Overview

Regions Bank and its account offerings are limited to customers in the 15 following Southern and Midwestern states: Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, North Carolina, South Carolina, Tennessee and Texas. If you do not reside in these areas, you won’t be able to open a Regions Bank account. If you are eligible, you’ll have your choice of a number of bank accounts from a simple savings account to a CD IRA.

However, Regions Bank offers some of the lowest interest rates in the industry. Most accounts detailed below offer the lowest rate, with only a Promotional CD account offering competitive numbers. If you want accounts with the highest rates and no monthly fees, you’ll want to look somewhere else.

Read on below to explore Regions' many offerings.

| Product | Key Details |

| Savings Accounts |

|

| Certificates of Deposit |

|

| Money Market Accounts |

|

| Checking Accounts |

|

| IRAs |

|

Regions Bank Interest Rate Comparison

Regions Bank Overview

Regions Bank is a subsidiary of the financial services company Regions Financial Corporation, which was founded in 1971 in Alabama. Today, the company is still headquartered in Alabama, with its thousands of branches and ATMs spread out through 15 Southern and Midwestern states. These states are Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, North Carolina, South Carolina, Tennessee and Texas. You cannot open an account outside of these areas.

Regions offers more than personal banking accounts. You can also find small business loans and services, wealth management services, mortgages and more.

Regions Bank Account Features

Regions Bank offers a wide variety of bank accounts from a simple savings account to a Promotional CD with competitive interest rates. Unfortunately, the banks other accounts offer some of the lowest rates out there. If you do open an account with Regions, you’ll have access to online and mobile Banking as well as over 1,500 branches and just under 2,000 ATMs. The website even has an “Insights” section to provide customers with tools and tips for money management.

The bank also offers the opportunity to participate in a couple rewards programs, Relationship Rewards® and the Cashback Rewards® programs, when you have a checking account. These programs allow you to earn cash and points rewards through your everyday spending.

Compare Regions Bank to Other Competitive Offers

Regions LifeGreen Savings and Regions Savings Accounts

| Key Features | Details |

| Minimum Deposit |

|

| Access to Your Savings Account | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees |

|

| Current Terms and Rates | Rates based on the bank’s headquarters zip code, 35203

|

These two savings accounts earn at the same low interest rate. They also offer overdraft protection and discounts on a safe deposit box. Additionally, the Regions LifeGreen Savings account offers some added perks when compared to the simpler Regions Savings account. With a Regions LifeGreen Savings account, you can avoid a monthly maintenance fee and a minimum balance requirement. You will, however, have to own a Regions checking account to open a LifeGreen Savings account and meet a minimum opening deposit requirement. This requirement equals either $50 if you open online or $5 if you open the account at a branch and set up an automatic recurring monthly transfer from your Regions checking account.

This account also offers the opportunity to earn a 1% annual savings bonus up to $100. You can snag this bonus by making a monthly automatic transfer of at least $10 from your Regions checking account to your LifeGreen Savings account for the first 12 months of account ownership. These transfers will earn the 1% savings bonus.

The Regions Savings account offers a more standard approach to savings. There is a low monthly fee of $5, but if you want to avoid that small charge, you can maintain a minimum daily balance of at least $300. You can set up automatic transfers to make the requirement more achievable. You don’t have to link a checking account, but you do still have the option to do so. That could help with automatic transfers and overdraft protection.

Savings Account: Savings for Minors

| Key Features | Details |

| Minimum Deposit | $5 |

| Access to Your Savings Account | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | None |

| Current Terms and Rates | Rates based on the bank’s headquarters zip code, 35203

|

This account is geared toward customers under the age of 18, allowing you to help a child learn more about money and saving. With online and mobile banking, they can easily set up automatic transfers and watch their money grow, learning good savings habits along the way. Plus in today’s technology age, you and your child can bank wherever and whenever with Text Banking and the bank’s mobile app.

You will have to visit a bank branch to open a Regions Savings for Minors account.

Certificates of Deposit (CDs): Promotional CD

| Key Features | Details |

| Minimum Deposit | $500 |

| Access to Your CD | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | No monthly fees, but you’ll face a penalty fee for early withdrawal. |

| Current Terms and Rates | Rates based on the bank’s headquarters zip code, 35203

|

A Regions Promotional CD offers just that: promotional rates that are only available for a limited time. You’ll have to check with the bank to determine whether the promotional rates are available at the time you want to open an account.

While it’s not required, if you also have a Regions checking account you can snag Relationship Pricing rates with your CD. The rates listed on the bank’s website represent these Relationship Rates. Without the checking account, you’ll earn Standard Pricing rates. To learn about the Standard Pricing rates in your area, you’ll need to call or visit the bank to speak with a customer service representative. You’ll need to make an in-person appointment at a branch to open a Promotional account anyway.

Once you have a CD, you can be assured that it is eligible for automatic renewal. This means that if you don’t take any action to withdraw or transfer that money, the account will renew for the same term length at the market rate at the time of renewal.

You also have flexibility in where you want your CD funds to go. Interest is compounded daily and paid according to the terms of the CD whether monthly, quarterly, semi-annually, annually or at maturity. This differs from many other CDs which only payout at maturity. Plus, you can choose whether you want your funds to go toward your Regions checking, savings or money market account.

Certificates of Deposit (CDs): Regions CD

| Key Features | Details |

| Minimum Deposit |

|

| Access to Your CD | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | No monthly fees, but you’ll face a penalty fee for early withdrawal. |

| Current Terms and Rates | Rates based on the bank’s headquarters zip code, 35203

|

A regular CD comes with most of the same features as a Promotional CD, outlined above. This includes automatic renewals, flexible interest disbursements and interest compounded daily. Again, having a Regions checking account can qualify you for Relationship Pricing rates. To find out the Standard Pricing rates in your area, you’ll need to contact a customer service representative at the bank.

The main difference between a Promotional CD and a regular CD is the interest rates. The Promotional CDs earn at much higher rates for similar term lengths. However, another difference is that you’ll have to deposit at least $10,000 into a Promotional CD to start earning at those high rates. A regular Regions CD has two much lower deposit requirements, depending on the CD term.

Regions Money Market Account

| Key Features | Details |

| Minimum Deposit | $100 |

| Access to Your Money Market Account | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | $12 monthly fee, waivable with a minimum daily balance of at least $2,500 |

| Current Terms and Rates | Rates based on the bank’s headquarters zip code, 35203

|

A money market account is like a cross between a savings account and a checking account. The Regions Money Market Account includes check-writing abilities, account statements with check images and a 30% discount on a safe deposit box. It’s important to remember that checks are included in the outgoing transaction limit implemented with savings accounts. You can only make six transfers or payments per statement period. Any transactions outside of that will face a fee.

Having a money market account allows your money to safely grow inside an account, while also offering more flexibility in your usage. Plus, you can link your Regions Money Market Account with your Regions Checking account to provide Overdraft Protection.

Regions Premium Money Market Account

| Key Features | Details |

| Minimum Deposit | $100 |

| Access to Your Money Market Account | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | $15 monthly fee, waivable with one of the following

|

| Current Terms and Rates | Rates based on the bank’s headquarters zip code, 35203

|

If you’re looking for a money market account with more perks and opportunities to earn more, you can check out the Premium Money Market Account. Owning a Regions checking account with direct deposit or maintaining a minimum daily balance of at least $2,500 can earn you better interest rates. Linking a checking account can also provide that account with Overdraft Protection.

You’ll still have access to check writing, statements with check images and an even bigger discount for a safe deposit box.

More notably, this Premium Money Market Account earns at higher rates with higher account balances. You stand to earn the most with this account if you have the highest account balance and meet the relationship rate requirements.

Checking Accounts: LifeGreen® Checking Account

| Key Features | Details |

| Minimum Deposit | $50 |

| Access to Your Checking Account | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees |

|

The LifeGreen® Checking Account charges a slightly high fee, regardless of statement delivery type. However, you can waive the LifeGreen® Checking Account fee by meeting balance or direct deposit requirements.

Otherwise, the account offer someme perks and benefits. This includes a 30% safe deposit box discount, relationship rates for a LifeGreen Savings Account and CD accounts, overdraft protection and discounts for qualifying installment loans. You can even block further transactions from your Regions card with Regions LockIt on your Regions mobile app.

You’ll also have the option to participate in the Relationship Rewards® and the Cashback Rewards® programs with your Regions Visa® CheckCard. If you are a service member, you can provide your Military ID to waive the bank’s ATM fees at non-regions ATMs. This works for two transactions per statement cycle.

Checking Accounts: LifeGreen eAccess Account®

| Key Features | Details |

| Minimum Deposit | $50 |

| Access to Your Checking Account | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | $8, waivable with any combination of at least 10 Regions CheckCard and/or credit card purchases per statement cycle |

As its name suggests, this checking account takes a more technological approach to the checking account. For starters, you’re only allowed to write three free checks. Any checks after that will cost $0.50 each. This encourages accountholders to use Regions Visa® CheckCard instead. You also cannot receive paper statements, instead having free access to Online and Mobile Banking and Standard Delivery Bill Pay.

As for extra perks, you’ll still receive a discount for a safe deposit box and qualifying installment loans, better rates for a LifeGreen Savings Account and CDs and overdraft protection. You can also participate in the Relationship Rewards® and Cashback Rewards® programs and waive ATM fees with your Military ID.

Checking Accounts: LifeGreen Preferred Checking® Account

| Key Features | Details |

| Minimum Deposit | $50 |

| Access to Your Checking Account | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | $18, waivable with one of the following

|

| Current Terms and Rates | Rates based on the bank’s headquarters zip code, 35203

|

The LifeGreen Preferred Checking® Account is the more elite checking account at Regions Bank. For one, it’s the only Regions checking account that earns interest, albeit at the lowest rate. This triggers a higher monthly fee. While you can waive this fee in a few different ways, they all require high account balances, making this account better for higher earners.

The account’s monthly fee and interest-earning abilities sets it apart from the other checking accounts. The other perks remain the same, except you can snag better rates on a Premium Money Market account and a 50% discount on a safe deposit box.

Checking Accounts: LifeGreen® Checking Account for Students and LifeGreen® 62+ Checking Account

| Key Features | Details |

| Minimum Deposit | $50 for both accounts |

| Access to Your Checking Account | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees |

|

In order to open a LifeGreen® Checking Account for Students, you will need to be aged 25 or younger. It offers a fee-free checking account to help students get more acquainted with checking accounts and responsible money habits.

To the opposite, the LifeGreen® 62+ Checking Account is available to customers aged 62 or older. There is a low monthly fee with this account, although you can waive the fee in a couple of ways including a recurring direct deposit into the account. This can be something like a recurring paycheck or government benefit deposits.

Both accounts still come with the perks of the other checking accounts. This includes a 50% discount on a safe deposit box, better rates on a LifeGreen Savings Account and CDs, discounts on qualifying installment loans and the option to participate in the Relationship Rewards® and Cashback Rewards® programs. Plus, if you’re a student or retiree with a Military ID, you can still waive some ATM fees.

Regions Fixed-Rate IRA

| Key Features | Details |

| Minimum Deposit | $250 |

| Access to Your Checking Account | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | None |

| Current Terms and Rates | Rates based on the bank’s headquarters zip code, 35203

|

This Regions Bank IRA works similarly to a CD. You can open a fixed-rate IRA - either as a Roth or traditional IRA - for a term length between six to 60 months. The interest rate that applies at the opening will apply for the term’s entirety.

Regions Money Market IRA

| Key Features | Details |

| Minimum Deposit | $50 |

| Access to Your Checking Account | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | None |

| Current Terms and Rates | Rates based on the bank’s headquarters zip code, 35203

|

This IRA works like a money market account allowing you to make regular deposits of $25 or more. Plus, you can rollover IRA funds and make withdrawals at any time. You can also link this IRA to a checking or savings account and set up automatic and recurring deposits. That way your retirement savings will always be growing. Again, this account can be opened as either a Roth or a traditional IRA.

Regions 18-Month Variable-Rate IRA

| Key Features | Details |

| Minimum Deposit | $250 |

| Access to Your Checking Account | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | None |

| Current Terms and Rates | Rates based on the bank’s headquarters zip code, 35203

|

This third IRA option from Regions Bank offers a variable rate of interest over a fixed term of 18 months. The rate equals the sum of the most recent discount auction rates of the six-month Treasury Bill and 4.00%.

During the 18-month term, you can make additional deposits as long as they are at least $50. Once the term is over, you can withdraw or transfer your money or leave the account alone for automatic renewal.

Where Can I Find Regions Bank?

You can find Regions Bank online, on its mobile app, over the phone or at a physical branch. The bank’s branches and account offerings are limited to 15 Southern and Midwestern states, however. These states are Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, North Carolina, South Carolina, Tennessee and Texas. If you do not live in these areas, you will not be able to open an account with the bank.

What Can You Do Online With Regions Bank?

You can open a few different Regions Bank accounts on the bank’s website. This includes the savings accounts, Regions Money Market account and checking accounts. You’ll have to speak with a customer representative to open other accounts, like CDs and IRAs.

You can still find much of the information you’ll need to know for these accounts online. However, it can be hard to find certain information like the Standard Pricing rates and fees for CDs.

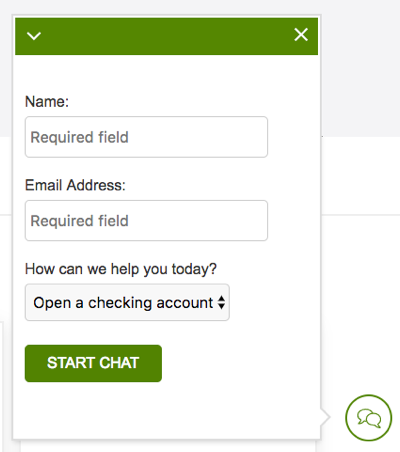

Luckily, you do have access to a Regions banker through online chat. You’ll just need to provide your name and email to begin chatting and asking your questions.

How Do I Access My Money?

You can access your money wherever you can find the bank. This means at a physical branch if you live near one, over the phone, online or on the bank’s mobile app. You’ll need to provide personal and account information any time you want to access your money.

When accessing your money online, you’ll log in with your online banking info. The same goes for mobile banking. Both online and mobile banking allows you to make transfers, request money monitor transactions and more at just a click of a button.

How Can I Save More Money With a Regions Bank Account?

Unfortunately, Regions Bank offers some of the lowest interest rates when it comes to its bank accounts. Even the more preferred savings account, LifeGreen Savings, offers the lowest interest rate.

Some accounts, like Regions CDs and money market accounts, earn at higher interest rates when you pair the account with a Regions checking account. This snags Relationship Pricing rates which usually end up a little higher than standard rates. You’ll also benefit further by having higher account balances, since some accounts offer higher rates for larger sums of money.

To earn at the highest rates the bank can offer, you’ll want to open one (or more) of its Promotional CDs. This ensures the most competitive rates since they’re promotional. Otherwise, you can look into the money market accounts or the 18 Month Variable Rate IRA.

What’s the Process for Opening an Account With Regions Bank?

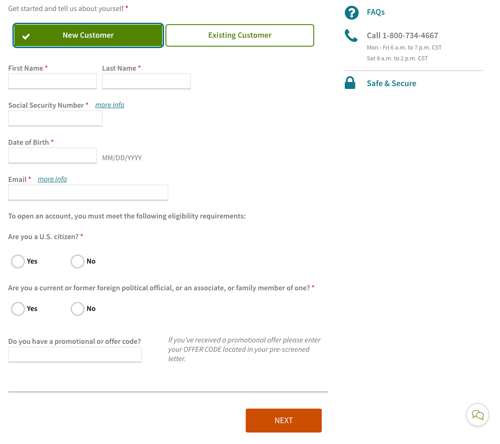

You can’t open every Regions bank account online. You can do so for its savings (except Savings for Minors), Regions Money Market and checking accounts. Once you choose the account you'd like to open, you'll be brought to the page shown in the image here to fill out your information. The application process should typically take 10 minutes to complete.

You’ll have to visit a branch in person to open a Savings for Minors account. You can visit a branch or call the bank at 1-800-734-4667 to open a CD and/or IRA account.

No matter how you apply for an account, you’ll need to provide personal and banking information. Your personal information will include your Social Security number, email address, driver’s license, etc. You’ll also have to provide some bank account information. This means information fo a checking or savings account or credit or debit card. This is in order to fund your new account. All bank accounts require a minimum deposit of some amount, depending on the account.

What’s the Catch?

For starters, Regions bank is limited to Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, North Carolina, South Carolina, Tennessee and Texas. So while the bank has thousands of ATMs and offices, these are confined to the above 15 states.

If you live in these areas and are able to open a Regions account, you may be disappointed by the low interest rates. Most of the bank’s accounts earn at the lowest interest rate in the industry. If you’re looking for higher rates and no fees, most online banks have much higher rates than Regions can offer.

Finally, many Regions Bank accounts charge a monthly fee and have minimum deposit requirements. This may place certain accounts out of reach for those who cannot meet those costs. You are able to waive some monthly fees, but that often requires meeting a minimum balance amount.

Bottom Line

Regions Bank certainly does not have a shortage of bank accounts. If you’re looking for a bank where you can open multiple accounts, like a savings account and money market account and an IRA, for example, this could be the bank for you. You’ll just have to make sure you live in an area where the bank is available.

The bank does fall short, however, in its ability to grow your money to the best of the industry’s abilities. Its interest rates are pretty low, even when you have the highest account balance and relationship rates. If you’re looking to maximize your deposits, you should look elsewhere for higher interest rates.