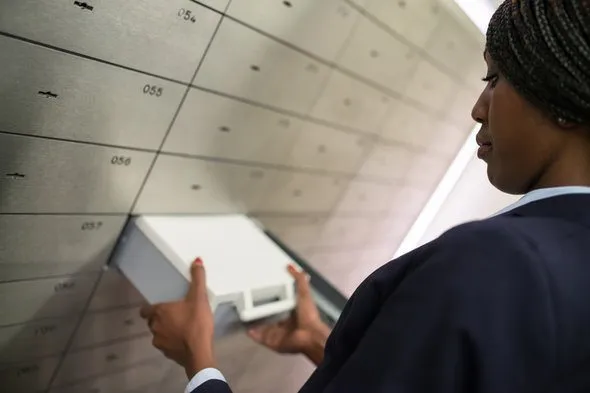

A safe deposit box, sometimes called a safety deposit box, is an individually locked box held within a larger vault. These are usually located in a bank, which is a very secure place to put it. These boxes come in a range of sizes and can be rented on an annual basis. People use them to store valuables, documents and other important items they want to be kept safe. Prices for a safe deposit box also vary from bank to bank, so check with your local branch to learn more.

If you are looking for ways to make your saving work for you, a financial advisor can help you create a plan to reach short- and long-term goals.

Are Safe Deposit Boxes Secure?

In terms of access, safe deposit boxes are very secure. Typically, each comes with two keys needed to open the box: one held by the bank and the other held by you, the box’s owner. When you go into the bank to access a safe deposit box, banks require identification. If someone else needs to access your box, they will need prior authorization from you. For extra security, don’t put any identifying information on your safe deposit box key, like the box number or bank’s name. This way, if you lose your key or someone steals it, no one will know what it belongs to.

Safe deposit boxes are housed in vaults with thick doors and walls, reinforced to keep them safe during hurricanes, tornadoes and other natural disasters. However, no space is entirely safe from natural disasters. You may want to place your items in waterproof containers to prevent water damage.

This might not sound any better than placing items in a safe at your own home. However, a thief can more easily break into your home and home safe than into a bank vault and deposit box. In case of a home robbery, robbers could force you to open your home safe or take the safe and open it by other means. Even if robbers broke into a bank’s vault, they could not open your deposit box without your key.

Is a Safe Deposit Box Insured Like a Bank Account?

Items kept in a safe deposit box are not insured by the bank or the Federal Deposit Insurance Corporation (FDIC). The FDIC only covers deposits like money in checking accounts, savings accounts or certificates of deposit. It does not cover physical items stored in a safe deposit box, even if the box is located at a bank. So in the event of theft or damage, the bank is not responsible for replacing them.

If you want your valuables to be protected, you’ll need to get separate insurance. One option is to purchase a rider, or add-on, to your homeowners or renters insurance. Riders can be used to cover specific high-value items like jewelry, rare coins or documents. Some insurance companies also offer policies specifically for safe deposit box contents.

Even though you will have to pay for the coverage yourself, many insurers may offer a lower rate for items stored in a safe deposit box because it is considered a secure location. If you’re storing valuable or irreplaceable items, it’s a good idea to talk to your insurance provider and make sure you have the right protection in place.

What Should You Store in a Safe Deposit Box?

Due to their secure nature, safe deposit boxes are an ideal place to store valuables and important documents. People typically store personal and property files, including original birth certificates, insurance policies, property deeds, car titles and U.S. bonds. You can also store items like gold coins, family heirlooms and photo negatives. Again, you may want to place paper items in waterproof containers for extra protection.

You shouldn’t use a safe deposit box to store passports, revocable living wills and powers of attorney. These are documents that need to be available without jumping through too many hoops. You also should avoid storing cash in your safe deposit box. Not only is it against the rules of many banks, it’s also safer in a bank account with FDIC insurance. Plus, stashing cash in a high-yield savings account can grow your money rather than let it sit idly.

Here’s a list of six things that are typically stored in a safety deposit box:

- Original copies of deeds: These valuable proof of ownership documents are best kept in a safe deposit box.

- Motor vehicle titles: As with deeds, these documents do not need to be readily accessed and can sit safely for months or years.

- Personal ID and legal records: This includes things like birth certificates, marriage certificates, divorce agreements, military discharge papers and social security cards.

- Estate planning documents: Copies of wills and trust documents can be stored safely, so long as you provide instructions on who will access the box after you’re gone.

- Business and financial documents: Stock, bond, and other financial security documents as well as any important contracts or paperwork related to your business interests.

- Heirlooms and other valuables: SAfe deposit boxes are great for storing jewelry, collectibles, or even things strictly with sentimental value. If you have any important digital files on flash or hard drive, consider adding them, too.

What Should You Not Store in a Safety Deposit Box

Avoid using a safe deposit box for anything you might need right away, especially in an emergency. Keep in mind that you can only get into your box during the bank’s regular hours. So, if you need something late at night or when the bank is closed, you’ll have to wait until it opens. Here are five things you may want to keep elsewhere:

- Cash: Any currency stored in a safe deposit box is not insured by the bank nor the FDIC. Safer to keep your money in a checking or savings account where you’ll have 24/7 access.

- Original will: Copies of estate planning docs are a great addition to a safe deposit box, but keep the originals on file with your lawyer or executor. Otherwise there could be significant delays to processing your estate if access to the box is an issue.

- Photo IDs: Things like passports and driver’s licenses should be stored at home as you’ll need them too frequently and may need to access them outside the bank’s operating hours.

- Medical or power of attorney documents: These need to be accessed during an emergency and will not be available if the bank isn’t open.

- Spare keys: You want to keep your backup keys safe but the limited access available to your safe deposit box makes it a bad choice for storing something you might need in a hurry.

It’s important to remember that no one can get into your safe deposit box unless you have pre-authorized them. Therefore, you may not want to store anything like medical directives or funeral arrangements. In those cases, you may not have time to pre-authorize anyone to access those documents. If you absolutely want to place these documents in a safe deposit box, you may want to authorize a trusted partner to access your safe deposit box in case of an emergency. That can minimize the risk of losing the box’s contents.

How Much Do Safe Deposit Boxes Cost to Rent?

The cost to rent a safe deposit box depends on the size of the box and location of your bank, ranging from about $20 for a small box to $200 for a large one. A small box is typically three inches by five inches, the size of an index card, and a foot long. Safe deposit boxes come in a range of sizes up from there, with the largest being 10 inches by 10 inches and two feet deep.

Prices not only differ between banks but can also vary by bank location. You should call your local bank branch to find out the annual rental costs for their safe deposit boxes. If you have a checking account, it may include a free or discounted box in its perks. If you don’t pay your rent for the box, the bank will seize the contents, so be sure to pay.

The table below has common and past prices for a safe deposit box at five major banks. Again, actual prices and availability vary by bank, location and time frame.

Average Safe Deposit Box Prices

| Box Size (inches) | 3×5 | 5×5 | 3×10 | 5×10 | 10×10 |

| Bank of America | $77 | $104 | – | $152 | $192 |

| Wells Fargo | $60 | – | $55 | $100 | – |

| PNC | $40 | – | – | – | $110 |

| TD Bank | $58 | $90 | $130 | $158 | $275 |

Where Can I Rent a Safe Deposit Box?

The safest place to rent a safe deposit box is a bank where you have an account. Banks specialize in storing money and they typically have dedicated, secured vaults for safe deposit boxes. If you want to rent a safe deposit box, call or visit your local bank branch. Often, there are waiting lists for safe deposit boxes. This means you may not get a box at the same time you go to open one. You may even decide to shop around to find a bank with available space.

If you just need to store copies of important documents and information, you can also try a virtual safe deposit box. Fidelity is one company that offers this service, providing free encrypted storage space to users. This is a convenient way to keep copies of files like birth certificates, passports, property deeds and more. An added benefit is the ability to access the files from any computer in the world, in case of emergency while traveling.

Pros and Cons of Using a Safe Deposit Box

Because reserving a safe deposit box comes with an ongoing rental fee, you will likely want to take the time to consider whether or not it’s the right fit for your budget. Here’s a breakdown of pros and cons to help you decide.

Pros:

- Unparalleled security: There is literally nowhere safer to store valuables than a locked box inside a bank vault that is under 24/7 surveillance.

- Disaster-proof (almost): Banks are designed to withstand environmental extremes most homes aren’t, and using a safe deposit box means that things like tornadoes, floods, and fires won’t be a concern.

- Limited access: You will be able to control who has access to the box and can rest easy knowing that your valuables are under the best possible protection.

Cons

- Business hours: Because your box resides inside a bank you will only have access to it during the bank’s operating hours. This can cause problems if there’s an emergency during holidays or non-working hours.

- Uninsured: Unlike bank accounts, which are backed by the FDIC, the contents of your safe deposit box are not protected unless you purchase a separate policy yourself.

- Estate planning: Without careful planning a safe deposit box can complicate estate planning procedures if the deceased did not set up protocols for who has access to it after their passing.

- Costs: In addition to the annual fees charged by the bank for reserving the box, there are additional fees for copying or replacing the keys.

Frequently Asked Questions

What Happens to a Safe Deposit Box When the Owner Dies?

When a safe deposit box owner dies, the bank will typically seal the box and require legal documentation from the estate to access and distribute the contents. Improper or incomplete documentation can lead to lengthy legal work, so it’s important that anyone with a safe deposit box set up clear instructions as part of their estate planning.

What Happens to Safe Deposit Boxes That Are Abandoned?

Boxes that are deemed abandoned, either from excessive periods of inactivity or unpaid fees, go through a process called escheatment. This is a formal legal process where the contents of the box are turned over to the state. The state then holds it for a period of time to be claimed by a rightful heir, or the property is legally disposed of.

Bottom Line

Safe deposit boxes offer a secure place to store your most valuable items. Banks and their heavily protected vaults are designed to protect its contents safe from theft and natural disasters. However, it’s not ideal for all valuable items, like passports or your will. You’ll still want to keep these items safe, of course, just more accessible than in a safe deposit box. If you’re thinking about opening a safe deposit box with your bank, you should call sooner rather than later since there may be a wait list.

Tips for Safe Banking

- No matter where you bank, your money and information are at risk. Monitor your checking and savings accounts periodically and check your bank statements carefully to ensure you have authorized each transaction.

- Do you have questions about how your savings rate can play a role in your long-term financial plan? A financial advisor can help with that. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Photo credit: ©iStock.com/simonkr, ©iStock.com/kali9, ©iStock.com/Tashi-Delek