A National Association of Realtors report shows that single females accounted for 18% of home purchases in 2019 (whereas single males made up only 9% of purchases in the same year). Within two age groups – 54-63 years old and 73-93 years old – single women represented a higher percentage of total home buyers (25%).

In this study, SmartAsset took a closer look at where those women were buying homes the most. Using 2019 data from the Consumer Financial Protection Bureau (CFPB), we compared the number of approved mortgages for women with the number of approved mortgages for all homebuyers in almost 400 U.S. metro areas. For details on our data sources and how we put all the information together to create our final rankings, read our the Data and Methodology section below.

This is SmartAsset’s 2021 study on where women are buying homes. Check out the 2020 version here.

Key Findings

- North Carolina leads the top 15. There are four North Carolina metro areas in the top 15 of the study. Goldsboro and Rocky Mount claim second and fifth place, respectively, while Fayetteville and New Bern are ranked 11th and 12th. In 2019, mortgages for women accounted for an average of about 28% of all approved mortgages in those four North Carolina areas.

- Women are three times more likely to represent those approved for mortgages in the top 10 cities than in the bottom 10 cities. New women homeowners in the top 10 metro areas of our study average 29.07% of all approved mortgages in 2019, whereas women in the bottom 10 metro areas on the list made up an average of less than 11% of homebuyers. In the lowest-ranking metro area – Logan, Idaho-Utah – less than 4% of approved mortgages in 2019 were for single women.

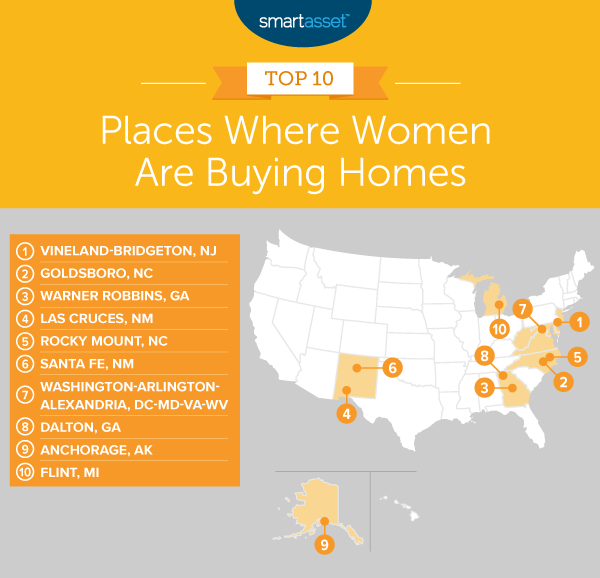

1. Vineland-Bridgeton, NJ

The Vineland-Bridgeton, New Jersey metro area claims the top spot out of all 395 metro areas in our study. In 2019, 32.23% of all new mortgages were owned by women homeowners. Specifically, women without co-signers took out 39 out of 121 total mortgages that year.

2. Goldsboro, NC

Data from 2019 shows that women homeowners took out 82 out of total 273 mortgages in Goldsboro, North Carolina. This means that 30.04% of mortgages were approved for women without co-signers.

3. Warner Robbins, GA

The Warner Robbins metro area is located roughly two hours southeast of Atlanta, which ranks in the top 10 of SmartAsset studies on the cities where women are most successful and the best places for women entrepreneurs. The metro area had 454 total mortgages approved in 2019, and women without co-signers took out 136 of them.

4. Las Cruces, NM

In 2019, women without co-signers represented 29.44% of those approved for mortgages in the Las Cruces, New Mexico metro area. Data shows that 53 out of 180 mortgages were approved for women without co-signers.

5. Rocky Mount, NC

The Rocky Mount, North Carolina metro area had 28.99% of its mortgages approved for women homeowners in 2019. CFPB data reveals that 120 out of 414 mortgages were taken out by women without co-signers.

6. Santa Fe, NM

In 2019, women represented 28.94% of all those approved for mortgages in the Santa Fe, New Mexico metro area. Of the total 463 mortgages approved, 134 were for women without co-signers.

7. Washington-Arlington-Alexandria, DC-MD-VA-WV

The Washington, D.C. metro area had 1,530 mortgages approved for women in 2019. That means 28.44% of 5,379 total mortgages were taken out by women without co-signers.

8. Dalton, GA

Dalton, Georgia claims the eighth spot out of all 395 metro areas in our study. In 2019, 30 approved mortgages were for women without co-signers, making up 27.78% of the total.

9. Anchorage, AK

In Anchorage, Alaska, 455 out of 1,653 mortgages in 2019 were for women. This means that women without co-signers make up 27.53% of the total new homeowners.

10. Flint, MI

The Flint, Michigan metro area rounds out our top 10. In 2019, 27.32% of approved mortgages, or 241 out of total 882, were approved for women without co-signers.

Data and Methodology

To find the places where women are buying the most homes, we looked at data for 395 metro areas and compared them across the following two metrics:

- Mortgages approved for women in 2019.

- Total number of mortgages approved in 2019.

Data comes from the Consumer Finance Protection Bureau’s Home Mortgage Disclosure Act database. For each metric, we counted only mortgages that were used to purchase homes rather than refinance an existing mortgage or those used for home improvements. We also only included conventional, first-lien mortgages. To isolate homes bought by single women, we analyzed home loans secured by women without a co-signer.

To rank metro areas, we divided the number of mortgages originated to women by the total number of mortgages approved in 2019. We then ranked places based on this figure.

Tips for New Homebuyers

- Consider a financial advisor. A financial advisor can help you make smarter financial decisions to be in better control of your money, an important thing for those investing in the housing market. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors, get started now.

- Prevent potential mortgage mishaps. The payments don’t stop after you’ve put money down; you’ll also need to make mortgage payments. Figure out what those might be before you move forward by using SmartAsset’s mortgage calculator.

- It pays to read the fine print. Though a mortgage is typically the largest expense for homeowners, other costs like closing costs, property taxes and home insurance can add up. These may seem small compared to the down payment, but costs can add up. Our comprehensive home buying guide has a property tax calculator, budget calculator and many informative articles that can help you make smart decisions regarding housing.

Questions about our study? Contact press@smartasset.com.

Photo credit: ©iStock.com/kate_sept2004