Overview

Santander Bank offers some high interest rates on its bank accounts. However, these high rates are mostly reserved for high account balances (think over $10,000) and linked relationship accounts. This means you’d benefit best by opening a savings account and a checking account with this bank instead of just one or the other.

Additionally, the bank stands out for its products and resources for students. There are a couple accounts geared toward younger owners and programs to help universities and its students. This makes Santander a good choice for students who may need some extra money management guidance.

Read on below to explore Santander's many offerings.

| Product | Key Features |

| Savings Accounts |

|

| Certificates of Deposit |

|

| Money Market Account |

|

| Checking Accounts |

|

Santander Bank Interest Rate Comparison

Santander Bank Overview

Although new and still limited in its United States presence, Santander Bank is part of a larger company, Santander Group, which serves more than 100 million customers in the United Kingdom, Latin America and Europe. Here in the U.S., you can find the bank headquartered in Boston, at hundreds of its Northeast branches and thousands of Santander ATMs.

The bank even has a program called Santander Universities which seeks to support higher education. The bank collaborates with over 1,000 colleges, universities and research centers to help expand programs in college readiness, service learning, study abroad and more.

For its customers, Santander aims to provide the most comprehensive financial experience. This is done through plenty of financial products, services, materials and personal bankers to help you reach your financial goals.

Santander Bank Savings Overview

Santander Bank offers a few kinds of banking accounts, from a simple savings account to a Premier interest-earning checking account. However, the accounts that earn at the best interest rates seem to be the certificates of deposit.

Whichever account you choose to open, you’ll have access to hundreds of branches and more than 2,000 Santander ATMs across the Northeast. You also have the ability to complete most of your banking needs online and on the bank’s mobile app. The bank also guarantees real-time fraud monitoring and Switch Services if you’re moving your funds from another bank.

Compare Santander Bank to Other Competitive Offers

Santander® Savings Account

| Key Features | Details |

| Minimum Deposit | $25 |

| Access to Your Savings Account | Online, mobile, over the phone and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | $1 monthly fee, waivable with one of the following

|

| Current Terms and Rates | 0.01% APY |

The Santander® Savings Account is the first and simplest of the bank’s savings offerings. You can open the account at a low minimum deposit requirement and a low monthly fee. You can even waive the monthly fee by owning a Santander checking account in addition to this savings account. Plus, this account relationship can save you from checking account overdrafts and the fees that come with it.

Savings is made easier with AutoSave which makes automatic and recurring transfers from your checking account. The bank will also provide consolidated statements. This puts all your Santander accounts in one place rather than shuffling through to find the right one.

Santander® Youth Savings

| Key Features | Details |

| Minimum Deposit | $10 |

| Access to Your Savings Account | Online, mobile, over the phone and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | None |

| Current Terms and Rates | Call the bank to find out your local rates. Rates below are based on a Customer Service phone call with SmartAsset.

|

This savings account is made to help minors under the age of 18 learn how to use and manage their money. You can open the account with a small minimum deposit of $10 and watch it grow according to the interest rate. That can show your child just how interest works and how saving can pay off. It can also help to encourage children to stash away their extra birthday money or allowance instead of spending it right away.

It’s important to note that you must visit a branch to open this account, so it won’t be available to everyone.

Santander Certificates of Deposit (CDs)

| Key Features | Details |

| Minimum Deposit | $500 |

| Access to Your Savings Account | Online, mobile, over the phone and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | No monthly fees, but you could face penalties for early withdrawal. |

| Current Terms and Rates | Call the bank to find out your local terms and rates.

|

Certificates of deposit offer a more structured savings account. You choose a CD with a set term length, make your deposit and let it be until the term is over, or reaches maturity. You usually cannot make any deposits or withdrawals until maturity. Luckily, Santander Bank offers a variety of CD term lengths.

Santander CD accounts provide some added flexibility when it comes to your interest earned. You can either roll it back into your CD to earn more, or you can transfer it to your checking, savings or money market savings account. That would allow you to take advantage of your savings in a more immediate way.

Unfortunately, the bank’s website is not too forthcoming on the account rates. CDs tend to have a wide range of options and rates. To find the most accurate offerings, you’ll have to give the bank a call, send an email or visit a branch if there’s one near you.

Santander® Money Market Savings

| Key Features | Details |

| Minimum Deposit | $25 |

| Access to Your Money Market Account | Online, mobile, over the phone and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees |

|

| Current Terms and Rates |

|

This is Santander Bank’s standard money market account. Money market accounts are like a mix of a savings and checking account. For one, this Santander® Money Market Savings account comes with check writing abilities. You can write up to six money market checks (or make transfers) each statement cycle. The account charges a low monthly fee, which you can waive in a couple different ways. For one, you can simply open a Santander Checking account. Secondly, you can maintain an average daily balance of at least $10,000.

Santander Money Markets offer pretty high interest rates, but only when you also have a checking account with the bank. Without this relationship, your interest rate options will drop significantly. It’s also important to note that the monthly interest rates are only locked in for six months. After that, the rate is subject to change and most of the time, that rate is lower. To keep the same rate, you may have to deposit an additional $10,000 into the account.

This money market account also includes an Auto Save feature to help make saving more automatic and convenient by making recurring transfers from your checking account. You’ll also be able to set up overdraft protection to cover any shortfalls in your checking account with your money market account. Keeping track of these accounts is made easier by consolidated statements that shows your various accounts in one statement rather than multiple.

Santander® Select Money Market Savings Account

| Key Features | Details |

| Minimum Deposit | $25 |

| Access to Your Money Market Account | Online, mobile, over the phone and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | None |

| Current Terms and Rates |

|

The Santander® Select Money Market Savings Account comes with many of the same perks as the standard money market account. However, owning this account gives you special access to a personal, dedicated banker who can coordinate your banking needs. This means you don’t have to call the regular customer service line. Instead, you can speak to a professional banking specialist about your account concerns and questions.

In order to open a Santander® Select Money Market Savings, you must also have a Santander Select Checking account. This eliminates the monthly fee, separate statements and the hassle of money transfers. It also boosts your interest rates significantly.

Checking Accounts: Santander Simply Right® Checking

| Key Features | Details |

| Minimum Deposit | $25 |

| Access to Your Checking Account | Online, mobile, over the phone and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees |

|

You can get a simple savings accounts here, the Santander Simply Right® Checking account. You never have to meet any minimum balance requirements. That leaves you to use your checking account however you need, making deposits, paying bills and more.

True to its name, the Simply Right® Checking offers a simpler way to manage your money. There is a $10 monthly fee to keep the account, but it’s the easiest checking account fee to waive. As long as you use the account as you should, making at least one transaction each month, you get to avoid the monthly fee.

Owning an account can waive the monthly fee for a Santander® Savings or Santander® Money Market Savings account. It’s also better for you (and the environment) to sign up for Paperless eStatements. That allows you to avoid a $3 fee per statement for paper statements.

Checking Accounts: Santander® Select Checking

| Key Features | Details |

| Minimum Deposit | $50 |

| Access to Your Checking Account | Online, mobile, over the phone and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | $25, waivable with a combined balance of at least $25,000 in deposits and investments. |

| Current Terms and Rates | Interest bearing. |

If you’re looking for more perks and benefits with your checking account, the Santander® Select Checking could be for you. For starters, it earns interest unlike the bank’s other checking accounts. The interest rate is the lowest you can go, although it’s a good start for a checking account.

As a Select account, you’ll have access to a Select World Debit MasterCard. You’ll also be able to open a Santander® Select Money Market Savings account.

Checking Accounts: Student Value Checking

| Key Features | Details |

| Minimum Deposit | $10 |

| Access to Your Checking Account | Online, mobile, over the phone and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees |

|

In order to open a Student Value Checking account, you must be between the ages of 16 and 25. This helps students easily manage their money while also focusing on their studies. Students also don’t have to worry about fitting this account into their already tight budgets since there is no minimum balance requirement or a monthly fee.

Students will also appreciate the ease of online banking, mobile banking and wallets and paperless statements. You can also customize email and text message alerts to stay on top of your accounts.

If you want to save more (what student doesn’t?), account ownership also waives the monthly fee for a Santander® Savings or Santander® Money Market Savings account.

Where Can I Find Santander Bank?

You can find the bank online, on its variety of mobile apps or at one of a few hundred physical branches. However, the bank has branches only in Connecticut, Delaware, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania and Rhode Island. To find out if there’s a branch or ATM near you, you can use the Santander Bank Branch and ATM location tool.

If you’re not in the United States, you can find the bank in Mexico, Colombia, Puerto Rico, Peru, Brazil, Chile, Uruguay, Argentina, Spain, Portugal, the U.K., Belgium, Germany and Poland.

What Can You Do Online With Santander Bank?

With limited physical locations, Santander provides much of its information and offerings online (homepage shown here). You can find out about its personal and business bank accounts and apply to most of them online, too. Once you are a customer, you can easily access all your accounts online.

However, what you cannot do online is find the bank’s rates for its accounts. To do this, you will have to call customer service. There is a specific prompt in the automatic answering machine that connects you with a representative who can tell you about the bank’s rates.

How Do I Access My Money?

You can access your money anywhere you can find Santander Bank. This means at over 500 branches and more than 2,000 ATMs. Branches are limited to 11 Northeast states, but you can find Santander ATMs at many CVS/pharmacy locations. You’ll be able to use your debit MasterCard at these locations.

If you don’t have physical access to these locations, you can manage your money with online and mobile banking. Once you have an account, or accounts, you’ll be able to log in with your online banking information and access those accounts. There, you can make transfers, pay bills or simply check on your balances. Plus, you can use Mobile Check Deposit to deposit checks on the go.

How Can I Save More Money With a Santander Bank Account?

For starters, the bank offers its customers the benefit of low or nonexistent monthly fees for its accounts. Even if there is a fee, you can often waive it in a few different ways.

When it comes to interest rates, it doesn’t offer the highest in the industry. This is especially true for its standard savings accounts. Your best bet to earn at the highest interest rates is to open a longer term CD account.

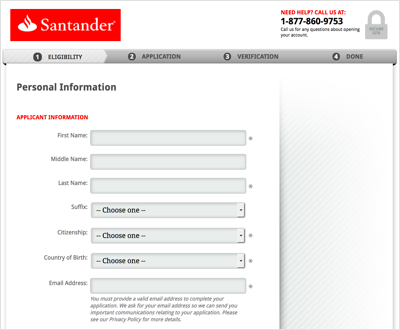

What’s the Process for Opening an Account With Santander Bank?

You can easily open a savings, money market savings or a checking account online. All you have to do is go to the account page and click an “Open Now” button. That will lead you to the webpage shown here, where you'll begin your application. You will have to visit a branch in-person to open a Santander® Youth Savings or CD account. You can also call the bank to open a CD account at 1-877-768-2265.

No matter how you apply for an account, you'll need to provide your Social Security number, a government-issued ID and a valid email address. You'll also have to fund the account at opening when there is a minimum deposit.

What’s the Catch?

A big catch to this bank is that it is not entirely forthcoming about its accounts’ interest rates. Unlike all other banks we’ve reviewed, there is no information about rates or account balance tiers on the website. You will have to call customer service to find out the rates you can see based on the state you plan to open the account in.

Further, the rates from this bank aren’t the most competitive. If you want a simple savings account, your money will be growing at the lowest rate possible. The bank’s best rates are available with a CD account.

Bottom Line

Santander Bank has some solid offerings, although they tend to be the higher-end Premier accounts. These accounts require high account balances and relationship accounts to earn at the highest interest rates possible. You’ll also have access to a personal and professional banker at all times. Otherwise, you’ll be subjected to some of the industry’s lowest-earning interest rates.