Saving for retirement takes a lot of time, discipline and planning. But tracking your progress along the way is easier when you set incremental goals. Luckily, T. Rowe Price has released precise savings guidelines to help people who are saving for retirement stay on course.

Instead of a one-size-fits-all approach, the targets vary based on your income, age and marital status. We’ll break down T. Rowe Price’s savings benchmarks below and discuss how you can reach those savings goals.

Do you have questions about saving for retirement? Speak with a financial advisor today.

Benchmarks By Age, Marital Status and Income

Everyone’s savings goals are going to be different and a lot of that variability is due to whether you are married or not. For married couples, savings goals will depend on whether both spouses work or if the family relies solely on one income.

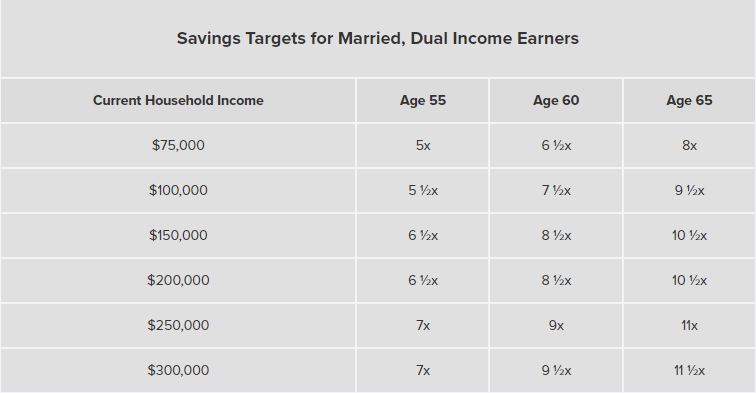

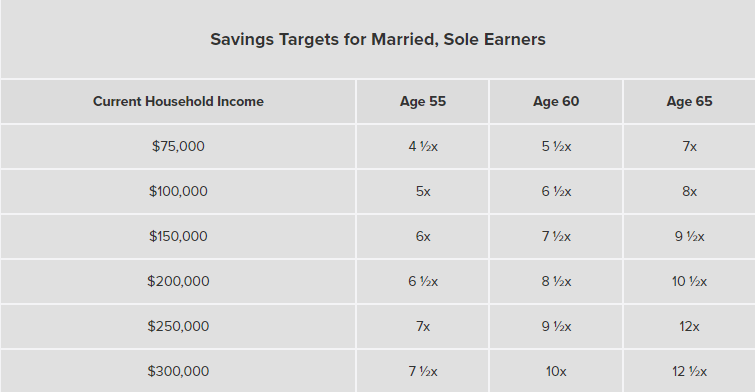

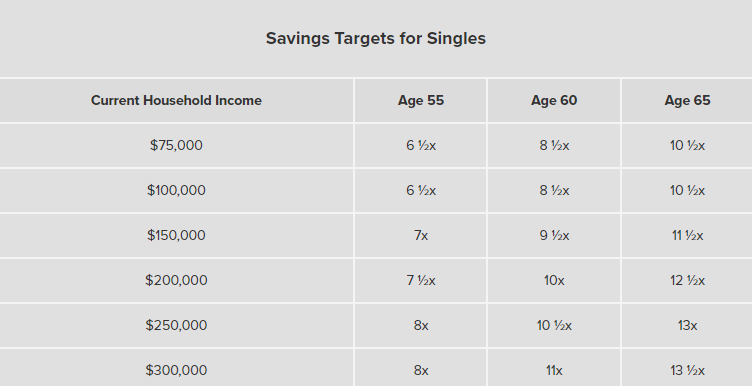

Taking those factors into consideration, T. Rowe Price created a benchmark table showing how much money each person should be saving given their marital status. Looking at the table below from T. Rowe Price, a dual income means that “one spouse generates 75% of the income that the other spouse earns.”

Here’s a closer look at the savings targets for 55-year-olds:

Married, Dual Income

According to T. Rowe Price, a married person at age 55 who makes $75,000 a year with dual income in the marriage should have 5x their salary saved by then. A 55-year-old with a $150,000 income, meanwhile, should have 6 ½ times their salary saved. At $300,000 per year, the savings target jumps to 7x.

Married, Sole Earner

A married person at age 55 who is making $75,000 a year, and is the only earner in the marriage, should have 4 ½ times their salary saved at that stage. If they earn twice the amount of income, their savings target increases to 6x. At $300,000 per year, the same 55-year-old would need to have 7 ½ times their salary saved.

Single

A single 55-year-old who makes $75,000 a year should have 6 ½ times their salary saved by that point. They’ll need to have 7x their salary saved if they make $150,000 per year and 8x if their income is $300,000 per year.

Begin Reviewing Your Savings Early

To live a long and healthy life in retirement, identifying your savings benchmark should start at a young age. As you can see from the data above, the earlier you start saving and planning, the more likely it is that you can hit those targets.

According to T. Rowe Price, a good place to start would be looking at how much you’ve saved so far. And then you’ll want to determine how much you should be saving based on your age, marital status and income.

Whether you are starting to save money early or late in your career, a good idea would be to add additional income streams so that you are not relying solely on Social Security in retirement. If your employer has a 401(k) plan, take advantage of it and contribute at least an equal percentage that your employer is willing to match.

If you don’t have access to a 401(k), opening an individual retirement account (IRA) can increase your savings. And if you need help doing the math with your savings, SmartAsset’s retirement calculator can help you determine your current and future financial outlook.

Bottom Line

Having savings goals can help you stay on track as you save for retirement. T. Rowe Price’s savings benchmarks vary depending on a person’s income, age and marital status. While the savings targets are designed for those nearing retirement, they can also help younger savers stay on course and plan for the decades ahead.

Tips for Your Retirement Savings

- Although Social Security likely won’t provide you enough money to fund your retirement lifestyle, it can help quite a bit. In turn, it’s important to include your projected Social Security earnings in your retirement savings projections. To get a glimpse of what you can expect, visit the SmartAsset Social Security calculator.

- Financial advisors deal with many areas of finance, including investing, financial planning and more. You may want a financial advisor to help with your retirement savings. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Photo credit: ©iStock.com/Inside Creative House, ©iStock.com/Kemal Yildirim, ©iStock.com/PeopleImages