Starting a business can be expensive. You’ll likely have to cover the cost of a building or office space, equipment, utilities and legal and accounting fees. Fortunately, business owners can recoup some of the money they’ve spent by deducting expenses on their federal income tax returns. While you can’t write off the total cost of any property you’ve invested in (at least after your first year of operation), you can get an annual tax break for depreciation and amortization by filing Form 4562.

Consider working with a financial advisor as you prepare your tax returns.

What Is Form 4562?

IRS Form 4562 is used by individuals and businesses to report depreciation and amortization of property placed in service during the tax year. It’s also the form used to claim certain first-year expensing deductions, including Section 179 deductions and special depreciation allowances. Taxpayers file Form 4562 alongside their annual tax return when they’re eligible to deduct the cost of qualifying assets over time or upfront.

The form applies to a wide range of assets, such as machinery, equipment, vehicles and some business-use property. It helps the Internal Revenue Service track how assets are depreciated from year to year and ensures deductions are calculated consistently with tax rules. Even if no new property was placed in service, Form 4562 may still be required if depreciation is continuing on previously reported assets.

Form 4562 is commonly used by self-employed individuals, small business owners and landlords, but it can also apply to employees who claim certain job-related depreciation, when allowed. Because depreciation rules can be complex and mistakes may trigger audits or lost deductions, accuracy is especially important. Many taxpayers choose to work with a tax professional to ensure Form 4562 is completed correctly and aligned with their overall tax strategy.

How to Depreciate Properties

Since you’ll use Form 4562 to write off a portion of your property’s value annually, you’ll need to know its estimated recovery period. That tells you how long it’ll take your property to depreciate (meaning how long it’ll be useful to you) and how long it’ll take to recover the full cost of your investment. A property’s recovery period determines how much you can deduct and how long you’ll be able to claim your depreciation deduction.

The IRS assigns different types of properties to different classes based on their recovery periods. Property classes are divided into two systems: a general depreciation system (GDS) and an alternative depreciation system (ADS). Both systems are part of the U.S. tax depreciation system known as the Modified Accelerated Cost Recovery System (MACRS).

In most cases, you’ll use the GDS to determine a property’s estimated recovery period. For example, the carpet you purchase for a real estate investment property would be considered a five-year property. Under the GDS it would have a recovery period of five years, meaning that you can claim a depreciation deduction each year for five years.

Sometimes you need to use the ADS. For example, you must use the ADS if a property is primarily used in a country outside of the U.S. or you’re only using the property 50% of the time (or less) during the year. The ADS usually increases the number of years that a property is subject to depreciation. As a result, you can’t deduct as much money under this system and you won’t qualify for a special depreciation allowance (more on that below).

Completing Form 4562: Part I & II

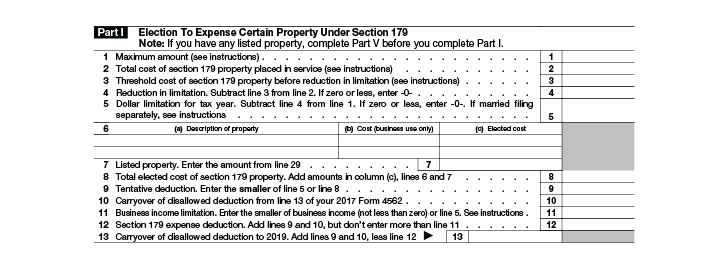

Part I allows you to claim a Section 179 deduction for any computer software your business uses and certain types of tangible properties (like cell phones). You’ll need to check the instructions for Form 4562 to see a full list of the kinds of properties that qualify for the deduction. If you have any listed property (like computers or cars weighing 6,000 pounds or less), you’ll need to complete Part V before you begin Part I.

The Section 179 deduction lets you deduct the full price you paid for a particular property. By claiming this tax break, you may be able to deduct the total value of a property at one time instead of gradually writing off the cost of it year after year through depreciation. But if you’d rather not claim the Section 179 deduction, you don’t have to complete Part I.

Keep in mind that the IRS caps how much you can deduct. For tax year 2026 and onward, you may be able to write off up to $2.56 million annually for most qualifying properties. In 2026, the maximum deduction is reduced dollar-for-dollar by the amount that total Section 179 property placed in service exceeds $4,090,000. For example, if a business places $3.1 million of such property in service, the maximum deduction is reduced by $50,000, resulting in a limit of $1.17 million.

The instructions for Form 4562 include a worksheet that you can use to complete Part I. Something you’ll need to consider is that the amount you can deduct depends on the amount of business income that’s taxable. Fortunately, you may be able to carry over part of the deduction and claim it when filing taxes for the next tax year.

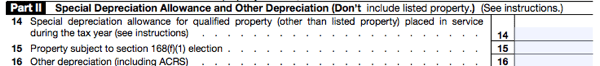

In Part II, you’ll be able to claim an extra deduction known as the special depreciation allowance. Note that you can only claim this deduction for the first year that you use a property for your business. It’s a 50% allowance that’s applied to everyone who qualifies unless you send a note with Form 4562 stating that you don’t want this additional deduction.

You may qualify for the special depreciation allowance if you own a property that recycles materials or certain computer software. You cannot claim this allowance for listed properties or assets that you’re required to depreciate under the ADS.

Filling out Form 4562: Part III

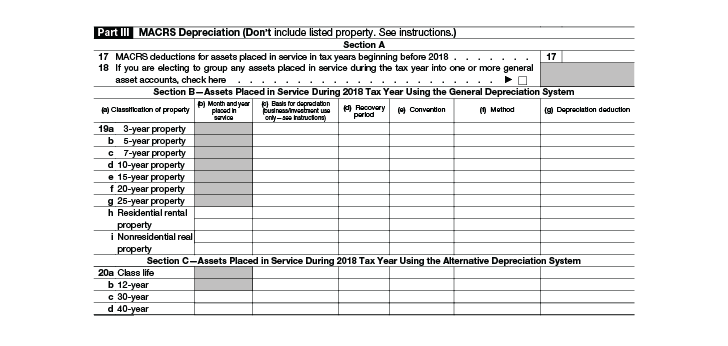

You’ll use Part III to depreciate most tangible properties that you’ve used since 1986 for your business (but not any listed properties). Here’s where MACRS comes into play.

In order to determine how much you can deduct, you’ll need to figure out how a particular property is classified (three-year property, five-year property, etc.) and its recovery period using the instructions for Form 4562 and IRS Publication 946. Just remember that recovery periods vary depending on the kind of asset you own and whether you’re using the general depreciation system or the alternative depreciation system.

In order to determine how much you can deduct, you must also list a property’s basis for depreciation (the cost of an asset minus its salvage value, or what you could sell the asset for once you’ve finished using it) and the depreciation method you used. While there are different ways to calculate depreciation, the most popular method is known as straight-line depreciation. That involves dividing the depreciation basis by the amount of time you’re expecting to use a specific property.

One additional factor you’ll need to enter is the convention for your properties. That’s the period when depreciation technically begins during a tax year. There are three types of conventions, including the mid-quarter convention and the mid-month convention. A half-year convention involves taking a property you began using at the beginning of the year and acting as if you started using it in the middle of the year (hence getting half of a full year’s depreciation deduction).

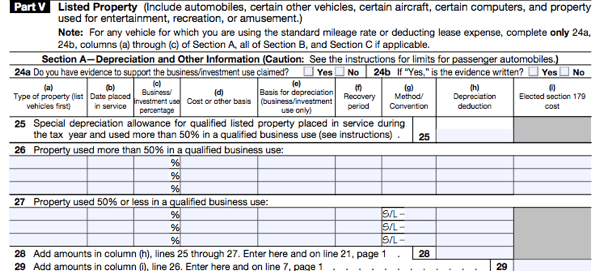

Completing Form 4562: Part IV and V

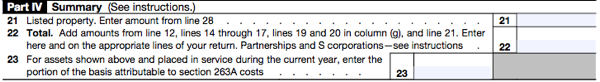

In Part IV, you’ll combine certain numbers you’ve used in other parts of the form including one from line 28 in Part V. That’s why it’s a good idea to complete Part V first if you have any listed property. Whatever you enter in line 22 goes on your income tax return and reflects the total amount for your depreciation deduction.

In Part V, you can claim a deduction for listed property, including any video recording equipment you use for fun, certain computers and certain vehicles. Much like you did in Part III, you’ll need to calculate depreciation for these properties based on factors like their recovery periods, depreciation basis and your depreciation method or convention. You’ll be required to separate the listed properties you’ve used often from the ones you’ve used 50% (or less) of the time during the tax year.

Remember that if you want to claim the Section 179 deduction, you’ll need to complete this section first before starting Part I of Form 4562. You may qualify for the special depreciation allowance if you have listed property that you’ve used more than 50% of the time.

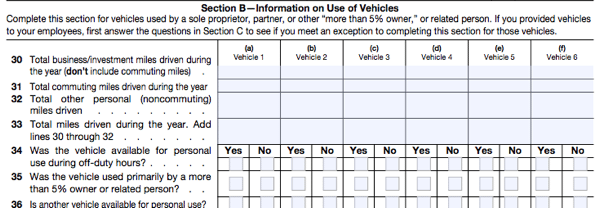

In Part V, Section B you can provide details about the vehicles used by your business partners and the people who own more than 5% of your company.

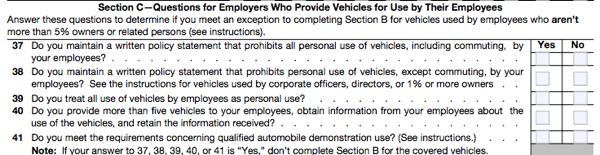

If you have employees who use company vehicles, you’ll need to answer five questions under Section C.

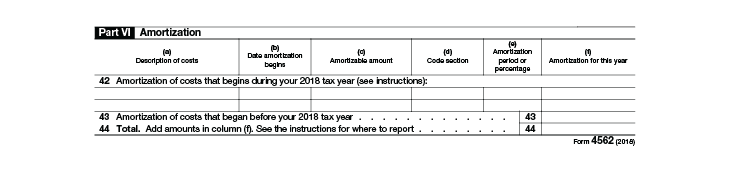

Part VI: Amortization

The final part of Form 4562 allows you to claim a deduction for the costs you amortize. In other words, you can get a deduction for writing off the cost of certain items (like startup costs) and intangible items (like patents and trademarks). You’ll deduct these costs evenly throughout a fixed time period.

Bottom Line

While starting a business is expensive, there are plenty of opportunities to reduce your tax liability to recoup some of those costs. One of those ways is through depreciation, especially with real estate. In order to make that claim, and receive the benefits, you need to make sure you follow the instructions to fill out Form 4562. If you’re not sure how to fill it out correctly or aren’t sure if you qualify, consider talking to a tax professional.

Tax Season Tips

- Figuring out how to depreciate assets isn’t always simple. If you need assistance completing the form, a financial advisor can be a valuable partner. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- If you’re an independent contractor navigating all of these money questions, keeping updated financial records is an even bigger priority. Check out our Independent Contractor’s Guide to Taxes for further insight.

Photo credit: ©iStock.com/Wavebreakmedia, ©iStock.com/shironosov, Images of Form 4562 come from IRS.gov, ©iStock.com/Portra