, buying may be the better option for you. On the other hand, if your stop in a new city will be a short one, you’ll likely want to rent. SmartAsset’s rent vs. buy calculator can help you see the cost differential between purchasing a home or apartment and renting.

Photo credit: ©iStock.com/MixMedia