According to a recent poll from the National Endowment for Financial Education, nearly nine in 10 Americans say COVID-19 has triggered stress on their personal finances. Money – or lack thereof – creates anxiety-inducing burdens for individuals and families even in normal times. But this is especially true now in the midst of the coronavirus pandemic, whose attendant economic fallout has included soaring unemployment. Some cities, though, see their residents under more strain than others, so SmartAsset crunched the numbers to find the cities under the most financial stress.

We compared data for 99 of the largest U.S. cities across the following eight metrics: unemployment rate, percentage of the population living below the poverty line, percentage of households severely burdened by housing costs, recent housing insecurity, recent food insufficiency, percentage of the population who reported not seeing a doctor because of cost, four-year change in median household income and divorce rate. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s 2020 study on the cities with the most financial stress. Check out the 2019 version here.

Key Findings

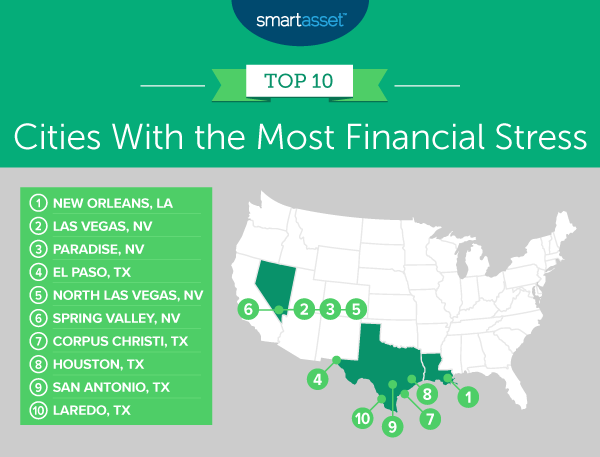

- Nevada struggles with unemployment and divorce rate. Four of the 10 most financially stressed cities in the study are in Nevada – Las Vegas, Paradise, North Las Vegas and Spring Valley. (There is also one more Nevada city – Henderson – ranking No. 11.) The four Nevada cities in our top 10 have the highest county unemployment rate in the study and rank within the worst 25 of the study for divorce rate.

- Texas especially struggles with housing insecurity and poverty. Five of the 10 most financially stressed cities in the study are in Texas: El Paso, Corpus Christi, Houston, San Antonio and Laredo. The percentage of adults experiencing recent housing insecurity, which is reported on the state level, is highest in Texas. Four of the five cities rank within the worst 25 of the study for their high percentages of the population living below the poverty line.

- Unemployment plays a large role in financial stress. The COVID-19 pandemic has sent the unemployment rate higher than it has been in many years. For all 99 cities for which we considered data, the average May 2020 unemployment rate (reported on the county level) was 13.8%, and for certain cities across the country, it has approached 30%.

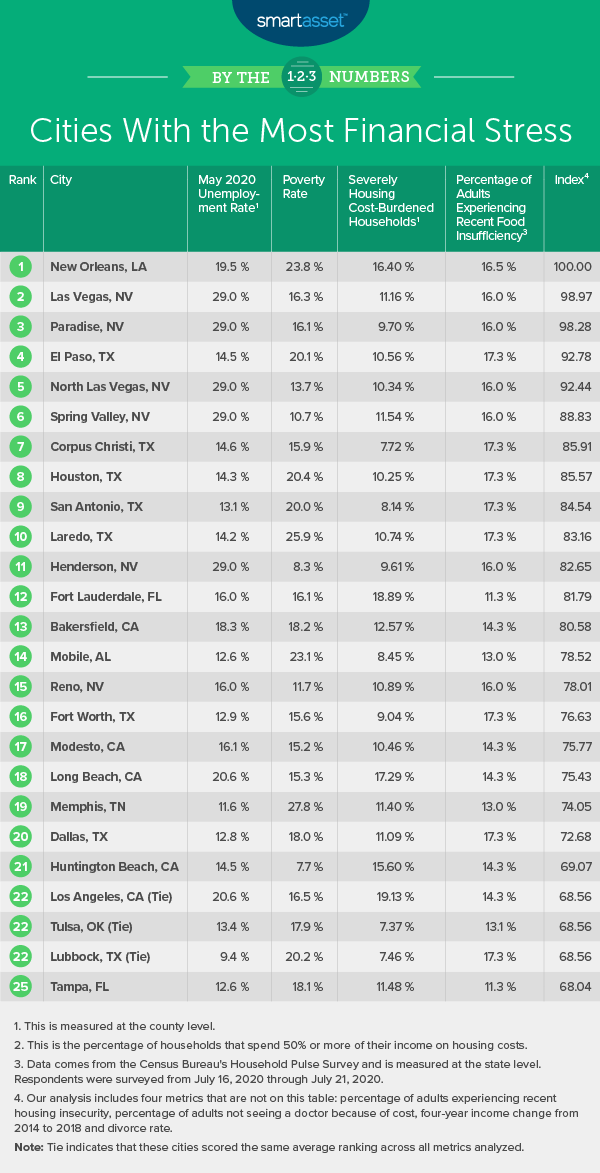

1. New Orleans, LA

New Orleans, Louisiana is the only city in our top 10 that isn’t located in either Nevada or Texas. The Big Easy ranks within the worst 10 cities of the study for three different metrics: It has the eighth-highest percentage of severely housing cost-burdened households (16.40%), the ninth-highest rate for the percentage of the population below poverty line (23.8%) and the 10th-highest county unemployment rate in the study (19.5%).

2. Las Vegas, NV

Las Vegas, Nevada is the No. 2 financially stressed city in the U.S. Almost a third (29.0%) of Clark County’s residents are unemployed. Furthermore, Las Vegas has the seventh-smallest four-year change in median household income, an increase of just 6.53% from 2014 to 2018. More than 11% of the city’s households are severely housing cost-burdened. The divorce rate in Las Vegas is 13.3%, the 20th-highest rate for this metric across all 99 cities in the study.

3. Paradise, NV

Another Clark County city, Paradise, Nevada, is one of the most financially stressed cities in the U.S. Paradise has the third-lowest four-year change in median household income in the study – at 2.24% – and the fifth-highest divorce rate, at 15.4%.

4. El Paso, TX

El Paso is the first of five Texas locales on this list. Recent housing insecurity in Texas is at 35.7%, the highest rate for this metric in the study. Almost 17% of people in the state reported they didn’t see a doctor in the previous 12 months because of cost, the second-highest rate for this metric in the study. Recent food insufficiency in Texas has reached 17.3%, the third-highest rate for this metric. Furthermore, 11% of households in the city are severely housing cost-burdened, and the four-year change in median household income was an increase of less than 10% from 2014 to 2018.

5. North Las Vegas, NV

North Las Vegas, Nevada, shares an unemployment rate of 29.0% with the other Clark County cities in our study. The city ranks eighth-lowest for its relatively small four-year change in median household income from 2014 to 2018, at just 6.69%. Additionally, 13.7% of the city’s population lives below the poverty line, and 10.34% of the city’s households are severely housing cost-burdened.

6. Spring Valley, NV

Spring Valley, Nevada ranks sixth for its relatively high divorce rate, at 14.8%. Both the percentage of the population living below the poverty line and the percentage of households that are severely housing cost-burdened exceed 10%. According to Census Bureau data from mid-July 2020, 16% of adults in Nevada lived in households with food insufficiency. Furthermore, more than 33% of adults in the state experienced housing insecurity.

7. Corpus Christi, TX

Many residents of Corpus Christi, Texas are struggling to make ends meet. Almost 16% of the city’s population lives below the poverty line. And although the city experienced an increase in terms of its 2014 to 2018 change in median income, Corpus Christi has the 12th-lowest change for this metric in the study, at just 8.71%. It also ranks 31st-highest out of all 99 cities in the study for its county unemployment rate, at 14.6%. Furthermore, Census data from July 2020 indicates that a significant number of people in the state of Texas are experiencing housing insecurity and food insecurity – at 35.7% and 17.3%, respectively. Data from the Kaiser Family Foundation for 2018 shows that 16.8% of people in the state reported not seeing a doctor in the previous 12 months due to concerns about cost.

8. Houston, TX

Houston, Texas shares the same housing insecurity and food insecurity percentages with the other Texas cities in the study, at 35.7% and 17.3%, respectively. In addition, it has the 18th-highest rate in the study for the percentage of the population living below the poverty line, at 20.4%. The unemployment rate in Harris County is 14.3%, the 36th-highest across all 99 cities for which we analyzed data.

9. San Antonio, TX

San Antonio, Texas has the 10th-worst four-year change in median household income, a jump of just 8.13% from 2014 to 2018. The city ranks 22nd-highest out of a total of 99 cities for the percentage of the population below the poverty line, at 20.0%. More than 8% of the city’s households are severely housing cost-burdened, meaning that housing costs comprise more than 50% of their total income.

10. Laredo, TX

Laredo, Texas has the fourth-highest percentage of people living below the poverty line, at 25.9%. While the divorce rate might be relatively low – at 9.4%, ranking 79th-highest out of a total of 99 – more than one in 10 households in the city are severely housing cost-burdened, meaning that housing costs exceed half of household income. Laredo also shares the statewide rankings with the other Texas cities in the study: July 2020 Census data shows housing insecurity and food insufficiency at 35.7% and 17.3%, respectively, and 2018 Kaiser Family Foundation data shows that almost 17% of people in the state did not see a doctor in the previous 12 months because of cost.

Data and Methodology

To find the cities with the most financial stress, we compared data for 99 of the largest U.S. cities across the following eight metrics:

- Unemployment rate. Data comes from the Bureau of Labor Statistics and is for May 2020. Data is reported at the county level.

- Percentage of the population living below the poverty line. Data comes from the Census Bureau’s 2018 1-year American Community Survey.

- Percentage of severely housing cost-burdened households. This is the percentage of households that spent 50% or more of their income on housing costs. Data comes from the Census Bureau’s 2018 1-year American Community Survey.

- Recent housing insecurity. This is the percentage of adults who missed the previous month’s rent or mortgage payment, or who have slight or no confidence that their household can pay next month’s rent or mortgage on time. Data comes from the Census Bureau and is for July 2020. Data is reported at the state level.

- Recent food insufficiency. This is the percentage of adults in households where there was either sometimes or often not enough to eat in the previous seven days. Data comes from the Census Bureau and is for July 2020. Data is reported at the state level.

- Percentage reporting not seeing a doctor because of cost. Data comes from the Kaiser Family Foundation and is for 2018. Data is reported at the state level.

- Four-year change in median household income. Data comes from the Census Bureau’s 2014 and 2018 1-year American Community Surveys.

- Divorce rate. Data comes from the Census Bureau’s 2018 1-year American Community Survey.

First, we ranked each city in each metric. We then found the average ranking for each city, giving equal weight to every metric except for unemployment, which we gave a double weight. We used this average ranking to create our final score. The city with the highest average received a score of 100, while the city with the lowest average ranking received a score of 0.

Money Management Tips to Lower Your Anxiety

- There could be some wiggle room in your budget. Even in the worst of times, reassessing your budget can be an efficient strategy to find some simple ways to save here and there. Get started with SmartAsset’s free budget tool.

- Save for retirement while you can. A prime way to reduce worry about your financial future hinges on being proactive. So if you have the capacity to do so right now, continue – or start – to save for retirement. Invest in your future self: Our comprehensive retirement guide can help.

- If possible, seek professional advice. If you need guidance for a long-term financial plan to ease some of the stress you’re holding, a professional advisor may be able to help. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool connects you with financial advisors in your area in five minutes. If you’re ready to be connected with local advisors, get started now.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/MartinPrescott