Social Security is a financial safety net for millions of retired Americans. Founded in the aftermath of the Great Depression, this social insurance program was designed to pay out monthly income for workers after reaching full retirement age. But for most people today, the money provided by Social Security is not enough to live on during retirement. More than 64 million beneficiaries will see an increase of 1.3% in 2021, which translates to a modest raise of $20 a month. This means that average benefits total just $1,543 per month, compelling many Americans to supplement that income with pensions, 401(k) plans and other retirement savings programs. Keeping this in mind, SmartAsset analyzed data from top U.S. cities with the largest populations aged 65 and older to identify where retirees are the most dependent on Social Security.

To do this, we took the average total retirement income and the average Social Security income from the 100 U.S. cities with the largest 65-and-older populations and found out where Social Security makes up the biggest percentage of total retirement income. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s 2021 edition of our study on the cities where retirees rely most on Social Security. You can read the 2020 edition here.

Key Findings

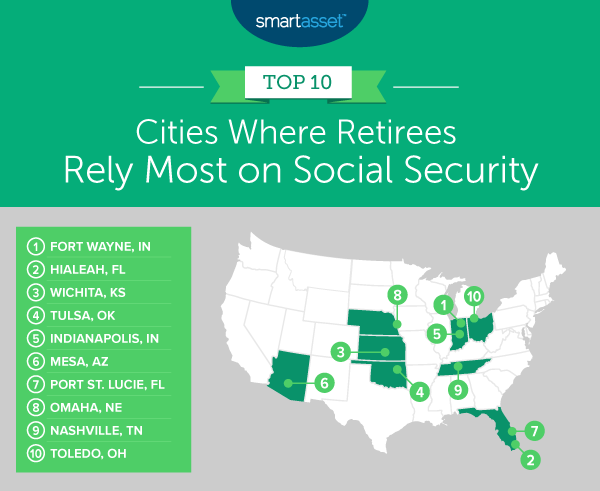

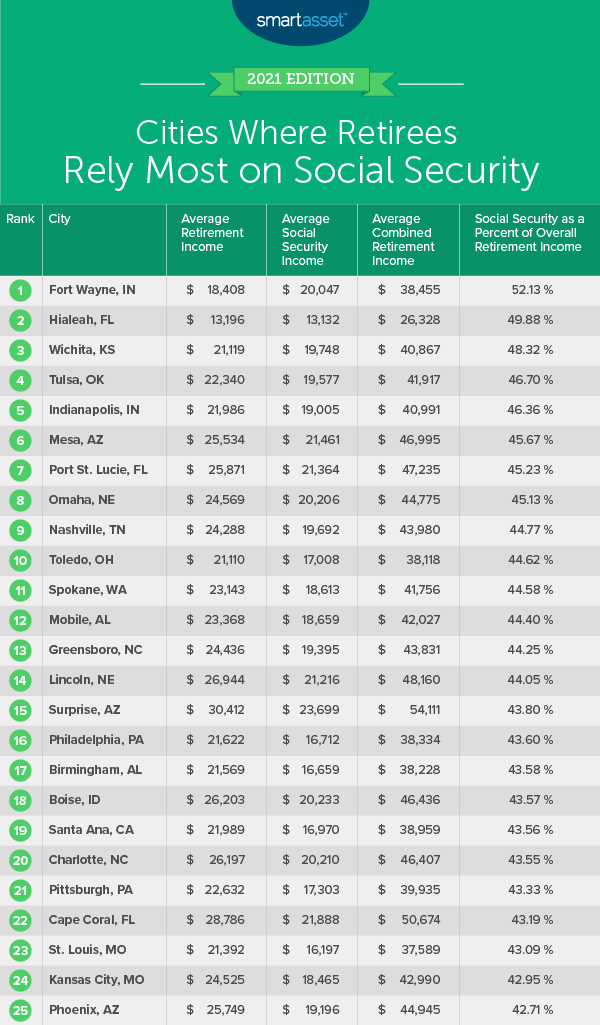

- Social Security is 40.12% of retirement income on average. Across the 100 cities we studied, Social Security represents 40.12% of all retirement income. This shows how important it is to save for retirement when you are young, as Social Security isn’t going to be able to make up most of what a person needs in retirement. In only one city – Fort Wayne, Indiana – does Social Security make up the majority of retirement income.

- California retirees rely the least on Social Security. The bottom of the study is dominated by the Golden State. Of the bottom 20 cities, 12 are in California, with Social Security making up an average of just 34.65% of their overall retirement income. For a comparison, Social Security benefits in the top 20 cities of this study average 45.39% of their overall retirement income.

1. Fort Wayne, IN

With more than 37,000 people aged 65 and older, Fort Wayne, Indiana tops our list as the U.S. city in which retirees rely most on Social Security. The average combined retirement income there is $38,455. Social Security benefits – averaging $20,047 – make up more than half of the overall retirement income (52.13% to be precise).

2. Hialeah, FL

Hialeah, Florida has almost 48,000 people aged 65 and older. Their average combined retirement income is $26,328, and Social Security makes up 49.88% of it, averaging $13,132.

3. Wichita, KS

Wichita, Kansas has more than 54,000 people aged 65 and older. These retirees have an average combined retirement income of $40,867. Social Security income makes up 48.32% of it, averaging $19,748.

4. Tulsa, OK

Tulsa, Oklahoma has more than 56,000 people aged 65 and older. The average retirement income, excluding Social Security benefits, is $22,340. Tulsa retirees average $19,577 in Social Security benefits, which makes up 46.70% of their overall retirement income.

5. Indianapolis, IN

Indianapolis has more than 105,000 residents older than age 65, the largest population of retirees in the top 10 of this study. Those retirees have a combined average retirement income of $40,991. Social Security makes up 46.36% of that income, averaging $19,005.

6. Mesa, AZ

Retirees in Mesa, Arizona average a combined retirement income of $46,995. Non-Social Security income is $25,534. And Social Security benefits average $21,461, making up 45.67% of the total retirement income.

7. Port St. Lucie, FL

Port St. Lucie has almost 39,000 residents older than the age of 65. Their average combined retirement income is $47,235. Of that total, 45.23% ($21,364) comes from Social Security benefits.

8. Omaha, NE

With a 65-and-older population of more than 61,000, Omaha, Nebraska’s combined retirement income averages $44,775. Social Security makes up 45.13% of that total income, averaging $20,206.

9. Nashville, TN

With almost 78,000 people older than the age of 65, the average Social Security income in Nashville, Tennessee is $19,692. This makes up 44.77% of their overall retirement income, which averages $43,980. That means that they have $24,288 in non-Social Security income.

10. Toledo, OH

With a little more than 39,000 people aged 65 and older, Toledo, Ohio rounds out the top 10 of our study with an average Social Security income of $17,008. That makes up 44.62% of their overall retirement income, which averages $38,118.

Data and Methodology

To find the places where retirees rely most on Social Security, we examined data for the 100 cities with the largest population of residents aged 65 and older. Specifically, we looked at the following two metrics:

- Average retirement income for senior households. This is all income which comes from pension plans, periodic income from annuities or insurance and income from IRA plans. Data comes from the U.S. Census Bureau’s 2019 5-year American Community Survey.

- Average Social Security income for senior households. This includes Social Security pensions and survivors benefits and permanent disability insurance payments made by the Social Security Administration. Data comes from the U.S. Census Bureau’s 2019 5-year American Community Survey.

We combined the two income metrics to create one overall retirement income metric. We divided average Social Security income by overall retirement income, showing what percentage of total retirement income was coming from Social Security. We then ranked the cities from highest to lowest.

Tips for Retirement

- Rely on an expert. Saving early and often is important for a comfortable retirement. The right financial advisor can help you create a financial plan for your retirement needs. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Run the numbers now to stay on track. Use SmartAsset’s free retirement calculator to see what you will need in retirement income and if you are on pace to have saved enough.

- Make workplace benefits work for you. If you have access to a workplace retirement plan like a 401(k), make sure to take advantage of it. This is often the easiest way to save money for retirement.

Photo credit: ©iStock.com/PETTET