Overview

PNC Bank offers a wide range of banking products from a simple checking account to a high-earning long-term CD. At the base level, the bank doesn’t offer very high interest rates. However, you are given a few opportunities to boost your rates through higher account balances or account relationships.

What stands out about PNC Bank is its Virtual Wallet® product. It includes various tools and resources to help you pay bills, save for both short-term and long-term goals, manage your paychecks and more.

Read on below to explore PNC Bank's many offerings.

| Product | Key Details |

| Savings Accounts |

|

| Certificates of Deposit |

|

| Money Market Account |

|

| Checking Accounts |

|

| IRAs |

|

PNC Bank Interest Rate Comparison

PNC Bank Overview

PNC Bank offers a lot more than just what you see here. Not only can you open a money market account, but you can save for retirement, invest, get a home loan and so much more. This allows you to keep all your money and assets in one place if you so choose.

PNC Bank Account Features

PNC Bank offers a number of savings accounts from four different certificates of deposit to a Premiere Money Market account. While each account doesn’t earn the highest rates at the start, you do have some opportunities to get a rate boost, especially when you have higher account balances.

Plus, PNC Bank offers its Virtual Wallet® product which makes banking even more accessible and convenient. Your Virtual Wallet® will include various tools to help you pay bills, budget, save and more.

Banking with this institution gives you free and easy access to online and mobile banking. You also have thousands of ATMs and locations to choose from, depending on where you live.

Compare PNC Bank to Other Competitive Offers

PNC Bank Savings Account: PNC Standard Savings

| Key Features | Details |

| Minimum Deposit | $25 |

| Access to Your Savings Account | Online, mobile and physical branches. |

| Security | FDIC-insured deposits up to the legal limit. |

| Fees | $5 monthly fee, waivable with one of the following

|

| Current Terms and Rates | Rates based on SmartAsset's NYC location.

|

This account from PNC Bank lives up to its name by providing a standard and simple approach toward savings. It is advertised as the account that can help you reach your savings goal, whether that’s an emergency fund or for a special gift. Plus, you’ll have access to financial education tools and resources to help you better understand and manage your money.

This account doesn’t earn at the most competitive interest rate. It’s important to double check your exact interest rate, too, since the bank’s rates can change by location. You do have the opportunity to boost your rate slightly by linking a PNC checking account to your savings account. You will also have to set up a qualifying monthly direct deposit to the linked checking account or make at least five qualifying purchases each month with your debit card or PNC Visa® credit card. Be sure to check your agreements to know exactly what you need to do to snag the rate boost.

You can set up automatic transfers from your checking account so your savings becomes mindless. This account relationship also allows for overdraft protection for your checking account. That way, you can avoid heavy overdraft penalties by covering yourself with your savings account.

In addition to unlimited and free access to the bank and your money by phone, web and mobile, you’ll also receive a free PNC Banking card.

PNC Bank Savings Account: PNC ‘S’ is for Savings

| Key Features | Details |

| Minimum Deposit | $25 |

| Access to Your Savings Account | Online, mobile and physical branches. |

| Security | FDIC-insured deposits up to the legal limit, |

| Fees | $5 monthly fee, waivable with one of the following

|

| Current Terms and Rates | Rates based on SmartAsset's NYC location: 0.01% APY |

This is PNC Bank’s savings account for kids. Like most children’s savings accounts, this account can help you teach your children about finances and money management. However, PNC Bank offers these tips and resources with characters from Sesame Street®, hopefully making it more enjoyable and useful for your child. You, your child and Sesame Street® can work through activities to build basic money concepts like sharing and saving. You can also set specific savings goals with your child that they can tangibly achieve.

PNC Bank Fixed Rate CD (Certificates of Deposit)

| Key Features | Details |

| Minimum Deposit | $1,000 |

| Access to Your CD | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law |

| Fees | None |

| Current Terms | Current Rates (based on SmartAsset's NYC location) |

| 1 Month |

|

| 3 Month |

|

| 6 Month |

|

| 12 Month |

|

| 18 Month |

|

| 24 Month |

|

| 36 Month |

|

| 48 Month |

|

| 60 Month |

|

| 84 Month |

|

| 120 Month |

|

A certificate of deposit (CD) account offers a more structured way of saving. You choose your account term length, make your deposit and then wait for the term to end to access your funds again. Luckily, CDs tend to earn at higher interest rates than regular savings accounts. Typically, the longer the term length, the higher the interest rate.

This Fixed-Rate CD offers just that: a fixed rate for the duration of your CD term. You have a wide variety of term lengths to choose from, ranging from seven days to 10 years. This allows you to work towards both your short-term and long-term savings goals.

You can open this account as a Multiple Maturity Fixed-Rate CD. This will automatically renew your CD at maturity at the same rates and terms. If at a maturity date you don’t want to renew, you can always take action to withdraw or transfer the funds or change the terms of the CD.

If you’re looking to save for retirement, you can open a Fixed-Rate CD as an IRA CD. The same rates still apply. Just be sure to state that you want to open the CD account as an IRA when you’re applying.

PNC Bank Ready Access CD (Certificates of Deposit)

| Key Features | Details |

| Minimum Deposit | $1,000 |

| Access to Your CD | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | None |

| Current Terms and Rates | Rates based on SmartAsset's NYC location.

|

PNC Bank’s Ready Access CD changes up a key factor of CDs. After the first seven days of account ownership, you can access your funds at any time. This allows for more flexibility in case you should need some money in an emergency.

Ready Access CDs come in term lengths of three to 12 months. The bank does occasionally offer promotional accounts with more term lengths. Again, your CD will automatically renew at maturity unless you take action to the opposite.

PNC Bank Premiere Money Market Account

| Key Features | Details |

| Minimum Deposit | $0 |

| Access to Your Account | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | $12 monthly fee (waivable with an average monthly balance of at least $5,000) |

| Current Terms and Rates | Rates based on SmartAsset's NYC locationStandard Rates

|

PNC Bank offers one money market account, the Premiere Money Market account. This account can help you manage your money easily, especially with free online and mobile access. Plus, you will receive a free PNC Banking card connected to the account, as well.

You have a couple of opportunities to grow your money at higher rates with this account. For starters, the higher your account balance climbs, the higher the interest rate. You can also snag higher rates by linking the account with a PNC Bank checking account and meet a few other requirements depending on the checking account you link. Be sure to read over any account agreements so you know exactly how to qualify.

With the Premiere Money Market Account, you won’t be charged for withdrawals or transfers. You’ll also be able to set up auto savings which will automatically make transfers from a checking account to your money market account.

You can open this account as a retirement savings vehicle. Just make sure to state that this is how you want to open the account. Doing so can allow for solid retirement savings, but also the flexibility of withdrawing without penalty when you need to.

PNC Bank Standard Checking Account

| Key Features | Details |

| Minimum Deposit | $25 |

| Access to Your Checking Account | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | $7 monthly fee, waivable with one of the following

|

PNC Bank offers three different basic checking accounts (as opposed to its Virtual Wallet offerings). To start, the Standard Checking account offers the basics without too many bells and whistles. You can use your PNC Bank Visa® Debit Card at thousands of PNC ATMs. Plus, you’ll receive some reimbursement for non-PNC ATM fees you run into. You’ll also have easy and free access to online and mobile banking and Bill Pay and free check writing abilities.

A big feature of owning a PNC Bank checking account is the ability to earn cash back through PNC Purchase Payback®. You can earn rewards just by using your debit card at the places you already shop. The more you use your card, the more rewards you can earn.

PNC Bank Performance Checking Account

| Key Features | Details |

| Minimum Deposit | $25 |

| Access to Your Checking Account | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | $15, waivable with one of the following

|

| Current Terms and Rates | Rates based on SmartAsset’s NYC location: 0.01% APY |

Next up is the PNC Bank Performance Checking account. You’ll receive a PNC Bank Visa® Debit Card which you can use to access you money at thousands of PNC ATMs. You also have the liberty of using non-PNC ATMs, without worrying too much about ATM fees since the bank will reimburse you for a portion of those fees.

This is an interest-earning account, but only for balances of $2,000 and over. You can also earn cash rewards through the PNC Purchase Payback® program. Other perks include unlimited check writing, design check discounts, free overdraft protection, safe deposit box discount and one free savings or money market account.

Your Performance Checking account perks extend beyond the account itself, too. Having this account can snag you bonus rewards with your PNC Visa Credit Card and higher savings account interest rates, including CDs and IRA CDs.

PNC Bank Performance Select Checking Account

| Key Features | Details |

| Minimum Deposit | $25 |

| Access to Your Account | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | $25, waivable with one of the following

|

| Current Terms and Rates | Rates based on SmartAsset’s NYC location: 0.01% APY |

Finally, the Performance Select Checking account offers the highest tier of perks and benefits. This account builds on the Performance Checking account’s features like earning interest, free cashier’s checks, free overdraft protection and more. However, this account allows you to open up to eight free checking, savings or money market accounts. The account offers full reimbursement for all non-PNC Bank ATM fees. You’ll also get free domestic wire transfers, PNC Exclusive checks, ATM statements and stop payments. Plus, the bank will provide account holders with identity-theft reimbursement insurance of up to $10,000.

By owning this account, you can earn higher bonus rewards with your PNC Visa® Credit Card, higher interest rates on Premiere Money Market or Standard Savings account and higher rates on CDs and IRA CDs. You can also see a discount on consumer home equity and consumer personal line of credit accounts and safe deposit boxes.

PNC Bank IRAs: Fixed Rate CD IRA and Premiere Money Market IRA

| Key Features | Details |

| Minimum Deposit | $250 |

| Access to Your CD | Online, mobile and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | None |

| Current Terms and Rates | See above Fixed-Rate CD and Premiere Money Market rates |

These PNC Bank IRA offerings mimic the bank’s Fixed-Rate CD and Premiere Money Market accounts. The limits and rates remain the same. You just have to make sure you state you want to open the CD or MMA as an IRA. It is often best to visit a branch to get the most accurate information and an easier application process.

Where Can I Find PNC Bank?

You can find PNC Bank online at www.pnc.com, on its mobile app or at over 2,000 branches. You’ll have easy access to the bank and its products online. However, its physical branches are limited to 19 states in the East and Midwest regions and the District of Columbia.

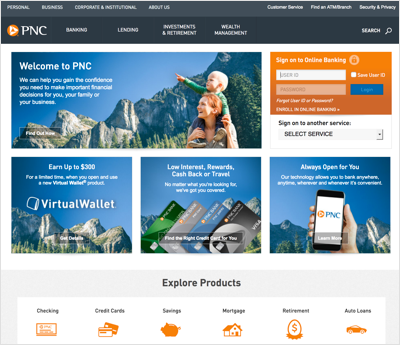

What Can You Do Online With PNC Bank?

You can do a ton online with PNC Bank. For starters, you can explore all the bank’s financial offerings, from banking accounts to home refinancing to wealth management all right from the homepage (shown here). Then when you find the account or product you want to open, you can easily apply online, too.

Once you’re a customer, you’ll be able to access your account(s) by logging in through the website. There, you’ll find your balances, transactions, money management tools and more. You can also access these features on mobile.

How Do I Access My Money?

You can access your money online, on mobile, at ATMs or branches and over the phone. To access your money online and on mobile, you’ll need to provide your login information. You’ll also need to provide personal and account information to access your money at ATMs, branches and over the phone.

PNC Bank Virtual Wallet®

An important product in PNC Bank’s offerings is its Virtual Wallet®. This combines various tools to help you spend, save and grow your money. When you open a Virtual Wallet®, your accounts and tools are all kept in one place with easier ways to manage your funds, whether that’s making transfers or paying pills. The Virtual Wallet® page, shown here, outlines and visualizes everything that goes into your wallet.

The ‘Spend’ function is essentially your primary checking account. This will track your purchases and ATM transactions. You’ll also use spend to pay any bills. “Reserve” is your wallet’s short-term savings account. This helps with overdraft protection and upcoming expenses. You can transfer money from ‘Reserve’ to ‘Spend’ at no charge. ‘Growth’ is the third main account, which is your long-term savings account. This can serve as your second line of overdraft protection, but is also perfect for saving for retirement, a car, a home and more. Lastly, you can choose to add a PNC Credit Card to your Virtual Wallet®. This account isn’t mandatory or automatically included, but it does provide added perks to your PNC Credit Card.

Your Virtual Wallet® perks start with the Calendar, Bill Pay and Danger Day?. This tracks everything from payday to scheduled bill reminders. Danger Day? alerts you in red on your calendar to notify you when you’re at risk of overdrawing your account to pay bills. Money Bar® will show you the money Scheduled Out to go (for bills and other payments), money that’s free to spend and the money in Reserve that you’ve stashed away. Here, you can also make adjustments as needed with a simple slider function. Your Wish List is where you can set fun goals for yourself like your next vacation. You can set different priorities for each item on your Wish List.

The Spending + Budget function shows you where your money is going each month in a more specific way with categories like education, restaurants and entertainment. You can also set up reminder emails so you don’t max out your budget. Since it’s easy to spend without a second thought, you’ll also have access to Savings Engine® which sets aside funds automatically on paydays and bill due dates. Through this and the tool Punch the Pig®, you can “punch” a cartoon pig on your online banking account to transfer money from “Spend” to “Growth.”

There are a few different Virtual Wallets you can choose from. The basic Virtual Wallet comes with the Standard Checking account. You can earn cash through PNC Purchase Payback and bonus rewards on your PNC points® Visa Credit Card.

The next level Virtual Wallet goes with Performance Checking as your “Spend” account. This will also earn bonus rewards on a PNC Credit Card, but also includes interest earned on certain balances and some waived non-PNC Bank fees.

To earn higher rewards, you can open a Virtual Wallet with Performance Select, earning you premium account features and the highest level of rewards and benefits for your credit cards and account balances.

Finally, you can open a Virtual Wallet Student, which provides students and their parents with an easier way to manage money while the student is away at school.

How Can I Save More Money With a PNC Bank Account?

At a base level, PNC Bank doesn’t offer the highest interest rates when it comes to savings accounts. However, there are a couple different ways to save more money with a PNC Bank Account. For one, you can make a larger deposit toward accounts that have balance tiers to earn at a higher interest rate. Linking certain bank accounts together can also unlock higher interest rates. There are even levels of accounts that you can link so as to get the highest rewards and interest rates. Plus, if you have a high account balance and linked accounts, you’ll be earning at the highest rates possible (depending on whether the account qualifies).

What’s the Process for Opening an Account With PNC Bank?

You can open just about any PNC Bank account that you would like on the bank’s website. It’s as simple as clicking an “APPLY NOW” button for the account you would like to open and finding yourself on the first page, shown here. You will need to enter your zip code on the website to find the most accurate list of accounts available to you depending on your location. You may have to call the bank at 1-800-762-5684 to open certain accounts.

The application process will typically take around 10 minutes to complete. To apply, you’ll need to provide personal information like your government issued photo ID, Social Security number, date of birth and addresses. You’ll also need to provide existing account information in order to make your initial account deposit.

To apply for a Fixed-Rate CD or Ready Access CD, you will need to print out the contact forms provided on the website to send to the bank. With IRAs, it may also be easier to visit a branch. That way, you can have all the paperwork and terms and conditions in front of you and explained to you.

What’s the Catch?

One catch to banking with PNC is that the savings rates aren’t the most competitive in the industry. That means you can grow your money faster with other banks. Luckily, PNC doesn’t offer the lowest rates so if you do want to bank here, your money will still grow.

To get the highest rates the bank offers, however, you will need to jump through a few hoops. One way is to have higher account balances, rather than balances in lower tiers. You can also link certain accounts together to snag even higher rates.

Finally, the bank has physical branches in only 19 states, largely in the East and the Midwest regions. So if you really value having a branch nearby and you don’t live in these areas, you may want to find another institution to bank with.

Bottom Line

PNC falls a little short when it comes to interest rates. You will have to take more steps to earn at the highest rates, while some other banks earn higher rates from the start. However, where it really shines is in its product offerings. You can do basically all your banking here. You can also be assured you’ll have adequate resources and access for managing your money, especially with the bank’s Virtual Wallet®.