The American Dream of homeownership and financial independence is a hallmark of middle-class life. Indeed, working hard defines this cohort’s pull-yourself-up-by-your-bootstraps sensibility. But earning and saving up enough money to afford a down payment comfortably and reduce financial stress is getting increasingly difficult. With inequality on the rise in America, the middle class is getting squeezed on both sides. That has made many Americans in this demographic wonder how much money they can really save and whether they will be prepared come retirement. Some states, however, are better for the middle class than others. Below we look at metrics related to income, homeownership and taxes to find the best states for the middle class.

In order to rank the best states for the middle class, we looked at data on the percent of households in the middle class, percent of households below the middle class, number of new middle-class jobs, percent growth in middle-class jobs, effective property tax rate, the effective income tax rate, median home value and homeownership rate. Check out our data and methodology below to see where we got our data and how we put it together to create our final ranking.

Key Findings

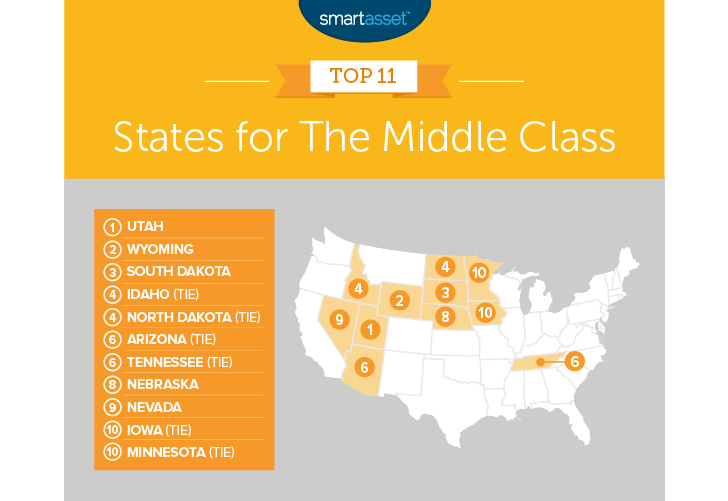

- Go West – The best states for the middle class are clustered in the Western part of the U.S. For example, three of the top five states for the middle class are Utah, Wyoming and Idaho.

- Midwest scores well – Other than Western states, it is states in the Midwest that score best. All but one state in our top 10 lies in either the Midwest or the Western portion of the country.

- Tough for the middle class in the Northeast – With high tax burdens, low homeownership rates and unaffordable housing, it is not too surprising that states in the Northeast tumble down the ranks. Five of the worst-ranked states are New Jersey, Massachusetts, Rhode Island, New York and Connecticut. (Only Washington, D.C. ranks lower, at dead last.)

1. Utah

The Beehive State takes the top spot as the best states for the middle class. Utah possesses the largest proportion of middle class households in our study, with just over 49% of households earning between $35,000 and $100,000. This state has also seen impressive growth in middle-class jobs. This makes it a great state to be in the middle class and also means the state can support a larger middle class. Utah also has a homeownership rate of 70%, which is a top-10 rate.

2. Wyoming

Wyoming, according to our data, is a place where the middle class is excelling. More than 46% of households are part of the middle class, according to our definition. That’s a top-15 rate. That figure may continue to climb if the current pace of middle-class job growth holds up. From 2003 to 2017, the number of middle-class jobs grew by 59%. In that metric, Wyoming ranks second.

3. South Dakota

South Dakota contains a sizeable middle class. Current U.S. Census Bureau data reveals just over 49% of South Dakota households qualify as middle class. Another good sign for the middle class in South Dakota is the low income tax rate. This state has a top-10 effective income tax rate. While South Dakota may not be able to support a ton of new middle-class families, the number of new middle-class jobs is on the rise. From 2003 to 2017, the number of middle-class jobs grew by 23% in South Dakota.

4. (tie) Idaho

Idaho occupies the fourth spot, tied for that honor with North Dakota. Nearly a majority of Idaho households are in the middle class, a fact that boosts the state up in the rankings. Another positive signal that Idaho will continue to be a stronghold for the middle class in the future is the job growth numbers. From 2003 to 2017, the number of middle-class jobs in Idaho increased by 31%.

4. (tie) North Dakota

North Dakota comes in tied with Idaho for fourth. This state owes its spot in this top 10 to the fantastic growth in middle-class jobs. From 2003 to 2017, the number of middle-class jobs doubled. Concerning total jobs, that is an increase of more than 139,000 jobs that pay between $30,000 and $70,000 per year. Middle-class residents here also don’t pay too much in income tax. North Dakota ranks 10th in effective income tax.

6. (tie) Arizona

One of the most popular states for retirees comes in sixth. Arizona is one of the best states in the country for securing a middle-class job. Arizona saw its number of middle-class jobs grow by nearly 300,000 between 2003 and 2017. That equals job growth of 28%. The middle class in Arizona is also reasonably large, equaling nearly 46% of all households. Arizona also promotes homeownership for the middle class with its low property tax rate.

6. (tie) Tennessee

For the sixth spot, it’s a toss-up between Arizona and Tennessee. The middle class in Tennessee is not too tax-burdened. In both property taxes and income taxes, Tennessee ranks in the top 15. Middle-class jobs in Tennessee are more available than they used to be. Our data shows that the number of people working middle-class jobs in Tennessee grew by just under 270,000 from 2003 to 2017.

8. Nebraska

Nebraska takes eighth. In many of our studies, Nebraska and its large cities, like Omaha and Lincoln, tend to rank well for their impressive job figures. This is also the case for Nebraska and middle-class jobs. In both number of middle-class jobs and percent growth in middle-class jobs, Nebraska ranks in the top 20. Nebraska ranks in the top half for all but two metrics. If Nebraska wants to improve its score going forward, it could look to lower its property taxes. Nebraska has some of the highest property taxes in the nation.

9. Nevada

Nevada has a large middle class. Census Bureau data reveals that more than 46% of households in Nevada have an income placing them in the middle class. The Silver State is also in a handful of states that do not add state income tax. Overall, Nevada ranks in the top 15 in four separate metrics to crack the top 10.

10. (tie) Iowa

For middle-class households who place a high value on homeownership, Iowa is the state to be. Iowa has some of the most affordable homes in the country. The median home, Census Bureau data shows, is worth just $142,300. That has kept the middle class within range of homeownership. Just under 71% of homes are owner-occupied, a top-five rate.

10. (tie) Minnesota

Last but not least is Minnesota. This state scored above average in the majority of metrics without securing many top-10 rankings. Minnesota only claimed top-10 spots in homeownership rate and total job growth. Yet, sometimes overall consistency is more important than taking the top spot in any one metric. Minnesota also only ranked below average in two metrics, which is how Minnesota finished as the 10th best state for the middle class.

Data and Methodology

In order to rank the best states for the middle class, we looked at data for all 50 states and Washington, D.C. Specifically, we looked at the following eight metrics:

- Percent of households in the middle class. This is the percent of households with an income between $35,000 and $100,000. Data comes from the U.S. Census Bureau’s 2017 1-Year American Community Survey.

- Percent of households below the middle class. This is the percent of households that earn under $35,000. Data comes from the U.S. Census Bureau’s 2017 1-Year American Community Survey.

- Total middle-class job growth. This is the growth in jobs earning between $30,000 and $70,000 between 2013 and 2017. Data comes from the Bureau of Labor Statistics.

- Percent change in middle-class job growth. This is the percent change in jobs earning between $30,000 and $70,000 from 2003 to 2017. Data comes from the Bureau of Labor Statistics.

- Average effective property tax rate. This is the average effective property tax rate. Data comes from the U.S. Census Bureau’s 2017 1-Year American Community Survey.

- Effective income tax rate. This is the average amount a household earning $56,000 per year would pay in income taxes. Data comes from SmartAsset’s Places With the Lowest Tax Burden study.

- Median home value. Data comes from the U.S. Census Bureau’s 2017 1-Year American Community Survey.

- Homeownership rate. Data comes from the U.S. Census Bureau’s 2017 1-Year American Community Survey.

First, we ranked each state in each metric. Then we found each state’s average ranking and gave double weight to the percent of households in the middle and a single weight to all other metrics. We assigned a score to all states based on their rankings. The state with the best average ranking received a 100. The state with the worst average ranking received a 0.

Tips for Investing in a Home You Can Afford

- Save early – Buying a home is no different than most financial plans people make. The more prepared you are, the easier the homebuying process will be. So in order to be prepared when it’s time to purchase a home, make sure you have a down payment saved up. It can take years of saving to hit your desired down payment figure, so start early.

- Watch out for extras – It can be tempting to buy the best home you can, the one with the mortgage that you can just barely afford. But before you do that, make sure you are accounting for all the costs you incur during homeownership. Homeowners also have to pay property taxes and homeowner’s insurance. If you stretch your finances too thin on the mortgage, you may have nothing left to pay for the other costs.

- Ask an expert – Despite all the hoopla around homeownership, not everyone should become a homeowner. People who move around a lot, for example, may not be good candidates for homeownership. People who live in depressed housing markets also should probably avoid investing in housing. But doing the math on all that can be difficult, so why not get an expert’s opinion? A financial advisor can advise you on whether or not you should become a homeowner. If you are not sure where to find a financial advisor, check out SmartAsset’s financial advisor matching tool. It will match you with up to three local financial advisors who fit your investing needs.

Questions about our study? Contact press@smartasset.com.

Photo credit: ©iStock.com/monkeybusinessimages