The projections for the solvency of Social Security a decade from now are not good. And if something isn’t done, the trust funds for Old-Age and Survivors Insurance (OASI) and the combined Old-Age and Survivors Insurance and Disability Insurance (OASDI) could be depleted in 2033 and 2034, respectively, according to the 2023 OASDI Trustees Report.

But what if American workers paid extra payroll tax? Would that save Social Security? A brief from the Center for Retirement Research at Boston College raises that question. Here’s what the experts had to say.

If you have questions about retirement planning or Social Security, consider working with a financial advisor.

Would Workers Paying a Higher Payroll Tax Save Social Security?

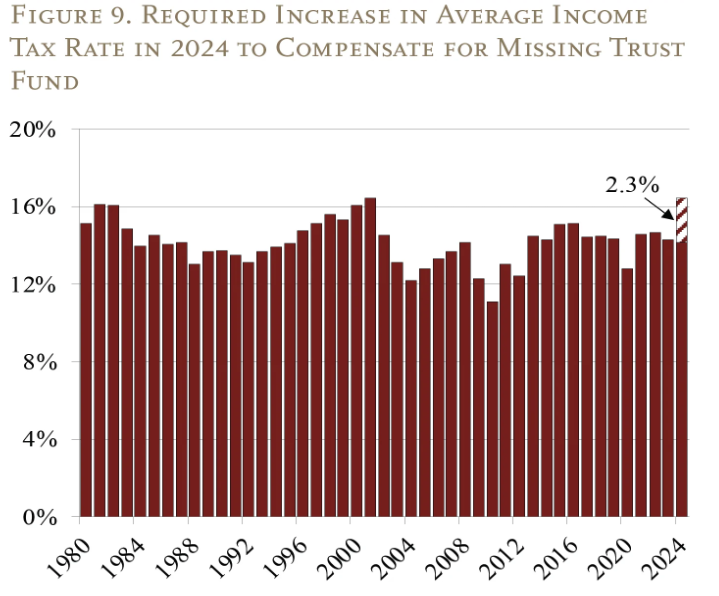

Workers paying a higher payroll tax to save Social Security likely wouldn’t be enough. “Even if we were to go all the way and raise taxes by enough to cover all missing trust fund earnings, the average tax rate would still be within the bounds of historical experience,” the CRR report says.

In fact, the report raised the argument that the responsibility to pay to ensure Social Security solvency could be carried by the general population, not just workers on the payroll tax.

“This part of the Social Security financing problem could be transferred to general revenue,” the CRR report says. “If so, the average income tax rate would have to increase by 2.3 percentage points (from 14.1% to 16.4%) in 2024.”

OASI and OASDI Are at Risk of Coming Up Short

With the OASI trust fund set to be depleted by 2033, the Trustees Report notes that only 77% of scheduled benefits would be paid out.

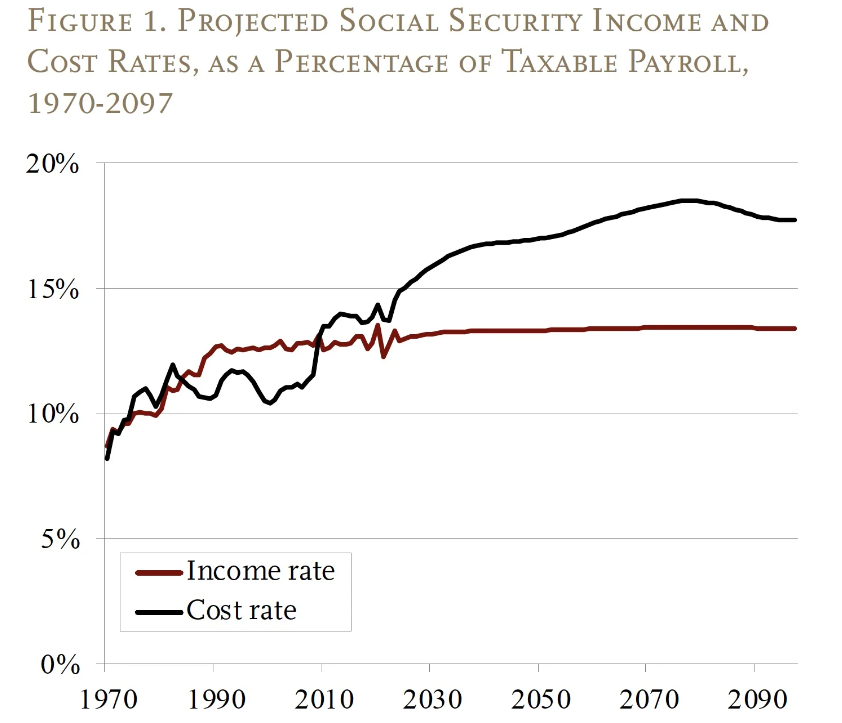

As for the OASDI, which combines the Old-Age and Survivors Insurance with Disability Insurance, it’s projected to be depleted in 2034, according to the 2023 OASDI Trustees Report. The CRR report says this is due to the cost rate projecting to increase higher than the income rate.

Cost Rate vs. Income Rate for OASDI

The chart below from the CRR report shows the cost rate in taxable payrolls in the OASDI program is currently around 13%.

By 2040, the cost rate is projected to spike to 17%. And by 2078, the cost rate reaches 18.5%. At the same time, the income rate, which is a percentage of income paid into Social Security benefits, stays stagnant at around 13% over the next 67 years.

What Is Causing the Increase in Cost Rate?

Data from the CRR report showed the increase in the cost rate is partially due to the drop in the population after the baby boom from the late 1940s to the early 1960s. Contributing factors also included the fact that the population continued to drop in the early 1970s. In addition, the number of baby boomers entering retirement now (and drawing down on Social Security benefits) combined with not enough people in the workforce (who would contribute more in taxes to the Social Security coffers) has played a part as well.

Other causes can be attributed to the Social Security cost rate exceeding the income rate over the last 13 years, as it forced the government to use trust fund assets to assist with Social Security benefits.

Data also found that taxes and interest rates were starting to fall behind annual Social Security benefits in 2021. But if strong policies are not in place to change the Social Security system, more problems will likely occur.

“Fixing Social Security sooner rather than later would distribute the burden more equitably across cohorts, restore confidence in the nation’s major retirement program and give people time to adjust to needed changes,” the CRR report says.

Bottom Line

The outlook for the solvency of Social Security isn’t positive over the next decade, with the OASI and OASDI Trust Fund reserves expected to be depleted in 2033 and 2034, respectively. But it’s not too late for policymakers to make a change that will show financial stability in the Social Security system. A Center for Retirement Research at Boston College report explores whether having Americans pay more in payroll tax might solve this solvency problem.

Tips for Retirement Planning

- Saving is important but most people all too often don’t sock away enough money to last all of their golden years. Likewise, Social Security can help, but it isn’t likely to be sufficient to cover the cost of your desired lifestyle in retirement. Instead, you will likely need your savings to grow through investments. For help with this, consider working with a financial advisor. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Taxes can take a big chunk out of your retirement income, depending on where you live. To find out if you should relocate after you hang up your hat, check our story on the best states to retire for taxes.

Photo credit: ©iStock.com/Richard Stephen, ©iStock.com/RichVintage