The Internal Revenue Service (IRS) sends U.S. investors a myriad of tax forms every year. While the number and complexity of these forms can be off-putting and confusing, it’s important that you understand them and what your responsibilities regarding these are. Here’s an overview of common IRS investment tax forms and what you need to know about them. If you’re uncertain about taxes on your investment consider working with a financial advisor.

What Are Investment Tax Forms?

Specific institutions like brokerage firms and mutual funds must report any investment income they’ve paid out to their investors. Federal tax laws require these reports on an annual basis, which record the income made during the preceding tax year and other aspects of these investments. There are various forms these institutions send out. One copy is sent to the IRS, and the account holder keeps the other.

Reasons You May Receive Tax Forms

There are several reasons why the government may send you a tax form for your investments. Some reportable events you may need to file for are:

- When you earn dividends on an investment

- If you experience any gains or losses, such as when you sell

- Any interest income you make

- Taking out distributions from applicable accounts, such as a retirement account

- Income you collect outside of employment, like money made on a rental property

- Profit from real estate sales

- Interest paid on loans or investments

Common Investment Tax Forms

You will receive certain types of forms based on the types of investment you have. These will be federal forms and, in some cases, they also will be state forms. So, someone who invests through funds will receive a different tax form than someone who invests in individual securities. Likewise, someone who invests only domestically will receive different forms than someone who also invests outside the U.S. The most common investment form you’ll encounter is the 1099.

You will receive certain types of forms based on the types of investment you have. These will be federal forms and, in some cases, they also will be state forms. So, someone who invests through funds will receive a different tax form than someone who invests in individual securities. Likewise, someone who invests only domestically will receive different forms than someone who also invests outside the U.S. The most common investment form you’ll encounter is the 1099.

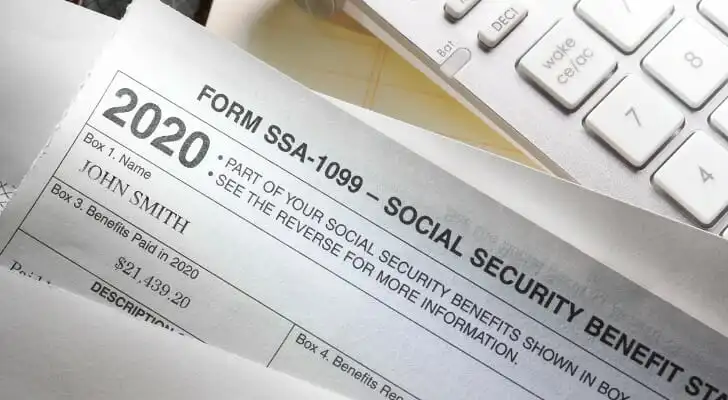

1099 Forms

You may be familiar with the 1099, even if you do not have a taxable account. That is because there are many different versions of the 1099 form. However, they are all related and applicable for individuals who made some type of income over the preceding year, which may or may not be taxable. They form a record of this income for you and the IRS, that can involve income outside of wages.

The 1099 forms you may encounter as an investor include:

- 1099-B – The form’s full title is 1099-B: Proceeds from Broker and Barter Exchange. Per the name, it’s used by brokerages and barter exchanges who use it to report the capital gains and losses of their customers.

- 1099-DIV – This form is used by financial institutions, such as banks, to report dividends and capital gains distributions.

- 1099-INT – The 1099-INT form is issued to investors by those who pay them interest income. Investors then use it to record the details of their interest income.

- 1099-R – This form allows individuals to report any distributions from their retirement benefits, like a pension or IRA.

- 1099-MISC – This is a tax form that reports a range of miscellaneous income instead of dividends. The IRS details a list of them, with minimum amounts and the entity or person who gave you the income.

- 1099-OID – Using this form, you can report an original issue discount (OID) included in your income that keep you from debt obligations.

- 1099-Q – When filing the 1099-Q, you report any distributions from a qualified tuition program (QTP), such as a 529 account. You also file this form if you are in charge of a program created by a state or eligible institution.

Other Tax Forms

While 1099 forms are common, they’re not the only type you may see. Some other common tax forms are:

- Form 5498 – This specific form helps you report information regarding contributions to IRAs. That includes traditional IRAs, Roth IRAs, SEP IRAs and SIMPLE IRAs.

- Form 5498-ESA – You file this form if you have made contributions to an education savings account (ESA).

- Form 1042-S – Filing this form lets you record information about income paid to foreign persons by a business or institution that is U.S.-based.

The Takeaway

Any time you make an income or take a distribution from an account, you can expect to pay taxes. They’re just an unavoidable part of every citizen and investor’s life. But, it’s certainly not easy to work through all the logistics on your own. Improving your knowledge can help combat feelings of anxiety and distress when that pile of forms gets sent your way. On top of that, the right financial knowledge can help you plan accordingly. So, if there are ways to reduce the amount you pay in taxes, knowledge will help you create the best strategy.

Investing Tips

- You should be familiar with which scenarios require you to pay taxes; however, it’s also important to know what you may have to pay. SmartAsset’s income tax calculators can help you approximate what your federal, FICA, state and local tax amounts might look like. Keeping tabs on your taxes can help you streamline the planning process and help you stay informed.

- Investing comes with its challenges, including taxes. You don’t have to navigate the forms and paperwork all on your own, though. The right financial advisor has the financial know-how to help reduce your stress the next time you’re left with questions. Finding such an advisor doesn’t have to be hard. With SmartAsset’s free matching tool, you can easily and quickly connect with local advisors ready to help. If you want to improve your own tax experience, get started now.

Photo credit: ©iStock.com/Pra-chid, ©iStock.com/Bill Oxford, ©iStock.com/Skyhobo